Tuesday, March 31, 2009

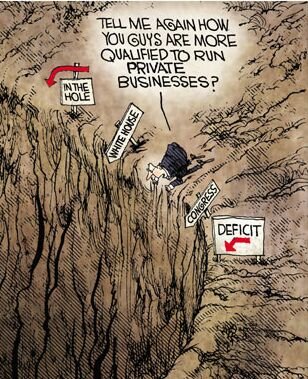

The upper right had corner of today's Ramirez...

See the rest of it and more of 'em via the NYP.

Monday, March 30, 2009

Andrew Biggs writes...

Who do you think is more reliable —- the full faith and credit of the United States backing up Treasury bonds, or the McDonald’s Corporation, backed only by “billions and billions served”?Big Mac, please!

By some market measures it is the latter, and for good reason. The price of credit defaults swaps guaranteeing payment on 10-year Treasury bonds has risen by 1000 percent since December 2007, with an implied 12 percent probability of default on government debt over the next decade. In the view of the markets, this makes U.S. government bonds a more risky proposition than debt issued by McDonald’s.

Why? ... [To find out you'll have to read the whole thing.]

Sunday, March 29, 2009

As the "creative destruction" of capitalism described by Schumpeter proceeds in action, our vibrant economy reallocates assets to their most productive uses....

Axed Wall St. women turn to stripping.Scores of professional New York women stripped of their six-figure jobs are now working as "gentlemen's club entertainers" at upscale Manhattan jiggle joints. Former Wall Streeters, fashion executives and real-estate agents are pole dancing and stripping for as much as $1,500 a night -- but also because they like the flexible hours.

Randi Newton, 28, who lives in Midtown, was a financial analyst at Morgan Stanley before the crash but was fired.

"A few nights after I got laid off, I went with friends to a strip club to get drunk and forget my unemployment troubles," Newton said. "The manager offered me a job as a dancer. I thought it was different. And fun."

Today, Newton ... pole dances at Rick's Cabaret in Murray Hill three or four nights a week and says she makes "$160,000 a year on tips alone ... It was very odd seeing a strip club being better run than a major brokerage firm, not to mention I've never had problems with sexual harassment at Rick's"...

Jiggle-joint owners say they are hiring more "talent" than ever right now, due to a surge in business ... "These places give men hope," Rick's president Eric Langdan said, "the worst of times for us is the breast of times."

[NY Post]

Hey, who knew that "tourism" is a science? (seen at about 7:30 on the map of all sciences.)

From the realm of politics out beyond the big water....

"How are we supposed to trust the government with data protection if the Home Secretary can’t even keep the fact that her husband has been watching porn secret?"

[via Tim Worstall]

The fate of promised middle class tax cuts, now and then.

Dumb derričres of the week, in the world of sport...

[University of Kentucky basketball coach Billy Gillispie] won, but not enough. He shook hands, but not enough. After just two years, Kentucky had had enough ... The school fired Gillispie on Friday...

Gillispie never signed a formal contract as his lawyer and the university fought over the wording.

... the university does not plan to pay Gillispie a $6 million buyout that was to be part of his seven-year deal that remains unsigned.

~~

and Pro ...Ex-NFL Star Vick Lands in More Hot Water

Michael Vick’s National Football League comeback was dealt a potential blow this week as U.S. authorities alleged the former star quarterback illegally spent $1.35 million of his company’s pension-plan funds to help pay criminal fines stemming from his unlawful dog-fighting conviction...

Revealed! The true story behind the AIG bailout.

Friday, March 27, 2009

The case for a big-deficit economic stimulus isn't so cut-and-dry obvious as the Obama Administration and liberal economists would have all believe -- at least in the opinion of European leaders, whom you might think would be the big spenders themselves in today's situation ...

"Road to hell" might be a bit harsh, but most of the rest of Europe seems to agree in substance...EU presidency: US stimulus is 'the road to hell'

The head of the European Union slammed President Barack Obama's plan to spend nearly $2 trillion to push the U.S. economy out of recession as "the road to hell" that EU governments must avoid ... Topolanek took aim at Washington's deficit spending.

"All of these steps, these combinations and permanency is the road to hell," Topolanek said. "We need to read the history books and the lessons of history and the biggest success of the (EU) is the refusal to go this way."

"Americans will need liquidity to finance all their measures and they will balance this with the sale of their bonds but this will undermine the liquidity of the global financial market," Topolanek said. [AP]

The head of the European Central Bank, Mr. Trichet, interviewed in the Wall Street Journal:Mr. Topolanek is not alone in his concern that Mr. Obama’s stimulus package, which will push the United States budget deficit this year to 10 percent or more of gross domestic product, will put a huge strain on global financial markets.

German officials have also criticized the evolving American program, and many other European nations have declined to create fiscal stimulus programs anywhere near as large as that of the United States... [NY Times]A cacophony of top voices is rising. European Central Bank chief Jean-Claude Trichet opposes stimulus, as does the German finance minister, the British central bank chief, the European president, and others.

In the German-French view, sealed by Chancellor Merkel and French President Nicolas Sarkozy in a summit two weeks ago, public debt in the form of stimulus is premature... [CSM]

WSJ: Do you think the criticism that European governments have not done enough, in terms of fiscal stimulus, is justified?And -- get this -- Europeans are warning that the stimulus deficits are setting the U.S. on the path to socialism. Europeans!

MR. TRICHET: I think it's not...

... you have to reassure your own people that you have an exit strategy, to reassure households that we are not putting in jeopardy the situation of the children, and to reassure businesses that what is done today is not done to the detriment of their own taxation in the years to come.

Activation of the economy depends crucially on confidence. And confidence today needs that we can prove to our own people that we have the right balance between the short-term and the medium-and long-term perspective....

If your people have the sentiment that they will be not better off in an endless spiraling of deficits, they will not spend any money that you give them today.

After behind the scenes conversations about the aggressiveness of the U.S. approach, the views of a number of American allies are now crystal clear — America is spending itself into a hole which it cannot get out of, and the nation is on a course which will eventually lead to socialism. [Time]

Europeans, who generally see American fiscal policy as too laissez-faire, think Mr. Obama is moving the U.S. too far toward big government ...

And they’re balking at U.S. prodding to follow suit. European governments want their role in economic stimulus to be smaller than it is in the U.S. On the economic crisis, the EU, which more often draws disapproval than praise from Republicans, finds itself more aligned with the GOP thinking than that of the Democrats.

As they say on TV, you can’t make this stuff up.[Peter A. Brown, assistant director of the Quinnipiac University Polling Institute, in the WSJ]

Wednesday, March 25, 2009

An innovative charter school successfully brings quality education to the inner city...

According to state data, Bronx Preparatory Charter School has been outperforming other schools in District 9 by leaps and bounds. The percentage of fifth- through eighth-graders at Prep who meet state requirements in math and reading is more than 22 points higher than the district average.So, following up on the very purpose of experimental, innovative charter schools, the city's public education system learns what works from Bronx Prep and then copies it. No wait -- this is the public education system...

Additionally, Bronx Prep's preliminary four-year graduation rate in 2008 was 73.1 percent compared to a 2007 citywide high-school graduation rate of 55.8 percent.

[but] high marks might not be enough to keep the Bronx charter school out of hot water.Yesterday the establishment delivered on the threat...

Trustees on the SUNY Charter Schools Committee are set to vote today on a recommendation to put Bronx Prep on probation for failing to meet state requirements for teacher certification. State records show that between 49 and 64 percent of teachers at the school taught without proper certification between 2004 and 2007...

"SUNY does view putting schools on probation, something generally done for compliance reasons, as a last resort," SUNY spokesperson Cynthia Proctor said. "It's certainly possible for a school to be doing well even if they're violating the [state teaching] provision but, of course, we can't allow that [violation] to happen." ...

... for many parents at the school yesterday, the certification issue took a back seat to how well their kids are performing.

"We don't ask who's certified and who isn't I just know they're doing a good job," said Ingrid James, whose daughter is in the seventh grade.

Jane Hannaway, director of education policy at the Urban Institute a nonpartisan think tank in Washington, DC said the school's results jibe with studies that have found a weak correlation between certification and teacher quality.

"I think the general point is that certification in and of itself doesn't explain a whole lot about teacher effectiveness," she said. [NY Post]

Score one for the teachers union in its battle against kids: Though Bronx Prep Charter School students have chalked up terrific academic results, state officials nonetheless put the school on probation yesterday.

Why? Because a few of its teachers are technically "uncertified." Brilliant.

Talk about missing the forest for the trees. Bronx Prep, which serves 5th- through 12th-graders from predominately poor, minority homes, is a model for city public schools.

And if having a few "uncertified" teachers on board is part of its winning formula, well, how about encouraging other schools to hire a few "uncertifieds," too?

Its 11th-graders scored better, on average, on last year's SATs than kids at every other public high school in the borough, save selective-admission Bronx Science. And get this: 100 percent of Prep's 11th-graders sat for the SAT.

This is clearly one successful school. Yet now, it's officially on "probation," its charter in danger of revocation....

...certification is a club used by advocates of the status quo to beat down competition.

That is to say, yesterday's spectacle basically amounted to New York's education cartel attempting to rid itself of an embarrassing example of its own very visible failure in The Bronx. Yesterday, it moved a step closer toward its goal.

Don't forget: If Bronx Prep's charter is revoked or even if its successful staff is shaken up, the kids will suffer. But it'll be teachers-union honcho Randi Weingarten who'll be smiling. [editorial, NYP]

Tuesday, March 24, 2009

The darkest, most shocking secrets of government continue to be revealed...

He might pose then as though he wants to cut the taxes, but with the budget gap projected to be bigger then than today, there's a real fat chance those taxes would be cut.GOV PLOTS SECRET TAX HIKE ON RICH

Gov. Paterson and legislative Democrats have secretly agreed on an $8 billion, two-year tax hike on individuals making more than $500,000 a year that will "sunset" around the time he plans to run for election in 2010, legislative sources told The Post.

Also under intense discussion ... is a proposal to raise the state's 4 percent sales tax to 4.5 percent the total of which would jump to close to 10 percent in parts of the state with the addition of local sales taxes...

While Paterson has repeatedly claimed he was against a "millionaires' tax" on the wealthy and hasn't backed a sales-tax hike, the sources said he was privately backing both...

"Paterson has told everyone he really wants the taxes, but he wants it to appear to the public that he's against them," a senior legislative official said.

"Then, next year, when he's running, he'll say we can afford to phase them out so he can claim that he's a tax cutter."...

Democrats who control the Legislature and the governor's office for the first time since the late 1930s plan to ram the budget through with virtually no debate or scrutiny using special "messages of necessity" issued by Paterson that will circumvent the legally required three-day waiting period designed to give lawmakers, and the public, time to review proposed new laws, several sources said.It seems our accidental (post-Spitzer) governor lacks the disciplinary skills to keep his loyal (ahem) minions on message. With every radio station in NYC today reporting, "Governor Patterson is planning to raise taxes and then pretend he wants to cut them...", it's on to political Plan B.

As lieutenant governor and Senate minority leader, Paterson strongly opposed using the "messages" to cut off debate... [NY Post]

How does one know when a politician is lying? One sees something like this...

Monday, March 23, 2009

French Air Force grounded by Windows virus. Yes, they forgot to run Windows Update. Bringing to mind the classic: "Why are there so many tree-lined boulevards in France? Because Germans like to march in the shade." And many more. [HT for the scurrilous humor to Tim Worstall.]

Do Polish hookers cost too much? No. Many other important questions about the world financial crisis addressed as well.

The perfect crime.

How does an "expert analyst" get to be frequently quoted in the press?

my case study is Noriel Roubini. In 10 years he will either continue to be a regular talking head who no longer says anything unconventional ... or he will continue to make unconventional guesses and will have lost influence and be forgotten.

Putin and Reagan in 1988 (maybe).

Check the "tourist" on the left with the camera. The story. And Putin's family pictures. Quick impressions: Soviet family photos from the 1980s look like American ones from the 1930s, and Vlad may never have smiled in his life. I mean, if you don't smile for the camera...

Sunday, March 22, 2009

Let's say you owned a business or were a major investor in one. How would you feel if the US government suddenly decided to prohibit you from giving your employees compensation incentives to do good work and not jump ship to your competitors?

I'd be be pretty damn mad. And I am! And you should be too. Because as taxpayers we now are owners of AIG, Citibank, JP Morgan and a whole bunch of other major businesses -- and the House of Representatives is doing just that to all of them, by voting to place a 90% retroactive tax on compensation paid by such firms that takes the form of ...

"any retention payment, incentive payment, or other bonus which is in addition to any amount payable to such individual for service performed by such individual at a regular hourly, daily, weekly, monthly, or similar periodic rate."Forget the possible resulting violations of the US Constitution -- that it specificially prohibits Congress from enacting ex post facto laws and bills of attainder, while protecting contracts.

"Bills of attainder, ex-post-facto laws, and laws impairing the obligation of contracts, are contrary to the first principles of the social compact, and to every principle of sound legislation." -- James Madison, Federalist Papers, #44.And forget that when Congress enacted the bailout law only last month it specifically stated that it would not apply compensation limits to preexisting contracts -- and that it knew full well of the bonuses at the time.

These are mere quibbles of Constitutionality and plain justice -- with some careful legal drafting and enough populist pressure on the courts, Congress can always get its will past whatever judicial qualms some judges might have about them. Just remember how all those honest and loyal Japanese-American citizens wound up forcibly placed behind barbed wire in concentration camps for the duration of World War II. What's a tax on financial executives compared to that?

But this tax ... it is so stupid! Why should the businesses that I have been forced to invest in be barred from structuring compensation packages to promote good management and the retention of key employees?

What is the benefit bestowed upon the nation by Congress in its wisdom, via this promotion of bad management? Well...

Is Congress's vengence being focused on punishing the wrongdoers? No!

The worst malefactors at AIG are gone. The new top management isn't taking bonuses. Those in the bonus pool are making sums that for most of us would be astronomical but that are significantly less than what they used to make. Driving away the very people who understand how to fix this complicated mess may make everyone else feel better, but it isn't particularly cost-effective. [Wapo]Does it spare the honest, capable employees who could have had top jobs elsewhere, but signed on to help straighten out the mess at AIG? No!

Those left behind to clean up the mess, the majority of whom never lost a dime for AIG, now feel they have been sold out by their Congress and their president. "They've chosen to throw us under the bus," said a Financial Products executive, one of several who spoke on condition of anonymity, fearing reprisals. "They have vilified us." [Wapo]Is it going to help enlist additional voluntary cooperation of healthy financial firms, which don't need government aid, in the government's future efforts to fix the finanical system? Ha! What do you think?

I gather that the blowup over the "bonuses" is already creating extreme reluctance by private parties to participate in ongoing and new government bailout programs that might subject them to similar firestorms in the future. [Dan Shaviro]Well, at least this clawback of bonuses will cover a fair part of the cost of the AIG bailout, saving taxpayers good money there, right?

The financial-services industry is warning that the move to impose a steep tax on bonuses at companies that receive taxpayer aid may cause some banks to exit the Troubled Asset Relief Program before their competitors are healthy enough to do so, risking a new freeze of the nation’s credit markets.

“This will undermine the recovery efforts,” said Scott Talbott, senior vice president for government affairs at the Financial Services Roundtable, an industry trade group in Washington. “It will decrease industry interest in participating in any recovery program and cast a pall over existing and future contracts.” [Bloomberg]

Um, AIG has received $173 billion so far, the bonuses total $165 million, so recovering 90% of them (at most) will recover, ... uh, carry the one ... 8.6 ten thousandths of the cost of AIG's bailout. Wow!

But AIG's total compensation for all its employees is outrageously high, and ending these bonuses will reduce it right?

No, and no. The $165 million is only about 3% of AIG's payroll of 116,000 employees ... and under the law all the bonus compensation can be rolled back into regular salary -- saving nothing at all! Simply reducing the effectiveness of its compensation structure.

OK, at the very least, all this Congressional outrage over the bonuses represents genuine and sincere Congressional concern over the waste and abuse of taxpayer funds.

So, if just 1% of Obama's $775 billion stimulus goes to waste and patronage for political favorites and abuse, Congress will spend 47 times as much time being outraged about it, right? And if just 1% of Congress's $1.8 trillion deficit for 2009 goes to similar waste, patronage for political favorites, and abuse, Congress's howling will be 109 times as loud, right? ... I doubt it.

Hey, just what is the benefit of this 90% tax supposed to be, anyhow?

To let Nancy Pelosi and the Democrats gain a percentage point in the polls by playing up to the ignorant resentments of the populist mob?

Frankly I've been kind of shocked by some of the normally reasonable and well-considered bloggers I read who've joined call for mob justice, as unjust and self-defeating and plain, yes, stupid, as it is -- such as at Econbrowser and Capital Gains & Games.

If anyone from either of those sites or anywhere else can tell me one good thing about this 90% tax, I'd like to hear it.

Otherwise, as an owner of these companies, I want that tax killed, and my bonus compensation programs designed to maximize the value of these firms reinstated NOW.

Wednesday, March 18, 2009

Out of all 50 states plus Washington DC, the lucky recipient getting the most economic stimulus spending per capita sent to it from our leaders in Washington DC is ... Washington DC!

In fact, the District of Columbia receives more than twice the average per capita stimulus provided to all the states of $525 (and median of $488).

1) Washington DC ... $1,089

2) Alaska ............. 834

3) Wyoming ............ 751

4) North Dakota ....... 718

- -

26) Pennsylvania ...... 488

- -

51) Nevada ............ 406

Who knew things were so tough in the nation's capital? Hey, they're not!

Yet among the 50 states plus itself, DC ranks as a top recipient of all categories of stimulus spending across-the-board: #1 in spending on transporation, #1 in HUD spending, #1 in health spending, #1 in crime fighting funds, #2 in spending on water, #2 in Pell grants, #3 in job training, and #4 in education funds.

Hey, is it enough to make one wonder if somebody who lives in DC might be "connected"?

Though it's not clear from these numbers that there's much (positive) connection between the amount of stimulus spending a state receives and the condition of its economy -- the amount of stimulating it needs.

Nevada, #51 and last the list, is pretty much the ground zero of the housing market collapse and suffered the greatest increase in its unemployment rate in 2008 over 2007 of all the states (except for little Rhode Island). While the number 2-to-4 top recipients -- Alaska, Wyoming, and North Dakota -- didn't make the list of "states with statistically significant unemployment rate changes, 2007-08" compiled by the BLS.

Here's the full listing of all 51 recipients....

Compiled from per capita data by category published in the WSJ (except for "transportation", which was computed by taking the gross transportation figure for each state divided by a "capita" derived dividing the state's gross education amount by its per capita education amount).

Sunday, March 15, 2009

A Bulgarian grandmaster appears to have broken the world record for the highest number of chess games played simultaneously, organizers said Monday. Kiril Georgiev played 360 opponents... [AP]What was the hardest part for Grandmaster Georgiev in setting the new record? Not all the thinking involved in playing this intellectual game against so many opponents at once. A typical non-chessplayer sees a master playing 20 or 60 or 100 games at one time -- and winning! -- and is likely to imagine, "Wow, he's out-thinking all those other people together." But it's not true. As a former tournament player who gave a few small simuls myself, I can attest that the master is simply "out-knowledging" all the other players, "out-remembering" them.

For an analagous situation imagine, say, a "Chemistry Q&A Challenge" in which every contestant who gives a wrong answer to a question about chemistry is eliminated. Contestents are recruited randomly from the street -- except for one who is a PhD in chemistry. Who's going to win? Even if the PhD has to take on every other contestant head-to-head he's odds on to beat them all.

For an analagous situation imagine, say, a "Chemistry Q&A Challenge" in which every contestant who gives a wrong answer to a question about chemistry is eliminated. Contestents are recruited randomly from the street -- except for one who is a PhD in chemistry. Who's going to win? Even if the PhD has to take on every other contestant head-to-head he's odds on to beat them all.That's how chess simuls work. The amateurs at their boards ponder and analyze and work to come up with a move, the master walks by, glances, maybe thinks "yeah, yeah, that again", makes the right answer and walks on. He knows the move to make, he doesn't figure it out. The master is actually spending most of his time thinking, "Am I going to get out of here in time for dinner? ... Hey, is that girl over there into chess geeks like me?", or whatever.

A few games may prove challenging to the master since a few decent-strength "ringers" often sneak into such exhibitions in the hope of beating a name player -- to be able to brag for the rest of their lives "I once beat Grandmaster Bigshotski! (while his attention was divided among 74 other games)". But for the most part these simuls boil down to an unfair contest of one person's broad and deep knowledge versus everybody else trying to figure things out for themselves. It is far, far more mentally challenging for a master to play against one other master than against any number of amateurs.

So, if thinking isn't the challenge for the master in a simultaneous exhibition, what is? What's the constraint that is difficult to fight that limits the number of opponents that can be played, so there always is a record to be broken?

Man, it's the endless walking.

Just to get from the first board to the last meant walking some 500 yards. It took him six hours to complete the first eight moves. During the display, Georgiev was allowed to take breaks of five to 10 minutes every hour. He got head and leg massages...GM Georgiev's physical training methods were entirely modern. One hundred-odd years ago the top British Grandmaster Joseph Henry Blackburne famously used another method to motivate himself to keep moving, to alleviate his boredom, and give his opponents a handicap advantage at the same time: He'd place a bottle of whiskey amid his opponents' boards and down a shot every time he walked by.

Georgiev's training for the match began by running four miles a day for two months through a forest in his native Bulgaria....

He finished with 284 wins, six losses and 70 draws, scoring 88% ... after walking 12 miles. [GM Soltis]

A new kind of eco tax.

You've heard of the gas tax, and the fat tax, and the fat-rated gas tax, but now comes an entirely new kind of "gas" tax.

Proposals to tax the flatulence of cows and other livestock have been denounced by farming groups in the Irish Republic and Denmark.

A cow tax of €13 per animal has been mooted in Ireland, while Denmark is discussing a levy as high as €80 per cow...

Livestock contribute 18 per cent of the greenhouse gases believed to cause global warming, according to the UN Food and Agriculture Organisation. The Danish Tax Commission estimates that a cow will emit four tonnes of methane a year in burps and flatulence, compared with 2.7 tonnes of carbon dioxide for an average car .... [TimesOnline]

Saturday, March 14, 2009

Bernie Madoff now is prisoner #61727-054.

But still walking free are the vermin parasites of the Madoff scandal -- the "fund of funds" managers who take fat fees for dumping client funds in other funds that take fat fees, without even bothering to check if the latter are fraudulent (much less high-quality enough to justify paying two layers of fees to be in them.)

But still walking free are the vermin parasites of the Madoff scandal -- the "fund of funds" managers who take fat fees for dumping client funds in other funds that take fat fees, without even bothering to check if the latter are fraudulent (much less high-quality enough to justify paying two layers of fees to be in them.)[] Fairfield Greenwich Advisors had $7.5 billion of the $14 billion under its "management" in Madoff.

[] Tremont Group Holdings, owned by OppenheimerFunds and Massachusetts Mutual Life Insurance Co., had $3.3 billion, more than half its assets, in Madoff.

[] Ascot Partners had $1.8 billion, substantially all its assets, invested in Madoff.

[] Rene-Thierry Magon de la Villehuchet, manager of Access International Advisors, owned a castle in Europe and lived a life among the European nobility and as an international yachtsman on the fees he took from investing $1.4 billion of his clients' funds in Madoff.

The list goes on.

In my book these guys are in a very real way even worse than Madoff. With Madoff, as with the likes of Al Capone, you at least have to give the devil his due for actually putting the work into committing an historical crime and taking the risk of ending his days in jail for it.

But these fund of funds managers committed no-effort fraud to coast to riches. The lack-of-diversfication alone in pouring the bulk of their funds into Madoff should be clear breach of fiduciary duty for a professional investment manager, IMHO -- before even getting to their lack of due diligence in selecting superior funds to invest in, which is their purported justification for charging fees to clients to put their money in fee-charging funds.

And without these guys funneling all their billions into Madoff, he couldn't possibly have performed his scam on nearly as large a scale or for as long.

Well, we'll eventually see what the courts have to say about them -- but if they wind up in one circle of hell lower than Bernie I won't be surprised.

There's a lesson here for the average investor: beware in picking a fund manager, and never pick a fund manager to pick your fund manager. The person responsible for your money is you.

Friday, March 13, 2009

... local real estate advertisements are prohibited by law from including the words "family friendly", "private", "kids", "walking" and "playroom", because they are discriminatory.

Despite repeated warnings in state-mandated training sessions that such language could violate anti-discrimination laws in the context of selling or renting an apartment, the seemingly innocuous terms continued to appear in ads."Quiet" and "safe" are also banned -- try to figure that out. "People" is a forbidden word. (Who's supposed to be reading these ads?) An ad can't even name the school district the apartment is in!So this week, real-estate giant Corcoran officially banned more than 200 potentially "offensive" words and even installed new software that makes it impossible for brokers to type them into their ads...

Now, due to a slew of recent court cases and increased enforcement, companies such as Corcoran are taking pains to strip terms such as "bachelor pad," which may discriminate against couples, and the terms "couples" and "family-friendly," which may offend singles.

The Corcoran list considers mentions of nearby churches and synagogues as sinful, while the word "professional" is out because an ad cannot discriminate based on occupation. The company also excised the term "exclusive" because it may be interpreted as meaning racially exclusive.

The guidelines have some Corcoran employees frustrated.

"By saying 'walking distance,' I would be discriminating against those who are unable to walk," Christine Toes, a Corcoran vice president, wrote on the blog urbandigs.com. "Hopefully, I can still use 'close proximity to public transportation.' "...However, it is not against the law for brokers to describe a coffin-sized studio as "cozy." [NY Post]

Wednesday, March 11, 2009

Three brothers are planning a record 24-hour stay on the peak of Mount Everest [via Newmark's Door]. Well, up on the summit there's cell phone service now, so they can pass the time calling friends. ("Guess where I am!").

It seems mountains just aren't as tall as they used to be. Last year more than 600 people climbed Everest, including a mother-daughter team, and a 76-year old and a 75-year old, the former setting the new record as its oldest climber.

But the 75-year old was none other than Yuichiro Miura, who 33 years earlier was the subject of what is still my favorite documentary film of all time, The Man Who Skied Down Everest, which recorded Miura's two weeks climbing Everest to ski down it in four minutes. He pretty much made the ski run down too, well, most of the way -- sliding, falling and bouncing about the last third of the distance before very luckily slamming into the side of a boulder, which kept him from sailing over the edge of and into a "bottomless" crevasse. All caught on slow-motion film from every angle.

While he was in his hospital bed the press asked him, "Are you going to try it again to ski all the way?" He said, "Hell no." That was in 1975.

But he did climb Everest again, in 2003, at age 70, setting the then-record for oldest climber of the mountain. The record was broken soon after, and he climbed the Mount again last year to reclaim it -- but missed it to that 76-year-old who beat him up there by one day.

Talking about his climb to the top last year Miura attributed such accomplishments to the power of positive thinking.

"If you have a goal in life you have to go through the physical and mental training, forget about age and take up the challenge. I feel like I'm in my thirties."

But considering the difficulty I have getting out of bed in the morning, I find that depressing.

I prefer to think he has a genetic advantage. Miura's father skied down Mount Blanc at age 99.

Tuesday, March 10, 2009

Warren Buffett, speaking on dealing with today's economic problems, invokes the good old days of the nation pulling together after Pearl Harbor...

People -– when you have a Pearl Harbor, you have to know the nation is going to be united on December 8th to take care of whatever comes up. And we have little squabbles, we put them aside and everybody goes to work ... The Army doesn’t blame the Navy because there were too many ships in Pearl Harbor, and it shouldn’t have happened ... None of that sort of thing. We got united, and we really need that now...In reality there were nine official government investigatory commissions and Congressional hearings, the first of which, the Roberts Commission, appointed by President Roosevelt, met on the same day it was established -- not December 8th but the 22nd. It was remarkably efficient as government commissions go, as in just four short weeks (which included Christmas and New Years) it was able to find the Pearl Harbor commanders Admiral Kimmel and General Short guilty of "dereliction of duty". Both lost their rank and commands as a result -- Kimmel lost two stars and was out of the navy in two months. But that didn't prevent him from being put before the eight other investigations. Since then...

... you didn’t have–start congressional hearings on December 8th, you know, that were going to last for weeks while all of the commanders and the various people were in various ways pilloried or taunted or whatever about `Why in the world did they let this happen?’ None of that. I mean, people said, `We’ve got to get something done.’ And they–and they trusted their leadership.

Thirty-three four-star admirals, two former chairmen of the Joint Chiefs of Staff, a former director of intelligence, the Pearl Harbor Survivors Association, and others have subsequently supported the effort to have the ranks of Admiral Kimmel and General Short restored. [NY Sun]The scapegoating of the day even was dramatized by Hollywood in the film In Harm's Way, in which the navy captain played by John Wayne is put before a board of inquiry for having his ship torpedoed during the Pearl Harbor attack.

And as to how the populace instinctively rallied around its political leadership, the White House Historical Association tells us...

Crowds of angry Americans surrounded the White House on December 7 as news spread of the Japanese bombing of Pearl Harbor. The Secret Service installed bulletproof glass in the windows of the president’s Oval Office, sentries patrolled the roof with machine guns...Historical events become much prettier as they recede into the past.

Monday, March 09, 2009

Way, way back, a good eight months ago, when oil was $145 a barrel and various econobloggers were arguing that the Fed needed to raise interest rates to pop the commodity bubble, the price of wheat also zooomed up, and of course the price of energy for businesses did too.

So every pizzeria within my walking area of Manhattan raised its price per slice by about 50 cents, typically from $2 to $2.50 for a plain cheese one ... a good 25%! And they all told everybody and had signs up saying "due to the higher price of wheat and of gas for the ovens..."

So every pizzeria within my walking area of Manhattan raised its price per slice by about 50 cents, typically from $2 to $2.50 for a plain cheese one ... a good 25%! And they all told everybody and had signs up saying "due to the higher price of wheat and of gas for the ovens..."Having three kids and being of the beer-and-pizza generation myself, pizza plays a big part in my life. So I know the people who run all these local places and as the recession has run on I've asked them, "How's business?"

Every answer is, "It's awful, we're getting killed."

Yet even with the price of wheat and energy for the ovens now way back down, far down, not one of them has reduced its price. Not one!

However, over on Sixth Avenue between 17th and 18th streets, a new pizzeria has just opened charging only $1 per slice ... the guys in there have a high speed assembly line going that deals out slices like Vegas blackjack dealers deal cards "whap whap whap" ... and the line to buy often runs out onto the street.

Keynesian economists will tell you that recessions are caused in large part by "sticky prices and wages" -- that people who are always happy to raise their prices (including for their labor) whenever they can strongly resist lowering their prices when the demand for what they have to sell falls. Since they won't lower their prices to maintain sales and employment, sales and employment fall and the economy shrinks, until firms restructure in the new situation.

I don't know if John Maynard got his ideas from buying pizza in the hard times of the 1930s, but this was pizza night for my kids ... and here we are.

Sunday, March 08, 2009

The recession in perspective: The Minneapolis Fed has new interactive graphics that you can use to compare the current recession to previous ones.

Excellent new blog on the crisis by economist Scott Sumner -- seemingly the last monetarist in a time of scared Keynesians. The teaser, "BTW, I'll have lots of negative things to say about Krugman" lured me in like a subprime borrower. But he's delivered, and there's a lot more interesting reading there, providing a coherent alternative point of view.

NASCAR picture of the week. It's the American sport!

Elsewhere in sport, the NBA adopts its own recession-fighting deficit spending program.

The amazing Story of Iceland: in just a half a generation, from modest fishermen to bankers-to-the-world to fishermen in $330,000 of debt each.

In the endless contest of Man versus Nature, which side is more inept?

Thursday, March 05, 2009

Another one to clip and save in the "We're from the government, and we're here to help you" file, "Especially if you are poor" sub-file.INSURANCE BUREAUCRATS REJECT $79 HEALTH PLAN

The state is trying to shut down a New York City doctor's ambitious plan to treat uninsured patients for around $1,000 a year.

Dr. John Muney offers his patients everything from mammograms to mole removal at his AMG Medical Group clinics, which operate in all five boroughs. "I'm trying to help uninsured people here," he said.

His patients agree to pay $79 a month for a year in return for unlimited office visits with a $10 co-pay.

But his plan landed him in the crosshairs of the state Insurance Department, which ordered him to drop his fixed-rate plan - which it claims is equivalent to an insurance policy.

Muney insists it is not insurance because it doesn't cover anything that he can't do in his offices, like complicated surgery. He points out his offices do not operate 24/7 so they can't function like emergency rooms ... "I'm just providing my services at my place during certain hours."

He says he can afford to charge such a small amount because he doesn't have to process mountains of paperwork and spend hours on billing.

"If they leave me alone, I can serve thousands of patients," he said.

The state believes his plan runs afoul of the law because it promises to cover unplanned procedures - like treating a sudden ear infection - under a fixed rate. That's something only a licensed insurance company can do.

"The law is strict on how insurance is defined," said an Insurance Department spokesman.

A possible solution that Muney's lawyer crafted would force patients to pay more than $10 for unplanned procedures...

They are waiting to see if the state will accept the compromise. Still, Muney is unhappy because, he said, "I really don't want to charge more. They're forcing me."

One of his patients, Matthew Robinson, 52, was furious to learn the state was interfering with the plan ... "How can the state dictate you've got to charge more?" [NY Post]

Fixed-rate pricing for a service = "insurance" -- a novel innovation by regulators, in their endless quest to extend their domain. How long before they apply the idea to phone service, utilility bills and prix fixe restaurant menus?

Tuesday, March 03, 2009

Imagine being 66 years old today, having invested your Social Security benefits through a private account, and having retired after the markets collapsed in 2008. How would you be feeling today?

Just fine! So Andrew Biggs, former Deputy Commissioner for Policy of the Social Security Administration, tells us....

In the Retirement Policy Outlook I published through AEI in November, I showed that an individual retiring in 2008 who held a personal account his entire career would have increased his total Social Security benefits by around 15 percent.Read the whole thing.

I also simulated full-career account holders retiring in years ranging from 1915 through 2008, showing that they would have increased their total benefits by between 6 and 23 percent, with an average increase of around 15 percent...

The next time someone warns you that Social Security shouldn't invest in markets because markets have bad years, remember how Social Security produces below-market returns for today's workers every year. (Nifty chart!)

Markets can be risky -- but to guarantee a loss over 40 years takes a government.

Rx

Monday, March 02, 2009

More data show that it is not nearly the "national" home price crisis you may think.

[] The national foreclosure rate rocketed up 81% in 2008, to 1.8% (from 0.99% in 2007).

But only nine states had foreclosure rates above the average -- and just four had rates seriously above the average: Nevada at 7.4%, Arizona and Florida at 4.5%, and California at 4% ... while fully 41 states had below-average rates.

Subtract those four states and the median foreclosure rate in 2008 was only 0.90%.

(Interactive data via USA Today)

[] Home prices increased in 28 states during the fourth quarter of 2008, according to the federal OFHEO State House Price Indexes (click on "State HPI Summary"). In most other states price declines were modest.

But prices declined in Arizona by 2.91%, in Nevada by 2.66%, in Califoria 2.61%, and in Florida by 5.47% -- annual rates of decline from over-10% to over-20%.

[] A new study from the University of Virginia reports:

So ... when told that you should support the Obama mortgage bailout plan at a cost of $75 billion, because by bailing out your neighbor's mortgage you support the market in your area and so support the value of your own home, consider that it might be true if you live in California, Nevada, Arizona or Florida.most foreclosures have been concentrated in California, Florida, Nevada, Arizona and a modest number of metropolitan counties in other states ... 66 percent of potential housing value losses in 2008 and subsequent years may be in California, with another 21 percent in Florida, Nevada and Arizona, for a total of 87 percent of national declines ...

... claims that overall housing values have tanked nationwide are exaggerated...

Potential losses in housing values from 2008 foreclosures in all 50 states —- if values decline to 2000 levels —- were less than one-third of the $350 billion provided to banks and insurance companies to cope with losses in mortgage-backed securities...

But if you live in Kansas, Vermont or the Carolinas, responsibly bought a home you can afford, and saw it rise in value during 2008, your share of that $75 billion will be going to bail out somebody who lives a long way from you.

Sunday, March 01, 2009

Keynes wasn't the Keynesian that today's Keynesians claim...

"Keynes did not think that public works expenditure was very effective in countering existing or impending recessions ... Keynes opposed immediate, short-term stimulus in 1937 when the British unemployment rate was 11 percent — much higher than we are experiencing today." -- Prof. Mario Rizzo, NYU

Economic historian Niall Ferguson on the coming consequences of the world economic crisis: "There will be blood ... It's just that I don't see it producing anything comparable with 1914 or 1939."

"Death by Rescue -- in pictures"

Shoe throwing at world leaders -- has Bush started a movement?

Bernie Madoff was penny ante.

Now that the US has de-industrialized, what nation is "by far the world's leading manufacturer"? Hint: Not China.

Worst food ever?

As the rest of the nation's economy sinks and is ordered/forced to cut back on spending, guess who gains and spends like bankers used to?