Friday, October 30, 2009

Around and about...

The people of Venezuela have been told to stop singing in the shower and to wash in three minutes as their country faces an energy crisis. The call has come from president Hugo Chavez, the Left-wing leader of the oil exporting South American nation...(... some mockingly holding their noses behind him.)

"Some people sing in the shower, in the shower half an hour. No kids, three minutes is more than enough. I've counted, three minutes, and I don't stink," he said during a televised Cabinet meeting.

"If you are going to lie back, in the bath, with the soap and you turn on the what's it called, the Jacuzzi ... imagine that, what kind of communism is that? We're not in times of Jacuzzi," he said, to laughter from his ministers... [Daily Mail]

Maybe the only problem that nobody's blamed on global warming is mountains starting to rise up faster out of the ground. Ooops.

Save the planet, eat your dog. Recycle rabbits as fuel.

Are US newspapers in a death spiral? This looks worse than the effects of just a recession. The Wall Street Journal becomes the #1 circulation daily paper thanks to USA Today's circulation dropping 17%. Advancement by watching the others die.

How mandated health insurance may leave many people worse off. (By Tyler Cowen of Marginal Revolution).

The fiscal storm clouds continue to form in plain sight on the horizon, as nobody in D.C. cares...

We've already seen the S&P timetable for this. It looks (unsurprisingly) like the schedule may have been advanced a few years. If you think the recession-causing shock of mortgage-backed securities losing their AAA rating was bad, wait until you see what happens US Treasury bonds lose theirs.The United States, which posted a record deficit in the last fiscal year, may lose its Aaa-rating if it does not reduce the gap to manageable levels in the next 3-4 years, Moody's Investors Service said on Thursday....

"The Aaa rating of the U.S. is not guaranteed," said Steven Hess, Moody's lead analyst for the United States said in an interview with Reuters Television. "So if they don't get the deficit down in the next 3-4 years to a sustainable level, then the rating will be in jeopardy." [CNBC]

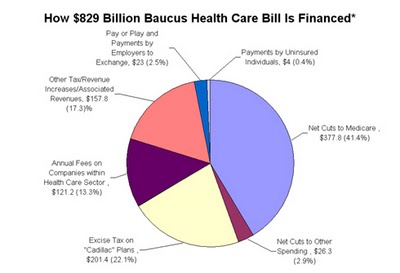

Speaking of coming fiscal calamity, the Tax Foundation shows us how health care reform is planned to be financed. For instance, very happily, the Baucus plan will be fully 44% paid for by other spending cuts!...

We all believe that, right?

Wednesday, October 28, 2009

World Series musings...

As a footnote:

The stadium's construction costs have been publicly subsidized in the form of $942 million in tax-exempt bonds issued by New York City.

Seeking tax-free status for the bonds to ensure a lower interest rate, New York structured the deal to ensure it didn't run afoul of a federal tax code provision which requires that such bonds not be "private activity bonds" [issued to benefit a private business, such as say the New York Yankees Partnership, rather than the city government].

This serves as a huge benefit because the bonds are exempt from city, state, and federal taxes, and have an interest rate about 25 percent below that of taxable bonds.

There are two parts to this financing scheme which seem "foul." First, the new Yankee Stadium will be city-owned and thus exempt from property taxes. Meanwhile its primary tenant, the Yankees, will pay no rent. This clearly brings up the issue of whether such tax-exempt bonds should have been issued at all, and especially when the city is so far in the red.

Secondly, to pay off the bonds over time, New York City will receive payments theoretically equivalent to the property taxes that Yankee Stadium would otherwise pay. The city claims that these payments in lieu of taxes (PILOTs) equal taxes that would otherwise be owed. In reality, these payments are inflated by overvaluing the stadium property by three times that of comparable property.

By inflating the payments in lieu of taxes, the City can say to taxpayers that the Yankees are paying a significant part of the stadium's cost -- while telling the IRS that the City is paying for almost all of it.

The IRS got mad but let the deal go forward anyway, a rare instance of when the IRS shouldn't have given in so easily.

But the IRS later issued a proposal that would tighten the rules governing such bonds so it would be nearly impossible for this kind of financing to be used again by a profitable sports franchise.So your team won't be able to do the same thing to build itself a nice stadium. (But then, your team probably doesn't need the taxpayers' money as much as the poor cash-strapped Yankees do.)

Who's going to win? Baseball is the most probabilistic of sports. While fans love to think each big game is determined by top players proving their character -- raising their play (or choking) in the clutch -- reality is that when a round bat hits a round ball the outcome is weighted probability. The data show post-season game outcomes closely match the odds revealed by season W-L records. If a team with a .600 win percentage plays against one with a .550 win percentage, the former will have a 5% greater chance of winning a game between them, as a sound first estimate.

The Yankees won at a .636 rate this year while the Phillies did at a .574 rate. That's .062 difference in favor of the Yankees -- which means they'd be expected to win one more game than the Phillies per 16 games played ... while the Series is seven games maximum.

In a full seven-game series, the Yankees would be expected to do better by 7/16ths of one game, less than half. That's how much chance there is in baseball outcomes -- though rabid fans will never believe it. (And it's not a whole lot for an extra $88 million of player payroll!)

Of course, at various sabremetric web sites you can find the probabilities parsed in far more detail than that, by home stadium advantage, starting pitcher and a whole lot more -- but that's the big picture.

How the game has changed. The last time the Yankees played the Phillies in the World Series was in 1950.

In that Series the Phillies' ace, Robin Roberts, missed the opening game -- because he'd started three of the last five games of the season! In those days, that's how you used your best pitcher in a tight pennant race. Then he pitched game two of the Series.

In that game Yankees starter Allie Reynolds pitched 10 innings to beat Roberts 2-1. Reynolds then came back as a reliever in game four to get the save. That nailed down a four-game sweep for the Yankees, who used five pitchers total in the four games.

It's a safe-money bet that during this Series you'll see these teams use five pitchers in a single game more than once.

Tuesday, October 27, 2009

Lawsuits of the week

Man arrested for being naked in his own home. "Williamson, 29, faces an indecent exposure charge after a passerby saw him in the buff in his own home making coffee. Channel 5 reports the woman and 7-year-old boy who saw him naked apparently had cut through Williamson's front yard from a nearby path." No report yet on whether they were arrested for trespass.

If your music is used to torture terrorists, can you sue for copyright infringement?

Your insurance company won't pay $2,400 a month for growth hormone for your son, just because he's 5'7" at age 16? Sue. ("Short stature became a disease when unlimited amounts of growth hormone became available." Dr. Alan D. Rogol.)

Miss California USA officials want their breast implant money back from the dethroned Carrie Prejean...

The demand was a response to a lawsuit filed by Prejean in which she claimed pageant officials violated the former beauty queen's privacy by acknowledging to reporters that her breasts were fake.

The truth about Prejean's breasts "ceased being private during the swimsuit competition of the nationally televised Miss USA pageant, in which Ms. Prejean walked the stage in a bikini," pageant lawyers said... [CNN]

And, well, let's just quote the judge on this one...

...the court finds it significant that the plaintiff candidly admits he was unaware that his penis was protruding from his underwear until the final two days of his trip...

Monday, October 26, 2009

How Obama's people brought "cultural revolution" to the failed management at General Motors

I feel so much better about all this now.Everyone knew Detroit's reputation for insular, slow-moving cultures. Even by that low standard, I was shocked by the stunningly poor management that we found, particularly at GM, where we encountered, among other things, perhaps the weakest finance operation any of us had ever seen in a major company ... We were appalled by the absence of sound analysis provided to justify expenditures.

The cultural deficiencies were equally stunning. At GM's Renaissance Center headquarters, the top brass were sequestered on the uppermost floor, behind locked and guarded glass doors. Executives housed on that floor had elevator cards that allowed them to descend to their private garage without stopping at any of the intervening floors (no mixing with the drones)...I found CEO Rick Wagoner to be likable, dedicated, and generally knowledgeable. But he set a tone of "friendly arrogance" that seemed to permeate the organization. Certainly he and his team seemed to believe that virtually all of their problems could be laid at the feet of some combination of the financial crisis, oil prices, the yen-dollar exchange rate, and the UAW.

It seemed completely obvious to us that any management team that had burned through $21 billion of cash in a year and another $13 billion in the first quarter of 2009 could not be allowed to continue. Equally important, GM's February viability plan was more "business as usual" and not the aggressive new approach that we felt was essential...

To radically shake up GM's management culture and instill within it that entirely new aggressiveness, I knew what I had to do: fire Wagoner and install a new leader -- Wagoner's own #2 man, his fellow GM "lifer" and long-time sequesteree of that uppermost executive floor, Fritz Henderson, following Wagoner's recommendation on this...

(OK, for all the laywers out there, one of those paragraphs was not part of Rattner's story as published -- though it deserved to be.)

Sunday, October 25, 2009

Sunday sports blogging...

[] We all know the complaint, "the ump is blind" -- but it's not supposed to be true literally in a playoff game. A single picture tops a thousand words of excuse.

[] Rising income inequality in the NFL and its implications are examined by Mark J. Perry (who normally blogs at Carpe Diem). Here's another factoid to document the story:

The seven highest-paid Indianapolis Colts in 2009 will have a combined $81.3-million cap cost -- which leaves the bottom 46 players on the active roster, eight practice-squad players and, say, estimated injured-reserve players to split the remaining estimated $40.7 million of the cap.

Salary-cap average of the relative Colt haves: $11,614,286.

Salary-cap average of the relative Colt have-nots: $678,333. [Peter King]

By the way, just one Colt player, quarterback Peyton Manning, gets $21 million of that cap money. You do the math on that.

[] Breaking News!!! ...

Even at Elite Programs, Ticket Prices for Women's Basketball Lag Behind Men's, Report SaysYes, that must be it. University athletic departments intentionally defund themselves of valuable revenue from ticket sales solely for the enjoyment of discriminating against women.

... a report is urging athletics departments to abandon their longstanding practice of charging less for tickets to women's basketball games than to men's games...

the report says colleges charged nearly three times as much, on average, for single-game seats for men's games. The disparity was even greater for season tickets, with the average highest-priced package at $233 for women and $2,500 for men.

"Colleges charge a premium for admission to see males play, even when women's basketball teams are ranked as among the very best performers in the nation," write the authors, Laura Pappano and Allison J. Tracy, both of the Wellesley Centers for Women.

By charging less for admission to highly ranked women's games, the authors say, athletics departments engage in "institutional discrimination"...

I can't possibly think of any other reason why ticket prices would be lower for women's games. And neither can the "editor in charge of common sense" at The Chronicle of Higher Education. Oh, wait, there isn't one. The authors of the second and fifth comments below the story will have to do.

To be fair to the authors, you can read their own longer description of their study, in case you want to buy it. "[Author] Allison J. Tracy, Ph.D., is currently working on developing an explicitly feminist approach to quantitative data analysis..."

Don't we live in a wonderful country when Wellesley can charge parents $40,000 annual tuition, plus receive a whole heap of government aid, to be able to support such stellar research applications of feminist math?

[] Should football teams ever punt? This question has attracted football mavens since at least a few years ago when economist David Romer published a paper saying pretty convincingly, basically "no -- almost never".

But there's a big difference between theory and practice. Why in practice, in such an extremely competitive sport, do coaches keep punting far too much even when they know that they shouldn't and are sacrificing wins by doing so?

Many observers -- including Romer -- say it's because winning the game is only a coach's #2 priority. His #1 priority is keeping his job. And a coach who never punts when all the fans and media experts "know" he should risks being lynched by the ignorant mob. Ask Jim Zorn. (This behavior -- leaders knowingly doing the wrong thing for self-preservation -- has serious economic implications, which provided Romer's official rationale for doing the paper, apart from being a football fan).

Even Bill Belichick, who one would imagine has more job security than anybody in the NFL, and has a degree in economics, and has discussed the Romer paper with the press, says psychology is the problem -- players and fans who don't understand a coaches' decisions can make them untenable. Before a correct strategy can be adopted, players and public must first be educated about it, starting at a lower level.

Leading those public education efforts is coach Kevin Kelley of Pulaski Academy high school football team in Little Rock, Arkansas, who's been winning state championships getting fans adjusted to the "we never punt -- and we kick off onsides most of the time too" idea. Advanced NFL Stats gives links to a video interview with Kelley and more about him.

Friday, October 23, 2009

Soupy Sales, maven of Jazz music, RIP.

Two bits from it will always be remembered in the annals of kid-showdom and live television.

The first is recounted in every obituary: To kill a minute of extra time he ad libbed by telling the kids to send to him "all those funny green pieces of paper with pictures of presidents on them" that their parents had about the house, and he'd send them a postcard from Puerto Rico in return. Some reports say he received thousands of dollars (though they likely exaggerate). He also got suspended.

The second wasn't explained until years later when replayed on "look back" shows.

In an otherwise normal bit he walked over to open one of those half-doors always popular on kids shows to talk to one of his characters (White Fang, Black Tooth, whichever). But it was his birthday, and unbeknownst to him the show's crew had hired a stripper to do her dance with balloons at the door instead. He opens the door and there's a naked dancing girl with her balloons. The camera shows him seeing the girl and rebounding in shock, but doesn't show the girl. (Though they had another camera set up recording the scene for posterity that did.) The show was live, so Soupy had to finish the scene for the kids with a naked girl juggling her balloons in front of him.

Eat your heart out SNL, nobody makes live television like that any more.

Less well remembered today is that Soupy was a maven of Jazz music, using it on all his shows. Famous jazz musicians regularly visited his kids show (unappreciated by the likes of me). Early in his career, in pre-videotape days, he hosted a live jazz performance show that looking back featured many of the greats. Below is one of the few surviving kinescopes, Soupy introducing Clifford Brown. [via the NY Times]

Thursday, October 22, 2009

Obama/Baucus-care as a "classic" raid on the Social Security trust fund.

Ah, but the increased debt for entitlements is "off budget" -- so it doesn't count in their 10-year budget calculation.

Baucus Plan Would Raid Social SecuritySpelling things out, they work like this...

The health legislation sponsored by Senate Finance Committee chairman Max Baucus (D., Mont.) received an apparent boost when the Congressional Budget Office stated it would reduce the budget deficit by $81 billion over the next ten years. Obama administration budget director Peter Orszag crowed that the CBO scoring "demonstrates that we can expand coverage and improve quality while being fiscally responsible."

But the CBO analysis actually leads to a very different conclusion: that [it is] a classic "raid" on Social Security...

Baucus's plan purportedly would improve the budget balance by $81 billion from 2010 through 2019, and in 2019 itself would cut the deficit by $12 billion...

But the devil is in the details of the CBO memo. CBO breaks down the Baucus plan's budgetary effects into those occurring "on budget" (where the substantive policy changes are) and those "off budget" (meaning through the Social Security program). The Baucus plan's on-budget provisions would reduce the ten-year budget deficit by a tiny $1 billion and in 2019 would increase borrowing by $6 billion. In the real world, where entitlement costs rise faster than projected and Congress fails to implement promised cuts to Medicare spending, the Baucus plan will doubtless generate significant deficits.

Meanwhile, the Baucus plan's fiscal skullduggery takes place off-budget. Social Security revenues would increase by $80 billion over ten years, with an $18 billon increase in 2019 alone.

Around 3 million individuals would leave employer-sponsored health coverage — which is exempt from taxes — to purchase insurance through a subsidized "exchange." Leaving employer-sponsored coverage would raise workers' taxable wages and thereby boost Social Security revenues. Millions more would trade a portion of their insurance benefits for higher wages to avoid a new tax on high-cost policies.

By skimming the new Social Security taxes, the Baucus plan appears to significantly cut the deficit when, in truth, it balances only by the skin of its teeth.

This is perhaps the clearest example of "raiding the trust fund" on record.

Democrats and Republicans have long believed that Social Security surpluses encourage the rest of the budget to run larger deficits, as borrowing from Social Security does not increase the measured budget deficit or the publicly-held national debt. But it's difficult to tell whether any particular legislation comprises a "raid," since the legislation might be passed even in the absence of Social Security surpluses.

In the case of the Baucus proposal, however, it is incontrovertible. The plan does not simply rely on existing Social Security surpluses but creates new ones to offset higher spending on health coverage.

Without new Social Security revenues the plan would not balance and, if the president is to be believed, would face a presidential veto. It's that simple: no new Social Security taxes, no new spending.

A health debate that began with earnest claims that we could "bend the cost curve" to cut costs while increasing quality has devolved to a farce in which vastly increased government spending is papered over with implausible spending cuts and dubious bookkeeping.

The Obama/Baucus-care plan converts billions of dollars worth of currently tax-free benefits to taxable wages -- thus creating additional Social Security taxes to collected on the wages and an obligation for more Social Security benefits to be paid on them in the future. Then...

The plan spends all the new Social Security taxes on health care, leaving the government's obligation for the additional Social Security benefits unfunded. Then...

As the result of spending all the new Social Security taxes on health care, the Obama/Baucus plan is able to declares itself “deficit neutral” over 10 years. Of course, every dollar of Social Security tax spent on health care is "borrowed" from the Social Security trust fund, and thus increases debt owed by the government via newly issued Social Security trust fund bonds by one dollar. But since this increasing trust fund debt is treated by the government as "off budget", Obama and Baucus ignore it. Then...

After the 10 years pass, the increased debt owed to the Social Security trust fund, plus interest on it, comes due in cash money owed by the government. At that point, to pay this, the government must either roll this "off budget" debt into the massively growing "on budget debt" by issuing more bonds to the public (so the credit rating of the US falls even faster than this) ... or else raise taxes by even more than is currently projected as needed to stay even with exploding entitlement costs (a 50% income tax increase by 2030).

But to Obama and Baucus this is not an issue because they are retired from politics, so it is somebody else's problem. (Indeed it is everybody else's problem.) And, long prior to this, circa 2009...

Obama and Baucus "pop the cork" and celebrate with their fellow Democrats their historic passage of Obama/Baucus-care, on a deficit neutral basis for 10 years!

They also quietly rejoice in their ability to use governmental accounting rules, which made it all possible. For if as a CEO and CFO they'd ever tried to use this same "keep all our new debt 'off the books' for 10 years" ploy anywhere outside of government, they’d have ended up sharing a cell adjacent to the ones holding the guys from Enron.

Which leaves what is a continuing mystery of human behavior for me: Why do we all en masse accept behavior on the part of politicians and government on a level so much below the lowest we would ever accept in the private sector — even as we all rush to them to save us from the private sector?

Wednesday, October 21, 2009

How to make $450,000 per year at Carnegie Hall: Play Move the piano.

The best job at Carnegie Hall isn’t performingNow, the next time you visit NYC and pay an outlandish price for tickets to a show, you'll know what in fair part you are paying for.

The guys who push the piano onto the stage at Carnegie Hall make more than the guy who plays it.

Dennis O’Connell, who oversees props at the legendary concert hall, made $530,044 in the fiscal year that ended in June...

The four other members of the full-time stage crew — two carpenters and two electricians — had an average income of $430,543 during the same period, according to Carnegie Hall’s tax return...

The stagehands have a powerful union: Local One of the International Alliance of Theatrical Stage Employees shut down 26 Broadway shows for nearly three weeks in November 2007. Its strike cost the city $40 million, the city comptroller said at the time... Labor historian Joshua Freeman said the union’s power to shut down a vital part of the city’s entertainment industry gives it leverage. [Metro]

Updating the old joke: "How do I get to Carnegie Hall?" "

Why I don't read Krugman anymore.

After a friend sent a note about Krugman, I looked at his last column and read this...

Last weekend, the lobbying organization America’s Health Insurance Plans, or AHIP, released a report attacking the reform plan just passed by the Senate Finance Committee ... health-care experts quickly, and correctly, dismissed it as a hatchet job...Which is a lot of ... what's the word? ... oh, yeah:

... the report threw every anti-reform argument the authors could think of at the wall, hoping that something would stick. [etc., etc.]

The AHIP report explicitly covered no more than four (4) items -- and I can right now name a lot more than four arguments I've heard against Obamacare and its re-working of 16% of the entire economy. So can you, I'd wager.

And if Krugman ever gets as a bright idea for a column, "Top 50 Lies Told Against Health Care Reform", you know he'll add 46 to the list himself and complain about how space limitations keep him to only those.

Moreover, as noted in Keith Hennessey's capable analysis of the report, AHIP avoided mentioning cost-raisers in the proposed reform (potent political arguments against it) that it likes because the costs raised go into insurers' pockets.

(Anti-reform arguments not merely overlooked but buried!)

Which on its face -- as Hennessey and other health care analysts I've read have pointed out -- makes the AHIP report not an attempt to kill reform, but rather an attempt to shape it more to its liking. Just exactly as is being done by every other interest group that's either a Democratic constituent or has used a side deal to buy a seat at their bargaining table (Phamra, the AMA, unions, and all rest).

Which is consistent with the head of AHIP being a former labor-leader Democrat who's worked with the Obamaites so far, rather than against them.

All of which apparently is far, far too subtle and complex for the Krugman of today to comprehend or report on in his column.

I mean, it's useless even to any in the choir of pro-reform advocates he preaches to who might want to actually understand what is going on.

(Once there was a Krugman who could describe things like the Savings & Loan collapse of the 1980s quite analytically, showing how all the parties acted rationally in light of their self-interest and the incentives placed upon them by the larger system at the time -- rather than as embodiments of good and evil. But an economist friend once told me that he believes that Krugman was kidnapped and tied up in a Princeton basement sometime in the early years of the Bush Administration -- and if so he must surely be dead by now.)

Krugman today gives us whopper-wrong pretend facts combined with analytical fantasy, all "good-guys" versus "bad guys", which = Bob Herbert.

Why should I read him?

Face it, he's an addict, a junkie.

No, I'll take that back ... Krugman always had these tendencies, apparently inborn. But, much like Bobby Fischer, upon attaining the pinnacle of fame in his profession along with ample financial security, he seems to have decided he had no more need to compromise with the rest of the world by disciplining himself to be reasoned, and has let the self-indulgence flow.

It's his good friend Brad DeLong who sorely needs detox.

Monday, October 19, 2009

Noted around and about...

The BBC asks, "What happened to global warming?" (And, hey, is it say "hello" again to global cooling?)

Why women have sex: "The No. 1 reason was because it’s fun.”

Legal prosecutions of the week: criminal and civil.

All about converting a former nuclear missile silo into your home. (Plenty of helpful illustrations). Recommended: Buy one that stored its missile vertically (such an Atlas F silo), not one that stored the missile prone until lifted for launch (such an Atlas E -- too much in the way of bunker space and rampways).

It's bad enough when a strange dog jumps on your leg, but when a wild parrot jumps the back of your head... (Caution: Not workplace friendly if your workplace is an aviary with young birds about.)

Sunday, October 18, 2009

Sunday sports blogging

What story did you most enjoy doing?

Probably spending a week inside the Green Bay Packers in 1995....[Then-head coach] Mike Holmgren allowed me unfettered access. You are involved in all of the coaching meetings.

I once had Holmgren call in two young players and tell them they could not keep their pet in their apartment in Green Bay. I asked him, "What pet?" He said, "It's come to my attention these two guys have a lion." It's true. They had a lion in their apartment. He told them they weren't going to be on the team on Monday if the lion was still in their apartment.

Who's your least favorite interview?

I don't speak to T.O. anymore. I just think that life's too short to talk to nine-year-olds too often....

[] In light of all the unending belief in and dispute about "clutch hitting" in baseball, the Sabrenomics blog takes a look at the question of "clutch pitching" ... and finds the same answer.

[] The Sports Economist makes the case that coaching ability declines with age...

Using NFL data from 1920-2004, we found strong evidence of improvements with age and then a gradual decline in performance that mimics (with a 10 year lag) the decline seen in athletic performance......and I was going to make about six different arguments against the idea -- then I thought, "Al Davis". Never mind.

[] Of course, to lose coaching ability one must have it in the first place. Pro Football Reference.com alerts us to the fact that the amazing Dick Jauron, currently coach of the Buffalo Bills, with his career record of all of one winning season in 10 so far, is about to join the ranks of the Top 50 NFL coaches of all time in number of games coached.

Yes, he has coached more games than Vince Lombardi and this year is on course to attain longevity surpassing the likes of John Madden, John Robinson, Brian Billick, and Jimmy Johnson. And the question arises -- in the NFL's world of supposedly cutthroat competition, where even the merely "good" are ruthlessly cast aside -- how has this guy lasted? (I put my guess for a partial explanation in a comment.)

Saturday, October 17, 2009

Stimulus results in NYC: $500 million for 54 jobs

'Stim' out of steam -- Half-billion in fed cash for measly 54 local jobsWell, that's something to look forward too. And we do know the NYC transit union workers union got themselves an 11% pay raise for doing their current jobs from $350 million of stimulus money the for coming years (when already paid like this). So while that may create any more jobs for anybody, hey, those who already have jobs get more. And it's pretty much the same story with stimulus funds given to the public school system.

The feds have spent a half-billion dollars on 10 of the largest government stimulus contracts in New York City and Long Island -- but created or retained only 54 jobs.

That's an astounding $9 million per job.

The largest contract, at Brookhaven labs on Long Island for $261 million, has put only 26 people on the payroll, while two contracts for $23 million apiece to rehab the Thurgood Marshall Courthouse in Manhattan hasn't created a single job, according to new data.

A $53 million contract to fix a Brooklyn post office created just a third of a job, while a $5.5 million plumbing contract for a federal courthouse didn't create any.

Statewide, New York has gotten $776 million in government contracts through the stimulus, creating or saving 656 jobs [a much more efficient mere $1.18 million per job] according to the data, which the feds compile from contractors. ...

A $15 million contract for the Feinstein Institute for Medical Research on Long Island to test new ways to treat schizophrenia has created just 3.8 jobs.

But John Kane, who runs the program, said, "If we are successful in helping people with this illness, it means that many of the people helped by it could get jobs and function in the community."... [NY Post]

This count of jobs created in New York is part of a national count...

First hard stimulus data finds 30,000 jobs saved or createdSo their expectations were that the stimulus would cost more than $531,861 per job.

The first direct stimulus reports showed that stimulus contracts saved or created just 30,083 jobs...

Obama administration officials stressed that data was partial -- it represented just $16 billion out of the $339 billion awarded -- but they said it exceeded their projections.

The White House recovery team said that the reported jobs number represented just 5 percent of the jobs directly saved or created by stimulus since it came out of contracts that represented only 5 percent of the stimulus spending so far... [The Hill]Which is a "change the subject" response, to get away from questions about why the stimulus is so costly per job, and so late, being that with the recession now closing in on two years old, the great bulk of the stimulus spending still hasn't occurred yet.

Friday, October 16, 2009

US Treasury bonds are the safest in the world -- so how can they be risky in the Social Security Trust Fund?

Their thinking generally runs like this...

"Yes, the government has spent the entire Social Security surplus, $2.5 trillion so far. So what? That resulted in the government giving its IOU for that amount to the Trust Fund -- and its IOU is US Treasury bonds, which are the safest investment in the world! If Congress had instead "saved" the surplus it would have had to be invested in somebody else's bonds, and those all are more risky than US bonds. So this way things are better!

"Social Security benefits are safer when backed by US Bonds -- default upon which is unthinkable!"

No, they aren't safer, they are much more at risk -- and here's the short explanation why:

It's the year 2030 and Congress has to increase income taxes by 50% across-the-board to pay for entitlements -- near one-third of which is needed to pay off the Social Security Trust Fund bonds. And this is only the start, taxes are projected to rise from there forever more.

Voters -- including seniors who are having this huge tax hike land on the their pensions, 401(k)s, investment income and Social Security benefits -- are furious! "You never told us this was going to happen!!"

A political deal results -- in exchange for tax increases large enough to fund some of these benefits, other benefits are cut. (Just as in the 1983 bailout of Social Security: 50% tax increase, 50% benefit cut.)

Among the benefits cut: Social Security benefits (after all, paying for seniors' health care is far more important than giving them a little more spending cash) -- by just enough so the bonds in the Trust Fund will never be needed, never cashed in, and no tax increase need be imposed to fund them.

No "default" results from the fact that the bonds are never cashed in because by their unique terms they aren't payable until presented, and the government simply never presents them to itself. (The Trust Fund bonds are 15-year bonds that have been issued since 1983, up to 26 years so far. None have ever been cashed, yet no "default" has ever occurred because they roll over automatically when not needed. After Congress decides they will never be needed, they all roll over happily forever unto perpetuity, unused).

Result: Social Security benefits paid are reduced from today's promised level by about 20% (doubtless in some form of significantly means-tested manner). And near one-third of the income tax increase otherwise needed by 2030 is averted.

Alternative Universe: From 1983 on, the government instead of spending the Social Security surplus saved all of it by investing it in a diversified portfolio of gilts, German bonds, Japanese bonds, etc.

In 2030 it is receiving payment on these bonds from their issuers. Thus there is no tax cost to operating the Social Security Trust Fund -- and there is no pressure to cut benefits. Social Security benefits remain fully safe.

Also, the general income tax increase needed circa 2030 is merely 35% across-the-board, not 50%, easing the nation's overall fiscal crisis accordingly.

Thus we see the difference between a nation saving to meet a future major financial need by (a) actually saving, and (b) not saving but instead issuing its IOUs to itself.

Thursday, October 15, 2009

Why is it illegal to blackmail David Letterman?

Moral-reasoning pop quiz:So the lawyer must explain why it is illegal to threaten to do something that one is legally entitled to do.

There’s a film coming out — a thinly disguised portrayal of a media mogul — and word is that if it’s released it will hurt the mogul’s reputation.

Powerful people intervene: they call a meeting and offer the movie studio money — a lot of money — to scrap the movie and destroy the negatives. If the studio takes the money, could it be prosecuted for extortion?

“It’s an interesting question,” James Lindgren, a law professor at Northwestern, said last week.

The mogul in question was William Randolph Hearst, and the movie was Orson Welles’s “Citizen Kane.” The studio turned down the offer...

Lindgren is the author of a paper called “Unraveling the Paradox of Blackmail,” which raises the question: why is blackmail considered a crime?

The thinking goes like this: It’s perfectly legal for Robert Halderman to write, or threaten to write, a screenplay (or an e-mail to TMZ) exposing the fact that David Letterman had flings with “Late Show” employees. It’s also legal for Halderman to ask Letterman for money as part of a business transaction.

So why are the two things illegal when you put them together?

In other words, Lindgren said, “Why is it illegal to threaten to do what you can do legally anyway?” ...

Meanwhile, the economist will add that the blackmailer actually helps his victim by giving him an additional option he may voluntarily choose to minimize the damage he suffers.

That is, Halderman is perfectly entitled to take his dirt on Letterman to the National Enquirer or anyone else. If he offers Letterman a "first option" on the material for $2 million that can only help Letterman, not hurt him. If it is worth that much to Letterman, he pays and is better off compared to if the material is published. If it is not worth that much to Letterman he doesn't pay and is no worse off.

Making it illegal for Halderman to ask for money from Letterman, forcing Halderman to get his money from the Enquirer, can only hurt Letterman, not help him.

Isn't economics fun? It makes the blackmailer's demand of money from his victim an act of altruism.

Wednesday, October 14, 2009

Rangel to die by a thousand small knife wounds in the back?

Charles Hurt, political observer, observes...

Charles Hurt, political observer, observes......[an] indication that things were starting to go badly for Rangel came the morning after that vote [on Rangel's ouster] when the Congressional Black Caucus wrote Pelosi blatantly threatening that one of her most obedient voting blocs would abandon her if she abandons their beloved Rangel.

What was interesting is that the letter came one day after Democrats had protected Rangel -- meaning the CBC was getting very different signals behind the scenes.

Then came the news later that day that the Ethics Committee had unanimously decided to expand its investigation into Rangel...

The key here is that the Ethics Committee -- while supposedly independent of Pelosi -- is run by top Pelosi loyalist Zoe Lofgren, a fellow California liberal who understands exactly the trouble Pelosi is in.

If she dumps Rangel, she loses the CBC. If she keeps Rangel, Democrats will pay the price in next year's elections.

Pelosi's best bet is to be seen as trying to protect Rangel while the Ethics Committee shreds him to pieces, so that eventually he gives up or even the CBC agrees that he's damaged beyond repair.

For concrete evidence of this strategy, look no further than the startling revelation that the committee had already issued 150 subpoenas, interviewed 34 witnesses and analyzed 12,000 pages of documents probing Rangel's finances and business dealings.

"That tells me they are taking this very seriously," said a top Republican leadership aide who was previously convinced that the Ethics Committee investigation was just some kind of sham...

Tuesday, October 13, 2009

NYC public schools -- stimulus waste, merit pay reward.

The $1 billion in stimulus cash being spent in city schools this year has not created new jobs, and may be one of worst uses of funds aimed at jumpstarting the economy, experts say.We've seen that before -- as with the transit workers union (already getting paid like this) taking $350 million of stimulus money from subway construction for an 11% pay wage for itself. (One wonders what the "multiplier" for that is.)

The Department of Education doled out $625 million this year to 1,475 schools, instructing that most of the money go for staffers that "would otherwise have been cut." The rest is helping pay the rising cost of fringe benefits and administrative costs.

No cash is going to build or repair schools...

Instead, the DOE now has 1,400 "excess" teachers getting paid without jobs to fill.

It's fiercely debated whether the DOE's gobbling up $2 billion in stimulus funds over two years -- 36 percent of the city's total share -- is boosting the economy or bloating a bureaucracy...

Nicole Gelinas, a fellow at the Manhattan Institute, said the $22 billion DOE budget -- up nearly 68 percent under Mayor Bloomberg -- is already too swollen.

"Most of this money is going for personnel with higher salaries and pension costs," she said, noting that 13,157 DOE staffers make six figures.

"The city's crumbling infrastructure is getting short shrift because powerful special interests like education unions squawk the loudest."... [NY Post]

But on the happier side of the education ledger...

Charter teachers $oar as their pupils scoreIt's too bad the smartly spent money amounts to so much less than the rest, but we'll take what we can.

Nearly 350 teachers and other staffers at 10 city charter schools raked in more than $1.5 million this year in a groundbreaking merit-pay program that ties bonuses directly to how their students fare, The Post has learned...

Teachers and other staffers who participated in the Partnership for Innovation in Compensation for Charter Schools (PICCS) program earned an average of $4,480 in bonus pay ...

The payments ranged from $1,400 to $8,800 because of the formula tying bonuses to student performance -- something that opponents of merit pay have said fosters unhealthy competition among teachers in the same building.

And while the United Federation of Teachers opposes tying teachers' appraisals to their kids' test scores, even instructors in the three unionized charter schools that participated in the initiative touted its merits.

"When it's done correctly, the focus is on the student -- not what the teacher can do," said Lisa DiGaudio, 34, a sixth-grade teacher and UFT member at Merrick Academy Charter School in Queens. "In my building, really we worked together -- we never had discussions about competition."...

Her school raised reading-test passing rates by 18 percentage points this past school year, to 88 percent, and lifted math-test passing rates by 14 points, to 98 percent.

"[The program's] gotten more people talking, but it's not a discussion about how much money we've gotten," said DiGaudio. "It's about what can we do next."... [NY Post]

Sunday, October 11, 2009

Enjoying the wild and crazy peoples of the world...

Australians with their school answering machines. (Australian hoaxers deserve credit too.)

Swedes and their musical stairs up from the underground.

Brits with their 4,500 illustrations of Bible stories in Lego pieces.

Maldivian (?) government ministers planning to hold this week's cabinet meeting underwater. ("...ministers would communicate during the meeting using hand signals and waterproof boards and pens. 'Obviously the hand signals that divers can use are limited, so the amount of work the cabinet are going to get done will be limited.'")

Gaza-ites (?) with their donkey-zebras.

Hungarians with their "Miss Plastic Surgery" beauty contest.

And those wacky Norwegians with their Nobel Peace Prize.

Sunday sports blogging....

[] Are NFL coaches irrational when choosing between punting and trying for a field goal? Maybe yes (though commenters suggest a rationale for maybe no).

[] A newly discovered 1928 "home movie" of Babe Ruth comes to light.

[] Does the "hot team" entering the baseball playoffs have an advantage (and are the recently slumping teams at a disadvantage)? Nope.

[] Are referees intimidated by the home team's fans? Well, in Europe soccer referees are a lot more even-handed if there's a

[] The "clutch hitting" fog of mystery is finally cleared away...

Alex Rodriguez's newfound playoff prowess after years of choking in the post-season is a product of his steamy -- and surprisingly honest -- romance with sexy screen siren Kate Hudson, a team source and a top sports shrink said yesterday... [details]

Saturday, October 10, 2009

Clearing wreckage from the 9/11 World Trade Center attack resumes ... only 8+ years later.

In the year 2525?My children saw the World Trade Center towers fall from their grammar school. One of them now is in college and the other in high school. They may live long enough to see the Deutsche Bank building come down too.

Officials on Tuesday said cleanup work at the former Deutsche Bank building was done and demolition could resume -- but then pushed the completion date back yet again, deep into next year.

Sound familiar? It should.

Here's a brief history of the project:

* Sept. 11, 2001: World Trade Center debris irreparably damages the building.

* December 2006: Demolition of the tower begins, after years of wrangling over who would pay for it. Projected completion date: December 2007.

* August 2007: A blaze at the site claims the lives of two firefighters. Work is halted. Officials expect to resume demolition by November.

* February 2008: Officials say, in effect, the structure must be scrubbed with toothbrushes before work can resume. Projected completion date: December 2008.

* Summer 2008: More delays. Projected completion date: August 2009.

* Spring 2009: More delays. Projected completion date: January 2010.

* August 2009: More delays. Projected completion date: Spring 2010.

* Oct. 6, 2009: Cleanup work finishes. Demolition to begin. Officials announce new, slower work plan. Projected completion date: "Before" December 2010.

Does anyone seriously think that building will ever come down? Ha.

(Prior posts on the shameful debacle of the WTC "rebuilding".)

Thursday, October 08, 2009

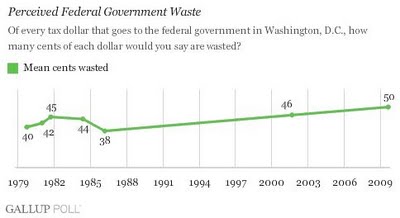

"Americans: Uncle Sam Wastes 50 Cents on the Dollar"

Gallup: "Americans are markedly cynical about the amount of waste in federal spending, more so than at several other times in recent history. On average, Americans believe 50 cents of every tax dollar that goes to the government in Washington, D.C., today are wasted...

"Americans are only a bit less critical of state government spending. The average amount they now say their own state wastes is 42 cents..."

When people say such things to pollsters should policy makers listen? Remarkably, some say "no". For instance, at the Capital Gains & Games blog Stan Collender writes:

There's one problem: the poll never defines "waste." Is it:But just as the poll question doesn't define "waste", this criticism of it doesn't define "worthless". Well, I can imagine two meanings for "worthless" in this context, and believe the Collender conclusion is wrong for both of them.1. Money used for a wasteful purpose?

2. Spending on a project that will have a negative economic return? A program that is working well but you think has outlasted its usefulness?

...

7. A program that is working well but you think has outlasted its usefulness?

8. Any or all of the above and anything else you can think of?Without a definition or any other type of guidance everything in the federal budget can and will be called "waste" by someone...

In other words... This poll is worthless.

#1: Politically worthless. Since the polled don't have a precise, uniform definition of the term "waste", and people are probably generally ill-informed about the details of government spending programs, the government is advised politically to ignore their opinion that it is wasting a great amount of tax money at their expense. Hmm...

One may imagine Louis XVI as he was being marched to the guillotine consoling himself: "this Parisian mob is barely literate, hardly knows anything at all about how my government functioned, and if asked couldn't even agree upon a single definition of how they imagine I 'wasted' the national wealth to impoverish them all. Bah, their opinion is worthless and I was right to ignore it all along..."

One may imagine Louis XVI as he was being marched to the guillotine consoling himself: "this Parisian mob is barely literate, hardly knows anything at all about how my government functioned, and if asked couldn't even agree upon a single definition of how they imagine I 'wasted' the national wealth to impoverish them all. Bah, their opinion is worthless and I was right to ignore it all along...""Stop talking to yourself, and head down please."

#2: Factually worthless. How could "the people" possibly know the truth? This is an

But the reality is that millions of average people -- indeed virtually all of us in this day and age -- have extensive, first-hand, personal experience of particular government programs in action, either as "customers" (ahem) of them, or as employees working within them, and often as both.

Let's consider some examples....

[] Here in New York City there are more than a million children in public schools -- at a cost now of more than $19,000 per student. Their millions of taxpayer-parents deal continuously with a school system managed like this.

[] Everybody deals with the Postal Service. And across the street from the local post office nearest to me is a deli that sells stamps -- at 75 cents each -- as one of its biggest customer draws, up there with lottery tickets. That's because the Postal Service has removed stamp machines from its post offices nationwide, because it it incapable of maintaining vending machines. So people wanting to buy a book of stamps, when faced with waiting in line behind messengers with baskets of certified mail to ship, go to the deli instead. Of course, the Postal Service's inability to operate stamp vending machines (even while it rents snack, soda, and coffee vending machines) is but one small symptom of its dysfucntional politicized management that is causing it to lose $7 billion this year (10% of sales -- as a monopoly!)

[] Medicare and Social Security? Even Obama tells us that Medicare's costs are 30% waste. (Which strangely, for some reason, just can't be cut from this single-payer government health program unless we all agree to "reform" private health insurance first. Is that some sort of blackmail?) And that's not even considering the underlying reality that Warren Buffett's employees at Dairy Queen pay 15% in payroll taxes from the first dollar of their wages to pay for his Social Security and Medicare benefits. How economically efficient and progressive is that?

[] Medicaid for the poor deals with millions of people as service recipients and providers, with with Medicaid graft -- not waste, but fraud and graft -- levels reported at 40% (!) in both New York and California. If "waste" is 30% in Medicare, believe me, it is a lot worse in Medicaid.

[] And as to military spending -- with all its dual-monopoly "bargaining", one-supplier cost-plus contracts, projects divided among all 50 states so politicians in all of 'em share the booty (and make sure the projects never die), projects voted in for electoral rather than military-need purposes, etc. ... need one whack that piñata?

How about those programs for starters? How many millions of citizens have first-hand experience of them, both inside and out?

If all those millions from their personal experience form a consensus opinion of "50% waste in government", then perhaps our governing

Now, a pile-on argument often used to dismiss (and ridicule) the opinion of the plebeian citizenry is: If you really think so much government is waste, tell us what programs you want to eliminate -- Medicare? Social Security? National Defense?? Ha! If you can't name any then you are refuted as an ignorant rube.

Replying to Collender, Bruce Bartlett (seemingly less conservative all the time) goes this route...

With commentators of the 'all spending is good' persuasion chipping in variously...I interpreted these data as meaning that spending could be cut by half without reducing government's ability to deliver services that people think are important to them ...

I tried to address this false notion in my last column by pointing out exactly what the government spends money on. As you know better than I, when people are asked what specific program they would cut the only one that gets significant support is foreign aid...

Unless you consider defense, social security, and medicare as government waste, which voters do not, [it is] impossible...But this is just low-grade sophistry.

~~

You know, you guys always talk about waste, but I have yet to see one of you point out exactly where that waste is and what you would cut. Those words become so hollow and tiresome....

[] If I believe there is great waste in government programs, that doesn't mean I want to cut or eliminate public education, public health care, postal services and so on, at all. I just want to eliminate the waste within them.

In fact, I may actually want to expand these programs -- which we could afford to do if we got rid of the waste.

[] Average citizens are perfectly qualified to identify and report the government waste they see in their everyday lives -- but they are not the management experts who are supposed to know what to do about it. Those "management experts" are, of course, the very inside-the-beltway policy mavens who are in denial here about the waste reports.

To draw an analogy, average citizens were perfectly qualified to spot and report the fact that General Motors cars were low-grade rattletraps relative to the price charged for them -- that is, that there was great waste in the General Motors production system compared to that of its competitors. But it wasn't the job of those average citizens to tell General Motors how to improve its designs, increase its productivity, cut its costs, to eliminate that waste.

That job belonged to the General Motors/United Auto Workers leadership

Now the proletarian masses report major quality-of-service and waste issues to the government policy experts inside the beltway. And the experts dismiss them: "Waste? What waste? These foolish rubes don't even have a technical definition of the word 'waste'...", no doubt operating securely in the world view that since government is a monopoly, and in an even more secure position than General Motors was, it can't possibly "hit the wall" to their cost the way General Motors did.

Oh, wait ... it can.

Wednesday, October 07, 2009

Noted about...

From TMQ, the world's most eclectic NFL football column.Here are some of the Olympic events we'll miss because the Games will not be in Chicago:

• Synchronized Senate seat selling.• 4 X 400 city inspector kickback relay. Any dropped exchange of the envelope of cash disqualifies the team.

• Balance beam blame-shifting. All participants must maintain their political balance while denying being the one who told President Obama he should go to Copenhagen because the fix was already in for a Chicago selection.

• Patronage triathlon. First one to paint the alderman's house, give gifts to all his nephews and rig a primary wins a no-show city job.

~~

The brew of our futures...

~~A brewery has launched a low alcohol beer called "Nanny State" (slogan: "Ask your Mum's permission and get hold of some now") after being branded irresponsible for creating the UK's "strongest beer".

Scottish brewer BrewDog, of Fraserburgh, was criticised for producing Tokyo* which has an alcohol content of 18.2%.

Campaigners welcomed the 1.1% alcohol Nanny State, but said the name showed a lack of appreciation of the problem... [BBC]

Maybe you really don't want to buy that lottery ticket -- you might win...

If I were any of those people, it would be "Keep the Tokyo* coming"."Winning the lottery isn't always what it's cracked up to be," says Evelyn Adams, who won the New Jersey lottery not just once, but twice (1985, 1986), to the tune of $5.4 million. Today the money is all gone and Adams lives in a trailer...

Suzanne Mullins won $4.2 million in the Virginia lottery in 1993. Now she's deeply in debt to a company that lent her money using the winnings as collateral ... she'd agreed to pay back the loan with her yearly checks ... When the rules changed allowing her to collect her winnings in a lump sum, she cashed in the remaining amount [without repaying the loan]...

Willie Hurt of Lansing, Mich., won $3.1 million in 1989. Two years later he was broke and charged with murder...

Missourian Janite Lee won $18 million in 1993 ... eight years after winning, Lee had filed for bankruptcy with only $700 left in two bank accounts and no cash on hand.

William "Bud" Post won $16.2 million in the Pennsylvania lottery in 1988 but now lives on his Social Security. "I wish it never happened. It was totally a nightmare," says Post...A brother was arrested for hiring a hit man to kill him, hoping to inherit a share of the winnings ... A former girlfriend successfully sued him for a share of his winnings ... Post even spent time in jail for firing a gun over the head of a bill collector.

Within a year, he was $1 million in debt ... He eventually declared bankruptcy. Now he lives quietly on $450 a month and food stamps... [Bankrate.com]

Tuesday, October 06, 2009

Progressives being so progressive they come out regressive.

Diane Lim Rogers attended and reported back on her Economistmom blog (read the whole story). The progressives' consensus remedy for the coming surging deficits? A new national Value Added Tax (VAT), a type of sales tax -- which, as she observes, might seem a bit odd...

That a bunch of experts all at-least-slightly left-of-center would recommend a VAT is notable, because the VAT is known to be a “regressive” tax.Indeed. A VAT is regressive because it falls on consumption, and poorer people consume more of their income than richer people, so the tax falls more heavily upon the poorer. A strange policy for liberals to endorse.

But today's progressives have a problem. To cover rising entitlement costs with the existing progressive income tax would require rate hikes so large as to be implausible. And if such hikes were enacted, they would seriously damage the economy through the "deadweight cost of taxes", which rises not with tax rate but by the square of the increase in the tax rate -- so if a tax rate doubles, the deadweight cost of the tax on the economy quadruples.

What's a progressive to do? Apparently, give up being progressive about taxes.

as Bill Gale emphasized in his presentation, we have to stop insisting that every single component of our tax system has to satisfy some overall ideal standard of progressivity. Some parts of the tax system can be regressive...Still, it leaves a puzzle: Why are so many progressives endorsing closing the budget gap with regressive tax increases instead of progressive spending cuts?

Here's how the Iron Logic of Arithmetic applies as of today:

Entitlement benefits are greatly underfunded going forward. We all know that in our progressive world, as things stand now, the bulk of the cost of this is going to land on the rich, one way or another — either by paying the bulk of the taxes needed to make up the shortfall, or by having their benefits cut by means test. Thus, either…

1) Income taxes on the richest go up a lot, or

2) The benefits of the richest go down a lot (or a combination thereof)

But being that there is nothing either efficient or “progressive” about raising income taxes so high to pay transfers to the rich; and that progressives apparently just don’t like the idea of cutting benefits, even to the rich, period; they are now coming around to favoring a new option…

3) A VAT that will act regressively as a consumption tax on the poorer to fund transfers to the richest -- to save the benefits of the richest.

Can somebody please explain to me how, by measure of progressiveness, #3 isn’t the worst option of the lot?

Doesn't this make it look like the defining trait of contemporary “progressivism” is a drug-addict’s-like refusal to consider any spending cuts whatsoever?

Today, Warren Buffett’s employees at Dairy Queen have payroll tax taken from the first dollar of their wages to pay his Medicare and Social Security benefits. Now, on top of that, they would also have to pay a VAT to make sure Warren’s benefits won’t need to be cut? And this is progressive??

Why do progressives reject progressive means testing? Ms. Rogers expressed the conventional wisdom of the left in an earlier post....

I am genuinely torn about the issue of means testing. On the one hand, we cannot afford to honor our current commitments via the entitlement programs, and it seems that means testing is one at least socially-efficient way to trim government spending...But is this true?

On the other hand, means testing the entitlement programs means there will be fewer Americans who will directly benefit from the programs, and I do see how that tends to undermine public support for those programs.

Has public support for the Earned Income Credit been undermined by its not being available to the rich? Is Medicaid spending dropping anywhere? Has federal assistance for higher education has been undermined by the FAFSA form that means tests the parents of every college student (by value of home, total savings, amount of income, everything) before the college sets its

Society is *so* means-tested today — from income tax to EIC to Medicaid to Section 8 housing vouchers to assistance for low-income public school students and on and on, that multiple studies show lowest-income individuals can face effective marginal tax rates exceeding 100% due to the loss of benefits with rising income, and that this is significant perpetuator of poverty.

How many of these programs have been undermined by not being available to the well off? If the honest answer is “none”, how does this square with the progressives' professed concern?

And, of course, progressives have been the driving force behind all of this mass of explicitly means-tested programs and policies. So why is it that they are so concerned about means testing only Social Security and Medicare??

(Someone a bit cynical about the politics of it all might think the reason is this: A major, if not the #1, driver behind the progressives’ ride into political power has been feeding ever-more entitlement benefits to all seniors -- AARP as the progressives’ #1 constituent. Blowing up that political base by suddenly telling AARP, “Hey, you are a special interest that we’re cutting back on the basis of need and merit”, would amount to a political self-nuking. Being how that must be avoided, progressives need a progressive-sounding rationale to avoid it … “if we cut back helping the rich, we will become unable to help the poor”… but enough of that, let nobody accuse me of cynicism regarding politics.)

For progressives to say, “if we don’t raise taxes on the poorer to pay the richer we’ll become unable to help the poorer” seems to me something of a ‘just so story’ sitting on a scale somewhere between “convenient” and “gross hypocrisy” — and I have no idea what could possibly be behind such a thing.

Anyway, here again is Keith Hennessey’s picture of the bottom line (especially that last chart). As Gene Steuerle (one of the few budget mavens fully respected on both left and right) put it, “If spending is always growing faster than the economy, you never catch up”.

Even progressives who can do that much arithmetic must admit that there is no way tax increases alone will ever close that gap — not even if you add a VAT, and a head tax, a Georgist 100% land value tax, and whatever else you want.

So, it seems to me, “progressives” have two good reasons to start saying the words “cut spending” as of today.

#1) It is the progressive option compared to raising taxes to protect the benefits of the rich — especially compared to rasing taxes on the poor with a regressive VAT.

#2) Reality. It is going to impose itself in the end. Dealing with it sooner is better than later.

The only realistic, effective program that can be adopted to close the coming future monster budget gap, by those concerned about it today, is to start preparing for, lobbying for, a future deal of: “tax increases for spending cuts … spending cuts for tax increases” — as we saw in closing Social Security insolvency crisis in 1983.

Yet still, among progressives the courage to say “spending cuts” remains missing — even when the only alternative is regressive.

Monday, October 05, 2009

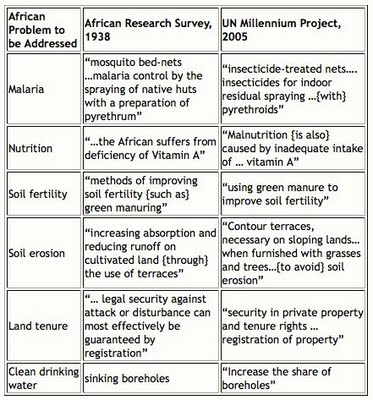

How's the progress in developing Africa?

Somebody tell Bono to try to think up something new.

[Chart via Reason]

Sunday, October 04, 2009

Sunday sports blogging

[] Wages of Wins confidently predicts that come this next NBA season the New York Knicks will suck again. But I don't care anymore.

Yes, as a kid I was a big fan of the Knicks, who under coach Red Holzman won championships with what had to be the smartest team ever, in any pro sport, period. The starting five ...

* Center -- future NBA coach and general manager Willis Reed.

* Small forward -- Rhodes scholar and future US Senator, Bill Bradley.

* Power forward -- already a past NBA player-coach (at age 24!) and a future NBA general manager and pro league Commissioner, Dave DeBusschere.

* Shooting guard -- on his way to a PhD, Dick Barnett.

* Point guard -- "the dummy" who ran the team, four-time all-star Walt Frazier.

While the top reserves were future Hall of Fame coach Phil Jackson, Rhodes scholar and future Congressman Tom McMillen, and aging Hall of Fame forward Jerry Lucas, who for fun used to show off to locker room visitors by memorizing pages out of the phone book.

They weren't the biggest team, the fastest or most physical, but boy did they know how to win with brains. My young self thought: "Wow, basketball is the thinking fan's game, and I'm a fan for life!" Little did I know.

By the end of the Isiah era (the "great extinction" of sentient basketball) the team had set not only all-time records for most losing per million dollars of mega-payroll, but had to have driven the franchise into IQ net negative numbers totalled up over its history. And as to being a fan ... I was cured.

[] You think the NFL isn't making enough money? (With the Dallas Cowboys charging fans up to $150,000 just for a license to buy a ticket -- cost of the ticket extra!)

Well, it's trying to make itself able to charge everyone (fans, broadcasters, vendors) even more via exempting itself from anti-trust rules, by getting itself and its 32 component teams to be treated as a single entity. The case American Needle v. NFL is now heading to the US Supreme Court. The Sports Economist has details you won't find in newspaper and ESPN reports, including a link to the legal brief filed by leading sports economists with the Supreme Court analyzing the issues. Read, football fans ... and hold on to your wallets.

[] Advanced NFL Stats has an extended "4th down study" revealing in as much detail as you can want exactly when teams should "go for it", punt, or try a field goal, and why. (And also showing that pro coaches are chicken weenies on 4th down, much too conservative -- although not without reason, as when they do correctly "go for it" and unfortunately fail to get it, they are highly prone to become the target of a media-fan lynch mob. Ask Jim Zorn.)

[] Sabrenomics points to the puzzle that we human beings are consistently overconfident in our abilities and opinions, yet "never learn" from our inevitable mistakes that result, however disastrous -- just as if there is some evolutionary advantage to having bad judgment about ourselves.

And, according to new research, in a world of uncertain risks, there is!

[] Pro Football Reference.com has launched a great search engine that lets you get practically anything you can want (or can imagine) from its huge data base of game logs and statistics going back to the 1920s. Do you want to know what quarterback has thrown the most "comeback" touchdown passes in the fourth quarter when trailing by 7 points or less? (Nope, John Elway isn't even close.) What cornerback had the most interceptions by his 25th birthday? Now you can.

[] Should professional economists who dabble in sports analysis on the side instead leave it to amateurs who take it really seriously? Steven Levitt, winner of the Clark Medal (the highest award for US economists after the Nobel) and of Freakonomics fame, publishes a paper of baseball analysis that draws a polite "tut-tut" from the Sabermetric Research blog -- and a smackdown in the comments...

To the extent economists aren't willing to consult with amateurs, I'd give a second piece of advice: if your research uncovers very large efficiency failures -- like, a pitcher can increase his income by about $6 million a year by throwing fewer fastballs -- then you should reexamine your assumptions and methods. Because there's virtually no chance you are right.

From little things one may sometimes divine bigger things.

But there is a question of competence...

One of the first rules politicians follow at every level, high and low, is to never put one's personal prestige and credibility (along with that of one's office) on the line voluntarily, as a matter of free choice, without knowing the outcome in advance -- that outcome being "victory", or something close enough to it to enhance one's credibility.

Obama went to Copenhagen voluntarily, not out of any necessity, to put his personal credibility and that of the Office of the President of the United States "on the line" in an effort to get an Olympic bid ... and came in dead last, the US city being the first eliminated in the first round, gaining only 18 of 94 votes. Ouch.

The after-effects are described by the New York Times...

A sense of stunned bewilderment suffused Air Force One and the White House. Only after the defeat did many advisers ask questions about the byzantine politics of the Olympic committee.Get that? The President of the United States and his staff of advisers didn't understand the politics.

That's the byzantine politics of an Olympic selection committee. What about the politics of Russia? Iran? The Middle East? China?

Mr. Obama’s decision to become the first American president to lobby the Olympic committee in person ... was predicated on the theory that Mr. Obama’s star power overseas — “the best brand in the world,” as his advisers have put it — was luminescent enough to make the difference.Does the Obama team think his "luminescence", his "best brand in the world", influences the Russian and Iranian and Chinese governments in their policy decisions? I don't know.

Two weeks ago Obama's people killed the missile defense system that was to be based in Poland and the Czech Republic ... right after assuring the Poles and Czechs it had made no decision to do so ... ever so diplomatically, on the day of the the 70th anniversary of the Soviet invasion of Poland ... with the Poles first hearing about it from the news media ... so infuriating the Polish Prime Minister that he refused to take Obama's call about it. (All perhaps another small indicator of competence?)

Maybe killing that missile defense system was the right thing to do militarily and technically. I don't know. But politically, given how Putin and the Russian government hated it, killing that system without getting something of value back from the Russians for doing so would be plain incompetence. Did we get anything back? Nothing that anyone has announced.

That evening at a social gathering (in Manhattan, all liberals talking) I was part of a several-party conversation that went around like this: "On the 70th anniversary! And we got zip for it. Incompetence" ... "You don't know we didn't get anything back" ... "If he'd gotten anything he'd have grabbed the credit for it by saying what" ... "Maybe not. It would be valuable to the Russians to look like they hadn't conceded anything, that might have gotten them to concede more" ... "Right, more of something nobody can see" ... "Not yet" ... "Well, he'd better have gotten more from Putin than 'future considerations' or 'a player to be named later'..."

Did Obama get something solid (if out of sight) from Putin for giving up that missile shield?

Or did he believe that giving it up voluntarily for nothing would add to the "good will" that his brand has with Putin, enhance the influence of his "luminescence" upon the Russians -- so he can count on them in the future to in turn, similarly, voluntarily, give up something important to him as a return favor?

I don't know. But if I had to guess, the odds I'd give about it have shifted a bit.

Saturday, October 03, 2009

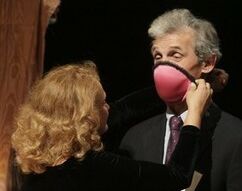

Ig Nobel Prizes for 2009 awarded

Public Health Prize winner Elena Bodnar demonstrates her invention —- a brassiere that, in an emergency, can be quickly converted into a pair of face masks, one for the brassiere wearer and one to be given to some needy bystander, with the help of Nobel laureate Wolfgang Ketterle.

The other winners...

PEACE PRIZE: Stephan Bolliger, Steffen Ross, Lars Oesterhelweg, Michael Thali and Beat Kneubuehl of the University of Bern, Switzerland, for determining — by experiment — whether it is better to be smashed over the head with a full bottle of beer or with an empty bottle.

REFERENCE: "Are Full or Empty Beer Bottles Sturdier and Does Their Fracture-Threshold Suffice to Break the Human Skull?" Stephan A. Bolliger, Steffen Ross, Lars Oesterhelweg, Michael J. Thali and Beat P. Kneubuehl, Journal of Forensic and Legal Medicine, vol. 16, no. 3, April 2009, pp. 138-42.

CHEMISTRY PRIZE: Javier Morales, Miguel Apátiga, and Victor M. Castaño of Universidad Nacional Autónoma de México, for creating diamonds from liquid — specifically from tequila...

MEDICINE PRIZE: Donald L. Unger, of Thousand Oaks, California, USA, for investigating a possible cause of arthritis of the fingers, by diligently cracking the knuckles of his left hand — but never cracking the knuckles of his right hand — every day for more than sixty (60) years...

PHYSICS PRIZE: Katherine K. Whitcome of the University of Cincinnati, USA, Daniel E. Lieberman of Harvard University, USA, and Liza J. Shapiro of the University of Texas, USA, for analytically determining why pregnant women don't tip over...

LITERATURE PRIZE: Ireland's police service (An Garda Siochana), for writing and presenting more than fifty traffic tickets to the most frequent driving offender in the country — Prawo Jazdy — whose name in Polish means "Driving License"...

ECONOMICS PRIZE: The directors, executives, and auditors of four Icelandic banks — Kaupthing Bank, Landsbanki, Glitnir Bank, and Central Bank of Iceland — for demonstrating that tiny banks can be rapidly transformed into huge banks, and vice versa — and for demonstrating that similar things can be done to an entire national economy...

MATHEMATICS PRIZE: Gideon Gono, governor of Zimbabwe’s Reserve Bank, for giving people a simple, everyday way to cope with a wide range of numbers — from very small to very big — by having his bank print bank notes with denominations ranging from one cent ($.01) to one hundred trillion dollars ($100,000,000,000,000)...

BIOLOGY PRIZE: Fumiaki Taguchi, Song Guofu, and Zhang Guanglei of Kitasato University Graduate School of Medical Sciences in Sagamihara, Japan, for demonstrating that kitchen refuse can be reduced more than 90% in mass by using bacteria extracted from the feces of giant pandas...

VETERINARY MEDICINE PRIZE: Catherine Douglas and Peter Rowlinson of Newcastle University, Newcastle-Upon-Tyne, UK, for showing that cows who have names give more milk than cows that are nameless...

Congratulations to all -- and thank you for advancing the bounds of human knowledge!

Friday, October 02, 2009

Noted...

Oldest "Human" Skeleton Found--Disproves "Missing Link"

Scientists today announced the discovery of the oldest fossil skeleton of a human ancestor. The find reveals that our forebears underwent a previously unknown stage of evolution more than a million years before Lucy, the iconic early human ancestor specimen that walked the Earth 3.2 million years ago.

The fossil puts to rest the notion, popular since Darwin's time, that a chimpanzee-like missing link—resembling something between humans and today's apes—would eventually be found at the root of the human family tree.

Indeed, the new evidence suggests that the study of chimpanzee anatomy and behavior —- long used to infer the nature of the earliest human ancestors —- is largely irrelevant to understanding our beginnings... [NatGeo]

~~

But for those "human trafficking" rules, eBay could resolve a lot of intra-family conflicts...

Girl, ten, tries to sell nan on eBay

Zoe Pemberton, ten, from Clacton, Essex, put her 61-year-old nan Marian Goodall on the eBay auction website hoping to get "just 99p for her". The youngster described Mrs Goodall as "rare and annoying and moaning a lot" ...

She said: "I was sitting down watching TV and she kept asking me to do things like make her a drink. I was on the laptop and suddenly thought I'd put nan on Ebay. I didn't know how much we'd get for her, maybe 99 pence..."