Friday, April 03, 2009

The real federal budget deficit for 2008: $3 trillion, not $455 billion.

The US government's budget deficit for 2008 was $454.8 billion as officially reported by the Treasury -- the number reported in the news that everyone writes editorials and op-eds about.

But wait ... the Treasury has also published another set of numbers on its web site, in its 2008 Financial Report of the United States Government, that give a very different figure for the increase in its net liabilities for 2008, albeit one that receives very little publicity: More than $3 trillion, with a "t".

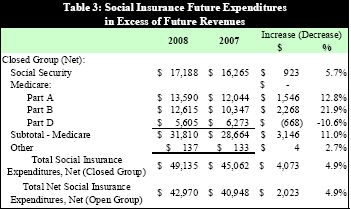

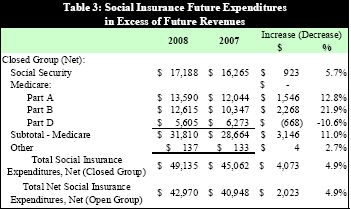

For starters, the one-year increased liability for Medicare and Social Security all by itself was $2.023 trillion (but not included in the official deficit number).

Then there is another $550 billion for pensions for federal employees and veterans, also not included in the official budget and deficit numbers...

To put that $3 trillion in perspective....

[] All federal revenues of all kinds in 2008 totaled $2,524 billion. Thus, to cover the $3,000 billion liability run up by the government would have required a 120% increase in all kinds of federal revenue across-the-board -- income taxes (personal and corporate), employment taxes, gas tax, excise taxes, tariffs, admission fees to national parks, all of 'em -- to 2.2 times what they are today.

[] All income taxes, personal and business, total $1.5 trillion. So to cover the $3 trillion with income taxes would on its face require a tripling of income tax bracket rates -- to 30% for the working poor, and 105% as the top rate for businesses and individuals.

[] All federal expenditures in 2008 totaled $2,979 billion. So the government ran up a one-year liability increase in 2008 that was larger than the government itself!

[] The total U.S. national debt held by the public at the end of 2007 was $5.04 trillion. That was the balance of all US bonds sold to the public since George Washington was inaugurated ... for purposes such as fighting two World Wars, getting through a Great Depression, putting men on the moon, waging the Cold War and defeating Communism ... over a period of 219 years.

The one-year "off the books" liability increase for 2008 of $2.58 trillion was more than half of that -- for Social Security, Medicare and federal pensions alone.

HOW IT HAPPENS

How can two such hugely different numbers one year's debt increase -- one 6.6 times larger than the other -- be provided by the US Treasury for the same thing? The answer lies in accounting methods: the difference between cash and accrual accounting.

Cash accounting is what the government uses for its official budget and deficit calculations. It counts only cash income "in" and cash expenditures "out" during the year, and comes up with a net total.

Accrual accounting, in contrast, also counts legally incurred rights to receive future income, and obligations to make future expenditures, that accrue during the accounting period.

The federal government uses cash accounting when computing its official budget deficit number.

In the private sector, cash accounting is illegal for most businesses much larger than a newsstand, and accrual accounting is required instead. The reasons should be obvious, but a simple example can make them clear.

Say you are running a business and one of your expenses is an obligation to pay pensions and health benefits to your employees when they retire in the future. Possibly, if you are fiscally responsible and a hard bargainer, you even have your employees pay to you, now up-front, amounts to cover the cost of their retirement benefits later.

With accrual accounting you count in your income for the year all the net business income you earn, plus the contributions from employees you receive, and then subtract from that amount the increase in your future liabilities, discounted to present value. (So if your liability to retirees 20 years from now increases by $1 million, and the interest rate is 5%, you incur a $377,000 charge against your income today). That gives you a full picture of your finances, looking into the future. In contrast...

With cash accounting all you count is your net cash income today, including the contributions from your employees towards their future retirement costs -- and you ignore the cost of the future retiree benefits you are running up. So those employee contributions you collect are pure profit!

Hey, do yourself a favor! Give your employees much bigger future retirement benefits, in exchange for bigger contributions from them today. Your profit just went way up! Now point out how you increased the business's profits to its happy shareholders. Give yourself a big raise and cash bonus as a reward!

Of course, a generation later, when all those retirement benefits suddenly come due as a cash cost, the business may well turn out to be General Motors or Chrysler with its shareholders howling, "if we were so profitable, what the !@#$% happened?", all the way to bankruptcy court.

(But that won't be your problem, you'll be retired to your mansion on the Italian Riviera.)

Or the organization you were running could turn out to be the US federal government. In 2008 it ran a cash deficit on operations of $638 billion. But it also received $180 billion in cash contributions towards future Social Security benefits that it included in its income, which (combined with a few other small items) reduced its cash-basis deficit to only the official $455 billion -- ignoring the $2.58 trillion liability incurred during the year for future Social Security, Medicare, and federal employee retirement benefits.

General Motors, Chrysler and the UAW were penny ante operators compared to our politicians!

DEFICITS AND DEBT

Which brings us to another point, the size of the real national debt that the real federal deficit increases annually -- including not only the total of US bonds issued by the Treasury, but also the present value of legally promised future spending for items such as, yes, federal employee pensions, Social Security and Medicare benefits.

Those who take the official defict number of $455 billion for 2008 at face value are likely to do the same with the official national debt numbers for 2008 of $5.8 trillion for "debt held by the public", and $10.0 trillion including "intra-governmental debt holdings" such as bonds held in the Social Security trust fund and other such government accounts.

But the real total accrued national debt including the "implicit debt" of social insurance liabilities, federal pensions and other items, at present value as of the end of 2008 was more than $53 trillion...

THE FUTURE

... and, as we see above, this number is growing by more than $3 trillion annually! (Under President Obama's plans it is going to grow a lot faster than that ... but that will be for next year's post.)

When will the US federal government reach the sorry financial situation that General Motors and Chrysler are in today?

Well, let's pick the year 2030 -- only 21 years from now. The Congressional Budget Office projects that just to keep even with spending increases for Social Security and Medicare, all income taxes across-the-board (both personal and corporate) will have to increase by more than 50% by then.

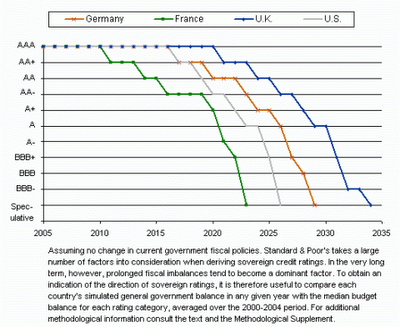

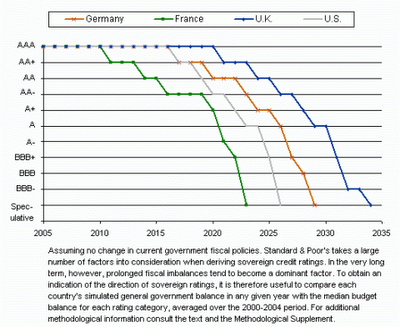

Except it may not be able to afford the army. The future credit rating of the US on the basis of current policy projected by Standard and Poor's:

"Junk" by 2027.

Well, at least the French go first.

The US government's budget deficit for 2008 was $454.8 billion as officially reported by the Treasury -- the number reported in the news that everyone writes editorials and op-eds about.

But wait ... the Treasury has also published another set of numbers on its web site, in its 2008 Financial Report of the United States Government, that give a very different figure for the increase in its net liabilities for 2008, albeit one that receives very little publicity: More than $3 trillion, with a "t".

For starters, the one-year increased liability for Medicare and Social Security all by itself was $2.023 trillion (but not included in the official deficit number).

Then there is another $550 billion for pensions for federal employees and veterans, also not included in the official budget and deficit numbers...

In FY 2008, the Government’s budget deficit of $454.8 billion (budget basis reporting) was $554.3 billion less than its net operating cost (from the Financial Report) of just over $1 trillion ... almost the entire difference between the Government’s budget deficit and net operating costs in FY 2008 can be attributed to a $550 billion increase in net accrued but unpaid Federal employee and veteran benefits. This amount is not included in the Budget, but is recognized as a cost and liability in the financial statements... [FRotUSG]So already we're at...

Official deficit.......................... $455 b... a total of more than $3 trillion for the increase in the government's real liabilities during 2008 -- and that's not counting many more little odds 'n ends that won't be bothered with here.

Pension liability increase ............... $550 b

Medicare/SocSec liability increase ..... $2,023 b

Total .................................. $3,028 b

To put that $3 trillion in perspective....

[] All federal revenues of all kinds in 2008 totaled $2,524 billion. Thus, to cover the $3,000 billion liability run up by the government would have required a 120% increase in all kinds of federal revenue across-the-board -- income taxes (personal and corporate), employment taxes, gas tax, excise taxes, tariffs, admission fees to national parks, all of 'em -- to 2.2 times what they are today.

[] All income taxes, personal and business, total $1.5 trillion. So to cover the $3 trillion with income taxes would on its face require a tripling of income tax bracket rates -- to 30% for the working poor, and 105% as the top rate for businesses and individuals.

[] All federal expenditures in 2008 totaled $2,979 billion. So the government ran up a one-year liability increase in 2008 that was larger than the government itself!

[] The total U.S. national debt held by the public at the end of 2007 was $5.04 trillion. That was the balance of all US bonds sold to the public since George Washington was inaugurated ... for purposes such as fighting two World Wars, getting through a Great Depression, putting men on the moon, waging the Cold War and defeating Communism ... over a period of 219 years.

The one-year "off the books" liability increase for 2008 of $2.58 trillion was more than half of that -- for Social Security, Medicare and federal pensions alone.

HOW IT HAPPENS

How can two such hugely different numbers one year's debt increase -- one 6.6 times larger than the other -- be provided by the US Treasury for the same thing? The answer lies in accounting methods: the difference between cash and accrual accounting.

Cash accounting is what the government uses for its official budget and deficit calculations. It counts only cash income "in" and cash expenditures "out" during the year, and comes up with a net total.

Accrual accounting, in contrast, also counts legally incurred rights to receive future income, and obligations to make future expenditures, that accrue during the accounting period.

The federal government uses cash accounting when computing its official budget deficit number.

In the private sector, cash accounting is illegal for most businesses much larger than a newsstand, and accrual accounting is required instead. The reasons should be obvious, but a simple example can make them clear.

Say you are running a business and one of your expenses is an obligation to pay pensions and health benefits to your employees when they retire in the future. Possibly, if you are fiscally responsible and a hard bargainer, you even have your employees pay to you, now up-front, amounts to cover the cost of their retirement benefits later.

With accrual accounting you count in your income for the year all the net business income you earn, plus the contributions from employees you receive, and then subtract from that amount the increase in your future liabilities, discounted to present value. (So if your liability to retirees 20 years from now increases by $1 million, and the interest rate is 5%, you incur a $377,000 charge against your income today). That gives you a full picture of your finances, looking into the future. In contrast...

With cash accounting all you count is your net cash income today, including the contributions from your employees towards their future retirement costs -- and you ignore the cost of the future retiree benefits you are running up. So those employee contributions you collect are pure profit!

Hey, do yourself a favor! Give your employees much bigger future retirement benefits, in exchange for bigger contributions from them today. Your profit just went way up! Now point out how you increased the business's profits to its happy shareholders. Give yourself a big raise and cash bonus as a reward!

Of course, a generation later, when all those retirement benefits suddenly come due as a cash cost, the business may well turn out to be General Motors or Chrysler with its shareholders howling, "if we were so profitable, what the !@#$% happened?", all the way to bankruptcy court.

(But that won't be your problem, you'll be retired to your mansion on the Italian Riviera.)

Or the organization you were running could turn out to be the US federal government. In 2008 it ran a cash deficit on operations of $638 billion. But it also received $180 billion in cash contributions towards future Social Security benefits that it included in its income, which (combined with a few other small items) reduced its cash-basis deficit to only the official $455 billion -- ignoring the $2.58 trillion liability incurred during the year for future Social Security, Medicare, and federal employee retirement benefits.

General Motors, Chrysler and the UAW were penny ante operators compared to our politicians!

DEFICITS AND DEBT

Which brings us to another point, the size of the real national debt that the real federal deficit increases annually -- including not only the total of US bonds issued by the Treasury, but also the present value of legally promised future spending for items such as, yes, federal employee pensions, Social Security and Medicare benefits.

Those who take the official defict number of $455 billion for 2008 at face value are likely to do the same with the official national debt numbers for 2008 of $5.8 trillion for "debt held by the public", and $10.0 trillion including "intra-governmental debt holdings" such as bonds held in the Social Security trust fund and other such government accounts.

But the real total accrued national debt including the "implicit debt" of social insurance liabilities, federal pensions and other items, at present value as of the end of 2008 was more than $53 trillion...

THE FUTURE

... and, as we see above, this number is growing by more than $3 trillion annually! (Under President Obama's plans it is going to grow a lot faster than that ... but that will be for next year's post.)

When will the US federal government reach the sorry financial situation that General Motors and Chrysler are in today?

Well, let's pick the year 2030 -- only 21 years from now. The Congressional Budget Office projects that just to keep even with spending increases for Social Security and Medicare, all income taxes across-the-board (both personal and corporate) will have to increase by more than 50% by then.

Social Security, Medicare, and Medicaid expenditures are projected to grow from 44 percent of Government non-interest expenditures to 65 percent by 2030.These numbers show that only 20 years from now the US federal government will be most of the way to converting itself into "a pension and retiree health benefit plan with an army".

[FRotUSG]

Except it may not be able to afford the army. The future credit rating of the US on the basis of current policy projected by Standard and Poor's:

"Junk" by 2027.

Well, at least the French go first.