Saturday, December 31, 2005

Watch 2006 arrive via live webcams around the U.S and the world.

Though things are pretty exciting right here at my table!

Happy New Year to you!

Take 11 minutes to enjoy New Year's Eve as the Germans (and Swiss, Australians, South Africans and Latvians) do.

Every New Year's Eve, half of all Germans plunk down in front of their televisions to watch a 1963 English comedy sketch called Dinner for One. ... The show's popularity has spread to Scandinavia, where it is typically watched on December 23, as well as Switzerland, Austria, South Africa, Australia, and Latvia....

Even though Dinner for One is, according to the Guinness Book of World Records, the most frequently repeated TV program ever, it has never been aired in the United Kingdom or the United States, and most of the English-speaking world is ignorant of its existence...

(You can watch all of Dinner for One here ....)

-- Slate

What this says about the world, you decide.

Happy New Year.Thursday, December 29, 2005

Ha! I won my one pre-season bet, the "under" on the Falcons winning 10 games this year. That was based on them not being as good as their record last year, and on Michael Vick remaining popularly described as a "great athlete for a QB", which is polite footballese for "can't pass".

Two weeks ago against the Bears -- a critical game to reach 10 wins -- as matters held in the balance midway in the third quarter, Vick was all of 4 of 17 for 16 yards, less than one yard per attempt, when he threw the game-sealing interception.

I should've mortgaged the house.

Meanwhile, my own Jetsies, who at one point this season were down to playing their fifth-string QB (now back up to fourth) are watched over by God. In 1970 they played the first Monday Night Football game losing 31-21, and now in 2005 they've played the last one, losing 31-21. Is this not proof of Intelligent Design? Of perhaps a malicious sort? God does not like them.

And does anybody have worse sports coverage than the New York Times for the amount of money they spend on it? Worse than bad, it's pretentious, pretentious sports coverage. Yuck.

Latest example: the the Times Sunday Magazine cover story, no less, by Michael Lewis, on coach Mike Leach of Texas Tech -- apparently an Einsteinian genius, as he is pictured on the cover thinking about "expanding SPACE and stretching TIME".

Theme of the story: This innovative genius, in spite of his huge success, is doomed never to get a better job by a conspiracy of the mediocre minds who are threatened by him...

"The chances of that happening can't be great ... Leach remains on the outside. Like all innovators in sports, he finds himself in an uncertain social position.See, organizations that make huge $$$$ by winning football games would never hire a coach who wins more than anybody else, beating everybody in sight, if he does so while committing the social "faux pas" of innovating. That kind of bad taste spoils the money. ;-)

"He has committed a faux pas: he has suggested by his methods that there is more going on out there on the (unlevel) field of play than his competitors realize, which reflects badly on them."

Hey, is it even possible to commit a "faux pas" in football? In Texas football? Has anybody but the Times ever written of such a thing?

And what are this coach's Einstein-like innovations, exactly? Well...

He stretches time by passing frequently to stop the clock. And he stretches space by throwing to a lot of different points all over the field.

He uses five receivers on a regular basis -- as nobody has ever seen, well, since they ran the run-and-shoot all the way across state at Houston.

He runs plays to see how the defense responds, then adjusts ... He lets his quarterback call audibles ... He emphasizes physical conditioning, and tells his players to hit, quote: "Be the hammer, not the nail".

Yes, he's a master of motivational slogans too!

"Do your job. DO - YOUR - JOB!"Plus, he's astute at reading the body language of the opposition -- he knows when they're tired and attacks them!

"You go out and knock the living dog snot out of people."

"You get after him - get after him like he stole something from you."

"The minute you see the defensive line bent over and their hands on their hips, that's when you know you have them."(Now there's a unique coaching insight worth a cover story of the New York Times Magazine! )

Want more? He has an uncannily innovative play-calling technique:

When a play doesn't work, he puts an X next to it. When a play works well, he draws a circle beside it - "to remind myself to run it again."I mean, c'mon ... I read the whole story and tried to find one new coaching innovation I didn't know about when I was a 12-year-old fan rooting for Joe Namath. Couldn't find one (except for how the coach deems it outright virtuous, when winning, to call time out with 15 seconds left to try to run up the score -- a technique, it is reported, the Luddite coaches on the losing sidelines sadly aren't innovative enough to appreciate).

And as for Coach Leach being socially ostracized by the football community out of any chances of advancement, the story starts by setting this background...

In this part of the country, the University of Texas and Oklahoma University are the old-money football schools ... Leach moved to Oklahoma [as offensive coordinator] for a single season, 1999. That year Oklahoma went from 101st to 8th in the country in offensive scoring ... The next year, running Leach's offense, Oklahoma won the national championship - but by then Texas Tech had picked up the pattern and hired Leach to run its team.Leach is so ostracized that at the age of 38 he was running the offense at one of the premier football programs in the country -- and after just one year of that, in recognition of his success, was recruited away to be head coach, still only age 39, of a nationally ranked program.

May we all be saved from such professional ostracism!

Hey, to be fair to Coach Leach he's been really successful and maybe he is the best football coach in the country -- but hardly due to anything reported here. And ostracized? Looks not.

(Much as Billy Beane, the subject of Lewis's best-selling book, Moneyball, is one of the most successful general managers in baseball -- though according to many astute baseball observers, not due to anything reported in that book. And Lewis's similar claim that Beane's new ideas have been blocked by the self-preserving old guard of baseball hardly seems backed by the way Beane's top assistants have been rapidly hired away from him by teams in Toronto, Boston, Los Angeles ... or the way the Red Sox made a big-money play to hire Beane himself.)

So ... was the Times printing a parody issue? (Could one tell?) Nah, no sense of humor.

Was author Lewis puckishly pulling a fast one on them? (Like Alan Sokal getting Social Text to publish that article saying gravity is a social construct?) Nah, he wants to keep getting their money.

I conclude Lewis was mailing it in, mining the Billy Beane-Moneyball meme well into diminishing returns for the easy bucks. In doing so, taking advantage of Times editors who know even less about sports than they do about economics and tax policy. And who'd of thought that was possible?

Why I don't get my economics or sports from the Times. ;-)

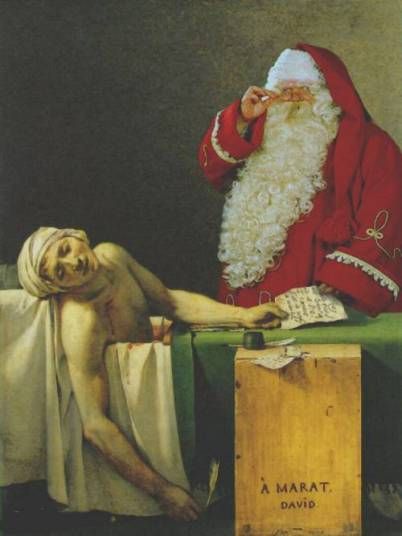

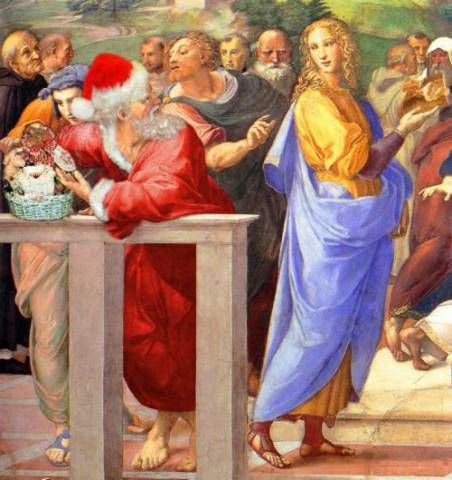

Sunday, December 25, 2005

Enjoy, and Merry Christmas to you and yours.

~~~~~~~~~~~~~~~~~~~~~~~~~~~

Friday, December 23, 2005

From Paul Krugman's most recent...

Since the 1970's, conservatives have used two theories to justify cutting taxes. One theory, supply-side economics, has always been hokum for the yokels...With one yokel, Nobelist Robert Lucas, going so far as to dedicate his 2003 Presidential Address (.pdf) of the American Economics Association to the importance of supply-side hokum...

Taking U.S. performance over the past 50 years as a benchmark, the potential for welfare gains from better long-run supply side policies exceeds by far the potential from further improvements in short-run demand management.... [emphasis in original]Lucas on tax policy...

The potential gains from improved stabilization policies are on the order of hundredths of a percent of consumption, perhaps two orders of magnitude smaller than the potential benefits of available "supply-side" fiscal reforms.

When I left graduate school, in 1963, I believed that the single most desirable change in the U.S. tax structure would be the taxation of capital gains as ordinary income. I now believe that neither capital gains nor any of the income from capital should be taxed at all.Is Krugman still a member of the AEA? After his career change and all, one could understand if he decided to save the dues.

Supply side economics [is] a term associated in the United States with extravagant claims about the effects of changes in the tax structure on capital accumulation.

The analysis I have reviewed supports these claims: Under what I view as conservative assumptions, I estimated that eliminating capital income taxation would increase the capital stock by about 35 percent.

The supply side economists have delivered the largest genuinely free lunch that I have seen in 25 years in this business, and I believe that we would have a better society if we followed their advice.

-- In Supply Side Economics: An Analytical Review, Oxford Economic Papers, 42:293.

Tuesday, December 20, 2005

The transit workers here in New York City have started an illegal strike, closing down a transportation system that seven million people use each day, and paralyzing the highways into and out of the city that are used by a great many more. How come?

The transit workers here in New York City have started an illegal strike, closing down a transportation system that seven million people use each day, and paralyzing the highways into and out of the city that are used by a great many more. How come?Well, the average NYC bus driver makes $63,000 per year -- that's only 50% more than the median household income in NYC of a little over $40,000 ($39,937 in 2003, plus a few percentage points for inflation) and median household income in the entire US of under $45,000.

Two average NYC bus drivers who marry each other have more than $125,000 of wages, which places their household in the top several percentage points of the income distribution, happily among "the rich" whom Democrats and the left so regularly bash.

Of course, they also receive benefits such as comprehensive medical coverage towards which they pay zero, and full pensions at age 55 after only 25 years of service.

Those on other job lines do well too: janitors and bus cleaners for the transit system are paid over $20 an hour -- more than 50% above the $13 an hour private sector rate (which results in each job opening attracting 140 test-passing, qualified applicants).

Being stuck with wage differentials no larger than this along the entire range of union positions versus comparable private sector jobs, well, it's no wonder the transit union felt itself provoked into an illegal strike against the public interest! What else could it possibly do?

Now, just recently I was following some threads of Wal-Mart bashing among various left-leaning commentators. Most amusing was watching purportedly market economists like Paul Krugman and Brad DeLong twist and cavil to sign on to this politically obligatory bashing, while looking for some rationale to keep from looking professionally absurd and hypocritical, even to themselves.

Krugman of course used to ridicule those who claimed that US jobs were destroyed by super-low wage foreign competitors that destroyed US firms outright while employing no one here in the US at all. It was just a matter of hot dogs and buns, he lectured -- if a hot dog maker increased productivity to make more hot dogs with fewer workers, this did not reduce employment but rather freed workers to move into making more buns. The result was both more hot dogs and more buns for the same amount of people -- so everybody became richer! Productivity increases that reduce employment in a particular industry were good. (See "agriculture" for the last 150 years.) The employment level is set not by the hot dog maker who lays off workers, but by the Federal Reserve.

But now he's signed on to the claim that firms located in the US that put out the "hiring sign" right here at home do destroy US jobs -- when they increase productivity and don't pay union-and-Democratic-party approved wages. It seems that in his mind Asian sweatshops that destroy US textile firms outright are better for US employment than a US firm that goes into a low income community, advertises to fill the 525 new jobs it is creating, and gets 8,000 applicants from those who are unemployed or in lesser jobs.

Krugman gives no explanation of this mystery -- but here his friend Brad DeLong has just stepped in.

Professor Delong has come up with the idea that Wal-Mart has a "monopoly" in the labor market(!) Yes, Wal-Mart is a monopolist, a noxious example, he says, of...

"using local monopoly power to sleaze and cheat your own workers"Now, I don't know where Berkeley professors do their shopping, but the last Wal-Mart I went to was the anchor tenant of a mall that was host to several other retailers, which itself was on a commercial strip with dozens of other employers stretching out of sight in either direction -- retailers of all sorts, car dealerships, restaurants, grocers, gas stations, swimming pool sellers, contractors, you name it. This commericial strip with scores of businesses of all descriptions -- plus the entire surrounding local community with all its other businesses -- is a labor market over which one single Wal-Mart store has monopoly power! It's too amusing to be true. ;-)

I mean, when Wal-Mart first enters a local market to offer jobs there it has zero presence in the market -- and how does a firm that's not even in a local market obtain monopoly power over it to force its new hires to accept sub-par wages?

Yet the "monopoly" claim is made, and we can see the inexorable logic that drives a party-position-first economist to it. (1) Wal-Mart must be abusing its employees, as a matter of dogma, that's unchallengeable. (2) But an employer can't abuse and cheat its employees in a functioning labor market -- not systematically with great success over a long run -- because they will just leave it to go to another employer, that's economics. (3) Therefore, there is no functioning labor market, Wal-Mart has a labor market monopoly.

There is no reason to look at facts (such as one employer's share of total local employment) because the logic is irrefutable. QED.

OK, back to the NYC transit strike. How does the transit workers union obtain compensation, oh, 50% above free market levels and still feel confident in its ability to conduct an illegal strike against the public interest to get more?

Well, the union has a monopoly, a real life monopoly, on employment in a transit system that millions of people -- the great majority of whom are poorer than the transit workers -- rely upon to get to work and for a host of other vital needs. That's monopoly power.

Will Professors Krugman and DeLong consider the effects of a real life (as opposed to fantasized) labor market monopoly here? Will they raise a call in defense of the lower income masses who are being exploited and extorted by this monopolist? After all, Krugman is writing for a New York City newspaper. And this strike is destroying retail jobs and slashing retail workers' income, in what is supposed to be their big season, for real here in his newspaper's home town.

Probably not. And when they don't we'll know why.

Saturday, December 17, 2005

[Update: Class action lawsuit filed against the IRS!]

A third federal Court of Appeals has struck down the federal tax on long-distance telephone service (National Railroad Passenger Corporation (.pdf) , DC Circuit, No. 04-5421) bringing $9 billion in potential tax refunds for phone users that much closer to reality. The IRS now is zero-for-ten in these cases, with courts ordering more than $12 million of refunds in them, to big companies such as OfficeMax, Amtrak, and Honeywell International.

What's new now is that individuals are beginning to catch on and stop paying the tax. And phone companies are removing the tax from phone bills upon customer request.

The gist of the legal matter is that the Tax Code says telephone tax applies to long-distance calls that are billed individually by both time and distance. But few phone calls are billed that way today. And when calls are billed any other way -- by flat rate, time only, negotiated bulk rate, "friends and family", whatever -- heavy phone service users who are up on the law have begun asking for their tax money back. The IRS has responded by saying the "and" in "time and distance" actually means "or" -- but the courts haven't bought that yet, and have been giving back the tax.

Nevertheless, the IRS is refusing to pay refunds and recently issued a formal notice (.pdf) saying all phone users are required to still pay the tax.

Which raises a problem: What to do if you don't want to pay a tax that the courts say you don't owe, but your phone tax bill isn't big enough, and your pockets aren't deep enough, to fight the IRS through the courts for a million dollar refund?

If you have a small business paying significant but not huge phone taxes the thing to do is to file a "protective refund claim" for taxes paid three years back. The IRS won't pay it now, but this will keep your potential refunds from expiring due to the three year statute of limitations that applies to refund claims. Then you wait as the big boys fight it out. If the IRS gives up in the end you'll get your money, without a court fight. Your business's tax advisor can file the protective refund claim for it.

If you are an individual whose monthly phone tax bill is so small that it doesn't pay even to go through the paperwork of a formal refund claim, but you still don't want to pay a tax you don't owe, there's a simpler option -- just stop paying the tax.

The phone companies are required by the IRS to collect the tax but not to enforce it. The first mainstream media story I've seen on this subject in the two years it has been developing reports that AT&T, Cingular Wireless, MCI, and Verizon Wireless now remove the tax charge from phone bills when asked to do so by customers. If they do I imagine their competitors do as well.

(The phone companies hate this tax, which was imposed as a temporary "luxury tax" in 1898 to help finance the Spanish-American war -- thus showing what Congress means by "temporary tax". The heads of all the big phone companies recently sent a letter (.pdf) to Treasury Secretary Snow urging him to instruct the IRS to give up on this, stop collecting the tax, and give everyone their money back. They want to get rid of this tax and aren't going to go out their way to give a hard time to growing numbers of customers who join them in this.)

What happens if an individual just stops paying the tax, having the phone company take the tax off the phone bill?

Well, probably nothing, at least for some while. The phone company informs the IRS of the fact, giving the customer's name and the amount of tax not collected. But then the small amount of money at issue per individual works against the IRS -- it can't afford to spend resources attempting to collect such small amounts, especially while all the courts are ruling the tax illegal. (The news story linked to above mentions individuals who haven't paid the tax for years, as anti-government protestors, and have never heard from the IRS.)

In the longer term, nobody can say for sure. If the tax somehow is reinstated as it was, non-payers might get back tax bills. But as they could show their failure to pay was based on a reasonable interpretation of the law backed by three Court of Appeals decisions, and contradicted by none, they should escape any penalties. That would leave them just paying the (modest for them) amount of tax itself plus interest -- basically same fiscal place as if they'd paid the tax to begin with.

(More background plus legal and case citations available here.)

Monday, December 12, 2005

It's true, females really do make males stupid.

it seems that you do not have to be cleverer to be a libertine than to be a faithful husband. But if the girls are putting it about, it is better to be virile and dim than impotent and smart.Next time one complains about your male intellect, tell her whose fault it is.

Self-employment is not conducive to blogging.

Not lately, at least. Might not be again until after Christmas.

While things are slow around here go enjoy some quirkies.

(Haven't you always wondered how the Hollywood studios handle "Superman's bulge"? Well, these days they "erase his package with digital effects". Now you know.)

Saturday, December 10, 2005

Mizuho Financial, Japan's second-biggest bank, said a typing error at its brokerage arm cost it at least ¥27 billion yen ($298 million)...A little more detail, for those of us who enjoy the suffering of others...

Mizuho's brokerage wrongly put an order to sell 610,000 shares for ¥1 each. It had intended to sell one share for ¥610,000... [Bloomberg]

... the Tokyo Stock Exchange is trying to prevent the brokerage from reneging on the transaction, TSE officials said Friday...Talk about cornering yourself in the market!

Due to a data entry mistake, Mizuho Securities placed an erroneous order Thursday morning to sell 610,000 shares of J-Com for 1 yen, instead of one share for 610,000 yen, during [J-Com's] debut on the TSE's startup market.

Since the size of the order is 42 times larger than J-Com's 14,500 outstanding shares, it was effectively a massive short-sell order and must be settled by delivery of the shares on the fourth market day from the order's placement. The order remained valid as of Friday...

Sure, at one yen per share -- less than a US penny -- why not buy?Morgan Stanley Japan reported to the Finance Ministry the same day that it acquired a 31.19 percent stake in J-Com Co. ... the U.S.-affiliated brokerage bought 4,522 J-Com shares Thursday when the recruitment agency went public on the Mothers market.

It is also believed that many individual investors, including day traders, jumped on the bandwagon and bought J-Com shares after the erroneous order was placed...

[The TSE is considering imposing a "forced settlement"] to set a certain price for a J-Com share that is higher than the investors' purchasing price and forcibly settle the deal by paying investors in cash ... -- the first such action in 55 years -- to preserve trust in the stock market.You know, typing really is an underappreciated skill.

Mizuho Securities would shoulder the full cost of the forcible settlement plan, in which case its losses could mount further, industry insiders said... [Japan Times]

Joe Namath fined for signing a football.

After going to the replay booth, the state Lobbying Commission has reconsidered its penalty levied against Joe Namath.OK, Joe beat the rap.

Broadway Joe, who registered as a lobbyist this year to rally legislators to back the failed West Side stadium, was fined by the watchdog agency for autographing a ball for Senate GOP leader Joe Bruno (R-Rensselaer).

Bruno had a say in whether the Jets got the stadium, and the commission determined that the ball he got from Namath was worth more than the $75 limit on gifts from lobbyists to lawmakers.

[But] the full commission ... voted down the sanction. [NY Daily News]

But this is what the political reformer types outlaw, signed footballs. Yet Bruno holding out for $300 million, well that they don't care about.

The thing the reformers miss about politicians collecting money is that it's not bribery, it's extortion.

Sunday, December 04, 2005

Another testimonial for expensive dating services.

Anti-aging guru Dr. Nicholas Perricone [the millionaire star of PBS fund raising] and his ex-wife are locked in an ugly custody battle — the doctor accused of being a cheat who has fits of rage and used human growth hormone, the wife slammed as a manic clean freak who washed her daughter's skin raw.Maybe there should be a legal "due diligence" requirement for marriage as there is for corporate mergers -- neither party can use in divorce court what they knew or should have known before marrying.

The ex-wife, Madeleine, 37, admits she suffers from bipolar disorder and once worked as a call girl.

But her ex-husband, 57, cheated on her with prostitutes, lied about three past marriages and handed off care of their 8-year-old daughter to chauffeurs and nannies while traveling the world, she alleges...

[The couple met] through an expensive dating service called The Singles Network in 1994 and married ... a year later. [NY Post]

"She was a prostitute and is crazy." "He had bad marriages before and has an ugly temper." "How could we possibly have known? We got together through an expensive dating service!"

Friday, December 02, 2005

IRS officials on November 30 emphasized how important it is for the boards of tax-exempt organizations to take steps to ensure the compensation packages they design are reasonable.You know, that would be areas like not paying $200,000+ of personal credit card charges for your financial officer, for items like the cost of flying his favorite dominatrix into town on a regular basis...

At a program in Washington sponsored by the Exempt Organizations Committee of the D.C. Bar Taxation Section, Galina Kolomietz, an attorney in the IRS Office of Chief Counsel, Tax-Exempt/Government Entities (TE/GE) Division, discussed several governance areas boards should focus on... [Tax Analysts]

"Who watches the watchers?", asked Juvenal. And who watches the accounts paid by the accounts payable executive?A charity executive used $210,000 meant to cure heart disease to get his own pulse pounding — repeatedly flying a dominatrix halfway across the country to spank him, law-enforcement sources said yesterday.

Abraham Alexander racked up charges on an employer credit card for a slew of personal items, including steamy S&M meet-and-beat sessions with Lady Sage, a world-renowned whip mistress based in Columbus, Ohio, the sources said.

Alexander, 45, is an accounts-payable exec at the not-for-profit Cardiovascular Research Foundation.

One guesses she didn't share the money.Lady Sage — who goes by her real name, Pam DeBord, outside her dungeon — says on her Web site that she charges $1,000 a day plus expenses to travel to clients. On top of that, clients pay $250 an hour for her spanking services...

The raven-haired 43-year-old poses in leather bondage outfits on her site — but in real life, she is a divorced former hairdresser and a mom of one who recently became a grandmother, her ex-husband said."She flies from America to Europe all the time for work and even the Middle East, places like Egypt," claimed the Ohio man, who did not give his name and who said he divorced her after learning that she worked as an S&M mistress behind his back...

Officials at the Cardiovascular Research Foundation ... described as the world's largest private medical research foundation, said thefts will be covered by insurance... [NY Post]

Then no harm done, except to those of us who pay insurance premiums.

This subject of compensation abuse by tax-exempts is becoming recognized as a serious issue. A lot of people think executives of for-profit companies pay themselves too much -- well, if so they do it while being watched by their shareholders, the IRS, and the SEC in many cases, among others. And if they don't produce on the bottom line they get axed.

Officers of tax exempts aren't watched by anybody -- the IRS, for instance, doesn't waste resources auditing those it doesn't tax -- nobody blames a charity for not making money, and they have a hugely effective political defense against all investigations: "Hey, we're a charity, why are you picking on us?" So how much do you think they pay themselves relative to the work they do?

"Who watches the tax exempts?" More on this in posts to come, maybe.