Friday, December 31, 2004

Almost all the best coverage of the tragic Indian Ocean tsunami that I've seen has been via the Internet. From the videos everyone wants to see, to scientific explanations.

But it's also given my hometown press a chance to show off its acumen.

From the Times' writers we get a display of the math instincts that lead people to become, well, writers...

At least a third of the dead were children, according to estimates by aid officials ... The realization began to emerge Tuesday that the dead included an exceptionally high number of children who, aid officials suggested, were least able to grab onto trees or boats when the deadly waves smashed through villages and over beaches. Children make up at least half the population of Asia...Although if children are half the population, then a third of the casualties being children would seem to be a disproportionately low number rather than an "exceptionally high" one, opines Opinionjournal.com.

Meanwhile, the writers and editors at the Post show off how much they learned from watching Bill Nye the Science Guy...

The quake, which measured 9.0 on the Richter scale, was caused by the shifting of geological plates along a 600-mile area.Hello?

This changed the Earth's mass...

As the mass returns to normal, it moves back and forth, much like a church bell when struck by a tong, said Stony Brook geophysicist Teng-fong Wong....That's a relief. But I'll feel better when we get our springtime mass and gravity back.

The quake caused a shift in the Earth's rotation, as the change in the planet's mass altered the effect of the pull of gravity on the Earth.

But not to worry. The same thing happens in the summer and winter. It's harmless and it shouldn't last long.

Correlation and causation.

We all know that witches do not cause crop failures.

But it may be that crop failures cause witches.

How can Gonzaga be only #21?

[If you're not into sports stats, skip this post]

Roland Patrick tips off whom he roots for by demanding to know how the Gonzaga men's basketball team, after compiling a 9-1 record while defeating the #16, #9 and #3 teams in the nation, and losing only to the #1 team on that team's own home court, can be ranked a lowly 21st in the ESPN/USA Today coaches poll.

What is it with those coaches? Favoritism, nepotism, not being a member of the right club, outright bribery?

Can we instead take an empirical, objective look at where Gonzaga should be ranked, free of the subjective human element?

Sports-stats geeks will say "sure!" Those who are interested (to obsessed) in measuring such things have developed two pretty effective methods of rating the relative strength of competitors (individuals or teams) as measured by ability to accurately predict outcomes of future contests.

The first of these is the Elo system, developed in the late 1950s by Dr. Arpad Elo, then at Marquette University, to rate chess players. The Elo system is based on the observation that a given chess player's performance over a number of games is normally distributed, so that when two players of different strengths meet the probable outcome of their games will be determined by the overlapping distributions. (More details)

The simple result is that on the 4-digt scale actually used in chess, a 0-point difference in rating predicts each player will score 50%, a difference of 100 points that the stronger will score 60%; 200 points, 75%; 300 points, 85%; and so on. Of course while ratings are used predict contest results, contest results are used to compute ratings.

The Elo system has proved surprisingly robust and has been adopted in a wide range of other sports and areas where competitive ratings are desired -- even to ranking universities and colleges on the basis of who chooses to attend them.

The second strength rating method is the Pythagorean system, first developed for baseball by Bill James. This resulted from James's observation that teams' winning percentages correlate very highly with their runs scored for/against ratios as run through a simple formula.

The Pythagorean system has proved highly adaptable too, working fine with football, basketball, and other sports where game outcomes are determined by scoring. In fact, scoring for/against ratios have shown to be a somewhat better predictor of future won-lost records than current won-lost records. Which causes fans of the Pythagorean system to say it is actually a better measure of how good a team is than its won-lost record. (Here's a calculator to show how strong your favorite team really is by scoring ratio.)

Elo system proponents scoff at that, saying the purpose of a contest is to win -- the World Series is won by the team that wins the most games, not the team that scores the most runs. So the Elo system, which considers only wins and losses, is a superior measure of actual performance ... and we head off into the sort of endless argument among sports-stats geeks that is surpassed for vitriol and inanity only by those among political partisans in election season.

Not that there's really a lot to argue about, because the two systems usually give very much the same result -- and when they don't, the difference derives usually not from the systems themselves but from sample size. If only a small number of games are being measured there's a big error factor in each computation, which can produce a big difference between them, which diminishes as more games are played. (E.g, the Elo system requires 20+ games for a reliable rating, which makes it useless for football although many insist on applying it there.)

FWIW, to me the Elo system is a better measure of a team's actual past achievement at what it is supposed to do, win -- though if I was wagering the mortgage money with my bookie on tomorrow's game I'd check the Pythagorean number against the betting line.

But back to Gonzaga. The obvious thing to do is to compare the coaches' poll giving Gonzaga its #21 ranking with objective, empirical Elo and Pythagorean rankings of its performance. And in this Internet-driven world that's easy to do as every sports-stat geek with an online connection seems to have his own personal variation of a rating system posted on his web site.

However, as the coaches' poll is published by USA Today we can go to computer ratings published by that very same newspaper: Jeff Sagarin's. Conveniently, Sagarin publishes both Elo and "Predictor" (his version of points-only Pythagorean) rankings for every team. Then rather than delve into some scholastic argument about which of the two is "best" he puts the two of them together to get his ranking.

His computer's impartial, impersonal, objective and totally empirical rankings for Gonzaga as of this writing: By Elo #2, by Predictor #44, combined for a final ranking of #22.

Should have stayed with the coaches' poll!

What does this mean? Maybe Gonzaga has overachieved or been lucky in winning a couple of those games, relative to its real strength as shown by its points differential -- some of its wins against lesser opponents apparently weren't very impressive. Or maybe it hasn't played enough games to reveal its real strength via points differential.

Most likely, with only 10 games played, it's just small sample size. Who knows where between #2 and #44 they should be ranked? Take a poll and find out.

Maybe there's a point here too that it's often not so easy in life to escape making a subjective judgment by resorting to quantified measures. Not much is simpler than quantifying a basketball team's performance, but when the best you can do is get an answer somewhere from #2 to # 44...

_________

Update: Promptly after writing the above Gonzaga lost to Missouri, ranked #110 by Sagarin's computer. Maybe the coaches and the Pythagoreans had a point.

Thursday, December 30, 2004

[Update: The 2008 deficit.]

The U.S. government's official budget deficit was $412 billion for fiscal 2004. That's the number reported in the newspapers that everyone editorializes and op-eds about. It represents the net increase in the government's liabilities -- the new debt it incurred during the year, basically by issuing bonds to borrow the cash it needed to pay its bills.

But wait ... the Treasury has just published on its web site, albeit with very little publicity, the 2004 Financial Report of the United States Government. And in it we find a very different number for the amount of increase of the government's net liabilities during 2004.

This number is $11.087 trillion ... with a "t". And, yes, that's just for one year.

So two numbers are published by the Treasury for the same thing -- the increase in the government's net liabilities during 2004 -- with a difference between them of $10.7 trillion. How can this be?

The difference is that of governmental accounting.

The government computes its $412 billion deficit number using cash-basis accounting.

Cash-basis accounting is what individuals use. "Cash in" measures income, "cash out" measures expense, and the difference is net income or loss, nothing or little else counts.

But cash-basis accounting is illegal for all publicly owned corporations, and even for private businesses that have inventory or which accrue in any significant amount either liabilities or rights-to-income that stretch over more than one year.

The reason for this is obvious. Using cash-basis accounting a business could incur a legally binding obligation to pay $10,000 current value some time in the future in exchange for receiving a cash payment of $1,000 this year and book the transaction as generating $1,000 of income -- instead of a $9,000 net liability.

Thus, the Generally Accepted Accounting Principles (GAAP) used in the private sector require all public corporations and other entities that incur multi-year accruals in any significant way to use accrual-basis accounting.

Accrual-basis accounting recognizes the full current value of all future income that one obtains a legal right to receive, and of all liabilities one becomes legally obligated to pay. So if one receives $1,000 cash in exchange for committing to pay $10,000 in the future, a $9,000 net cost is recognized, rather than $1,000 of income.

As noted, the government requires that GAAP rules be used by all public corporations and all but the very smallest of other entities that have inventories or accruals -- except itself. The government reserves for itself the right to use cash basis accounting.

And it is such cash-basis accounting, cash in minus cash out, that produces the government's reported deficit figure of $412 billion. (And a rather dubious version of cash-basis accounting at that -- as the Financial Report itself notes, a better measure is $615 billion.)

But what about the government's accruals? What about the currently accrued future cost of the already promised benefits of Medicare, Social Security, military pensions, government employee pensions, and so on, all measured net against the accrued value of the future income taxes, Social Security taxes, Medicare taxes, and so on that have been established to pay them?

Well, for the last few years, as per a legal requirement pushed through Congress by fiscal reformers, the Treasury has published within its financial report, for informational purposes, an annual Asset and Liability Statement for the government that does follow GAAP rules, using accrual accounting. And this statement shows the government's net liability increasing in 2004 by $11.087 trillion -- a good 27 times more than the official budget deficit.

Looking at the "Overall Perspective" summary on page 11 (.pdf) we can see what this increase is composed of. The significant items:

Medicare: $9.609 trillion

Social Security: $0.812 trillion

Federal debt held by public: $0.385 trillion

Federal/veterans pensions: $0.182 trillion

(Note: Medicare and Social Security net liabilities are computed over 75-years -- not using an unlimited horizon under which they are much larger.)

To place these numbers in some scale, total US national income in 2004 was $10.3 trillion -- that was the total combined income of all individuals, businesses, everybody. So the 2004 increase in the accrued liabilities of the US government exceeded total national income.

Now I'll go far out on a limb here and make a prediction: Currently promised entitlements that increase the current-value liabilities of the US government by more than 100% of national income annually will prove to be unsustainable.

Promises will be broken, folks.

Where will they be broken?

Well, federal & veterans' pensions total only about 1.5% of the accruing liability, not enough to make a difference. And the bond debt owed to the public must be paid, because the Constitution mandates it.

That leaves all the promise-breaking coming in Social Security and Medicare. The 2004 growth in Social Security's current value liabilities of $812 billion by itself equaled 43% of total US government revenues in 2004 of $1.9 trillion. Pretty hefty!

But even that is dwarfed by the eleven times larger one-year increase in current value liabilities for Medicare: more than $9 trillion -- four times the budget of the entire United States government in 2004.

The unquestioned Big Daddy Mountain Gorilla of accruing budget-busting, government-bankrupting entitlement expenses is Medicare.

Spell it out: M_E_D_I_C_A_R_E. And remember it well whenever anybody mentions the words "budget deficit" to you. (Should anyone says "Bush tax cuts" in this regard, remember the difference in scale between perhaps $200 billion added to the public debt through bond issuances in 2004, and $9.8 trillion added in accruing Medicare and Social Security liabilities in just 2004. )

Now, the Treasury doesn't give page 11 of its Financial Report much publicity and politicians give it even less heed. The reason for this is evident -- the information it presents is rather awkward for everyone in Washington, in both parties.

In every election Democrats make hay by accusing the Republicans of planning to cut these entitlements, which are the Democrats' proud heritage and crowning achievement. (Just as if the Democrats will have any way to avoid cutting them if they are in power when all the promises come due).

Bush the Younger and the Republicans for their part have responded by flanking the Democrats on the left on the entitlement issue by creating their own mega-dollar totally unfunded addition to Medicare in the form of their prescription drug benefit. (Unfortunately, what the health of the national fisc needs is for the Democrats to get the idea of flanking the Republicans on the right here, but don't anybody hold your breath waiting for that.)

And, of course, if the government used accrual accounting there would never have been any surplus back in 1998-2001 for the Clinton people to claim they had created ... nor to release the bipartisan spending restraints that Congress imposed on itself during the post-Reagan deficit years -- which release resulted in the big surge of bipartisan vote-buying Congressional discretionary spending that started with the lead-up to the 1998 Congressional election, and over which both Clinton and Bush the Younger afterward presided very happily.

Then with the national debt clock spinning forward 20-odd times faster under accrual rules after 2001, Republican tax cuts would hardly have been so credible to the public ... so page 11 really is quite awkward for everyone in Washington.

But there it is nonetheless, in black and white, you can read it yourself.

If there is any

So next year's annual increase in accrued government liabilities should be

Besides, who knows what new retiree entitlements our politicians will promise us all as they compete for votes in the next presidential election cycle? (Democrats were attacking Bush's drug benefit as being not nearly large enough even before it was enacted. Has any such new program ever not expanded rapidly?)

There's only one thing to be sure of: The government's existing promises of retiree entitlements will be broken -- you can bet your own retirement on it.

If you want to do something about it politically while there is still some (diminishing) time left to do so, before the great entitlement-funding fiscal crunch hits a decade or so from now, then accept this reality, consider the issues, make your own list of priorities among entitlements, and decide just how you want the promises to be broken. Choices here will make a difference.

Then get your opinion out in the world. That's why you have an Internet connection.

The retirement you save may be your own.

Wednesday, December 29, 2004

Where is all that "dark matter" hiding?

Unseen dark matter and/or dark energy comprise 85% of the universe, cosmologists say. But where is it hiding?

Not in caves, apparently. [via a football column]

Up in space, maybe? [via jane galt]

Well, duh. Who'd look for 85% of the universe in the bottom of a cave?

Even I coulda told you that!

One year ago today:

"Al Gore's endorsement of Howard Dean was a momentous event..." [12/29/03]Some while before that:

"I do not think of myself as an all-purpose pundit. I remember once (during the air phase of the Gulf War) seeing John Kenneth Galbraith making pronouncements on TV about the military situation, and telling friends that if I ever start pontificating in public about a technical subject I don't understand, they should gag me." [4/1/99]Think of all we'd have missed if they had.

Time for all to get our 2005 calendars.

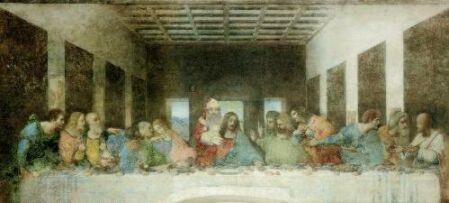

A small help in starting off the new year with the right attitude.

Hey, a coffee mug can help too.

When it's best not to return those disappointing Christmas gifts.

A dimwitted thief was arrested at a Long Island Radio Shack when he attempted to return roughly $2,200 in Christmas gifts — which he had stolen from the same shop, cops said yesterday.If you don't have a receipt, don't even consider it.

Nassau County police busted Vincent Festa, 44, a contractor, late Sunday at an Oyster Bay Radio Shack as he tried to return $2,198.93 of stolen electronics equipment.

On Dec. 21, Festa stole the items — including a desktop computer, MP3 player, digital camera, 2.5-inch television, home theater system, phone, and digital memory card — from the same store, authorities said.

Employees recognized Festa and phoned police, who busted him in the shop... [NY Post]

Tuesday, December 28, 2004

Michael Kinsley's restatement of his "logical proof" of why private investments in Social Security are a "certain failure" merely seems to repeat his first statement, rather than try to clarify or add anything to it.

As the gist of his argument seems unchanged I'll just link back to the prior answer given here (short and long versions) and ....

1) Repeat that it remains totally implausible that additional investment in stocks through private accounts of a mere $200 billion annually (as a theoretical top -- probably much less in reality) will "bid down" the yield on more than $33 trillion of stocks so much that anyone would even notice -- much less all the way down to the level of that on government bonds, as his "logical proof" dictates.

Can one really imagine that increasing investment by less than six tenths of one percent can have such a dramatic effect on stock prices?

2) Add something new to the discussion regarding bond prices and yields by pointing out that even purely logically it doesn't necessarily follow that borrowing today to fund future Social Security benefits will "bid up" bond yields at all, much less all the way to the level of that on stocks, as Kinsley's logical proof dictates.

This is because, as Alan Greenspan has stated, future promised Social Security benefits are a liability of the U.S. that already exist, and to the extent that the markets believe the U.S. will actually pay them, the cost of financing them logically should already be reflected in bond prices. In which case making these implicit obligations explicit by financing them today should make no difference at all. As the Chairman put it...

"A critical consideration for the privatization of social security is how financial markets are factoring in the implicit unfunded liability of the current system in setting long-term interest rates. ... If markets perceive that this liability has the same status as explicit federal debt, then one must presume that interest rates have already fully adjusted to the implicit contingent liability." [my emphasis]This gets to the question of just how secure promised Social Security benefits really are. If they are truly as fully secure as many defenders of the status quo assure us they are, and the markets believe it, then funding those benefits today should have no effect at all on interest rates. After all, the government is already on the hook for all that money, so simply admitting it honestly shouldn't change anything.

On the other hand, if promised benefits aren't secure and are expected to be cut, then funding them today at promised levels would be an extra cost expected to bid up the current rate on bonds. But if promised benefits aren't secure, shouldn't the defenders of the status quo be honestly admitting that and openly addressing that as a problem? Yet they aren't.

This issue is discussed at more length in a recent post -- for here the point is that even strictly logically it is not necessarily so that borrowing today to fund future benefits will increase rates on bonds by anything like what Kinsley assumes must be the case.

(3) Repeat something important that Kinsley ignores. Even assuming that real investments only match the cost of paying down government bonds, a major benefit results from borrowing today to prefund Social Security benefits that will become due 30 years from now.

As noted before with data from GAO, by 2030 the government is expected to be under never-before-seen fiscal pressure with annual deficits rising towards 20% of GDP -- matching the size of the entire government today -- on the basis of current policies.

Now, say the government issues a $1,000 bond in 2005 that it will pay off over 30 years. It invests the money it receives from the bond in a portfolio of private investments worth $1,000. The return on the private investments just matches the cost of paying off the bonds, that is all. After 30 years the bond is paid off and the $1,000 in investments remain. Now there is $1,000 available to pay benefits in 2035 without the government having to increase borrowing or taxes during a huge fiscal crunch.

The cost of paying the benefit in 2035 remains $1,000 -- but the financing of it has been moved forward in time by 30 years to when it is much more affordable. Instead of the benefit being at risk in 2035 because Congress can't afford to raise taxes/borrowing yet more in the crunch to pay it, the $1,000 was raised when conditions were easier so the benefit it will pay is secure. This is not a good thing?

4) Note that Kinsley almost gets to a vital logical point that almost all defenders of the Social Security status quo dodge -- actually comparing options by considering the faults of the status quo as well as those they ascribe to whatever reform proposal they are criticizing -- but then he dodges like everyone else.

Many responders made a related point, "Compared to what?" Whatever its flaws, is privatization inferior to the current system, with its looming inability to keep its promises? ...... he proclaims, mistakenly deducing that it will do so -- but also, and more importantly, ignoring how the status quo is guaranteed to do exactly that.

But privatization is not supposed to produce a net loss in anyone's retirement nest egg ...

The Social Security Administration's actuaries' say the average-wage individual who entered the work force in 1994 -- and so is in his/her late 20s or early 30s today -- will receive in benefits from Social Security 15% less than contributed to it through taxes over a lifetime. For high-wage individuals benefits will be as little as 50% of taxes.

And even these promised benefits are 30% underfunded. So if Social Security remains "paygo", with no investment returns supplementing it, then by the Iron Laws of Arithmetic the average-wage individual's return will drop to 40% less than taxes paid and the high-wage individual's return to 65% less. (In a paygo system a funding gap can be closed only by reducing benefits or increasing taxes, and both acts further reduce the ratio of benefits to taxes.)

Of course, this is the huge change in the nature of Social Security that defenders of the status quo -- including Kinsley, it seems -- never, ever want to mention.

Before the year 2000, all annual cohorts of retirees received from Social Security more than they contributed to it, with most receiving much more. After 2000 all annual cohorts of retirees will receive less than they contributed to Social Security, they will be made poorer by it on a lifetime basis, with this loss growing as the years pass.

So instead of saying ...

... privatization is not supposed to produce a net loss in anyone's retirement nest egg ...... shouldn't Kinsley be saying...

... Social Security is not supposed to produce a net loss ...... ? I'd think so.

And if he ever gets around to doing this, and admitting the size of the net losses Social Security is committed to produce, what will be his proposed remedy?

One remedy is private investment accounts. Even mere 2% accounts that earn the historical norm on private investments, when compounded for 40 years, can give most young workers positive net returns on Social Security -- and so save it as we know it. (And again, does anyone else really believe with Kinsley that increasing investment by less than 0.6% will drive such returns down?)

But without private investment accounts, how is this to be done, how will Social Security avoid making today's young workers poorer after making all prior generations richer?

This is the question Michael Kinsley didn't bother to consider, much less answer about the status quo when he said private accounts shouldn't reduce nest eggs. What about the status quo?

Even Sweden has 2.5% private accounts in Social Security for these reasons. It seems the Swedes haven't yet figured out the logical proof of how they can't work!

Swedish social policy -- too right-wing for Michael Kinsley and U.S. Democrats.

The real-life Scrooge wasn't such a Scrooge after all.

Roland Patrick points us to the story of the true-life Ebenezer in the Scotsman...

Dickens was in the capital to deliver a lecture to an audience of Edinburgh notables. He was wandering the city, killing time before the talk, when he visited the Canongate Kirk graveyard.

There, as revealed by his diaries, he saw a memorial slab which read: "Ebenezer Lennox Scroggie - meal man". The description referred to his main trade as a corn merchant. However, the author mistakenly translated it as "mean man".

Though he was shocked by the description, it gave him food for thought and two years later, art imitated life - or so the author believed...

The real "Scrooge", an Edinburgh merchant, could not have been more different from his literary counterpart ...

Scroggie was born in Kirkcaldy, Fife; his mother was the niece of Adam Smith, the 18th century political economist and philosopher....

Perhaps Scroggie’s most delightful claim to fame was the result of his dramatically halting proceedings at the General Assembly of the Church of Scotland, when he "goosed" the Countess of Mansfield during a particularly earnest debate...

No mention of whether it was as Christmas goose.

Monday, December 27, 2004

Blonde Jokes To Be Banned?As often in the fight for rights, things turn ugly...

Blonde jokes are set to be banned in Hungary after blonde women staged an angry protest outside parliament. The protestors handed in a petition claiming they were being discriminated against in every walk of life by bad taste blonde jokes.

Spokeswoman Zsuzsa Kovacs said: "Blondes face discrimination in the job market, in the workplace when they get a job, and even on the streets. People are banned from discriminating against Jews, or blacks, so why not grant blondes the same protection."

The petition was handed to the equal opportunities minister Kinga Goncz asking her to investigate whether jokes about blondes fall into the same category as religious discrimination.

The petition was just short of the 100,000 needed to force Parliament to debate the matter but Goncz's deputy who spoke to the crowd pledged the government would act to stop any discrimination. [Ananova]

This could be the start of a movement. Who knows where this could lead?Dark Side of Blonde Protest

Police say campaigners fighting for a ban on blonde jokes in Hungary turned violent in a protest outside a bar.

Hungary's Blonde Women's Movement marched on parliament to hand in a petition demanding MPs to outlaw blonde jokes. Police have now revealed that they also staged a protest outside a bar called Blondy that turned to violence when staff tried to move them on.

Bar manager, Laszlo Bolyocki, said: "Our bar is a new one and we didn't want to cause any offence with the name. But when we tried to get rid of the protestors they turned violent, and threw cakes and eggs at the windows and urged their blonde sisters working here to go on strike."

Blonde Women's Movement founder Krisztina Timar, 29, said: "This bar was using dumb blonde jokes to promote itself. It's thanks to stunts like this that people look down on us - and we have much worse chances of getting a job." [Ananova]

To be young and bored in New Jersey.

Or, uncounted things to do with a green lawn-ornament Buddha. My personal favorite among the well-told VidLit tales. Maybe because I've been there. Though Yiddish with Dick and Jane is amusing too. [broadband recommended]

Lenin statute moved to ash-heap of

Lenin Statue Homeless

A five tonne statue of Vladimir Lenin is making the rounds in Nitra as officials haggle over where it belongs...

"We have been looking for a place for the statue for a long time," Dagmar Bojdová, from Nitra town hall, said. "Some people think it should be melted down. But we never received such a proposal in writing. And I personally think that it shouldn't be destroyed. It's part of our past. It should be preserved for future generations."

While authorities search for an appropriate place, the Lenin statue stands in a yard next to trash containers and piles of garbage.

"When the statue was in the square, there wasn't as much interest as now," Ladislav Meszároš, of the maintenance service, said."People come here and take pictures of it. It's a local attraction." [Slovak Spectator]

Sunday, December 26, 2004

The year 2005 will take us another year forward into the Global Population Bust. Unprecedented population decline has already started in Western Europe -- Italy may be viewed as the bust's "ground zero" with Germany not far behind -- and is now demographically inevitable over most of the world, including Asia in general and China in particular, with Japan leading the way on that side of the globe by a generation or two.

Absolute decline in total world-wide numbers won't begin for some decades yet, but as the population of tomorrow is limited by the number of young living today, one doesn't need a crystal ball to see into the future in this case.

Even the United Nations has switched from warning of the dangers of overpopulation to those of population decline, e.g. ...

(The U.S. population is projected to continue growing at a modest rate due to its comparatively open immigration policy -- as immigrants both increase the population count themselves and have children at a higher rate than do native-borns.)United Nations projections indicate that between 1995 and 2050, the population of Japan and virtually all countries of Europe will most likely decline. In a number of cases, including Estonia, Bulgaria and Italy, countries would lose between one quarter and one third of their population. Population ageing will be pervasive, bringing the median age of population to historically unprecedented high levels...

In the next 50 years, the populations of most developed countries are projected to become smaller and older as a result of low fertility and increased longevity ...

Among the countries studied in the report, Italy is projected to register the largest population decline in relative terms, losing 28 per cent of its population between 1995 and 2050, according to the United Nations medium variant projections.

The population of the European Union, which in 1995 was larger than that of the United States by 105 million, in 2050, will become smaller by 18 million... [this publicizing this]

What we are seeing here is how the birth rate declines naturally with increasing material prosperity and a society's commercial development. In poor subsistence agriculture societies parents need lots of children to work the land and support them in their old age -- as there are no IRAs, employer pension plans or social security programs. And child mortality rates are high, so birth rates necessarily are as well. Ben Franklin, in his prescient demographic projections made in 1751 (intended to assure the mother country that it need not engage in protectionism against colonial manufactures) described the average American family as having eight children, of whom four survived.

But as a subsistence agricultural society develops into a wealthy commerce-based society children become much more of a financial cost to families -- while the time spent on them becomes an "opportunity cost" to parents, who obtain many new options to spend their time on other fun and rewarding things. And with declining child mortality parents need have fewer children born to see the family line continue. So the birth rate falls sharply, quite naturally.

This is hardly a modern development, nor a modern insight -- it has been well known throughout history. The noted economic historian Mark Blaug calls this "The universal rule of declining population growth in advanced civilizations, which dates back long before the present era".

If I recall correctly, Adam Smith wrote about it in Wealth of Nations and Gibbon did in the Decline and Fall of the Roman Empire. The Roman Emperor Augustus in the face of population decline among the prosperous higher Roman classes ordered them to have more children --providing the background for some fun plot turns in "I, Claudius".

The rise in population that accompanies economic development, such as we have seen in the last century, results not from high birth rates but from falling death rates. With economic development life expectancy rises and fewer people die. Life expectancy in the US today is nearing 80, in 1900 it was 47, and in Franklin's colonial times it was about 25 or less -- as it was near universally everywhere before the Industrial Revolution. When people begin putting off dying for so long, from an average age of 25 to 80, population rises!

But, alas, this lengthening of life expectancy is finite -- and when the limit is reached people begin dying together in large numbers. This, combined with a birth rate that has fallen sharply during the period of lengthening life expectancy, then leads to a population drop, such as is in the first stages of sweeping the world now.

The complete ignorance and disregard of this entire dynamic on the part of the Malthusian-Ehrlichian population growth catastrophists really should have just been a shameful embarrassment to them. I mean, even 1970s BBC tv show writers knew about it.

So when a respected scientist like E.O. Wilson writes in Scientific American...

The pattern of human population growth in the 20th century was more bacterial than primate.... I wonder how he retains that respect -- and his self-respect. Or is he really saying that when bacteria expand into a richer field of nutrients their reproductive rate declines while the life span of the average individual bacterium increases?

And when Wilson goes on to try and scare us with...

The number required to attain zero population growth -- that is, the number that balances the birth and death rates and holds the standing population size constant -- is 2.1 (the extra one tenth compensates for infant and child mortality). When the number of children per woman stays above 2.1 even slightly, the population still expands exponentially. This means that although the population climbs less and less steeply as the number approaches 2.1, humanity will still, in theory, eventually come to weigh as much as Earth and, if given enough time, will exceed the mass of the visible universe.... well, wow, that's every bit as intellectually impressive as the Japanese Ministry of Health and Welfare's prediction of when the Japanese people will go extinct due to their birth rate of only 1.4 per woman.

Yes, Wilson does skeptically note that birth rates have fallen in many places -- but comes up with an explanation expertly, wonderfully fitted to flatter the sensibilities of his university liberal peers -- while maintaining dire risk of population catastrophe. You see, it's because of ...

... the empowerment of women. The freeing of women socially and economically results in fewer children.So kudos to liberals for preaching feminism and the empowerment of women. We are saving the world from itself! But beware...

Reduced reproduction by female choice can be thought a fortunate, indeed almost miraculous, gift of human nature to future generations. It could have gone the other way: women, more prosperous and less shackled, could have chosen the satisfactions of a larger brood...Especially with all those unenlightened cultural conservatives still out there in all parts of the world, extolling the virtues of big families.

Still...

... Demographers of the future will, I believe, point out that on the other hand humanity was saved by this one quirk in the maternal instinct.Humanity saved by a lucky quirk! That's a nice hand-wave dismissal of what's been known by the likes of Blaug, Smith, Gibbon, Augustus, novelists like Robert Graves and the BBC's tv-writers.

But no, it sure looks a lot more to me like basic economics in action -- children are much less necessary and much more expensive in a developed commercial economy, so people have fewer of them. Q.E.D.

Yet wait a minute! ... Does Wilson really believe that humanity has been saved due a lucky quirk in the instincts just of women? Not of men? Men have nothing to do with it?

If so, I want to ask a question of all the men of Wilson's Harvard community, starting with E.O. himself. To wit:

"How many of you Harvard men really want to have eight or more children as in Ben Franklin's day, and would actually have had them if your empowered women hadn't restrained you, refused, and prevented you from doing so"?

I expect the answer would be along the lines of "Precious darn few of us!", and suspect Wilson knows that darn well.

In which case, when Wilson speaks of people reproducing like "bacteria" what he's really saying is....

"We educated, enlightened, liberal western males of course have no problem restraining our reproduction to an admirable less-than-2.1 each. But all those third-world males will continue to reproduce like bacteria if we can't get their women to stop them..."

And what do we call that?

But I digress. This was meant to be just a short post pointing to two new essays on the world population situation recommended by David Brooks...

I've decided to create the Hookie Awards. Named after the great public intellectual Sidney Hook, they go to the authors of some of the most important essays written in 2004...If you're interested in this subject they're worth looking at -- and if you're not interested in it you'd have stopped reading this post long ago, I'd suspect, so there we are.

The global decline in fertility rates has likewise prompted some astonishing essays.

Phillip Longman published "The Global Baby Bust" in Foreign Affairs, noting that while we have images in our heads of throngs of unemployed young people in the Middle East, fertility rates are falling faster there than anywhere else on earth. Over the next half-century, Mexico's median age will rise by an astounding 20 years. By 2050, Mexico will be an older society than the United States.

Nicholas Eberstadt writes about what the graying population means for Asia in "Power and Population in Asia" in Policy Review. Eberstadt argues that it is better to get rich and then get old than it is to get old first. Thus, while Japan should be able to adjust to the new demographics, China will face huge problems. In China, the pension system is the family, but nearly a quarter of seniors will have no living son to rely on for sustenance.

For the record, I'll note that my own favorite newspaper-type article on the subject appeared in the Times itself some while back, from which...

... If there is a ground zero in the epidemic of low fertility it would have to be in the northern Italian city of Bologna, where women give birth to an average of fewer than one child (in 1997, the number was 0.8). The city has more highly educated women than any other in the country. Produce is cheap, food is wonderful and living is generally easy."Prosperity has strangled us"? Not "empowerment of women has saved us from destruction"?

The local population has dropped steadily for two decades, but 1,500 people turn 75 every year.

Fewer children and more elderly mean a greater need for health care programs and specialized housing and transportation. But that does nothing to encourage young couples to have families. This year the budgets for retirees and children are roughly the same in Bologna, a city of 375,000. Next year 5 percent will be shifted from the young to the old. And that will happen every year for the next decade as the city becomes filled with elderly and starved for children.

How did Italy, a largely Catholic country that has always been seen as the stereotypical land of big, close-knit families, attain the world's lowest level of fertility?

"Prosperity has strangled us," said Pierpaolo Donati, professor of sociology at the University of Bologna ...

Maybe someone in the sociology department at Bologna should call in this message to the biology department in Cambridge, Mass.

Saturday, December 25, 2004

Merry Christmas.

Friday, December 24, 2004

Democrats will soon have to decide! Because right now, to fight the idea of putting private investments in Social Security, they are busy spinning two exactly opposite and contradictory arguments simultaneously. To wit:

#1) Promised benefits are so real, and so secure, that there's no need to do anything at all today to shore up Social Security for younger workers. The Social Security Trustees says there's a $10 trillion funding gap (current value) facing Social Security? Aw, what does that matter? Not only are promised Social Security benefits secure, they are a rock solid sure thing! E.g. ...

Promised benefits as a real and true obligation of the U.S. government can hardly get any more real than that."Out of all the possible problems to address in America, Social Security is probably not even in the top ten. It's solvent for at least the next 40 years, and possibly the next 50, even if we do absolutely nothing." [emphasis in original] Kevin Drum.

"... liberals need to drive home the message that 'There Is No Social Security Crisis' ... Social Security is healthy and successful ... The president and the Republicans in congress are trying to scare the American people to destroy the most successful program in American history .... Even if we make no changes and the president's pessimistic assumptions come true, future benefits will be even higher than benefits are today." [my emphasis] Matt Yglesias

But ... this creates a political problem for Democrats. Private accounts would today pre-fund benefits coming due in future decades, just like investments in a private company's pension plan pre-fund its future pension obligations.

However, the Democrats want to argue politically that pre-funding is just a big extra expense that will make the budget situation worse, impair the government's balance sheet and harm its credit standing. (The New York Times leads the way.)

Their problem when making this argument is the A-B-C rules of accounting: pre-funding a real future liability is not an expense. In fact, to the contrary, doing so by borrowing funds to be reinvested at a rate higher than the borrowing cost is routinely done to strengthen one's balance sheet and improve one's credit rating.

When General Motors recently did exactly this -- by borrowing $14 billion through a bond issuance to prefund its pension plan with investments that earn a higher rate than the rate it pays on the bonds -- it was praised, not condemned.

And all the millions of people who have taken out new low-rate home loans in recent years to pay off old higher-rate loans and consumer debt have done effectively the same thing -- taken on a new debt to fund an old, pre-existing debt at a favorable rate differential.

Have they all made themselves poorer by doing so? In the amount of the new debt they've taken on? Of course not. The only way one could claim such a thing is by claiming that their old, pre-existing debt ... wasn't real! They didn't really have to pay it, so funding it in advance was a cost with no benefit.

Sure, if General Motors doesn't have to pay its future pension obligations, then debt taken on today to finance them doesn't do so and is just an extra cost. And if you don't have to pay on your mortgage and credit cards in the future, then pre-funding them today at a favorable rate that you actually will pay is an extra expense that costs you money. Sure!

Which gets us to the second and opposite argument from #1 that the Democrats have just started spinning....

#2) The government has no obligation to pay promised Social Security benefits -- and Social Security's finances are so bad that it is obvious that it won't pay them all. Thus, pre-funding those benefits is a net expense -- a true additional cost we can't afford -- because otherwise the government isn't really going to pay them.

Am I the only blogger to note Krugman's curious recent description of Social Security's promised benefit schedule as: "nothing more than a suggestion to future Congresses"?

Hello?? Reading that I asked myself: is this the first public hint of a new spin coming?

Well, one didn't have to wait long for the full-fledged argument to arrive. A new position paper from the CBPP by Jason Furman, William G. Gale, and Peter R. Orszag, explicitly argues that -- contrary to the accounting rules that apply to General Motors and everyone else -- the government's pre-funding of its future liabilities should be considered a cost, an extra current expense.

Now many, including Nobelist Milton Friedman and Federal Reserve Chairman Alan Greenspan, have pointed out the simple fact that the unfinanced benefit promises of Social Security -- its $10 trillion dollar funding gap -- actually comprise an "implicit debt" of the U.S. government that is every bit as real as its existing "explicit debt" to the extent the government actually intends to pay those benefits.

Thus, the act of recognizing the implicit debt on the books by making it explicit has zero real effect on anything. It is just recognizing reality.

That's a simple enough idea. But Fruman, Gale, and Orszag reject it outright regarding Social Security, saying...

[Some argue that] borrowing to establish individual accounts would merely create "explicit debt" today (in the form of new Treasury bonds) in exchange for "implicit debt" that the federal government has already incurred (in the form of benefit promises to future Social Security beneficiaries that exceed the future revenues that Social Security will receive under current law). They argue that these two types of debt -- "implicit" debt and "explicit" debt -- are essentially the same, and that converting implicit debt to explicit debt thus is not an increase in overall debt and need not be included in the budget.But how are they different?

This argument is seriously flawed, however. The two types of debt are decidedly not the same, and converting implicit debt into explicit debt could worsen the nation's fiscal outlook and would reduce the government's fiscal flexibility...

... "implicit debt" associated with future Social Security benefit promises does not have to be financed in financial markets in coming decades ...One decade, singular. Starting around 2016 benefits will be financed by the financial markets in a big way, as Congress will have to start raising the funds -- through additional taxes or more borrowing -- needed to redeem $5 trillion of bonds in the Social Security trust fund. That's compared to a national debt compiled all throughout US history of $4.4 trillion as of today. And this will be occurring just as Congress will have to raise even much more than that to finance Medicare.

Indeed, this is a major argument for pre-funding Social Security benefits with real economic investments today -- to reduce the need to raise funds for them 20 and more years from now when the nation will be in an unprecedented fiscal vise. As has been noted in more detail previously.

.... and might not have to be financed even after that, because the implicit debt could, and likely would, be reduced through future policy changes... [my emphasis]Yes, it was, by significantly cutting benefits. Taxes were increased too by a closely matching amount, so the funding gap then was closed 50% by cutting benefits and 50% with tax hikes. But the economy was healthy then, and there was ample room to raise taxes.

In 1983, Social Security faced a large implicit debt; benefits would soon exceed the revenues to pay them and would continue to do so indefinitely. Congress and the President acted -- they changed Social Security benefits and taxes and did so without borrowing new money -- and the implicit debt was substantially reduced.

In 2030, as Congress is in the midst of raising $5 trillion of new taxes to pay Social Security benefits and much more than that in additional taxes to finance Medicare at the same time, where will be the room to cut the ever rising implicit debt -- it grows every year -- by raising taxes??

The same is likely to occur with regard to future unfunded Social Security promises..."Likely" to the degree of being a sure thing.

Once explicit debt is incurred, by contrast, and Treasury bonds are issued, the government is stuck with the debt...The point!

Fruman, Gale, and Orszag -- and Krugman -- are making a clear and outright statement that they don't want the government to become "stuck with the debt" of owing promised Social Security benefits! That would increase their real cost, because under the status quo after the cost of financing them hits the financial markets around 2016 it is "likely to occur" that Congress will reduce them.

While if the implicit Social Security debt is made explicit through privatization, Congress will actually be "stuck" with meeting its promises!

So it seems in the coming debate Democrats have a choice of taking one of these two positions as their argument against privately-owned investments in Social Security...

A) "There's no need to shore up Social Security with privatization because payment of future benefits is already a rock solid certain sure thing!"

OK -- but in this case they can't argue that pre-funding those benefits is any kind of "cost." To the contrary, if those benefit obligations are real and will be met, then, as per Friedman and Greenspan, making the implicit debt they represent explicit in the form of government bonds makes no cost difference. And prefunding them with real economic investments, as per General Motors, is beneficial. Even more so for the U.S. than GM, in light of the chance to alleviate the U.S.'s coming fiscal crunch of the 2030s.

or...

B) "Borrowing to pre-fund promised Social Security benefits, making the implicit Social Security debt explicit, will only add to the fiscal debt of the U.S., and so worsen the government's fiscal position during the foreseeable fiscal crisis of a generation from now."

OK -- but then they have to admit they are planning, intending and expecting to not pay a goodly share of the Social Security benefits promised for after 2016. Because the only way that making an implicit promise explicit increases its cost is if you are expecting not to keep it as long as it is merely implicit -- but find yourself stuck with it when it becomes explicit.

So the Democrats have a choice. Which will they choose?

Personally, as a matter of intellectual honesty, I'd certainly choose B. Whenever somebody tells me they are sure that Social Security benefits will come through the great fiscal crunch of the 2020s and 2030s unchanged, because they are fully secured by all that bond debt that the government owes to itself in that trust fund, I'm tempted to offer to sell them a bridge and some magic beans I own.

But I think most Democrats are going to have a hard time buying into B. They've spent generations making election year hay out of accusing Republicans of trying to cut Social Security benefits. Now, with Republicans moving to make Social Security obligations explicit, and to give workers property rights in them, the Democrats are supposed to respond with: "No, that's fiscally irresponsible! You all know that your benefits will have to be cut after 2016. You've all known that all along, of course, right?" I don't see it.

I won't take it seriously until I see Krugman & Co. get Ted Kennedy, Nancy Pelosi, and Harry Reid to stand up on the podium and say it out loud: "You all know we can't afford to increase the cost of your Social Security benefits by making an explicit promise to pay them. Oh, c'mon! Then we'd actually have to..."

Yes ... and I'll want to see Kevin Drum and Matt Yglesias signing on board with this argument too.

Thursday, December 23, 2004

December 21, 2004

STATEMENT BY THE PRESS SECRETARY

On Tuesday, December 21, 2004, the President signed into law:

H.J.Res. 102, which urges the Secretary of the Interior to: (1) recognize the 60th anniversary of the Battle of Peleliu; (2) work to protect the historic sites of that battlefield; and (3) establish commemorative programs honoring the Americans who fought at those sites;

H.R. 480, which redesignates the facility of the United States Postal Service located in Albany, New York, as the United States Postal Service Henry Johnson Annex;

H.R. 2119, An Act to provide for the conveyance of Federal lands, improvements, equipment, and resource materials at the Oxford Research Station in Granville County, North Carolina, to the State of North Carolina;

H.R. 2523, An Act to designate the United States courthouse located in Savannah, Georgia, as the Tomochichi United States Courthouse;

H.R. 3124, An Act to designate the facility of the United States Geological Survey and the United States Bureau of Reclamation located in Boise, Idaho, as the F.H. Newell Building;

H.R. 3147, An Act to designate the Federal building located in Ogden, Utah, as the James V. Hansen Federal Building;

H.R. 3204, the "Benjamin Franklin Commemorative Coin Act," which requires the Secretary of the Treasury to mint coins in commemoration of the tercentenary of the birth of Benjamin Franklin;

H.R. 3242, the "Specialty Crops Competitiveness Act of 2004," which ensures an abundant and affordable supply of highly nutritious fruits, vegetables, and other specialty crops for American consumers and international markets by enhancing the competitiveness of United States-grown specialty crops;

H.R. 3734, which designates the Federal building located in Roswell, New Mexico, as the Joe Skeen Federal Building.;

H.R. 3884, which designates the Federal building and United States courthouse located in San Antonio, Texas, as the Hipolito F. Garcia Federal Building and United States Courthouse;

H.R. 4232, which redesignates the facility of the United States Postal Service located in Kingwood, Texas, as the Congressman Jack Fields Post Office;

H.R. 4324, which amends chapter 84 of title 5, United States Code, to provide for Federal employees to make elections to make, modify, and terminate contributions to the Thrift Savings Fund at any time;

H.R. 4620, which confirms the authority of the Secretary of Agriculture to collect approved State commodity assessments on behalf of the State from the proceeds of marketing assistance loans;

H.R. 4807, which designates the facility of the United States Postal Service located in Rio Vista, California, as the Adam G. Kinser Post Office Building;

H.R. 4829, which designates the facility of the United States Postal Service located in Kingsville, Texas, as the Irma Rangel Post Office Building;

H.R. 4847, which designates the facility of the United States Postal Service located in Longboat Key, Florida, as the Lieutenant General James V. Edmundson Post Office Building;

H.R. 4968, which designates the facility of the United States Postal Service located in Rosine, Kentucky, as the Bill Monroe Post Office;

H.R. 5360, the "American History and Civics Education Act of 2004," which authorizes grants to establish academies for teachers and students of American history and civics;

H.R. 5364, which designates the facility of the United States Postal Service located in San Diego, California, as the Earl B. Gilliam/Imperial Avenue Post Office Building;

H.R. 5365, which treats certain arrangements maintained by the YMCA Retirement Fund as church plans for the purposes of certain provisions of the Internal Revenue Code of 1986; and

H.R. 5370, which designates the facility of the United States Postal Service located in Boulder, Colorado, as the Donald G. Brotzman Post Office Building.

That is all

What Arnold and the California legislature have done.

How come I hadn't heard about this? Was there an election or something knocking everything else out of the news?

But enquiring low-brow East Coast minds want to know: how often had prosecutors been stymied, and what kind of "handful of incidents"?CALIFORNIA: NEW LAW BANS SEX WITH THE DEAD

Gov. Arnold Schwarzenegger signed a bill barring necrophilia. Officials said the law would help prosecutors who had been stymied by the lack of an official ban on the practice.

"Nobody knows the full extent of the problem," said Tyler Ochoa, a professor at Santa Clara University School of Law. "But a handful of instances over the past decade is frequent enough to have a bill concerning it." The new law makes sex with a corpse a felony punishable by up to eight years in prison. [NY Times]

The Times is too proper and coy to report such things. But you know that the uncensored truth ( in the form of the original news wire report it bowlderized) is out there on the Internet...

"Prosecutors didn't have anything to charge these people with other than breaking and entering. But if they worked in a mortuary in the first place, prosecutors couldn't even charge them with that," Ochoa told Reuters news agency.

The state's first attempt to outlaw necrophilia, in response to a case of a man charged with having sex with the corpse of a 4-year-old girl in Southern California, stalled last year in a legislative committee.

Lawmakers revived the bill this year after an unsuccessful prosecution of a man found in a San Francisco funeral home drunk and passed out on top of an elderly woman's corpse... [Reuters]

Ewww...

OK, so is California finally catching up with civilization? Or is this just another step in the Republican campaign to suppress alternative lifestyles?

Either way, it beats naming post offices.Wednesday, December 22, 2004

I don't think I'd jump out the window of a top-floor room of the Palace Hotel in New York City even if I did have a parachute and video camera. No matter how daunting the room service bill. What if I landed in the middle of Madison Avenue?

Though for a special view of the night-time lights of Manhattan...

[broadband advised]

Globalization at Christmas

The global economy caught in the last-minute holiday crush:

Why is it impossible for parents to buy hot-demand new PlayStation2?Such are the effects of globalization. If America was self-sufficient in video games then a tanker accident 5,000 miles away wouldn't deprive American children of their favorite new electronic toys at Christmas.

Because a month ago an oil tanker became jammed in the Suez Canal, closing the waterway for the first time in 40 years and blocking several cargo ships bearing containers of electronic toys bound to stores for the holidays. The trade publication EuroGamer calls the situation "grave".

Sony has reacted in globalized terms by chartering Russian-built Antonov cargo planes to fly to China and pick up game consoles from the factory, then ferry them to the United States and European Union. Each plane can hold 40,000 PlayStation2 consoles, but apparently even deliveries of 40,000 consoles per plane will not meet Christmas demand....

Imagine trying to explain to Chinese peasants living in shacks whose tin roofs are held in place by stones that children in the United States are crying because a global airlift cannot bring them video games quickly enough...

[The things one can learn from a football column!]

On the other hand, those new electronic toys might have all the game-playing power of my old TRS-80. And the Chinese who have escaped poverty by going into the electronics export business would still be back in their tin-roofed shacks. So we're better off as things are after all.

How about the Wall Street Bull as a Christmas present?

For another or yourself -- get your $5 million out now...

It'll be $5 million more of his life after he gets your money, with The Bull staying exactly where it's been all along, nothing changed."The Charging Bull" - a massive bronze sculpture famously deposited outside the New York Stock Exchange before the start of business in December 1989 - is up for sale.

The only conditions are that a deep-pocketed buyer instantly must donate the 7,000-pound tourist favorite to the city. It must also be kept in Bowling Green Park, where authorities eventually transplanted the bull because it lacked a permit for Wall St.

"It ... must stay there," said sculptor Arturo Di Modica, who created the bull as a symbol of hope following the 1987 stock market crash.

"Love the bull," declared Di Modica, who delivered the piece before dawn on a flatbed truck. "Respect the bull."

And pony up for it, too. The starting price is $5 million ...The piece has become a destination for out-of-towners, who straddle the bull and take it by the horns. "All over, they talk about 'The Charging Bull,'" Di Modica said in a telephone interview from Italy. "I created something incredible."

Even if he unloads his pet project, Di Modica said he still plans to pay weekly late-night visits to the bull. "It's my strength," he said. "It's my life." [NYDN]

Whose Christmas present will this be? "Love the Bull!"

Tuesday, December 21, 2004

The mother country's National Health Service presents a holiday animation, The Twelve Sexually Transmitted Infections of Christmas.

If a college kid had created this I'd have chuckled and moved on, but as it was paid for with taxpayer funds the link is provided as a public service -- at least for anyone in the Sceptered Isles.

Warning: May not be suitable for prudish Americans easily offended by humorous holiday animations about sexual diseases.

See what all we Americans have missed ever since we didn't get Hillary-care?

In anticipation of Michael Kinsley's new & improved proof that Social Security privatization can't work.

Michael Kinsley reports being impressed by the blogosphere's response to his previous claim to have presented "mathematical proof" that privately owned accounts in Social Security can't work. But he alerts us that a new and improved proof is coming...

"I won't bore you with my mathematical proof that Social Security privatization can't work. Not quite true: I will bore you with it, but not until next week... [though] I'll be hard-put, next week, even to summarize my own argument, let alone discuss those of others, in the space available to a columnist."Yet I don't think space will be the issue. For if the new proof tries to support the same claim as the old one -- that new private investments in Social Security will "bid down" returns to stocks, so it will be mathematically impossible to get the higher returns from stocks that privatization schemes rely on -- then no matter how long it runs it will have the same fundamental problems as the old one.

To recap, here's the gist of the Kinsley argument to date:

My contention: Social Security privatization ... is mathematically certain to fail. Discussion is pointless.And thus the return on stocks will fall, that on government bonds will rise, and the higher return on stocks relative to that on bonds that is needed to make privatization schemes work will disappear. As he said: "Q.E.D."

To "work," privatization must generate more money for retirees than current arrangements....

Greater economic growth requires either more capital to invest, or smarter investment of the same amount of capital. Privatization will not lead to either of these.

If nothing else in the federal budget changes, every dollar deflected from the federal treasury into private social security accounts must be replaced by a dollar that the government raises in private markets. So the total pool of capital available for private investment remains the same....

If the economy doesn't produce more than it otherwise would, the Social Security privatization bonus must come from other investors in the form of a lower return.

The money newly available for private investment will bid up the price of (and thus lower the return on) stocks, while the government will need to raise the interest on bonds in order to attract replacement money... [emphasis added]

Ah, but for this claim to prove itself as true it must first jump two hurdles...

1) One can't talk "mathematical proof" without considering actual quantities and scale.

Privatization proposals talk about investing the likes of $2 trillion in private accounts over a decade or so. Call that $200 billion a year. And that amount would not be entirely invested in stocks any more than the full balances of all IRAs and 401(k)s are. But for argument's sake let's assume a new full $200 billion is invested in stocks through privatized Social Security accounts each year.

The market capitalization of the New York Stock Exchange is $12 trillion. (I've looked it up since last mentioning the subject). But that's just one stock exchange. The capitalization of the world's major stock exchanges combined exceeds $33 trillion (if anything in this world is globalized the financial markets are, and return isn't going to plunge in one without doing so in others -- and, of course, diversified private investment accounts can invest anywhere). Moreover, their capitalization is growing at a long-term average rate of about 4%, over a trillion dollars a year.

Now, $200 billion equals less than 0.6% -- six tenths of one percent -- of total stock market capitalization (and that percentage will decline as time passes).

So hurdle-to-jump #1 is:

How is it plausible that increasing demand for stocks by all of six tenths of one percent will produce an historic change in the pricing and yields of stocks? For that matter, how will it produce one big enough for anyone to even notice?

2) The economy is not static, no matter what one assumes.

For argument's sake again, let us assume that some measurable increase in the price of stocks does occur to measurably reduce the yield on them, due to the increase in demand for them arising from new private Social Security accounts.

But we can't stop there! How will businesses react to that?

Well, since they now can sell shares for more -- for a higher price, while paying lower dividend yields on them -- they will sell more shares. This is just the law of supply and demand: increase in price brings an increased quantity of product to market. If you increase the amount that companies can get for selling stock shares, they will be happy to print and sell more.

Lower yields on stock shares make it less expensive for companies to issue new stock to finance new productive investment -- just exactly like lower yields on bonds make it less expensive to issue new bonds for the same purpose.

Thus, with higher stock prices and lower yields on them, productive investments that were uneconomic for firms previously become profitable, and so will be financed with new stock issuances. Real economic investment increases.

This is exactly the benefit of increased savings that Kinsley assumes isn't supposed to exist when he makes the assumption: "If the economy doesn't produce more than it otherwise would". Yet with rising stock prices and declining stock yields it is unavoidable that investment increases! Real investment and the real productive economy grow faster.

Hey, this is exactly why economists of all political stripes are constantly saying the US savings rate is too low -- because they want to produce this effect to spur the productive economy!

Moreover, of course, this very increase in the supply of stock shares due to increased demand for them will offset much of that increase in demand for them. And this in turn will act as a countervailing force to check and prevent any dramatic increase in the price of, and decline in the yield on, stocks. This is why the term "equilibrium" is important in economics.

So hurdle-to-jump #2 is:

How does Kinsley propose to enforce his assumed "steady state economy", where these feedback equilibrium effects don't occur, as his model specifies?

We can only wait and see how his new & improved proof meets these challenges.

And, hey, we can only hope that private Social Security accounts will have a significant enough effect on stock prices and total investment to have these effects!

For the record, Kinsley's full earlier column and this little corner of the blogsphere's rather longer comments on it -- including a couple of other points that Kinsley doesn't consider but which seem relevant around here -- are a few posts back.

But the above seems like it will remain the gist of things, unless he changes what he is trying to prove.

Monday, December 20, 2004

The "Boyfriend Pillow" for women and "Lap Pillow" for men are popular sellers in Japan. Is it too late to order for Christmas? [BBC]

"That'll be $100 or 10 days in jail."

Did you ever wonder about those sentences for minor offenses that consist of a choice of paying a few bucks or going to jail? Who would choose jail? I always assumed they were left over from the old days when a few bucks were worth more...

... but maybe they have a social purpose after all.Husband chooses jail to escape nagging wife

A henpecked German has chosen to do time in jail rather than pay a parking fine to get away from his nagging wife.The 47-year-old man, from Itzehoe, faced a £55 fine - or 10 days in prison if he didn't pay up.

Police in the town said they were stunned when the man rang up and asked them to come and pick him up from his home. "He said he couldn't stand the constant bickering at home with his wife and was looking forward to a bit of peace and quiet in jail," said a police spokesman. [Ananova]

Sunday, December 19, 2004

NY Post (not on line):

Axed teachers still get $23 million from New York CityAh, so to the union six months to hear the case of a teacher alleged to be having sex with a student is expedited.

New York City is spending $23 million a year to house teachers in regional offices as they await the outcome of disciplinary procedures against them, Mayor Bloomberg said yesterday.

He claimed the city is forced to keep paying the 310 or so teachers -- in some cases for years -- because the union contract prohibits the city from moving quickly to resolve allegations against them.

The average salary of the teachers is $70,000 and the amount paid to them is enough to run a high school of 3,000 students.

"For $23 million a year they sit around doing nothing", Bloomberg said on his weekly radio show. "We can't put them in a classroom, but we have to keep them."...

The mayor referred to the front-page story in yesterday's Post about a music teacher at Franklin K. Lane high school accused of having a three-year affair with a student that started when she was 14 years old ... The teacher, Barry Shenker, has been assigned to a regional office in Queens -- sometimes called a "rubber room" -- and will collect full salary until disciplinary procedures are completed, which may take years.

"One of the things we've said to the teachers union is, 'Give us the ability to expeditiously, not over one or two years, get rid of bad teachers'."

United Federation of Teachers president Randi Weingarten said the union is open to the idea of suspending without pay teachers accused of egregious behavior, but insisted there must be a fair process. She said she has proposed a plan to expedite grievance hearings but the city has rejected the offer. Her plan called for the city and the union to appoint a special master to hear cases within six months of being reported...

Imagine having a child of your own in a private school to which you are paying $12,000 per year tuition -- what taxpayers pay per student to the NYC public schools -- and that you and other parents learn a teacher there is having an affair with one of your daughters.

So you approach the school principal and ask what will be done. And the principal replies: "I and the teacher's representative will get together to pick someone to look into the facts in six months..."

On Thursday the Post reported that a Bronx chemistry teacher spent an estimated 12 years in "rubber rooms" since 1989 -- awaiting outcomes of numerous disciplinary charges. He was found guilty earlier this month of harassing students at the Bronx High School of Science...Oh, well, I guess compared to 12 years, six months is expedited!

In a letter to principals this week, Schools Chancellor Joel Klein said the process for firing incompetent teachers is "entirely broken", with "Kafkaesque" procedures protecting the unfit ...The Chancellor is very right that this is not just about being unable to fire a few teachers who are grievous offenders. It's about lack of accountability for basic standards of fitness and performance all the way through the system -- as was previously related here in the words of a NYC public school teacher in much more detail. With that reality, it's hardly surprising how these cases happen over and over.

Oh well, at least when school system employees are caught not doing nothing when that's what they are actually supposed to be doing, they can be fired. Go figure.

________

Follow-up: An inner-city high school with a 98% graduation rate that spends about half as much per student as New York public schools is described by Diane Ravitch.

Saturday, December 18, 2004

"The economy is in good hands ... They don't have to spell, they only have to count ... The economy is in good hands ... They don't have to spell, they only have to count ..."

WASHINGTON - President George W. Bush and Office of Management and Budget Director Joshua Bolton talk to conferees, above a misspelled sign, at the White House Conference on the Economy in Washington, December 16, 2004... [Reuters]

Friday, December 17, 2004

Paul Krugman remains on leave from his book leave to continue waging war against private investments in Social Security through his column.

Alas, in today's installment he can do no better than trot out the tired old bogey man of "high fees", with the tired old examples of Chile (always a bogey man for those on the left) and Britain. Hey, from my own clip files I see that these very same talking points are at least ten years old -- from back when the Advisory Commission of 1994 was examining private investments in Social Security. Golly, for the money it's paying him can't the Times get anything more timely, or more convincing, from the great economist?

Anyway, three observations...

[] First: Britain's own Tim Worstall puts it to Krugman for grossly misrepresenting the situation in the British retirement system.

[] Second: While I don't know if Krugman is any more reliable about Chile, I'd anyhow suggest that regarding US Social Security reform the situation in the US is rather more relevant. After all, it's not like we don't have any existing private investment programs operating in the US! What's the situation here?

I looked things up when this canard was flying around a couple years ago, it was like this...

* The Federal Thrift Savings Plan was managing private accounts with a 0.1% expense rate -- good enough for government employees!

* Vanguard was charging 0.2% for index mutual funds -- and I know that Fidelity is charging less than Vanguard now.

* The mean administrative cost for Standard & Poor's 500 Index mutual funds was 0.4% .

* The average administrative cost for private-sector, multi-employer defined contribution plans was 0.8%, according to the Department of Labor.

And the mere 1% that Krugman brags about Social Security charging for running a big checkbook, while managing no real assets, was higher than all of them.

By the way, rather than cherry pick a couple examples that might even be bogus, wouldn't it be sounder for Krugman to generally survey the experience of the 20-odd nations that have established some version of personal social security accounts so far?