Wednesday, December 31, 2008

The NY Times editorialsts opine about labor economics:

The Labor AgendaI guess we can ask the workers of Detroit about how this has worked out for them, eh? How their wages have been boosted by the UAW. Those we can find who still have jobs...

...The first and biggest test of Mr. Obama’s commitment to labor ... will be his decision on whether or not to push the Employee Free Choice Act in 2009. Corporate America is determined to derail the bill, which would make it easier than it has been for workers to form unions by requiring that employers recognize a union if a majority of employees at a workplace sign cards indicating they wish to organize [eliminating the secret ballot vote unions often lose]...

The measure is vital legislation and should not be postponed. Even modest increases in the share of the unionized labor force push wages upward, because nonunion workplaces must keep up with unionized ones...

Detroit, the nation's poorest big city, is the poster place for a central city in a free fall, having lost half its population over the last 50 years, with no end in sight. Motown's economic losses have exceeded even those of its population. From 1970-2000, the city shed more than half its jobs... [Detroit Free Press]Less anecdotally, Andrew Biggs charts the relationship between the degree of unionization of the work force and labor's share of national income, internationally, and finds ...

there's no strong statistical relationship between one and the other... The split between workers and owners seems pretty much independent of whether the workers are union-represented or not.Like, maybe, the non-UAW workers (and former workers) of Detroit?

This seems strange given that we know that, in the U.S. at least, unionized jobs pay more than non-unionized ones, even within the same industry. The question is, who is "paying" for these higher wages? It might be other workers...

Saturday, December 27, 2008

Paul Krugman writes that FDR's administration -- indeed the entire Democratic party-managed government of his era -- was so clean that

"when a Congressional subcommittee investigated the W.P.A., it couldn’t find a single serious irregularity"Of course, that was a Democratic progam being investigated by a Democratic Congress that to do so named a Democrat-led committee that picked a Democrat-led subcommittee with a majority of Democratic members who reached that sterling conclusion. But I digress...

The point here is that standards of corruption -- and of Presidential behavior, and of reporting of it -- have so changed since the 1940s that FDR could do right out in the open what would have gotten Nixon indicted.

As David Brinkley recalled in his memoir about his early years as a reporter covering FDR's White House...

That $17,000 tax cut ordered by FDR for his friend was more than $250,000 in today's money (adjusted by CPI, or more than $2 million adjusted by its size relative to GDP)....the Internal Revenue Service had investigated the financial dealings of a Roosevelt friend and ordered him to pay twenty thousand dollars in fines, interest and penalties.

The president thought it was too much, telephoned the director of Internal Revenue and told him, "Cut his fine to three thousand. I think that's enough."It is diverting to imagine the scandal today if a president ordered the IRS to reduce a fine for a friend and it was duly leaked to the Washington Post, as it would be. But in Roosevelt's case he made the call in the hearing of some of us in the press corps, and nobody seemed to think it was news or even very interesting...

Yes, indeed ... if a news story broke today saying Dubya had called up the IRS and ordered it to cut the taxes owed by one of his cronies by more than $250,000 (or more than $2 million) I can just imagine what the NY Times editorial pages would be writing about it -- Krugman in particular!

But back then FDR did it right in front of the press corps, and none of them considered it even worth thinking about...

Thursday, December 25, 2008

After a tough day delivering presents, Santa got his account statement from Madoff...

Saturday, December 20, 2008

Santa's sled deserved ticket, union boss sez.

The law's the law -- even for Santa.

So says the tough-talking boss of the union representing the city traffic agent who ticketed Santa's sleigh in Brooklyn while he handed out presents to kids.

As neighbors and politicians demanded the summons be quashed Wednesday, James Huntley, who heads Local 1182, vigorously defended the agent... [NYDN]

Saturday, December 13, 2008

An interseting video discussion (from Canada).

[hat tip to Roland Patrick]

Wednesday, December 10, 2008

Tuesday, December 09, 2008

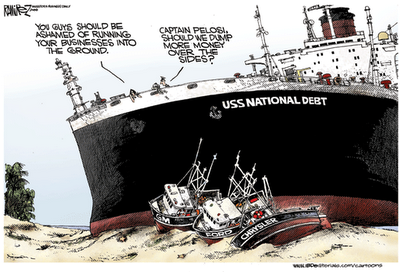

Damn clever, those foreigners, locating their US car factories geographically so far away from the UAW.STOCKHOLM, Sweden (AP) — Nobel economics prize winner Paul Krugman said Sunday that the beleaguered U.S. auto industry will likely disappear.

"It will do so because of the geographical forces that me and my colleagues have discussed," the Princeton University professor and New York Times columnist told reporters in Stockholm...

Charlie Rangel should have remembered his Twain before writing a letter to the editor.

"Never argue with someone who buys ink by the barrel and paper by the ton."Charlie writes a letter of 712 words to the editors of the New York Times.

They answer by footnoting Charlie's letter and writing 1,542 words in response covering the notes, prefaced by a 234-word introduction.

Let it be a lesson.

Thursday, December 04, 2008

This is a question circulating in various discussion forums, for instance...

Supposedly, we are now descending into deflation ... My question is: where did the money go? We have seen major inflation over the last 5 years (housing and commodities), which is, as we know, a monetary phenomenon - the Fed has run the printing press full blast, with their 'easy money' policy.OK, a fair question: If inflation (and deflation) are "always and everywhere a monetary phenomenon", as Milton Friedman famously put it, how can the quantity of money and the price level go in opposite directions?

Now, bust follows boom, and prices fall ... but the money is still out there, yes/no? Demand should be constant, with boatloads of bux chasing goods ... where are all the dollars? How can general price level drop?

The answer is that since economic activity is an ongoing process, what matters for the money supply is not merely the quantity of money but also the number of times it turns over, changes hands, within a given time period: it's velocity.

If you took Econ 101 in college you'll remember the old monetary equation, MV=PQ: Money (the quantity of money) x V (velocity, the number of times it changes hands within a time period) = P (the price of goods and services) x Q (the quantity of goods and services exchanged in the time period).

From that simple equation it's easy to see that if M stays even, then should V decline either prices must fall (deflation) or the quantity of goods exchanged in the economy must decline (recession) or both. In fact, even if M rises, should V fall by a more than offsetting amount, then either P or Q or both still must fall.

So the mistake in the quoted query is the phrase: "Demand should be constant, with boatloads of bux chasing goods".

Rather, something happens to cause a big increase in the demand for money, which causes people, banks and businesses to hold on to it longer rather than risk it by lending it to those who may be unable to repay, or invest it in businesses that may produce low returns or fail. So money changes hands less often and V declines.

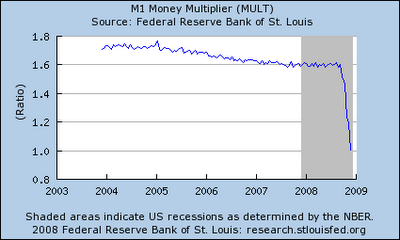

Let's see what's happened to V lately (or rather, a proxy* for it):

Oooops, off the cliff! Hold M steady with that, and you get the Great Depression. Which was what we got the last time we saw such a thing.

In the Great Depression the great economy killer was deflation -- 25% deflation in the US over three years. That is, the purchasing power originally in $100 wound up in $75, so the real value of a dollar rose by 33%. That's what crushed the economy, the difference that turned a normal recession into Vastly Worse.

To see why, imagine you are a business owner initially paying 6% on $100k loan. Then, while your income is down and business is slumping due to the recession, you find yourself paying in real terms relative to your original borrowing 8% interest, and after paying that you are stuck with a principal debt that has shot up a full third to around $133k. (The real value of the dollars you have to repay has risen 33%).

You can't repay that so you go bust, and when all the other businesses like yours go bust the bank goes bust. As banks start going bust people generally decide not to save their money in banks anymore (especially when their money is gaining value when stuffed in their mattresses or buried in their back yards, why risk putting it in a bank that may go bust?).

So 10,000 banks go bust (literally), and even the surviving banks can't loan out money (they need to keep cash in their vaults to be able to pay all the depositors who may want their money back) or won't loan out money (because they can't find enough borrowers not at risk of going bust).

V drops off a cliff, the economy collapses 30% and you get 25% unemployment.

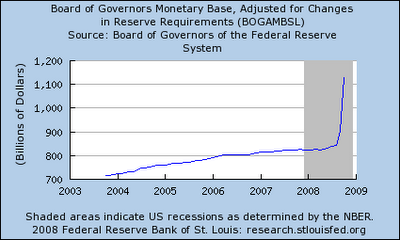

How to stop that? Fed Chairman Ben Bernanke (who in his academic life was a specialist on what caused the Depression) knows the answer: make M rise by as much as V falls.

Here's how M been doing lately?

It's up like V is down, offsetting V's fall. Ben's got his printing presses running overtime, with new ones on order.

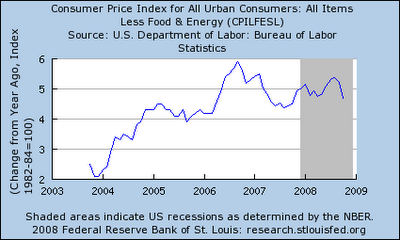

The result is that inflation is still positive and within the normal range for recent years...

... and if necessary you'll see Ben have the Fed dropping money from a fleet of helicopters, as Friedman once suggested, to keep it that way. As long as inflation stays in that range, positive, it may be recession "yes", but will be another Great Depression, "no".

Milton Friedman said that the Fed caused the Depression by letting the money supply collapse in the 1930s, and Bernanke on taking over at the Fed agreed it was true and apologized for it...

I would like to say to Milton and Anna: Regarding the Great Depression. You're right, we did it. We're very sorry. But thanks to you, we won't do it again.That second graph shows how he's trying to keep that promise. Watch the third graph in coming months to see how he is succeeding.

(* As Steve correctly notes in the comments, the multiplier is different than velocity, it is a picture of the money supply at a given point in time while velocity is turnover of the money supply measured over a period of time. But they are directly related. Velocity causes base money to be deposited in a bank, then be lent out and deposited again, and then again ... so that the final tally of deposits counted in a higher measure of money (such as M1 or M2) is a multiple of the initial amount -- shown in the "multiplier". The higher the velocity the more lending there will be, and the higher the multiplier will be. The lower the velocity the less lending there will be -- with more money kept in mattresses and vaults rather than lent -- reducing the multiplier.

I used the chart for the multiplier because FRED didn't have a similarly nifty chart for velocity.)

Wednesday, December 03, 2008

START THE PRESSES

One chore high on Ben Bernanke's to-do list was ordering the rebuilding of Uncle Sam's money presses a week ago to make sure they won't break down trying to keep up with the government's new $800 billion relief plan...

As part of the ambitious moves, the government's two huge printing facilities -- in Washington, DC, and Fort Worth, Tex. -- will have to expand their already strained, 24-hour output.To upgrade and rebuild money presses, the government said with little notice on Nov. 14 that it began negotiating an exclusive contract with Swiss printing giant KBA-Giori, SA to provide labor, parts, repairs, upgrades, improvements, service, software and equipment in a long-term contract....

"This new $800 billion initiative (by the Fed) will cause an increase in currency requirements ..." said Mark Gertler, a professor of economics at New York University.

Essentially, the $800 billion in the new moves will come through a series of yard-sale swaps back and forth - starting with hard cash that's swapped for a holder's risky assets.

The holder, in turn, then swaps his newly gained cash back to Uncle Sam for government IOU's, such as one-year Treasury bills, and the cash goes back into the hands of the Fed to be traded out again in other rounds of similar horse-trading - leveraging the cash many times over.

"It's called sanitizing the cash," said Gertler, noting that theoretically there's no limit on how much cash Uncle Sam can print....

In a related development, the Fed entered negotiations with Sikorsky Aircraft... [ NY Post ]