Thursday, March 31, 2005

(Or: How the new Baker/DeLong/Krugman paper near seals the case for reforming Social Security)

The idea that stock market returns will be lower in the future than the past, making private investments in Social Security unattractive, is the subject of NY Times story today --- perhaps inspired by the release of a new paper co-authored by Times columnist Paul Krugman along with Dean Baker and Brad DeLong.

Four quick observations regarding it, leading to what may seem a surprising conclusion:

First: Before gainsaying the mere 4.5 or 5 percent future return the paper predicts from stocks (if economic growth slows) keep in mind the legislated future return to participants from Social Security...

[Caldwell et. al.]

And also remember ...

a) these dismal-to-negative returns from Social Security are themselves about 30% underfunded for those born in 1970 or later, so their real return is even more negative than that -- move both those lines down another full percentage point.

b) these future returns from Social Security are not "maybe" depending on how the economy performs, but fixed via the written Social Security tax-to-benefit formula.

c) even these returns are subject to even further reductions via politics when the equivalent of a 35% income tax hike from today's levels becomes needed by 2030 just to cover the operation of the trust funds -- at the same time as even larger tax hikes become needed to fund Medicare.

In fact, the Democrats are recommending future benefit cuts already! Whenever you hear Nancy Pelosi, Harry Reid, et al, repeat their current mantra, "when the day comes that we finally need to do something, we can just work out something together like Ronald Reagan and Tip O'Neil did"... remember that what Ron and Tip did was cut benefits by 50% of the funding shortfall they faced.

So workers under age 35 today can safely expect their return from Social Security to be even lower than the graph above indicates.

Second: Assuming the B/D/K paper's "lower future return to assets" projection comes true, remember that this will affect bonds as well as stocks -- and as has been pointed out by Arnold Kling, this makes the current finances of Social Security much worse than currently projected, and private accounts more attractive.

In particular, the Social Security actuaries discount the future unfunded liabilities of Social Security to current value using a 3% real return from Treasury bonds.

But the actual historic return on such bonds since 1946 has been less than 1.6% (as noted previously). If, as per the "lower future return to assets" claim, the future return to bonds will be even less than that, only 1.5% or less, then the current value of the cost to the government of the unfunded liabilities of Social Security over a 75-year horizon jumps from today's estimated $5.5 trillion to more like $11 trillion -- the size of the currently estimated open-ended liability. And the open-ended liability becomes much larger than that.

Future lower bond returns increase the urgency of the need to do something about Social Security's financing gap soon.

Third: For all the brouhaha that they have stirred up about lower future stock returns, the authors of this paper don't actually predict them. In fact, they rather do the contrary....

We are somewhat skeptical of forecasts of slowing population growth. We cannot forecast natural increase.They are not predicting that there will be slower future economic growth and lower future stock returns.

In most futures we can think of, the world in 2050 or 2100 contains a great many people outside the U.S. whose productivity would be amplified if they were able to move to the U.S., and so we suspect that for at least the next century immigration will play as large a role in America’s future than it has in its past.

We are somewhat skeptical of forecasts of persistent productivity slowdowns as well, for the reasons set out by Gordon (2004), Oliner and Sichel (2003), and Kremer (1993).

Nevertheless, we believe that if such forecasts of slowed real GDP growth come to pass, then returns to capital and particularly returns to equity are highly likely to be significantly below past historical averages.

They are saying that if there is slower economic growth in the future (due to declining growth in the work force and declining productivity growth) then there will be lower future stock returns -- but they are skeptical that such decline in economic growth will occur (because they are skeptical that immigration will fail to supplement growth of the work force, and skeptical of a future decline in productivity growth).

So as to the projected decline in stock returns, well, they are skeptical about it themselves. Which sort of takes the sting out of things, eh?

Fourth: At this point we can expect the status quoers to invoke Krugman's argument-in-the-alternative from his past column that started all this -- that if the economy doesn't slow, so stock returns stay as high as they've been, then there will be plenty of payroll tax revenue to fund Social Security, so there is no future solvency problem, and thus no need for private accounts....

Which brings us to the privatizers' Catch-22.But this argument is pure bogus.

They can rescue their happy vision for stock returns by claiming that the Social Security actuaries are vastly underestimating future economic growth. But in that case, we don't need to worry about Social Security's future: if the economy grows fast enough to generate a rate of return that makes privatization work, it will also yield a bonanza of payroll tax revenue that will keep the current system sound for generations to come.

Private accounts are not designed or intended to address any solvency problem. Private accounts are neutral regarding the solvency issue, as the White House has plainly stated:

Q.: ... am I right in assuming that in the way you describe this, because it's a wash in terms of the net effect on Social Security from the accounts by themselves, that it would be fair to describe this as having -- the personal accounts by themselves as having no effect whatsoever on the solvency issue?Since private accounts aren't intended to affect solvency at all, arguing against them on the grounds they don't is nonsense.

SR. ADMIN. OFFICIAL: ... that's a fair inference.

Rather, private accounts are intended to improve the nature of Social Security benefits by doing three things:

i) Providing today's younger workers with positive returns that will benefit them on a lifetime basis -- as past participants have received for the last 65 years -- rather than the dismal-to-negative returns, seen above, that will make young workers poorer on a lifetime basis.

(Note that when Krugman says if economic growth doesn't slow then there will be "payroll tax revenue that will keep the current system sound for generations", he means while paying those dismal-to-negative returns shown on the graph above.)

ii) Giving participants ownership rights, and the significant benefits that ensue from them, in their Social Security benefits. As Alan Greenspan said while endorsing private accounts...

The normally placid Greenspan rose almost to the threshold of passion as he made a class-based argument by contending that private accounts would allow low-income people to become mini-capitalists — in his view, a very good thing.iii) Securing Social Security benefits being earned today from the certain future political pressure for benefit cuts that will arise a generation from now when income taxes will be rising to double today's level as a percentage of GDP, or annual deficits will be approaching 20% of GDP (larger than the entire federal government today) or some combination of both will be occurring.

"When you have assets which you own, which you can bequeath to your children, (assets) which have your name on them, I think it is highly desirable thing, because you give wealth to people in lower- and middle-income groups who have not had it before".

The Fed chairman predicted private accounts would be "extraordinarily popular," and "if they are I think it is a very important addition to our society because, as you know, I’ve been concerned about concentration of income and wealth in this country ... This, in my judgment, is one way you can address that."... [AG]

In that world, the pressure for benefit cuts -- already endorsed by Pelosi and Reid! -- as an alternative to even higher taxes and deficits will be intense.

Paul Krugman himself has written that within 30 years -- the life of his own home mortgage -- he expects a fiscal "train wreck"!

How will the train wreck play itself out? ... my prediction is that politicians will eventually be tempted to resolve the crisis the way irresponsible governments usually do: by printing money, both to pay current bills and to inflate away debt. And as that temptation becomes obvious, interest rates will soar...How easy will it be to raise taxes to pay Social Security benefits then?

But to the extent that benefits payable then are prefunded today, when the financing is easy, they will be secured in that "train wreck" future -- and the future fiscal pressure will be relieved to everyone's benefit.

Finally, a fourth important purpose of private accounts is to increase national savings, again a reason for Greenspan's endorsement of them.

[Greenspan] also said he believes individual accounts offer future retirees a better chance of achieving the standard of living they will expect.

"We have been utterly unable in the pay-as-you-go system to create the necessary savings to finance the capital investment that we're going to need for the future to create the goods and services that retirees are going to need," he said.

Now, summing up -- and with the larger perspective of the real benefits that private accounts are meant to provide -- let's look at the logical consequences of the DeLong/Krugman/Dean proposition for Social Security reform:

Economic growth -- and with it the financial return to assets such as stocks and bonds -- will in the future either slow or not slow...

* If economic growth does not slow but continues at the rate of the past, so stock returns stay high, then the solvency problem of the Social Security status quo goes away and the status quo can be easily afforded, so says Krugman.

But private accounts are neutral as to the solvency of Social Security. So if the status quo can be easily afforded, then private accounts can be equally easily afforded!

And they will pay high investment returns, as in the past -- compared to the minimal-to-negative returns from Social Security.

If a reform will improve the welfare of Social Security participants by increasing the return on their Social Security contributions from negative to the positive, plus by giving them the benefits of asset ownership ... and it will improve the welfare of nation as a whole through an increase national savings ... and it can be easily afforded ... then what argument is there against it?

* If economic growth does slow, so that asset returns will be lower in the future than than the past, lower than the Social Security actuaries project, then the current value of the future unfunded liabilities of Social Security is much larger than currently projected -- perhaps twice as large, or more than twice as large.

In that case, the fiscal problems of Social Security are much worse than even pessimists say today -- and the case for reform to address the much larger funding gap soon (and also to secure benefits being earned today from future fiscal pressure) becomes that much more urgent.

Either way, take your choice, it's an argument for Social Security reform.

Catch-22.

Well, that's how it looks to me. What do you think?

______

Update: N. Gregory Mankiw of Harvard, past Chairman of the President's Council of Economic Advisers, has a response (.pdf) to the B/D/K paper that covers all the economic and political bases and is well worth reading. [via Don Luskin]

Random notations...

Know your enemy -- maybe a little sooner. The Harvard Psychological Clinic had Adolf Hitler all figured out ... in 1943.

Don the sweater, doff the tie. Japan's Prime Minister Koizumi adopts Jimmy Carter's energy policy.

Who has the most fun with numbers? Do economists really lack the personality to be accountants? It could be true!

Doubleplusgood! Individuals are poor at making choices, so the government and businesses should relieve them of the burden, some say...

Mr. Thaler and Cass Sunstein of the University of Chicago Law School suggested that it is proper for the government, or an employer, to set boundaries to choice to achieve desired social objectives, an approach they call "libertarian paternalism." [NYT]

For men who aren't happy with what they've got. The German remedy (as noted here previously) is to grow two where there was one. (Some tact required with the spouse!) The Russian approach is to move one to where there was none. (Long sleeves required?) [Update: For all you 'only seeing is believing' types, here -- although I was just as happy with the text-only version of this tale.]

Why living in the mountains is dangerous. If the avalanches don't get you the artillery will.

Celebrating the arrival of baseball...

An underwear maker on Friday celebrated the birth of Japan's first new professional baseball team in 50 years with a commemorative bra shaped like baseballs that features team mascots both inside and out.So what are they doing in Washington, DC, to celebrate the arrival of the

The bra is made of synthetic leather and has dolls of the expansion team Tohoku Rakuten Golden Eagles' furry mascots "Clutch" and female "Clucchina" clutching the side of each bra cup turned baseball.

Completing the theme, the inside of the bra is trimmed with a real eagle's feather... [AFP]

Wednesday, March 30, 2005

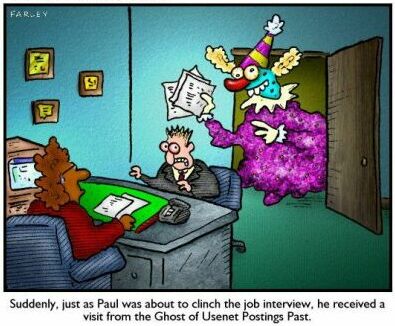

As Paul Krugman in his latest column warns us all to beware the tide of extremist right-wing Christian political assassins rising among us (even if they are not assassinating anybody)...

America isn't yet a place where liberal politicians, and even conservatives who aren't sufficiently hard-line, fear assassination. But unless moderates take a stand against the growing power of domestic extremists, it can happen here.... it's worth remembering what he considers to be the good old days of a healthy social climate in American politics. As he told CalPundit, while he was promoting his book...

"Is this the same country that we had in 1970? I think we have a much more polarized political system, a much more polarized social climate ...we're probably not the country of Richard Nixon ..."

Well, he's surely right about that. It's not the same country today as during the Nixon era, who could argue? There's no Spiro Agnew smoothing troubled waters, no race riots burning down inner cities, no SDS and Weathermen bombings, no anti-war protestors closing universities, no Kent State Massacres with the National Guard shooting down students on campus ...

Well, he's surely right about that. It's not the same country today as during the Nixon era, who could argue? There's no Spiro Agnew smoothing troubled waters, no race riots burning down inner cities, no SDS and Weathermen bombings, no anti-war protestors closing universities, no Kent State Massacres with the National Guard shooting down students on campus ...Nope, things are more dangerous today, because there's a conspiracy afoot, as he told the New Yorker, while he was promoting his book...

"This is hard for journalists to deal with. They don’t want to sound like crazy conspiracy theorists. But there’s nothing crazy about ferreting out the real goals of the right wing; on the contrary, it’s unrealistic to pretend that there isn’t a sort of conspiracy here, albeit one whose organization and goals are pretty much out in the open."... in fact, the very worst kind of conspiracy -- one that's out in the open!

So we have a conspiracy out in the open, empowering a rising tide of right-wing assassins who don't kill anyone, in a society that's today

Could the last fact, combined with the frustration of electoral defeat, be really what's driving Krugman mad?

(Or maybe it's just that the polarization theme sells, so pushing it is good business that "creates a publishing opportunity" for the man?

Not that he'd purposely sell his integrity with bogus laments over the loss of the social cohesion of the good old days of Nixon, or with bogus warnings about conspiracies being conducted out in the open, just to promote the sales of a book. How could one pretend to believe such things with a straight face?

But if one wanted to genuinely believe such nonsense, what better motivators are there than acclaim from the choir, reinforced self-righteousness, and good money? Madness perhaps can be adaptive, and profitable too.)

The NY Times forgets it's an owner of the Boston Red Sox as it blasts proposed Yankees deal.

As the NY Times' editors take a principled stand against city support for the construction of a new Yankee Stadium, they forget to add the "full disclosure" part...

The Times editorial — which accused the Yankees of "acting like a superstar free agent and asking for the moon" in its plans for a new stadium — never mentioned that the Times Co. is a part-owner of the Boston Red Sox and has a substantial self-interest in stopping the Yankees from building a new, more profitable stadium...That's our Times!

A Yankee insider snickered, "The Gray Lady's Red Sox are showing." The insider explained, "The better the Yankees do financially, the more money they'll have to pay the best players, and the more the Yankees will beat the Red Sox." ...

[Randy] Levine, who was a deputy mayor in Rudy Giuliani's administration, also blasted the Times' hypocrisy in criticizing the Yankees for asking for infrastructure improvements, while not acknowledging all the government subsidies the Times will enjoy at its new headquarters being built on Eighth Avenue.

"Isn't it amazing that the Times never mentions the tax enhancements it receives for its projects, including the new Times building, when they pass judgment on other transactions?" Levine said....[NY Post]

Watching the growth of government hiring in Britain...

The government is hiring more regulators than policemen, according to analysis of official employment data by the Centre for Economics and Business Research....Hey, somebody's got to keep the future Cumbernaulds coming.

Mark Pragnell, a CEBR economist, said: "We were also rather amazed to see that government has hired 5,000 more town planners. What do these people actually do?"...

The CEBR says that Britain now employs ... 25 per cent fewer architects than in 2001. "Perhaps they have all transformed themselves into town planners," Pragnell suggested... [Telegraph, via Tim Worstall]

Tuesday, March 29, 2005

The New Libertarian: a Journal of Neolibertarian Thought, has its first edition out. Check out the details at QandO.

When it turns out to be for libertarianism what Buckley's National Review was conservatism, you won't want to say you missed the first issue.

Six degrees of St. Elsewhere.

Proof that all of prime time network television has been just the troubled dream of an autistic child...

"I will first reveal to you a stunning tapestry of interconnected TV shows, then prove that none of those shows' episodes actually occurred. I’ll do the last with two magic words: St. Elsewhere..."

Who on the CSI team checks the butt prints?

Our choice for smart criminal of the week...

... though you may choose another.In Van Buren, Ark., Mark Thompson stole a car stereo from a car parked in front of a tire store, then decided to moon the empty store. He then fled, not noticing that his wallet had fallen out when he'd dropped his pants.

Police found it later, along with another piece of evidence: a rather large "butt print" on the store's window.

Monday, March 28, 2005

So asks the NY Times...

Meanwhile, back in Iraq...... arriving in the seaside capital of Beirut is a bracing and abrupt experience... How could Iraq have inspired this?

Chibli Mallat, a Beirut lawyer and opposition leader, has an answer. He believes that for years, Iraq stood as both a positive and malevolent symbol to others in the Middle East.Saddam Hussein's survival following the Persian Gulf war in 1991, Mr. Mallat said, froze the status quo in the region for more than a decade. The Iraqi dictator's prolific human rights abuses had the perverse effect of making every other unelected leader in the Middle East look tame by comparison. The result, he said, was political stasis.

"Saddam's survival created an atmosphere where people literally got away with murder," Mr. Mallat said. "His removal became a precondition for change in the region."

When the Americans finally returned to topple Mr. Hussein two years ago, and, more important, when millions of Iraqis risked their lives to cast ballots in January, the country emerged as a symbol for change across the region.

"Suddenly, there was a demand for democracy," Mr. Mallat said.

Mr. Mallat's view, compelling though it is, is a minority one in Lebanon...

Unlike Iraq, Lebanon has been a functioning democracy since 1990, when the civil war, which killed 100,000 people, finally came to an end. Lebanon's press is vibrant, with newspapers and television stations largely free to criticize the government ...

Indeed, it is no accident that the main slogan of the Lebanese opposition is not "Democracy," but "Sovereignty, Independence and Freedom." The goal is to expel Syrian forces, who have been in Lebanon for 30 years...

"Here we already have a democracy," said Mustafa Salha, a 40-year-old worker ... "Iraq didn't have anything to do with that."

... the goal of those taking to the streets in Lebanon has not so much been the beginning of democracy, but rather a better democracy than what they already have. The way to get that, most Lebanese seem to agree, is to expel the Syrian forces and by so doing end that country's overweening influence here...

Enter the government of the United States...

For many Lebanese, what made significant change possible in Lebanon was not the elections in Iraq, but the events of Sept. 11, 2001, which prompted the Bush administration to re-examine its reluctance to challenge the Syrian regime, as well as other Arab dictatorships that had backed terrorist groups. When the Lebanese began calling for a Syrian withdrawal, the Syrian government had to defy not just the Lebanese people, but the United States as well.

For that reason, more than a few Lebanese believe, President Bush's demands are proving decisive in driving the Syrians out. "This enthusiasm for democracy may not happen again," said Khalil Karam, professor of international relations at University of St. Joseph here, speaking of American foreign policy. "Without it, we could not stop Syria."

Mr. Salha, the factory worker, offered his own grudging invitation, if only to ensure that his homeland finally frees itself of Syrian domination.

"We are not against Bush," Mr. Salha said. "If he wants to make us safe and free, that's great. Let him do it."

Iraq's insurgents 'seek exit strategy'And now there are democracy marches even in Mongolia...

Many of Iraq's predominantly Sunni Arab insurgents would lay down their arms and join the political process in exchange for guarantees of their safety and that of their co-religionists, according to a prominent Sunni politician.

Sharif Ali Bin al-Hussein, who heads Iraq's main monarchist movement and is in contact with guerrilla leaders, said many insurgents including former officials of the ruling Ba'ath party, army officers, and Islamists have been searching for a way to end their campaign against US troops and Iraqi government forces since the January 30 election...

"Firstly, they want to ensure their own security," says Sharif Ali, who last week hosted a pan-Sunni conference attended by tribal sheikhs and other local leaders speaking on behalf of the insurgents...

Sharif Ali said the success of Iraq's elections dealt the insurgents a demoralising blow, prompting them to consider the need to enter the political process. [Financial Times, (hat tip, Reality Hammer)]

Lessons for the modern murderer.

First, forget using plastic garbage bags to get rid of the body...

But, hey, if you can't beat the evidence in our modern CSI-world, use it. If it's really, really bad you may walk free because it's prejudicial against you...At least one aspect of [murder] is relatively new, at least to the previous generation of law enforcement: the bags.

"When I started out, they used to get rid of bodies in steamer trunks," Dr. Baden said. "In the 1960's, when I first started in the medical examiner's office in New York City, it was before plastics were used largely. One of the ways of getting rid of bodies was putting them in steamer trunks and sending then off on a train someplace. We had several cases that came back from Los Angeles. They had quite an odor."

It turns out that a body placed in a garbage bag and dumped, presumably to be forgotten forever, is actually preserved longer, Dr. Baden said.

"The plastic tends to preserve them for longer periods of time than if it had just been buried in the ground," he said. "A lot of destruction to a body comes from insects, maggots, rats and vermin, depending on where you are. The plastic is very good at preserving the tissues for longer periods of time. They can't tell the odor or they can't get to it."

"There are a lot of myths," he continued. "In the old days they used to put bodies in lye. It turns out that lye, rather than destroy the body, preserves it, because it kills the bacteria and any insects. Plastic does the same thing."

Also, the plastic itself holds fingerprints well, making the bags not only preservers of evidence, but evidence in their own right... [NY Times]

A man who confessed to killing two women walked free from court yesterday when a judge ruled the evidence too damning.Or, as an alternative, you can say sure, you beat the life out of that body the prosecutors have there, but you did it in your sleep...

Father-of-two Lyle Simpson admitted being a killer, DNA evidence proved he was at the scene of one murder and he tried to commit suicide a day later.

Yet after three days of legal argument in the NSW Supreme Court, Judge Anthony Whealy ruled some evidence was just too damning and ran the risk of "unfair prejudice" to the accused...

Outside court yesterday, Simpson said: "I'm relieved to go home... I've had a rough time. My wife's been through hell. If you haven't been in jail you don't know what it's like to be locked up in cells, no TVs and radios."...

Evidence tendered in court showed Simpson phoned his wife Kamara several times on September 25 and told her he had "killed two sheilas". In another call, he allegedly said: "I have killed a prostitute, there's two less sheilas in the world."...

But in court, his defence team led by legal aid solicitor Joanne Harris successfully argued the evidence would unduly prejudice the jury.

A court source said: "The evidence would be too prejudicial for the jury to hear, they would naturally assume from some of the evidence, that he was guilty... [news.com.au]

So why waste perfectly good plastic bags on a dead body? It's not the evidence, but the judge and jury that count. [above cases via Strange Justice]A British man was cleared of murdering his father after a court accepted his excuse he was sleepwalking at the time ...

Jules Lowe, 32, was facing life imprisonment for killing his 83-year-old father Edward in a savage beating at their house in Manchester, north-west England, an attack he did not deny but claimed to have no memory of...

Lowe attacked his father at the family home after a heavy drinking session in October 2003 before going to bed, the court was told. The next day, the body of his father, which had been punched, kicked and stamped on, was spotted in the house's driveway and police were called. [injuries described]

Nine months after the attack, Lowe first mentioned a history of sleepwalking to defence lawyers and he was subjected to "the most detailed scientific tests in British legal history", the jury was told... the jury accepted he was not acting voluntarily due to sleepwalking...

Lowe will undergo tests in hospital, after which he will be released under certain conditions, possibly within months.... [AFP]

P.S.: You don't have to kill somebody for the "sleepwalking" defense to be useful -- it's fine for lesser offenses too...

A pub landlord who crashed his car while three times the alcohol limit was cleared of drink-driving -- because he could prove he is a sleepwalker. Matthew Sadler was tracked down by police after his mangled £18,000 BMW was found in undergrowth next to a busy road. The convertible had run into a lamppost and debris littered the highway... He was arrested but claimed to have no memory of the crash... [Mirror]Not because he'd been drunk but because he'd been asleep. And they bought it!

Let a word to the wise be sufficient -- if you are ever caught at the scene of your crime don't bother trying to hide any evidence, just start snoring!

Sunday, March 27, 2005

Fuzzy MathNot to worry, though, the problem has been identified. And no, it's not that the school system has high-paid innumerates writing math instruction manuals. It was ... a negligent fact checker!

[New York] City Department of Education booklets designed to train teachers how to prepare students for math tests are riddled with incorrect answers ...

"Children would get flunked for making these kinds of errors," said Jane Hirschmann, of Time Out From Testing. "The Department of Education has to be held to the same standards."

Perhaps the most embarrassing error is on the cover of the booklet for the fourth grade — make that the "forth grade." That's how educrats in the department's division of mathematics spelled it...

So a mathematician would know that 15+10=25, right? Apparently not.

An algebraic equation in the booklet for seventh-grade teachers uses variables, to ask, in essence, what 15+10 equals — but gives the correct answer as 24. In fact, 25 is not even among the four multiple-choice answers.

As if that isn't bad enough, the very next question insists the correct answer to another algebraic equation is 0=6... [NY Post]

School officialsWell, a letter in a file will take care of everything.scapegoatedblamed the mistakes on an ineffective fact-checker. "We have a clear protocol for review of all materials," Carmen Farina, deputy chancellor for teaching and learning, said in a statement. "In this case, a member of my staff inexcusably failed to follow our protocol, and I have written a letter of reprimand to the person's file." [WINS]

Yes, the NYC Department of Education actually employs fact checkers to assure that its math instructors spell "four" correctly, and know that 15+10 = ... er ... 25!

But not sufficiently skilled fact checkers. Obviously, for that, the school system needs more money!

But does it perhaps make you wonder how those math manual writers managed to pass their own tests? (And, when they think 0=6, how they keep their jobs?)

Economic illiteracy in the business press.

From innumeracy in the public schools to economic illiteracy in the press. Of course, we are inundated with a perpetual flood tide of it -- but one might think the business press might be a little less bad. Go wish.

Birthday boy Tim Worstall gives us a fine example in this current and widely reported story...

Crude oil prices climbed more than $1 per barrel on Thursday, following the news of a fatal blast at a Texas refinery.... which Google news at this moment says is the substance of more than 307 different news reports (like this).

A deadly explosion at a BP refinery in Texas City, Texas, led to supply concerns. The third-largest petroleum refinery in the US produced 30% of BP’s supply of petroleum products in North America... Crude oil futures for May delivery rose $1.03 a barrel on Thursday to settle at $54.84 per barrel...

What's the problem with it? Well, it's true that there was a refinery explosion and also that the price of crude oil rose soon afterward

But, as Tim points out, if a refinery that consumes a major amount of crude oil in the course of producing finished products is unexpectedly knocked off line for a significant period if time, then the amount of crude available to other refineries will increase, which will cause the price of crude to fall, other things being equal. And any price increases will be seen among finished products, which is where any resulting shortages will occurs.

Correlation is not causation -- and sometimes the idea that it is simply defies common sense. But that doesn't keep the business press from reporting it as so. (Is it any wonder the political press does what it does?)

Saturday, March 26, 2005

A fifth federal court has now ruled that long-distance phone calls as commonly billed today are not subject the telephone excise tax. This time the result was a $1.25 million tax refund awarded to the company seeking it. (Honeywell International, Inc. v. U.S., No. 03-1915T, Court of Claims.)

As has been explained here before, the issue boils down to the fact that the decades old provisions in the Tax Code that impose the telephone excise tax define a taxable long-distance call as one that is billed individually by both time and distance. But in today's world many if not most calls are billed otherwise -- flat rate per month, time but not distance, negotiated rate, and so on.

The IRS has argued that this shouldn't matter, Congress intended to tax all phone calls. But the five courts have all instructed the IRS that the law means what it says and says what it means -- and that Congress must update the law if it really intends to tax all calls.

Industry experts say $6 billion in tax refunds could be at stake, for businesses of all sizes and individuals too. More extensive legal analysis, legal citations for all the cases, and advice about how to protect a refund claim regarding your own phone bill without actually incurring the cost and effort of suing the IRS, have been given in a prior post.

Now, in addition and for the first time, a court has ruled "inbound 800" service to be tax free too, for the same basic reason. With "inbound 800" service a business pays for calls it receives. (Of course, these days such service utilizes numbers other than "800".) Here too the court ruled that the Tax Code's definition of taxable phone service is obsolete and did not match the taxpayer's.

In particular the court said that the Code's definition of taxable service was written to apply to 1980s-type AT&T "WATS" service that allowed unlimited inbound phone calls within a given geographical area, charging a flat rate or by total elapsed transmission time. However here the company's inbound 800 service billed per individual call, and thus didn't fit the description of calls made subject to tax by the Code -- so the calls are free from the telephone tax. (Fortis, Inc. v. United States; No. 03 Civ. 5137(JGK), D.C., S.D. New York. 2/14/05)

Well, that's a simplified blog description of a holding that runs on a bunch of pages about some very complex phone company billing practices. So if you are interested in this for real you should consult with a professional about it.

If you make a refund claim as Fortis did don't expect the IRS to pay it right away, or soon -- it will be appealing this case just like it's appealing the decisions against it on outbound long-distance calls.

But by making "protective" refund claims you can preserve your right to claim tax refunds three years back, keeping the statute of limitations from running out on them. Then you can wait and let the big companies fight it out with the IRS in court -- and if they win, the day may come when you get your piece of that $6 billion.

___________

UPDATE: This issue is now beginning to get some attention from Congress...

March 21, 2005

The Honorable John W. Snow

Secretary of the Treasury

15th and Pennsylvania Ave., NW

Washington, D.C. 20220

Dear John:

As you are probably aware, the IRS has been settling or losing a series of cases brought by telephone customers seeking refunds of their Federal Excise Tax (FET) payments. Many of these customers have successfully argued that the anachronism known as the FET no longer applies to the telecommunications services they actually use today, despite the best efforts of the IRS bureaucracy to keep this beast alive.

This discriminatory tax is an anachronism for two reasons: First, it was originally enacted in 1898 to fund the Spanish-American War and was considered at the time to be a type of luxury tax. With more telephones than people in the United States today, the FET now represents the polar opposite of a luxury tax, and merely serves to raise prices on consumers.

Second, the definitions of taxable services in the statute, last updated in 1965, describe services that are rapidly vanishing from the American marketplace. Fewer and fewer customers are paying for long distance calling based on time and distance. Similarly, stand-alone local telephone services are rapidly losing appeal to customers buying bundles of communications services for a flat rate.

I encourage you to order the IRS staff to provide relief for the millions of consumers who should not be paying a tax on services they aren't buying. Moreover, if you were to come to the conclusion that this 1898 tax does not apply to any 2005 services, you could expect an enthusiastic reaction from numerous lawmakers, not to mention millions of consumers.

Christopher Cox

Chairman

Homeland Security Committee

Friday, March 25, 2005

He has a special reason. You can make him happy indeed. And maybe also have the fun of seeing how fast you can drive a big financial firm to correct a pricing mistake, by redirecting cash from its vaults to the deserving of the blogosphere.

Krugman & DeLong versus Krugman & DeLong on productivity and Social Security's future.

I. Lower productivity growth in the future will contribute to a decline in stock returns compared to the past (so private equity investments in Social Security are a bad idea).

Dean Baker, J. Bradford DeLong, and Paul Krugman (forthcoming 2005), "Asset Returns and Economic Growth," Brookings Papers on Economic Activity 2005:1.II. Higher productivity growth in the future hasn't yet been recognized in the Social Security actuaries' projections, so their estimate of Social Security's future deficits is exaggerated (and exaggerates the need to do anything about them now).

Abstract:

We in America are probably facing a demographic transition—a slowdown in the rate of natural population increase — and possibly facing a slowdown in productivity growth as well. [emphasis added]

If these two factors do in fact push down the rate of economic growth in the future, is it still prudent to assume that the past performance of assets is an indication of future results? We argue "no"... [SDJ-1]

So now we can all see just how badly the Social Security actuaries have messed things up. They've not taken into account either how the coming slowdown in productivity growth will reduce stock returns to below their 6.5% estimate, or how future sustained high productivity growth will reduce the funding gap to below their estimate. Fire those guys!One would think that the fact that productivity growth has averaged 3.0% per year in the four years since 2000 would be worth a mention. One would expect some reason for completely throwing away the last four years' worth of data on productivity.

But it isn't there ... we've had good productivity news in the past four years: the Trustees' Report should recognize it.

UPDATE: Paul Krugman comments:

[...] high productivity growth since 2000... seems like big news... [but] isn't factored in at all. The reason is that the trustees use an average over the past four "full business cycles," measured from peak to peak (Section IV.B.7).... [T]hey won't take the good productivity news since 2000 into account [at all in forecasting the future] until the economy [begins] another recession. There's something very wrong with that... [SDJ-2]

Question!

By the way, here's a query for the Baker/Krugman/DeLong axis of reduced asset return and its allies.

Will the reduction in return on assets affect bonds as well as stocks? And if so, what does this mean for the discounted to current value size of Social Security's future funding gap -- which is discounted by the bond rate?

That is, today the Social Security actuaries use a 3% real bond rate to discount the future funding gap to a current value amount of $4 trillion through 2079.

But the actual 1946-to-2004 average annualized real return on Treasury bonds was only 1.6% (with the very high returns of the historic 1981-2004 bull bond market, which is extremely unlikely to be repeated from here, needed to achieve even that) and many authorities say 3% is much too high, as noted here previously.

And now we also have the "lower future return to assets" argument too! So let's say the critics of a 3% projected bond rate are indeed right.

Let's say the future return on bonds that we should realistically expect over the coming 75 years is actually 1.5% or less -- less than the historic rate, as per the axis' argument-- instead of the actuaries' 3%. What happens to the current value of the funding gap?

Well, a dollar of deficit to be incurred 75 years from now when discounted at 1.5% is about three times larger in current value than one discounted at 3%.

Are we looking at a 75-year funding gap that when properly discounted is closer to $8 trillion than $4 trillion?

But wait ... that original $4 trillion is just the funding deficit facing the Social Security Administration, which naively assumes some sort of "free money" will become available to make up for the lack of any savings in the trust fund, and so doesn't count the cost of trust fund operations post-

Of course the true funding gap for Social Security is that facing the government. That gap -- including the cost of redeeming the bonds in the trust fund -- was over $5.2 trillion last year according to the Treasury [.pdf], and is now about $5.5 trillion, again discounted at a 3% real bond rate.

But if the "reduced return to assets" argument is right and includes bonds, so future bond returns will be under 1.5%, are we looking at 75-year funding gap that when properly discounted is really closer to $11 trillion? And an open-ended gap that is a lot larger than that?

Hello? Fellows??

Thursday, March 24, 2005

The White House is considering lowering the interest rate used for the benefit offset in its Social Security proposal, the Wall Street Journal reports today.

And well the White House should!

Under its original proposal private accounts would be beneficial only to the extent that investments in them earn more than 3% a year above inflation -- which is assumed to be the rate that will be paid on Treasury bonds. The idea is to prevent the government from losing money on bonds issued to finance current Social Security expenditures when the taxes that otherwise would do so are diverted to private accounts.

But both history and logic say this 3% rate is too high. As noted in a previous post, from 1946 until 2004 the average annualized real return on long-term Treasuries was barely over half that -- less than 1.6%, according to Ibbotson, Jeremy Siegel of Wharton says, "three percent is way too high", and Bill Gross of Pimco (often called the 'Warren Buffett of bonds') says that to get a 3% real return on bonds "you would have to invest in Mexico or Russia".

The 1.4 percentage point difference is no small deal. If you invest at an even rate over 40 years an interest rate that's that much higher increases your final balance by about one-third.

Thus, to overcharge private account holders by that much would be really costly -- turning private accounts into potential money losers, making them so unattractive as to possibly sink the whole scheme.

As the Journal story notes:

... many outside experts say 3% is too high, and will limit the accounts' appeal. They noted Treasury bonds are now expected to return only about 2%, and stocks a few percentage points more. Thus, a private account of half stocks and half bonds would run a significant risk of returning less than 3%, leaving the account-holder worse off than someone who stuck with the traditional benefit.Indeed. And the other side is already coming out with calculators and papers highlighting exactly this fact.

Even the White House's own Social Security Reform Commission, upon whose analysis the White House's current proposal is based, used a 2% offset in its analysis.

So why did the White House people pick 3% as their offset number?

... the administration picked 3% because Social Security actuaries estimate that figure to be the government's long-term cost of borrowing.But as we noted in the earlier post, the actuaries say they've done this on the basis of bond returns since 1980 -- which was nearly the exact start date of an historic bull market in bonds, as rates fell from the historic high double digits of the oil crisis years to 2004 historic lows, and bond prices rose accordingly.

It is mathematically impossible for that to happen again from today's low rates. And note -- that period of historic high returns was needed to get the average return from 1946 to 2004 up to 1.6%. So logically, other things being equal, future returns from bonds should be even less than that.

It is hard to overstate the political bungle here. If the White House keeps the offset where it is, the private accounts proposal risks self-destructing. But if it lowers the offset rate towards a more realistic 1.6% or 2%, you know for sure that Paul Krugman and his kin will lead a charge proclaiming that by disregarding the actuaries' 3% projection for future bond returns the White House is willingly leading the government down the road to national bankruptcy -- notwithstanding how they themselves debunk the actuaries' projection of 6.5% future stock returns at every opportunity.

Nevertheless, the White House has to bite the bullet here, and it is good to see it finally getting around to doing so. And what new offset rate is the White House considering?

A former administration official says a change to the offset rate to between 2% and 3% has been discussed, with special attention on 2.7%.From 3% down all the way to 2.7%? Aiieeee!

Karl Rove, call your office and start getting evil!

You wonder why urban public schools don't work?

A Bronx teacher who repeatedly flunked his state certification exam paid a formerly homeless man with a developmental disorder $2 to take the test for him, authorities said yesterday.The stand-in was 20 years older than the teacher, overweight rather than thin, and white rather than black. The test administrators didn't notice the difference.

The illegal stand-in, who looks nothing like teacher Wayne Brightly, not only passed the high-stakes test, he scored so much better than the teacher had previously that the state knew something was wrong, officials said.

"I was pressured into it. He threatened me," the bogus test-taker Rubin Leitner told the Daily News yesterday after Special Schools Investigator Richard Condon revealed the scam.

"I gave him my all," said Leitner, 58, who suffers from Asperger's syndrome, a disorder similar to autism. "He gave me what he thought I was worth."

Brightly, 38, a teacher at one of the city's worst schools, Middle School 142, allegedly concocted the plot to swap identities with Leitner last summer. If he failed the state exam again, Brightly risked losing his $59,000-a-year job... [NY Daily News]

Of course the big problem with the school system is it needs more money, right?

Tuesday, March 22, 2005

Leonard Nimoy is publishing another book of kinky nude photographs — and this time he's focusing on an obese burlesque troupe, "The Fat Bottom Revue." The Star Trek star says he showed his massive models classic nude works by Herb Ritts and Helmut Newton, then asked them to comport themselves in similar poses. "They are interested in fat liberation," the former Mr. Spock says... [NY Post]

Monday, March 21, 2005

Every day in every way things are getting better and better in the developing world, and there are a lot of ways that matter besides income, say the folks at the World Bank.

A famous former gunfighter takes on a future famous Supreme Court justice. Who wins? When it was Bat Masterson versus Benjamin Cardozo [.pdf] , the western legend turned New York sportswriter did.

Romance management tip #1: If you get in a legal dispute with your mistress do not continue the affair...

A French woman fatally shot investment banking mogul Edouard Stern "in the course of sexual relations," Swiss authorities charged yesterday ... Stern and the suspect had a relationship for many years, authorities said — and a Geneva newspaper said the woman was involved in a lawsuit with him. [NYP]... and if you do continue the affair, keep the bondage stuff in the closet...

[the] Swiss banker [was] found trussed up in a latex body-suit and suspended from a meat hook. Edouard Stern died with two bullets to the head and two in his genitals at his £3 million Geneva home ... [Sun]

Romance management tip #2: How best to put this? Some men should be happy with what they've got ... or, there's no need to share everything with the wife ... or, if you ever find yourself with two, resist the urge to show them both off and go "Hey, Honey, choose!" ... or, aw, draw your own lesson.

Friday, March 18, 2005

Which is 40 less than Molski filed by himself...Disabled-Access Lawsuits Plague Businesses

... Around the country, business owners, judges and politicians are complaining that employers are being hit with a spray of "drive-by" ADA lawsuits that they say are little more than shakedown attempts by lawyers hoping for a quick cash settlement.

Those who are covered under the ADA say the lawsuits are necessary to get business owners to make their buildings more accessible. Among other things, the 1990 federal law requires ramps, parking stalls and signs, and dictates the height of countertops, the placement of toilet grab bars and the width of doors.

But some judges have suggested that a large number of ADA lawsuits are frivolous actions filed by a small number of disabled people and their lawyers...

U.S. District Judge Gregory Presnell of Orlando, Fla., noted in a ruling last year that Jorge Luis Rodriguez, a paraplegic, had filed some 200 ADA lawsuits in just a few years, most of them using the same attorney.

"The current ADA lawsuit binge is, therefore, essentially driven by economics — that is the economics of attorney's fees," Presnell wrote. He said Rodriguez's testimony left the impression that he is a "professional pawn in a scheme to bilk attorney's fees" from those being sued.

In December, a federal judge in Los Angeles said a man who filed hundreds of lawsuits accusing businesses of violating the ADA was running an extortion scam. The judge barred the plaintiff, Jarek Molski, from bringing any more lawsuits without court permission.

Molski, who has used a wheelchair since he was paralyzed in a motorcycle accident a decade ago, has filed 400 suits since 1998 against restaurants, wineries, bowling alleys, banks and other places. In most cases, the judge said, Molski demands $4,000 a day until the target of his suit is brought into compliance with ADA, then agrees to a cash settlement...

Eric Holland of the Justice Department's Disability Rights Division said the government takes every ADA complaint seriously and resolved 360 of them last year... [AP]

Are we lucky the entire Solar System didn't just crash into Upton, New York?

Scientists there may have accidentally created a black hole.

"Ooops, of all the things...!"

Wednesday, March 16, 2005

How to end global poverty

Hernando de Soto, working from the ground up, versus Jeffrey Sachs with a "utopian" plan. [Via Arnold Kling and Roland Patrick]

OK, the presentation isn't exactly fair as De Soto is speaking for himself while Sachs is being critically reviewed. But Sachs' book (introduction by Bono!) isn't webbed, so there we are.

The economics of fake IDs

"If you want to see a security system really tested, put it between teenagers and drinking or sex", says Adam Shostack.

Why Germans love cabbage

It seems it's all in that gene hTAS2R38, which affects taste. Of course -- what else but a genetic mutation could cause an entire population to love cabbage?

See, people really are different. (Now we can all wonder if this gene has anything to do with a population feeling an urge to group up in formation and march into France or Poland.)

If the circuits in your brain were crossed...

... what would Beethoven's Ninth taste like?

There are captive audiences...

... and then there are captive comedians.

Amusing videos

TV Commercials and viral marketing efforts from around the world. Go entertain yourself with 'Karaoke for the Deaf' while I get back to work.

Monday, March 14, 2005

The Administration really hasn't been very effective at getting its message and the best arguments for reform out to the public, but it's trying: Strengthening Social Security.Gov

Live and learn. They may get there yet.

Saturday, March 12, 2005

Workers at the NY Times are getting a little lesson today in what we all are certain to learn much more about later -- the virtues of pay-as-you-go benefit financing:

Worst of TimesPay that extra tax and be happy!

The New York Times faces a looming $4 million shortfall in the health and benefits plan that is administered by the Newspaper Guild and about 1,500 unionized members may have to give up a 3 percent pay hike. An e-mail from the Guild jolted unionized members, who were told that their benefits fund faces a "major financial shortfall that is projected to hit about $4 million this year."

The Guild said members face two options: skip the 3 percent pay hike that was to go into effect at the end of the month and divert the money to the benefits fund or take the pay hike and face "a drastic cut in benefit levels including the elimination of all dental, vision and life insurance."

Some insiders are incensed.

"Everyone was banking on that 3 percent raise at the end of the month — now they're telling us we have to forgo the raise or face a sharp cutback in our benefits package," grumbled one insider...

"They're giving us a choice," said [another]. "Either we can slide down a razor blade until we're split in half or else we can jump into a pit of molten lava." ...

The union is recommending that members skip the pay hike.

William O'Mara, secretary/treasurer of the Newspaper Guild, said the Times benefits fund is not broke, but it is paying out more in benefits each month than it is taking in.Of course the "benefits fund is not broke" just because it can't pay what it promised and owes. Certainly not.

Right now, he said there is an eight-month reserve, estimated to be between $8 million to $10 million in the fund.And Paul Krugman would no doubt be happy to explain to the Times' minions, as he has to his readers, that their current benefit system is entirely sustainable as it is, provided it is changed sufficiently (through "pay diversification" to collect more from them and provide less to them.)

The pay diversification should send in an additional $3 million, he said. "When you combine the pay diversification with some other cost savings measures, it should be enough so that we're not in a situation where more is going out than coming in each month," he said.

There was also anger directed at the union at the Edison Café.Oh, yes! And that's just a 3% tax hike they're facing.

"We all talked about the amazing efficiency of our union to make money go away," said one insider.

Added another worker, "How did they get into this jam? You don't get into a $4 million shortfall in a week."... [NY Post]

Imagine what these same people are going to be saying 20 years from now when a 35% income tax hike (perhaps Democrats then will call it "income diversification") is coming at them just to cover the cost of the trust funds they supposedly already financed with their FICA taxes ... plus another 30%+ and-rising-forever-more tax increase to cover the Medicare benefits promised to them that nobody ever told them they were going to have to pay for.

Think of the happiness that will be expressed in the Edison Cafés across America then! Joy!!

Addendum: One more little point in the story, as noted by Don Luskin in his pointer here ...

It didn't help among the rank and file that news of the benefits crisis broke the same day Times Publisher and Chairman of the board Arthur Sulzberger, Jr. had received a pay hike to $2.82 million in 2004 from $2.7 million 2003.So any day now we'll be reading new Krugman/Herbert columns damning millionaire CEOs who get their jobs by nepotism and raise their own multi-million dollar salaries while rank and file employees take cuts in pay and benefits.

Right? ;-)

(I've said it before and I'll say it again: the New York Times wouldn't be half as much fun without the New York Post reporting on it.)

Thursday, March 10, 2005

The real world continues to interfere with blogging, forcing the self-employed to earn money to pay the ISP bill. Life is cruel. So it'll continue to be short stuff requiring no thought on my part around here for a few more days.

A few items from various corners of the globe...

From Scotland: What's a better news story than "man bites dog"? How about blind man bites guide dog.

North Korea: If it really wants to promote tourism by having its friends post promotional travel videos for it on the web, they'll need to learn a bit more about the interplay between bandwidth, downloads, and copyright.

Iraq: The mistakes America made there, by an Iraqi blogger.

Vietnam: Is the democracy movement traveling this far from the mid-east?

The Congo: Who says killing the right people can't be good for the soul?

"We have been so tired of looking the other way for all this time," said a Pakistani corporal involved in the operation. "To actually kill some of the murderers and rapists that have turned this place into a living hell feels very good"... [via Tim Worstall]

Japan: Former world chess champion Bobby Fischer, the man who during the Cold War by himself bested the Soviet Empire at its own game, lands in solitary confinement after a dispute over a boiled egg.

In an earlier stage of my life I was a tournament chess player and somewhat involved in the world of chess politics. I didn't know Fischer but did know people who knew him about as well as anyone could. In his early days Fischer was always an ... unusual ... personality, but functional as a human being and capable of some really great accomplishments.

Since then he's become the perfect warning example of what can happen to someone with a borderline personality who doesn't take his meds. The lesson to take from this: if you have a borderline personality, take your meds.

By the way, Fischer has a web site.

England: Mothers Day may still be a couple months off, but that's not so far away if you want to order the perfect gift for her and have it arrive on time.

England: Mothers Day may still be a couple months off, but that's not so far away if you want to order the perfect gift for her and have it arrive on time.For instance, if mom is a tea drinker, how about a $14,000 teabag with 280 inset diamonds?

Limited supply, get your order in early!

Wednesday, March 09, 2005

Senators McCain and Feingold say, "We never intended that, no way!"

But a press release by a couple of politicians doesn't trump the courts and the Federal Election Commission. And they are saying "Yes way", unless something serious changes, as FEC Commissioner Bradley Smith explains.

"Senators McCain and Feingold have argued that we have to regulate the Internet, that we have to regulate e-mail. They sued us in court over this and they won."Good work, guys!

Color photographs of World War I

I'd never seen these before just recently, and they sure give a different impression than the old black & white. I've been tracking them as they appear and disappear from one web site and another.

Here are some all on one page. Here are links to more on what seems a more authorized site, but as I don't read French I can't navigate through it from the home page. Better luck to you.

More via Der Stern, though I don't read German either.

Update: Ah, here we are. Keep Googling and you shall find. Via the Conscientious photography weblog:

... link to the French archives that contain the photos ... If you don't speak French: you access the photos at the top right-hand side. The photos are sorted by location. For each location, there is a list of the photos; on those pages without thumbnails you view the photos by clicking on the icon that looks like an eye.That's the site.

Tuesday, March 08, 2005

Why has this company's stock more than doubled as magazine sales fell 21%, ad revenues fell 56% and TV revenue fell 82% from the year before [TheS] ... it just reported a $7.3 million quarterly loss and says it expects a bigger loss next quarter ... and "every analyst who currently covers the stock rates it either an 'underperform' or an outright 'sell'"? [NY Post]

Well, many reports from the Street say an "historic" short squeeze is going on as investors have lined up in great numbers to short the stock in light of the business's performance, but its biggest holder -- Martha herself -- has been unable to sell to take profits and provide a supply of shares. So the shorts are having trouble covering. That's what one calls a risky rally to buy into.

Especially as other insiders have sold 5 million shares during this short stretch while the price has risen.

Oh, did anyone mention there are prospective management problems when Martha returns to the office?

.... there are questions about how Stewart will work with the company's strong new chief executive, Susan M. Lyne, a widely respected former ABC entertainment head who is moving to put her own mark on the company...Yes, the WaPo did right there.

Paul A. Argenti, a professor of corporate communication at Dartmouth's Tuck School of Business who worked with Stewart as a consultant in the early 1990s, was blunt with his concerns about how Stewart and Lyne would work together.

"I cannot imagine those two people are going to get along," he said. "It happens in companies I work with all the time, where the person in charge won't allow a really good executive to shine because they fear that the spotlight will be taken off them. And Martha is more like that than anyone I've ever met."

I had a fair amount of sympathy for Martha during her prosecution -- but as to her stock, if anything like the short squeeze described above really is going on, it's going to be a heck of a lot more fun to watch than to own in coming months.

Kicking Dan Rather when he's down.

Donald Trump gets his boot in (you knew he would). Walter Cronkite gives a toe. Mike Wallace and Don Hewitt...

Monday, March 07, 2005

Britain has a new reality television show, Demolition, that promises to destroy on camera a building that its viewers vote the ugliest. Its producers never expected an entire town to volunteer itself...

Too ugly to live: the award-winning town begging to be put out of its misery on TVWhat is Cumbernauld's problem? As you can hear in this radio interview...

... civic pride appears to be truly dead and buried in Cumbernauld, a 1950s creation that is home to 52,000 souls 15 miles northeast of Glasgow. Its residents were among the first to contact the programme, begging for dynamite and bulldozer to deliver them oblivion...

In 2001 Cumbernauld won the Carbuncle Award for the most dismal place in Scotland, described by the judges as “a rabbit warren on stilts” and “soulless and inaccessible, something like Eastern Europe before the Wall came down”.

In 2003 The Idler’s Book of Crap Towns, naming it the second-worst place to live in the UK — beaten only by Hull — said of it: “Town planning students visit Cumbernauld as an example of what not to do.”

To cap it all, a survey last year named Cumbernauld as the town with the most shopping trolleys dumped in the streets.

Kenneth McLellan, 31, a bus driver who has always lived in Cumbernauld, said: “It’s a lovely place, no one around here would nominate it for demolition — apart from certain parts of the town centre which I have to admit is a monstrosity. That should be blown up..." [ToL]

It was designed by the government to be a model town for the 21st century ... they didn't want walkways beside roads so they built an entire separate network of walkways with their own overpasses and underpasses, but that proved very expensive, so the government economized on the housing, which is cold and wet ... the housing was built of concrete, which is hard to do anything with when fashions change, and built on stilts over what was to be a commercial district that largely never appeared ... the Kabul of Scotland...

Howard Stringer named Chairman of Sony.

Sony Corp. on Monday appointed as chairman Howard Stringer, an executive who oversees its entertainment business —- the first time a foreigner heads a major Japanese electronics maker and a ground-breaking move that symbolizes Sony's determination to make change... [AP]As far as I know, this is the first time an American has taken over a top Japanese firm.

I mention this in part because I'm old enough to remember when everyone was saying Japanese companies like Sony were soon going to be aking over America -- and also because I did jury duty with Howard a few years back.

He seemed a nice, unpretentious guy -- not a bit of "I'm one of the most important executives in America" about him. I don't think most of the others in the jury pool ever had any idea who he was.

Here's a recent interview with him about what he's been doing at Sony. And it turns out that he's a fan of blogging on top of it all.

Five inch knife found in man's head.

Hospital staff treating a retired school teacher for a headache found a five inch knife blade wedged in his head.Dr. Rogowski might enjoy comparing X-rays with Dr. Markey.The discovery was made after doctors X-rayed Leonard Woronowicz to see if he had cracked his skull in a fall while climbing over a stool in his kitchen four days earlier.

Instead they found a blade that had penetrated the 61-year-old's head just below his right ear. It had snapped off at the handle without touching any major blood vessels or nerves - or causing any lasting damage.

He said: "I thought they might give me an aspirin, instead they pulled a five inch knife blade out of my head."

Woronowicz, from the Polish town of Wojnowice, said he had tripped over the stool while doing work in his kitchen...

"I didn't even guess what had happened when the next day I wanted to cut a piece of bread but couldn't find the kitchen knife. Despite carefully searching the room I could only find the handle. But I forgot about it as my headaches got worse over the next few days, and I decided to go to a hospital."...

Dr Marek Rogowski from the Bialystok hospital said a surgeon could not have made a better job of placing the knife so that it missed all vital bones, nerves and blood vessels... [Ananova]

Headache, toothache ... take care, you never know.

Medical science marches on.

Bullets may cause cancer.

Tungsten alloys, being used in battlefield munitions ... may cause cancer in soldiers wounded by them, U.S. Army researchers said... "(The findings raise) extremely serious concerns over the potential health effects of tungsten-alloy-based munitions..." [UPI]Who says our civilization isn't advanced? What other one ever worried so about the potential health effects of its battlefield weapons?

______

"Individuals who suffer from both major depression and diabetes function worse than those with either illness alone."

...This is significant, especially given that about 10% of people with diabetes suffer from major depression. [AHRQ.gov]Thank you Dr. Egede and whoever approved that grant.

You know, whenever after you finish reading the results of a researcher's research he feels the need to tell you "this is significant", you can bet your tax money it's not.

Sunday, March 06, 2005

Creating your new $7 trillion entitlement in such a dumbass way that it will cost you maybe a couple million votes and the next election.

Deroy Murdock tells the tale...

... Amazingly enough, reckless Republicans unwittingly timed this program to jeopardize their November 2006 electoral prospects.

Rather than simply help poor, uninsured seniors, Republicans designed a mind-boggling contraption that reimburses 75 percent of the first $2,000 in pharmaceutical outlays after a $250 deductible. Then payments stop until spending hits $5,100, whereupon 95 percent reimbursements commence. This gap is nicknamed "the doughnut hole."

Some seniors, even those with private prescription coverage, will receive these benefits next January, then disappear into the doughnut hole before the midterm congressional elections. Their subsidies would not resume until 2007.

In a study released Thursday morning titled "Weird Science: Projecting the Effects of Medicare’s Odd Drug Benefit Design," Heritage Foundation Visiting Research Fellow Edmund F. Haislmaier estimates the dates at which seniors with various levels of drug expenses enter the doughnut hole and exit it, if at all.

Based on his calculations, at least 4,113,414 seniors will tumble down the doughnut hole and remain there on Election Day 2006 ...

How many seniors will vote Republican after enjoying GOP drug discounts that suddenly vanish until suddenly vanish at least until election eve?... [NR]

Even Sex Pistols go conservative when they become middle aged with kids.

Former Sex Pistols star Glen Matlock has called on British TV and radio bosses to stop broadcasting foul language -- even though his band launched to notoriety in 1976 by swearing on an early evening live UK television show ... spark[ing] nationwide outrage when they unleashed a stream of obscenities in response to presenter Bill Grundy's daring challenge to "say something outrageous".Yes, even Sex Pistols move to the right when they become middle-aged with kids. Is it any wonder Democrats are having problems winning elections?

However, Matlock -- now a father of two -- is disgusted by contemporary television's use of offensive words, and is urging TV and radio watchdogs to raise their standards and impose some much-needed guidelines.

He says, "It's pathetic when people just swear for the sake of it. Something ought to be done about it." [CM]

Friday, March 04, 2005

Which belly would you pay the most to advertise on?

Elisa Harp of Rosewell, Ga., auctioned off advertising space on her pregnant tummy (left) via eBay and received a cool $8,800 plus a trip to the Daytona 500 (as noted here earlier).

Elisa Harp of Rosewell, Ga., auctioned off advertising space on her pregnant tummy (left) via eBay and received a cool $8,800 plus a trip to the Daytona 500 (as noted here earlier).Amber Rainey of Myrtle Beach, S.C., also held an eBay auction of belly billboard space (right) and pulled in $4,050. Well, her pregnant belly appears somewhat less ample, so that seems fair. But Amber's gone Elisa one further, following up with a separate auction of the sponsorship of the coming birth...

SPONSORSHIP INCLUDES THE FOLLOWING: filming, web posting, broadcasting, and photography rights. Family that will be present during birth will wear apparel with company logos. Car transporting me to and from hospital will have your company logo displayed with magnetic signage. Company signs will be posted where appropriate. Media will be welcomed and invited....The winning bidder in all cases: Goldenpalace.com, which paid $5,600 to Amber for the birth rights, giving her $9,650 altogether.

Your company logo on t-shirts, hats and clothes worn by family, the baby, and me! Company signs will be hung throughout patient room and hospital (wherever allowed). Mother and baby will wear company apparel while conducting interviews and receiving media attention! [eBay]

Amber and Elisa both follow one Nick Long who held an eBay auction of advertising space on his back, selling it for 3,100 Birtish pounds, about $6,000 ... and model Shaune Bagwell, who auctioned off via eBay advertising space on her cleavage for $15,099 -- both to Goldenpalace.com!

And all the above declare that their inspiration was one Brent Moffett, who held an eBay auction of advertising space via permanent tattoo on his forehead and collected $30,000 ... from Goldenpalace.com!

And all the above declare that their inspiration was one Brent Moffett, who held an eBay auction of advertising space via permanent tattoo on his forehead and collected $30,000 ... from Goldenpalace.com!What is all this telling us?

Our occasional news of the Times.

How did I miss this? ...

Maureen Dowd and Paul Krugman are excluded from a new weapons policy at The New York Times according to a report in The Wall Street Journal:According to the WSJ story, the problem was ...After an internal debate, the New York Times has issued a policy banning its correspondents, photographers and free-lancers from carrying guns while on assignment. The issue arose late last year when Baghdad-based Times reporter Dexter Filkins was found to be carrying a gun...Maybe that explains why Dowd, Krugman and other Times' columnists are not required to follow The Times Style Guide or issue corrections when they get it wrong. Maybe someone needs to get Gail Collins some Kevlar... [via The National Debate]

"the Times worried that Mr. Filkins's actions violated the journalistic tenet of acting like a neutral observer."Well, yes, when you're working in a combat zone where terrorists are running around kidnapping and beheading Americans, we can see why the New York editors wouldn't want you to act as if you were anything but neutral about it all.

But the report seems right -- op-ed writers in Manhattan appear to be excluded from the policy. No need for them to appear neutral, of course.

And speaking of taking shots at Timesers, John Tierney's first column won't appear for another month yet and already he's being criticized at the Columbia Journalism Review as being too biased for the job! [via Luskin]

Although the particular objection raised against Tierney here -- that he's not sufficiently respectful of opposing points of view and doesn't give them a fair presentation before answering them, while the job of NY Times op-ed writer "requires someone who has demonstrated a willingness to deal genuinely with opponents' arguments" -- seems rather odd, doesn't it?

I mean, among the current op-eders who have "demonstrated a willingness to deal genuinely with opponents' arguments" we have Mo ... Bob Herbert (who writes columns lambasting government subsidies for private businesses while sitting in his brand new government subsidized office) and, of course, the single most biased columnist in America.

I did a quick Google search and didn't find any similar criticism by CJR of the incumbents. Peculiar, that, eh?

Maybe John ought to indulge his libertarian streak and report to his new office with a gun. For self-protection, of course. That'd be fun, eh?

Thursday, March 03, 2005

Interest rates are very important to the whole debate about Social Security.

Two new, interesting things to note:

#1: Alan Greenspan testified before Congress again yesterday ...

Greenspan again endorsed the key part of President Bush's Social Security overhaul to set up private accounts .... The administration estimates those accounts will require about $745 billion in new borrowing over the next decade .... He said it is entirely possible that the impact on interest rates will be "zero,"... [AP]How can $745 billion in borrowing over 10 years have zero effect on interest rates?

First, $75 billion a year isn't a whole lot by historical standards. Added to current projections, in GDP terms it still leaves debt a good deal lower than in the Reagan and following years.

Second, and maybe more to the point, it is not new debt. The government has already promised to pay all these unfunded Social Security benefits and is on the hook for them -- so funding them as it has to do sooner or later doesn't add any new debt for it any more than your deciding to pre-pay an obligation you owe adds to your debt, or any more GM's borrowing last year at low rates to pay off its unfunded pension obligations added to its total debt.

As Greenspan explained on an earlier occasion,

A critical consideration for the privatization of social security is how financial markets are factoring in the implicit unfunded liability of the current system in setting long-term interest rates.In other words, since the debt already exists why should simply admitting it affect interest rates?

If markets perceive that this liability has the same status as explicit federal debt, then one must presume that interest rates have already fully adjusted to the implicit contingent liability. (emphasis added)