Tuesday, September 29, 2009

We're from the federal government and we're here to help you ... clean up this mess.

Don't 'superfund' the Gowanus

Who should clean up [Brooklyn's] Gowanus Canal? The city's been masterminding a series of reclamation projects ... but now the federal Environmental Protection Agency is looking to designate it a Superfund site....

Until recent years, the Gowanus was abandoned by all but neighborhood activists. The site was industrial going back to the 1860s, even "hosting" coal-gasification plants. Even today, the city sewers dump 300 million gallons a year of raw waste into the canal.

Nonetheless, old-time home-owning families, newly arrived artists and gentrifiers, public-housing residents and small-business owners fought tenaciously to attract new investment and get government's attention for remediating the canal and the surrounding land.

By last year, their efforts were paying off -- as the Army Corps of Engineers moved to complete its feasibility study for restoring the canal's ecological health via dredging, and the city's housing agency chose a development consortium to build market-rate and affordable housing, with generous public space as well.

Now the neighborhood finds itself with two contradictory government clean-up plans -- one federal, one local -- and with virulent disagreements about which is better.

The federal Superfund promises big money extracted from the bad-guy industrialists who dumped waste into the canal for 150 years. But the Bloomberg administration, with the Corps, could deliver results far sooner -- indeed, the Superfund's involvement has put the local plans on hold.

At a public meeting last spring, the EPA's Walter Mugdan told the irate community that only the federal government has the money to restore an urban waterway this degraded.

But in fact, the feds don't actually come up with the necessary money. Instead, they designate the site toxic -- driving off all prospective private investment -- and then search for past polluters ("potentially responsible parties") to sue into producing the funds.

In the years since Gowanus was first opened to industry and shipping in the 1860s, it has seen some 1,500 property owners come and go -- only a few of whom can be identified today. And Superfund would likely require decades of research and litigation before the feds actually start doing anything. Remember -- the Hudson and Passaic Rivers were designated as Superfund sites in 1984; a quarter-century later, their cleanup has only just begun.

Plus, the Gowanus polluter owners that can be identified ... have already pledged to partner with the city to fund the cleanup.

In a case like this, in which the past polluters' incentives "to fight are so high, a key factor in getting through the logjam is getting people to do it willingly," notes Cas Holloway, chief of staff to Bloomberg's deputy mayor for operations...

...the threat of Superfund is also undoing the rest of of the Bloomberg strategy -- private investment and development. A recent study by the Department of City Planning concluded that 68 projects -- residential, retail, medical and commercial -- are ready for development. But few if any will get financing (or environmental insurance!) if the feds designate the site as toxic.

These projects are now on hold, waiting for the Superfund controversy to resolve itself. And as the Gowanus neighborhood has bitterly learned, being on hold is tantamount to not happening....

Public Place, a six-acre contaminated site, was to be cleaned up and developed by real-estate firm Hudson Cos. with 774 apartments (541 below market) and a public park joining a waterfront esplanade. The owner of an adjoining warehouse announced last spring that he was interested in incorporating his land into the site, building another 500 affordable apartments.

Now, says Hudson partner Alan Bell, they've halted the project: "We've spent a lot of money to get to this point -- but we're now in limbo because of the potential Superfund designation"... [NY Post]

Monday, September 28, 2009

New York Timesian accounting

Strangely, they all worked accidentally to increase top executives' pay, while the business is hemorrhaging losses and its rank-and-file employees are taking pay cuts and layoffs across the board.

Times' trouble with payWell, now at least we know the accounting philosophy behind its editorial pages' constant defense of the status quo in Social Security.

The New York Times regrets the error(s) -- sort of.

The newspaper publisher said it flubbed in awarding top execs more pay and stock options than they were allowed under the company's rules at a time when the firm has been slashing salaries, selling assets and scrambling to shore up its balance sheet. Now, it says, it will stay with the compensation guidelines.

The move also comes as the firm is trying to unload the money-losing Boston Globe after demanding $20 million in union concessions.

In 1991, the Times adopted a plan that limited execs to no more than 400,000 stock options each year. This year, however, Chairman Arthur Sulzberger (Pinch) Jr. and CEO Janet Robinson each were granted 100,000 options over that limit. Last year, Robinson did even better, with 250,000 more than allowed.

The Times also erred in approving an incentive scheme for 2011 and 2012 that exceeded a $3 million limit. Robinson and Sulzberger could have received as much as $3.5 million.

The publisher, which disclosed the mistakes in a regulatory filing late last week, didn't say what led to the errors and didn't offer any further explanation.

During the Globe talks, the Times first laid out $14 million in possible cuts, then said it miscalculated and lowered the savings estimates to $10 million.

As it struggles with a severe ad slump and $1 billion in debt, the Times has drawn greater scrutiny for its pay practices, accounting and corporate governance. Audit Integrity, which analyzes accounting and corporate governance risks, rates the Times "very aggressive" -- its worst rating.

It now ranks in the seventh percentile -- meaning it has a higher accounting and corporate governance risk than 93 percent of companies in North America... [ NY Post ]

Motown barter: Trade in your used car for a house, or two, or three.

"Why does the typical house in Detroit sell for $7,100? ... the median selling price for a home stood at a paltry $7,100 as of July ... down from $73,000 three years earlier." [WSJ]If you have dreams of building a real estate empire, buying low to sell high, will you ever have a better chance to buy low?

Yes, I know, it's Detroit ... but even paying 20% down, you might be able to buy a whole street of houses on your credit card.

Sunday, September 27, 2009

Seen around and about

The President of Audi of America speaks about the new General Motors...

To start, he said the Volt is "a car for idiots." Adding that they're too expensive and, "No one is going to pay a $15,000 premium for a car that competes with a (Toyota) Corolla. So there are not enough idiots who will buy it." He predicted that the Volt will fall flat, which will cause the federal government to step in and subsidize the Volt in order to save face... [Autoblog]... sounds plausible -- but then, how many cars does Audi sell in America?

The Swedish military has problems with its bras...

The Swedish Conscript Council has told the country's military leaders the bras are useless in combat because of weak catches. They also claim a lack of fireproofing means the bras can even catch fire and melt into the skin of a female soldier... [Ananova]... but then, when was the last time the Sweden sent its military into combat - with bras or without?

A lover's quadrangle results in "Krazy Glued" genitals. For some guys a triangle should be enough. (Well, Krazy Glued on is better than Bobbitted off, one guesses.)

An issue of vibrating importance going to the Supreme Court?

No peak oil yet. (So no need to buy that Volt until the government subsidy lowers its price.)

Friday, September 25, 2009

Politicians shocked! Price controls produce the same result as always.

Earlier this year Congress enacted new restrictions on credit card issuers' ability to raise borrowers' interest rates, banned several common credit card fees, and prohibited issuers from using some common credit-rating practices when determining borrowers' credit ratings for the purpose of setting their interest rates. (Details)

After passing the new law by an overwhelming vote, it hailed its achievement as a great bipartisan act of consumer protection.*

But now Reps. Barney Frank and Carolyn Maloney, the prime political movers behind the new restrictions, are shocked and appalled to find that credit card issuers are raising interest rates before the effective date of the new law, as per their press release ...

Pew Charitable Trust reports that interest rates have spiked by an average of 20% on credit cards representing more than 91% of the $864 billion in outstanding credit card balances. It’s clear that credit card companies are taking advantage of this period between the signing of my bill and the current effective date,” Rep. Maloney said. “The breadth and depth of the rate hikes happening now point to the need for faster consumer protections. Americans need relief now.”So they've just introduced new law to move up their prior new law's effective dates from next year to December 1, 2009.

Wow, that's quite a rate hike: an average of 20% on 91% of all credit card balances.

But, one wonders ... what did they expect?

When the government curtails the ability of employers to fire employees by imposing "job protections", it increases the cost to employers of hiring employees (by reducing their ability to get rid of bad and/or unneeded ones), so they employ fewer. Does anyone think we lack data on this? (See: Western Europe.)

When landlords are denied the ability to raise rents and not renew leases by rent controls and regulations, the cost to landlords of renting goes up. So rental apartments go off the market (to become co-ops or go into the owner's personal use, if not be abandoned) and market rents for the remaining available apartments increase. Economic common sense and overwhelming empirical data agree! (See: New York City).

Now, when politicians restrict the ability of credit card companies to change their rates flexibly up as well as down -- and ban a host of fees they charge -- what do we expect will happen?

Maybe ... the cost to lenders of issuing unsecured credit will go up ... so credit card rates will go up, and cards will become less freely available than before?

This is a surprise?

The credit card industry is very competitive -- extremely so in fact. If I want to find the best offer for a new credit card I can go to Bankrate.com, Creditcards.com, or a whole bunch of other web sites and see competing offers for a zillion of them lined up right in front of me to compare.

Has there been any serious analysis indicating to the contrary about the industry: that market concentration, anti-competitive cartels or the like, exist in it? So issuers reap monopoly excess profits? If so, I've missed it.

If not, then the competitive-level income lost to the industry by legislators banning given fees and rates and risk-evaluation practices must be recouped by the industry in other ways -- by raising basic "initial offer" interest rates and other unregulated fees, and giving out fewer cards to those with the greatest credit risk. Virtually QED.

Price controls reduce supply and thus increase the market price of the supply that remains. How about that?!

Yet it always comes as shocking surprise to politicians how price controls always work out exactly the same way as they have always worked out before.

If your credit card is among the 91% that have had an average 20% rate increase applied, perhaps you'll want to make a call or send a note of appreciation to Barney and/or to Carolyn, saying "thanks!".

~~

* There's an old saying in Washington that there's a stupid party and an evil party, and that once in a while they set aside their differences to act together in a bipartisan manner that is both stupid and evil.

[HT re. the press release to CG&G.]

Thursday, September 24, 2009

It takes the first African-American President...

O's NY coup shows race does matterPaterson's 80% negative rating is the worst of any governor in the nation -- he's been polling below Ahmadinejad.

Some say it was to stop Rudy Giuliani and a Republican resurgence in Albany. Others see payback for the mauling of Caroline Kennedy and the appointment of the clownish Kirsten Gillibrand.

However you explain President Obama's putsch against Gov. Paterson, there is only one factor that ultimately makes it possible: race.

Only the first black president could pull off a coup against New York's first black governor...

"It was a gutsy move," said one top state Democrat. "The president basically said openly what everybody else in politics has been saying quietly about Paterson: You're not qualified to be governor."

The grumbling didn't turn into action for one simple reason: No white New Yorker was willing to risk being called a racist.

Take Attorney General Andrew Cuomo, whose path to the party nomination has been cleared by Obama.

For months, polls have shown him an overwhelming favorite against Paterson, yet the boldness Cuomo demonstrated in taking on Eliot Spitzer and Wall Street bonus babies wilted at the prospect of a primary against a very weak black opponent.

The primal quest to follow in father Mario's footsteps would have to wait, as Cuomo gave every indication he would run for re-election instead of challenging Paterson.

Never mind that Paterson was an accidental governor, having replaced the disgraced Spitzer.

He had no proven constituency outside Harlem, yet neither Cuomo nor anybody else of standing would dare run against him.

Clearly, the promised era of postracial politics comes with limits...

Still, no Democrat in New York was going to challenge him.

Ironically, Paterson seems to have dealt himself out only by playing the race card, and dealing Obama in...

Insiders believe Paterson sealed his fate with the White House with his reckless claim that racism in the media was behind his negative coverage and his abysmal poll numbers. In a radio rant, he even predicted Obama himself would be the next victim...And the White House didn't appreciate that. (Watch out, Charlie Rangel, when trying to distract from your own problems -- you may not get a third chance.)

Wednesday, September 23, 2009

So you wanted to be a pro athlete?

... the probability of a high school athlete making it to the professional level is about 1 in 12,000. (I've heard that the probability is far more remote.)Which -- as with other lottery winners -- explains pro athletes' staggeringly high bankruptcy rates.

Baseball offers the most lucrative potential as well as the likelihood of having the longest career. But even that is estimated to be just three years for MLB. Doing the math, and discounting $400,000 per year for three years, beginning at age 17 and entering the big leagues at age 21 (not likely), the expected value of a career in baseball is about $86...

Now, certainly it's not the average high school athlete who considers himself pro material, but It's still predominantly those with low opportunity costs of their time that pursue the professional athlete track.

Even if we changed it so that a high school athlete was ten times more likely to make it to the professional level, the expected value is only about $860. That is total, not per year.

Making it to the pros for many athletes is like the person who lives in a trailer winning the lottery -- they've never learned how to handle the wealth.

[HT: Sabernomics]

Say "Good-bye" to the Social Security surplus, a decade early.

Bill Clinton quotes....

"She must live in mortal fear that there's somebody in the world living a healthy and productive life."... among others, from a book of interviews taped during his presidency, in the advance publicity.

Tuesday, September 22, 2009

Charter schools run up the score, math- and reading-wise.

~~

The difference is off the charts.The Hoxby study.

City students who attend charter schools make monumental strides in achievement over kids who apply to charter schools but don't actually enroll, according to a bombshell and potentially landmark study.

The Stanford University study -- which compared kids who won seats in charter-school lotteries with kids who lost and subsequently enrolled at traditional public schools -- was the most comprehensive look at the city's charter schools to date.

It found that students who win spots in charter schools outgain those who don't by 5 points in math and 3.6 points in reading on state tests in every year from fourth to eighth grades.

The cumulative difference means students who attend charter schools from kindergarten through eighth grade can close about 86 percent of the achievement gap in math with students in a high-performing, suburban district like Scarsdale.

They can close the achievement gap in reading by about 66 percent.

Landing a seat in a charter high school also raises the likelihood that students will graduate with a Regents diploma by 7 percent for each year they spend at the school, the study found.

"The results suggest that the charter schools are starting with the most disadvantaged students in New York City, and they're able to close the achievement gap very considerably," said Stanford economics professor Caroline Hoxby, who wrote the report.

The study compared the achievement of about 21,000 kids in city charter schools with that of about 19,000 kids who applied to but couldn't attend charter schools because of a lack of seats.

The apples-to-apples comparison allowed researchers to conclude that charter schools weren't getting better results by skimming the best students -- as some critics have charged. ... [NY Post]

~~

Congress bends the health care cost curve.

Although the government regularly pays $100,000 or more for kidney transplants, it stops paying for anti-rejection drugs after only 36 months...Then it gets to pay for another transplant!

... 15 months ago, Medicare paid for a second transplant -— total charges, $125,000 —- and the 36-month clock began ticking again. “If they had just paid for the pills, I’d still have my [first] kidney,” said Ms. Whitaker...Consider the cost curve bent.

Bills have been introduced in Congress since 2000 to lift the 36-month limit and extend coverage of immunosuppressant drugs indefinitely.

They have never made it to a vote, largely because of the projected upfront cost; the Congressional Budget Office estimates that unlimited coverage would add $100 million a year to the $23 billion Medicare kidney program.

~~~

Monday, September 21, 2009

From the Journal of Advanced Academic Analysis

The secret of making money in the stock market, revealed:

A linear link between S&P 500 return and the change rate of the number of nine-year-olds in the USA has been found ... The prediction of S&P 500 returns for the months after 2003, including those beyond 2007, are obtained using the number of 3 year-olds between 1990 and 2003 shifted by 6 years ahead ...

The secret of making money from betting on the Washington Redskins, revealed:

We find a significantly positive, non-spurious, and robust correlation between the Redskins' winning percentage and the amount of federal government bureaucratic activity as measured by the number of pages in the Federal Register.

The empathetic neural responses of dead fish, revealed by MRI [.pdf] :

One mature Atlantic Salmon (Salmo salar) participated in the fMRI study. The salmon was approximately 18 inches long, weighed 3.8 lbs, and was not alive ...

The salmon was shown a series of photographs depicting human individuals in social situations with a specified emotional valence. The salmon was asked to determine what emotion the individual in the photo must have been experiencing ... [serious explanation]

Roll up your window when driving through a tunnel, the air in there is polluted.

Professor Morawska said the study involved more than 300 trips through the four kilometres of the M5 East tunnel, with journeys lasting up to 26 minutes, depending on traffic congestion.

She said drivers and occupants of new vehicles which had their windows closed were safer than people travelling in older vehicles. "People who are driving older vehicles which are inferior in terms of tightness and also those riding motorcycles or driving convertibles, these people are exposed ..."

It's not quite a "tractor beam" but a "gravity tractor", to pull away incoming killer asteroids ...

Dr Ralph Cordey, who is EADS Astrium's head of exploration and business, told BBC News that the concept of a gravity tug was actually first mooted by two NASA astronauts, Edward Lu and Stanley Love, a few years ago. He said: "Frankly, I thought it was crackers...."

A Harvard Psychiatrist Explains Zombie Neurobiology. Ah, that's why it's worth $66,000 a year to go to that medical school.

Sunday, September 20, 2009

"Cash for Clunkers" in review.

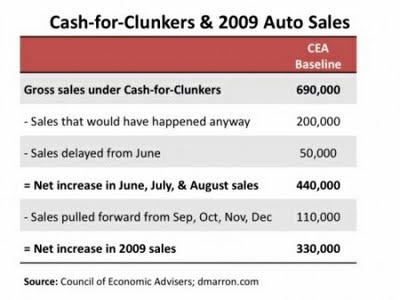

Donald Marron points us to a Council of Economic Advisers study (.pdf) on the outcome of the Cash For Clunkers program.

The gist: There were 690,000 "clunker" sales, of which 360,000 would have happened anyway between June and December of this year, so the program increased net sales for 2009 by 300,000.

As the program cost taxpayers $2.88 billion, each of the 330,000 additional auto sales cost taxpayers about $8,727.

That's not counting the loss to society of the turned in vehicles that were destroyed in spite of having positive market value. This is a genuine cost too (as explained in a prior post detailing who gained and lost how much through clunker sales).

The maximum trade-in value of a "clunker" was $4,500. If we guestimate their average value at $2,250, that's another $1.55 billion of cost -- $4.43 billion total, $13,324 per additional sale. Not cheap!

How did the

From a separate report....

The real winners can best be described by a listing of the August sales leaders:Our politicians are crowing about Cash for Clunkers being "the most successful stimulus ever".1. Toyota Camry - 54,396

2. Ford F Series - 45,590

3. Honda Civic - 43,294

4. Toyota Corolla/Matrix - 43,061

5. Honda Accord - 39,726

6. Chevrolet Silverado - 32,421

7. Honda CR-V - 30,284

8. Nissan Altima - 26,833

9. Ford Focus - 25,547

10. Hyundai Elantra - 21,673The program was designed to aid U.S. carmakers -— principally General Motors and Chrysler who were emerging from bankruptcy protection.

There is not one GM or Chrysler in the passenger car category listed. (There is one GM truck.)

Another gauge of the Cash for Clunkers program’s success is the percent of market share recorded by the members of the Detroit Three.

Automotive News reports: "GM lost a monstrous 5.0 points of market share compared with August 2008, and Chrysler Group was down 1.4 points. GM’s share was an anemic 19.4 percent; Chrysler’s was 7.4 percent"...

So, our federal government, which owns 60 percent of GM, managed to fund hundreds of millions of dollars to GM’s competitors.

In a similar scenario, imagine Ford Motor Co.’s stockholders giving $4,500 for clunker trade-ins on competitors’ cars.

I don’t think so.

~~

You be the judge.

Saturday, September 19, 2009

Buy low, sell ...???

Days after the anniversary of the investment bank's collapse, its shares are seeing an uncanny amount of trading activity.You can still invest in ye olde General Motors too, now called Motors Liquidation Company, ticker symbol MTLQQ.PK. Friday it closed at 77 cents -- up 10% for the day! (And up more than 90% from it's July low!) It's three-month stock chart.

The stock's high was 23 cents yesterday, with 65 million shares changing hands during the first five hours of trading. The stock ultimately closed at around 22 cents -- up nearly 40 percent on the day, with volume of more than 94 million shares.

It's a fairly impressive rally for a firm that choked on toxic assets last September 15 and has been relegated to over-the-counter trading under the ticker symbol LEHMQ.

Traders speculate that the Lehman stock surge has been fueled by a belief that the bank, which still houses hundreds of billions in soured mortgage assets and esoteric derivatives, may have enough juice left in it to return at least some money to shareholders.... [NY Post]

If you have "play money", you can have some fun investing in America's past! But always remember: caveat emptor.

Friday, September 18, 2009

Can the budget deficit be closed by spending cuts -- and "spending cut nitwits"?

Bruce Bartlett, long time conservative, supply-side economist and member of the Reagan and Bush I administrations (although disillusioned and embittered by Republican policy since Bush II) looks at the surging budget deficit and the prospects for spending cuts, and despairs. He writes in Forbes, "We Can't Cut Spending. Why? Because the Votes Aren't There".

[My emphasis in that last paragraph, back to that in a bit.]...it is impossible to get control of spending without cutting entitlement programs. Many Republicans agree, but they never make any serious effort to do so. On the contrary, they defend entitlements when Democrats suggest cutting them.

The Republican National Committee has run television ads opposing cuts in Medicare because Obama proposed using such cuts to fund health reform. Many demonstrators at right-wing tea parties were seen carrying signs demanding that the government keep its hands off Medicare....

How likely is it that the people protesting Obama's Medicare cuts will stand with Republicans if they propose cutting that program even more to balance the budget? They will switch sides in an instant. The elderly will fight anyone who tries to cut their benefits even as they hypocritically demand fiscal responsibility and rant about the national debt. The elderly are the reason why we have a national debt.Unfortunately, the ranks of the elderly are rising. In 1980, those over age 65 constituted 11.3% of the population. Today they represent 13%, a figure that will rise to 16% in 2020 with the aging of the baby boomers and increasing longevity, 19.3% in 2030 ...

Furthermore, the elderly are a rising portion of the electorate. Back when Medicare was established, those over 65 constituted 15.8% of voters. Last year, they made up 19.5%...

In short, there is no evidence that it is politically possible to cut spending enough to make more than a trivial difference in our nation's fiscal problems. The votes aren't there and never will be. Those who continue to insist otherwise are living in a dream world and deserve no attention from serious people.

He's even more candid on his new blog...

Is he right? "Yes" about today -- but largely "no" about tomorrow, in this observer's opinion.Why Spending Won't Be Cut

Every time I try to explain why our fiscal problems are so deep that higher revenues must be considered, some nitwit always says to me, “Why don’t we just cut spending?”

It’s as if the choice between raising taxes and cutting spending is no more difficult than the choice to buy melon or cantaloupe for breakfast.

What these nitwits implicitly assume is that we live in some kind of dictatorship where Ron Paul has Stalin-like power and spending can be cut with the wave of a hand, where no one has to worry about getting the votes in Congress for politically painful legislation, where the budget largely consists entirely of foreign aid, where there are no entitlement programs or interest on the debt to pay, and where the primary beneficiaries of spending (the elderly) aren’t the largest and fastest growing voting bloc in America...

It's certainly true that the budget deficits to come won't be eliminated by spending cuts exclusively, but that's a bit of a sham argument -- it's at least as true that they can't possibly be eliminated by tax increases at alone. Just look at them (especially the last chart). No possible tax increases can cover all that.

That leaves just two possibilities: (1) National bankruptcy and social collapse, or (2) a combination of tax increases and spending cuts in a political bargain.

Yes, spending will be cut, because there is no other option. The challenge for deficit hawks is how to best prepare for and manage those cuts from here.

There are ample precedents of option #2 working on a major scale in the US. When Social Security went broke in 1983 its funding gap was closed near exactly 50%-50% with benefit cuts and tax increases. And the unsustainable Reagan deficits produced Bush I's deal with the Democrats of a ("please forget reading my lips") tax increase in exchange for spending cuts plus meaningful "paygo" rules that restricted future spending growth. (Which created a good part of the following fiscal improvement for which the Clintonistas later claimed 120% of the credit.)

Bartlett is right that "counting the votes" is essential, and that no votes today exist for cutting spending on anything, least of all entitlements. Not on either side of the aisle -- and that each side will viciously (and hypocritically) attack the other for proposing any cuts.

When Republicans proposed a modest, progressive, Pozen-style Social Security benefit cut for the rich, Democrats stormed town halls to demagogue it as "destroying Social Security to make grandma eat cat food". The Democrats today are proposing cuts in Medicare, and Republicans are returning the favor.

But that's just today, while keeping the status quo is a "free lunch" for both parties.

Today's political calculus is easy: "spending cuts = political pain" for Congress, "status quo = no pain". Ergo "status quo" wins, each and every time. (The future be damned.) Simple.

Instead, let's consider political incentives in the future when big tax increases will faced. Now "national bankruptcy = more pain than we can endure", and "status quo = national bankruptcy". To avoid that the political calculus becomes rather more interesting: "spending cuts = political pain", "tax increases = political pain" ... leading to ... "If I'm going to feel pain, so are you ... you aren't seeing me take a tax increase until I see you take a spending cut ... now let's look for the combination that's least painful for both of us."

For instance, take the Social Security Trust Fund. Today it's easy for the left to say: "It's simply unimaginable that benefits secured by the Trust Fund won't be paid. Those are US bonds in the Trust Fund!" -- especially with retirees becoming a larger part of the voting electorate all the time!

But it's easy only because it's free. Today nobody on the left has to do anything at all about it to say the benefits will be paid. They don't have to incur the serious political pain of saying "let's raise taxes a lot now."

Moreover, the argument that the "senior vote" will block all spending cuts isn't nearly as persuasive as it may first look -- as evidenced by Social Security's "tax increase for benefit cuts" reform bargain of 1983.

The key here is that at the time of the deal you cut only the benefits of the few richest seniors through a means test. Beyond that you keep the benefits of current seniors intact, and cut only the benefits of the young who aren't seniors yet.

The 1983 Social Security reform did this in two ways:

[This is getting long. If you are still interested, read on. Otherwise, on to the next post.]

Thursday, September 17, 2009

Obamacare news: Snowe melts away ... Rockefeller steams ... Democrats feel the heat?

(1) It's going to be an entirely partisan Democratic versus Republican fight on over health care from here on. And no social legislation on this scale (Social Security, Medicare, you name it) has ever been enacted like that, on a straight party-line vote, without bipartisan support (and "cover").

(2) The Democrats need every single vote now. (In fact, they have only 59 of 60 in the Senate until the Kennedy replacement arrives.) That puts them in very tight spot. At first consideration, one might think their reaction would be "the most controversial items go overboard" to make the bill as palatable as possible.

But as we saw in this year's circus of horrors performance of the New York State Senate, the marginal voter gets tremendous power -- call it even the power of "extortion" if you will. If you are a member of the last small group of voters -- or, glory be, have the very last vote itself! -- determining whether your party succeeds or fails, you can name your price in booty. That's what we saw in New York. You can also dictate the terms of the bill itself -- because it can't pass without you. Rather than compromise, the incentives become to play hardball.

Problem is, when the bill needs every single vote, everybody becomes the marginal voter who can dictate terms: "The public option is in, or I walk!" ... "The public option is out, or I walk!" Then where are you?

The New York Senate case was just about grabbing loot and patronage. This case is about turning major policy, securing power, and keeping your seat and job if you are a Democrat in a moderate state or district. It isn't nearly as easy to reach a split-the-difference compromise on these things ("that's my seat!") as it is about divvying up swag and patronage. So intra-party fighting could be much tougher to resolve.

And the fighting may have already started, on the very issue over which Snowe walked.

The Democratic head of the Senate Finance Committee, Sen. Max Baucus, has worked out a program to finance reform by taxing "high-cost" health insurance plans (placing a 35% tax on plans costing above $8,000 for individuals and $21,000 for families).

Maine is a state where health plans cost of lot, so the tax would hit there hard. As Senator Snowe wants to get re-elected from there, she signed out and said "goodbye".

But Maine isn't the only state with high-cost insurance. And some other states that have it also have Democratic senators -- such as West Virginia, and its senator Jay Rockefeller. Being a Democrat he can't walk away, but he can start shooting at his Democratic brethren.

And even before the Baucus Plan has been announced, he already is...

Dem Senator Warns of 'Big, Big Tax' on Middle Class in Baucus BillBut he's telling them already, loud and clear. And the coal miners have a union influential in Democratic politics, one hears. (What union leader just got elected to head the AFL-CIO?)

It's not every day that you hear a Democratic senator charge that a fellow Democrat is proposing to raise taxes on the middle class, but that is what happened on Tuesday when Sen. Jay Rockefeller, D-W.Va., ripped into the health-care bill developed by Sen. Max Baucus, D-Mt., the chairman of the Senate Finance Committee...

The West Virginia Democrat worries ... that a lot of middle class workers, like the coal miners in his state, will end up facing "a big, big tax" under the Baucus bill because they currently enjoy generous employer-provided health care benefits which they receive tax free.

Referring to Baucus, Rockefeller said, "He should understand that (his proposal) means that virtually every single coal miner is going to have a big, big tax put on them because the tax will be put on the company and the company will immediately pass it down and lower benefits because they are self insured, most of them, because they are larger. They will pass it down, lower benefits, and probably this will mean higher premiums for coal miners who are getting very good health care benefits for a very good reason. That is, like steelworkers and others, they are doing about the most dangerous job that can be done in America."

"So that’s not really a smart idea," Rockefeller continued. "In fact, it’s a very dangerous idea, and I’m not even sure the coal miners in West Virginia are aware that this is what is waiting if this bill passes"...

Rockefeller, who sits on the Finance Committee, said that he cannot support the Baucus bill unless it receives major improvements during the amendment process....Let the internecine warfare begin!

Tuesday, September 15, 2009

ACORN outed for idiocy. Candidate for a political Darwin Award?

Result: The Senate has voted 83-7 to cut off ACORN's federal funding, making it ineligible for Housing and Urban Development funds -- effectively putting it out of business as a group allegedly dedicated to supporting affordable urban housing.

Result: The Senate has voted 83-7 to cut off ACORN's federal funding, making it ineligible for Housing and Urban Development funds -- effectively putting it out of business as a group allegedly dedicated to supporting affordable urban housing.OK, if you are ACORN all that arguably is bad enough -- but even worse is how stupid you are. Here are the whitebread middle-class conservative activist couple who repeatedly successfully passed themselves off to you as inner-city "pimp and ho". How dim did you have to be?

Duo Who Turned This TrickCongrats and kudos to O'Keefe and Giles, who did far more to expose ACORN using little more than grandma's coat than the mainstream media with all its resources managed to do in a decade.

In real life, Hannah Giles, 20, isn't a lady of the night. She's a minister's daughter studying journalism at Florida International University.And James E. O'Keefe III, 25, a Fordham MBA student from New Jersey, isn't a pimp so much as a pro vocateur -- determined to expose what he sees as the hypocrisies and moral lapses of liberals by employing their own tactics against them.

The pair met last year on Facebook after O'Keefe posted his own gotcha videos, showing Planned Parenthood employees agreeing to his request to earmark his donations for the abor tions of African-American babies...

After six weeks of research, Giles said they scavenged together their costumes from friends, except for the pimp coat, which was on loan from O'Keefe's grandmother.

In total, the project cost them $1,300.

O'Keefe contends their tactics are "the future of activism and investigative reporting".

"This is now my full-time job," he said.

[NY Post]

Here's the story of their subtle infiltration of ACORN's Brooklyn office and the video they took. (And more ACORN video from Baltimore and Washington DC.)

As to ACORN: if Darwin Awards were given to political organizations, we'd have a winner here.

It's the best of all possible recessions after all.

Ah, but now, on second thought, the NY Times tells us it was "the luckiest thing that could have happened"! In so many ways!

Ah yes, a calamity great enough to incite immediate panic in world leaders is good!...That is one reason the Lehman default turned out to be a good thing. Here’s another: If Lehman had been sold to Bank of America, as originally planned, some other firm — no doubt bigger, and posing more danger to the global financial system — would have failed instead. By then, there was simply too much panic in the air. A crisis of some sort was inevitable....

[And]

... Almost everyone I’ve ever spoken to in Hank Paulson’s old Treasury Department agrees that without the immediate panic caused by the Lehman default, the government would never have agreed to make the loans needed to save A.I.G., a company it knew very little about.

In effect, the Lehman bankruptcy caused the government to panic, which in turn caused it to save the firm it really had to save to prevent catastrophe...

Two thoughts about this kind of revisionism...

(1) Editor to writer: "It's the one-year anniversary and we need a story line that everyone else hasn't already used 10,000 times."

(2) Giving the concept all it is due: Yes, life is a one-time trial. There are all kinds of "butterfly effects" with big consequences occurring all the time that we don't recognize. Maybe if Hitler had been killed in 1938 then World War II would have been fought ten years later with all sides using nuclear weapons, so the world was lucky he lived as long as he did. Who knows? We can't re-run history 10,000 times to see what caused what. Nobody knows nuthin'. I do believe that.

But if the NY Times wants to go down this road, it would be nice if it remembered how little it knows during a year of telling us as a fact that "this caused that", before telling us as a fact "nope, that caused this". It might become a bit more modest in some of the other opinions that eminate from it as well.

Monday, September 14, 2009

"Teachers, teachers everywhere, but not a one to teach."

As the second week of the school year starts, the New York City public school system still has 1,281 teaching vacancies open (as of last Friday). It also has more than 2,200 teachers drawing full salary and benefits who are not filling them. Why?

[] About 600 teachers sit during working hours in the system's "rubber rooms", doing literally nothing at all, except to await arbitration or court trial after being faced with charges ranging from sexually abusing students to gross incompetence. The process typically takes years. (But the teachers get summers off, along with all other benefits.)

[] Another 1,600 teachers sit around in various locations doing nothing as members of the "Absent Teacher Reserve". A bit of explanation about this...

One of the few important reforms that Mayor Bloomberg has been able to buy from the teachers' union (at the cost of a 43% pay hike for the union since 2002 -- senior teachers' salaries now exceed $100,000) is agreement to let school principals choose the teachers they hire to teach in their schools.

Now, this may sound more like "common sense" than a dearly purchased reform, but before then teachers could choose any job they wanted in the system, on the basis of seniority. If that meant a poor-quality senior teacher from the outside came in and bounced out a top-quality junior teacher that the principal, students and parents wanted to keep, then too bad, union rules.

This also systematically created serious inequities among schools serving different communities. Senior, highly-paid teachers of course flocked to the best schools in comfortable, well-off communities with the easiest students to teach. That left schools in poor neighborhoods with the most challenging students getting the most inexperienced, low-paid teachers ... but I digress.

The union's agreement ended that. Good. But now the teacher who loses his job because his old school closed or the classes he taught were ended has to convince a principal to hire him in a new job on the merits. The great majority succeed quickly, as competent teachers are in high demand in the system.

But if such a teacher can't get a job, the union contract does not let the school system dismiss him. He gets paid anyhow, as a member of the Reserve. And that means that a teacher who, say, doesn't really mind getting full pay and earning a pension for doing nothing, doesn't have to try overly hard to find a new job ...

(... almost half ... according to a study by the New Teacher Project, have refused even to apply for another position) or their records are so bad or they present themselves so badly that no other principal wants to hire them. The union contract requires that they get paid anyway ... [The New Yorker]The cost of these >1,600 teachers in salaries and benefits is well over $150 million a year -- but until this year the school system "ate it" as the price of getting bad teachers out of the classrooms and new, better, younger ones in, to improve the system for the future.

But this year, with recession taking a toll on the school system's finances, new hiring has been frozen -- so teaching vacancies have opened up.

And with principals not wanting to fill those vacancies with teachers from the Reserve, and/or the teachers in the Reserve not wanting any job at all, the vacancies remain and the schools go under-staffed.

Thus, 2,200 teachers do nothing in the rubber rooms and in the Reserve while drawing full pay and benefits (including earning pensions) while the school system remains "short" about 1,200 teachers.

The cost of those 2,200 teachers: over $200 million -- a small but meaningful part of the $19,000 per student.

And there's a larger issue...

It's enough to get even to get progressives as far left as the Village Voice saying that is it time to "roll" the teachers' union."If you just focus on the people in the Rubber Rooms, you miss the real point, which is that, by making it so hard to get even the obvious freaks and crazies that are there off the payroll, you insure that the teachers who are simply incompetent or mediocre are never incented to improve and are never removable," [principal] Anthony Lombardi says.

In a system with eighty-nine thousand teachers, the untouchable six hundred Rubber Roomers and ... teachers on the reserve list are only emblematic of the larger challenge of evaluating, retraining, and, if necessary, weeding out the poor performers among the other 87,300.

More: Shut Up and Let the Lady Teach ... New York Post.

Shame of the World Trade Center "rebuilding" project, V.

The Empire State Building was built in 470 days -- from first shovel of dirt turned on January 22, 1930, to grand opening on May 1, 1931.New York decided to hand Osama a victory after all.

Al Qaeda didn't bring the city to its knees on 9/11. But ... we've failed utterly to replace what the terrorists destroyed. Ground Zero remains a pit -- and looks to stay that way for the foreseeable future.

... the blackened hulks of 130 Liberty St. (the Deutsche Bank building) and Fiterman Hall yet stand ...

Some naive souls fall for the official claims that "progress" is being made at a supposedly full-bore construction site. Newsday just reported excitedly that structural steel for 1 WTC has risen 100 feet above street level, compared with "only" 25 feet a year ago. Gee, that leaves 1,676 feet to go. At 75 feet a year, it will only take until mid-2031 to finish the job ...

Only one of Larry Silverstein's office buildings, Tower 4, has even started -- below ground. The models and images -- like the renderings of Towers 2, 3 and 4 posted around the site -- are a cruel joke, and the public knows it. It's impossible to imagine any of them rising soon -- if ever...

After eight years of political obstruction and Port Authority stalling, Silverstein finally got land he can build on -- only to be foiled by an unforgiving credit market that's snuffed out construction lending. That's given a dubious plausibility to the PA's claim that it's Silverstein who's holding up the works. Of course, he could have started work years ago -- if the PA had managed to turn the site over to him, as it was supposed to, in build-ready condition...

Only the unloved, morbid Memorial has found traction -- and even it will only be partly done by Sept. 11, 2011...

How did we come to this? We let our "leaders" do essentially nothing for nearly five years after 9/11 -- a time when the boom could have supported Silverstein's borrowing effort and provided tenants for his towers.

The corrupt, rudderless state government is mostly to blame. Then-Gov. George Pataki wasted 2002 and 2003 setting up an impotent Lower Manhattan Development Corp. He authorized interminable design competitions, then overrode his advisers to choose the Daniel Libeskind site plan -- which was so inappropriate that it took another year of emendation to make it even remotely buildable...

Pataki prohibited building on the Twin Tower footprints, thus forcing new buildings into too small a space. He fussed with the original Freedom Tower design -- even as he ignored the NYPD's objections to the tower's location on security grounds, concerns that would force a complete redrawing of the structure, delaying everything by yet another year.

The scandals of 130 Liberty St. and Fiterman Hall are also the state's doing; the LMDC controls the former, while the state-dominated City University of New York owns the latter.Blame also George W. Bush, a wartime president who was oblivious to the symbolic urgency of swiftly rebuilding the World Trade Center. If he ever picked up the phone to say, Boys, let's get on with the job, it's never been reported.

Mayor Bloomberg dithered until 2006, when he brokered a deal that forced Silverstein to cede Tower 1 to the PA -- which is building it at the slowest pace since the elements forged the Grand Canyon.

Rudy Giuliani, a 9/11 hero, called for the entire WTC site to be made into a memorial -- lending rhetorical throw-weight to the insidious campaign led by The New York Times against commercial rebuilding. [The Times, having invested in building a 52-story commercial office tower of its own, had every reason not to want competing space to be built.]

And we're all to blame. How? For allowing most of the $20 billion the feds sent to rebuild Lower Manhattan to be wasted on tax credits and ancillary projects -- even on new buildings far from Ground Zero -- instead of the one thing that was needed: a new World Trade Center.

[New York Post]

Shame IV, III, II & I, and back when I was young and had foolish hope.

Friday, September 11, 2009

First holding penalty of the new pro football season

The 2009 NFL season began last night (Pittsburgh 13, Tennessee 10). But this year's pro football action actually started last weekend with the Lingerie Football League season opener, which apparently produced the new pro season's first holding penalty.

Friday science news in review...

Why women have sex:

Research has shown most men find most women at least somewhat sexually attractive, whereas most women do not find most men sexually attractive at all ...."I hoped he would put the rubbish out."

NASA could learn something from the kids:

Teenagers armed with only a £56 camera and latex balloon have managed to take stunning pictures of space from 20-miles above Earth.

Are we living in a universe that's a hologram projected in from, well, outside?

The placebo effect is getting more effective: "drug makers desperate to know why".

Uh oh, the nocebo effect is bad enough as it is.

Hic. Another reason to drink. If she doesn't care about my looks anyhow and I promise to take the trash out, what difference will it make? (No, I'm not that old, but it's never too early to start fighting off Alzheimer's).

Thursday, September 10, 2009

Pro Football the way it used to be -- plus a note on "opportunity cost".

For some perspective on this, let's reminisce for a moment about how the game used to be, within the memory of a lot of people still walking around today, courtesy of the SI vault:

They laughed ... but Jerry Richardson parlayed his hamburger stand into a multi-billion dollar food industry business (Hardee's, Denny's, Canteen and more) and then returned to pro football as owner of the NFL's Carolina Panthers.

In the 1950s and '60s, the NFL was a kind of hobby ... Every preseason the players gathered around to listen to commissioner Bert Bell's annual this-is-not-a-career address, as if they needed him to deliver that news.

Johnny Unitas was making $7,000 the first time he heard ol' Bert, in 1956. Three years later his Baltimore Colt roommate, a middle-round draft choice named Jerry Richardson, was taking down $7,500 when he heard the commissioner's speech...

Almost every player had something going on the side, either supplementing his income or trying to develop a means to making a living once his playing days were over. "What have you got lined up?" was the clubhouse chatter of the day.

Unitas remembers ... the guys all meeting in the trainer's room after "work" but before their noon practice. There were more sample cases around than playbooks. "We had insurance salesmen, whiskey salesmen, paint salesmen, cardboard-box salesmen," says Unitas. "We'd all start at seven and call on customers until 10:30 or 11. That's just what we did. We had to."...

According to Alex Hawkins ... contract negotiations [with the team] were anguished and generally one-sided. "You might argue over $500 in your contract—$500!—for months," says Hawkins. "And in the end you'd come out of [general manager] Don Kellett's office crying, just crying."

Unitas had worked his way up to $10,000 by 1959 [in 2009 dollars: $74,000] but only after leading Baltimore to the first of two consecutive NFL championships ... "Finally, in 1960 I asked for $25,000," recalls Unitas. "Kellett blew his lid." Unitas eventually got his $25,000, but not until he took his case to owner Carroll Rosenbloom...

Less persuasive, apparently, was Richardson, whose contract called for him to be paid $9,750 for his third season, in 1961, but who wanted a full five figures ... he had a wife and two kids and a third on the way ... he had caught a touchdown pass in the championship game, and $9,750 just didn't seem right.Over $250, he walked. Left camp in 1961 and never played another down of football. Went home to Spartanburg, S.C., and opened a hamburger stand...

"After the '61 season, my wife and I drove through Spartanburg, and sure enough, there was Jerry Richardson flipping burgers," says Hawkins. "We laughed and laughed at him. Told him what a great season we had had, how much fun we'd had. Ordered four burgers and told him to hurry it up, too. Kept asking him how much money you could make cooking hamburgers. It was a great joke. For Christmas, he sent me 12 of them in the mail."...

Skip Sauer at the Sports Economist cites Richardson's quitting the Colts as an example of "opportunity costs" being weighed in action.

Every action you take precludes you from taking other actions. Economists will tell you that the real cost of any action is not its money cost but its opportunity cost -- the alternative course of action of most value to you that you can no longer take.

(If you spend the money you've put aside for wife's anniversary present on rounds of drinks for your buddies in the local sports bar, your opportunity cost isn't the dollar amount of money spent, but rather the loss of the pleasure of your wife's company when she departs to stay with her mother, and after the divorce. Similarly, the opportunity cost of spending the money on the present is not having a such good time with your buddies for a few hours. Which cost you weigh more heavily is up to you and your personal utility schedule. The money cost is the same either way, a wash.)

For Jerry Richardson the opportunity cost of playing in the NFL was delaying using his businesses skills and instincts to start building his fortune. The opportunity cost of quitting the NFL to start building his fortune was $9,750 plus whatever psychic rewards (fame, game-day glory) he received from being a pro football player. He compared the two and made his choice. As Prof. Sauer put it: "If Jerry Richardson was going to be underpaid, he had better things to do. Like become a mega-millionaire."

It's interesting that considering the size of Richardson's fortune today, the difference between the two options discounted to $250 in 1961.

Keith Hennessey reviews Obama's speech so you don't have to.

Here he is on last night's health care speech. Two observations in particular out of the many caught my eye...

Read the whole thing.“Universal” what? – OK, this one is fascinating. Nowhere in the speech does he promise universal health insurance, or universal health care.

His only specific universal statement is “It’s time to give every American the same opportunity [to buy health insurance through an exchange] that we’ve given ourselves.”

This is a fallback, allowing him to declare victory if expanded coverage falls far short of universality. You have to look carefully to see this. (I had to word search for “universal” and “every.”)~~~[and]~~~

The deficit language is the most interesting. He tries to be definitive:"I will not sign a plan that adds one dime to our deficits – either now or in the future. Period."He immediately follows this with language that is written as if it strengthens this commitment. I think instead it undermines the commitment."And to prove that I’m serious, there will be a provision in this plan that requires us to come forward with more spending cuts if the savings we promised don’t materialize."I think he’s anticipating that the Congressional Budget Office will continue to score legislation as increasing long-term budget deficits by an increasing amount each year.

The President and his Budget Director will, I think, continue to assert that their “game changers” will reduce long-term budget deficits, despite providing no quantitative evidence to support this claim.

This new Presidential language suggests that they will include additional language that requires actual spending cuts if (when) the game changers don’t work.

If I’m right, it’s a transparent gimmick designed to try to get CBO to say the bills don’t increase the long-term budget deficit, without actually making any of the hard choices needed to do so.

If you care about the deficit, keep a close eye on this ...

Wednesday, September 09, 2009

Junk stat of the month, in the junk story of the month.

Jacob Weisberg in Slate says Republicans are trying to kill off old people. Really. I thought he was being sarcastic at first but he doesn't stop going on about it -- no, he's angry.

Weisberg lists several ways in which Republicans are committing geronticide (seemingly everything except Soylent Green) but I'll mention just one of them -- Republicans want to drive seniors to kill themselves by destroying Social Security. He expounds (my emphasis)...

Let's put aside some simple facts that Weisberg apparently can't deal with:Other GOP policies promote death for senior citizens with more modest incomes. Take the conservative push to privatize Social Security, which George W. Bush proposed and failed to get Congress to pass in 2005.

Social Security has driven life expectancy up and death rates down since it was instituted. It has an especially pronounced impact on suicide rates for the elderly, which have declined 56 percent since 1930.

Had Bush prevailed, we would now be undoing income security for the elderly. Those who gambled on the stock market and lost would be less able to afford medicine, food, and heating for their homes. In aggregate, they'd presumably die younger and commit suicide more often.

That the Bush proposal, far from "undoing" Social Security, rather more modestly proposed to close its $15 trillion funding gap by gradually reducing benefits for the rich. (Does Weisberg prefer closing the gap by increasing taxes on workers to pay benefits to the rich? So Warren Buffett's employees at Dairy Queen will pay tax increases to keep his benefits whole?) ....

That if the Bush proposal had been in force, even after the stock market crash, workers would have received larger benefits than from the status quo ....

And that when today's workers get to retirement age and find their benefits are underfunded by about 25% at a time when taxes can't be raised to pay them (because income taxes have already been raised by 50%), well, hey, what effect is that going to have on their suicide rates?

No, let's put all such issues aside and look at the single claim: enacting Social Security reduced suicide rates among seniors.

Weisberg's only authority for this is a link (indirectly) to a National Bureau of Economic Research working paper by David Cutler and Ellen Meara on the larger subject of mortality rates during the 20th century (of which suicide is such a minor part that it isn't even mentioned in the abstract).

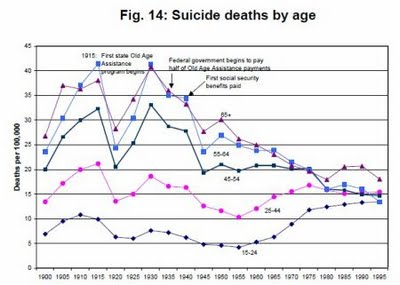

Cutler and Meara say a large decline in suicide rates among the elderly occurred after 1930 and was "coincident" with the increase in income seniors received from Social Security. True enough, but we all know correlation isn't causation (for instance). And as Andrew tells us... "Cutler and Meara don't run any statistical tests themselves; they draw their conclusions entirely from their Figure 14."

OK, now take a look at that chart for a moment. What jumps right out at you from it saying "Ain't no proof of claim here!"

The minor thing is that while a big drop in suicide rates followed 1930, the first monthly benefit check wasn't paid by Social Security until 1940. Though that certainly raises some questions by itself.

The major thing is that the drop in the suicide rate occurred simultaneously across all age groups -- among 65+ers, and those 55 to 64, 45 to 54, 25 to 44, and even 15 to 24(!) -- from the same 1930 peak, in the same pattern for 25 years, only smoothed out somewhat for the lower age groups.

Is the claim really that in 1940 Social Security benefits paid to seniors significantly reduced suicide rates among 30-year olds? (And that in fact Social Security reduced suicides among 30-year olds years before any benefits to seniors were paid at all?)

That seems to stretch credulity (nearly as much as Soylent Green). In which case we should be looking for another cause of the general and simultaneous decline in all suicide rates, across all age groups, in the years following 1930.

And Weisberg should rework his rhetoric and try again.

Another Obama "uh, oh" moment.

Leading liberals are already thinking the unthinkable: Challenging President Obama for the Democratic nomination in 2012.Of course, the fact that Keith Olberman says something doesn't make it so.

According to a report on the left-leaning Huffington Post website, MSNBC host Keith Olbermann and Eugene Robinson, an African-American national columnist for The Washington Post, discussed just such a possibility Thursday night...

Olbermann said the president has "compromised on everything so far and as self-defeating as it may be, the progressive caucus and progressives would abandon him if necessary, if this was to be the policy of this administration into 2012. If it’s necessary to find somebody to run against him, I think they’d do it, no matter how destructive that may seem."

But the fact that left-side cable TV hosts and their guests are openly discussing such things -- that's quite a change from just a few months ago.

It seems "reversion to the mean" exists in political popularity just as much as anywhere else.

Tuesday, September 08, 2009

Why is so much of the "stimulus" money going to state and local governments?

... by the time the stimulus law was being debated this January, the private sector had lost four million jobs during this recession, whereas state and local government employment had grown by 124,000. (Since then, state and local government has lost 14,000 jobs –- for a cumulative gain of 110,000 jobs –- while the private sector lost another 2.9 million.)That's an over 20 to 1 ratio, and yet...

In the average month, over two million private-sector employees were let go, as compared to 96,000 state and local government employees...

... one-third of the aid in the “stimulus” law is aimed at state and local governments. This allocation ... vastly overstates the importance of state and local government in the national employment picture, and thereby diminishes the law’s potency as a stimulus to national employment.Donald Boyd of the Rockefeller Institute of Government provides more data [.pdf], including state-by-state numbers, noting...

... an effective stimulus law would have allocated state and local government something from 4 percent (its share of layoffs) to 14 percent (its share of employment) of its funds.

Economic analysis does not support the extraordinary importance afforded state and local governments by the stimulus law, but political analysis might.

In particular, patronage jobs are an important part of the political participation machine. Perhaps when members of Congress were talking about “saving jobs” as they authored the stimulus law, they were talking about 535 specific jobs — their own!

... the dropoff in employment in the private sector has been extraordinarily sharp (a cumulative decline of 5.9 percent), while state and local government employment each have risen by 0.6 percent ...And those were five recessions without any stimulus to protect public-sector employment.

While this may seem surprising, the broad pattern is typical of recessions ...

Local government accounts for about 74 percent of state-local employment ... local government tax revenue tends to be more stable than state tax revenue, in large part because of heavy reliance on property taxes. Property tax revenue for the nation as a whole historically has been very stable, even in this recession with its significant decline in real estate values....

Several ... state and local government sectors have counterparts in the private sector, and they have proven resilient there as well ... private sector employment change in several health, education, and social services industries, have grown since the start of the recession even as private sector employment as a whole has fallen by nearly 6 percent ... in each case, the demand for the related services — education, health care, and social services — is stable or rising in recessions.

In 30 states, combined state-local employment rose from April-June 2008 to the same period a year later...

Local government employment so far has been more resilient than state government employment, with gains in 34 states and declines in 16 states in the April-June 2009 quarter versus a year ago...

State government employment was down in 26 states and rose in 24 states in the April-June 2009 quarter versus a year ago...

It is common for state and local government employment to rise in recessions, or if it falls, to decline only after a substantial lag ... in each of the last six recessions (including the current one) ...[t]he broad pattern has been for state and local government employment to increase even as private sector employment falls...

So maybe Professor Mulligan has a point: why is so much of the stimulus going to state and local politicians, er, governments?

Monday, September 07, 2009

A Labor Day message to labor unions from the American public...

Labor Unions See Sharp Slide in U.S. Public SupportOne strives to understand what could have so influenced public opinion about labor unions lately.

For first time, fewer than half of Americans approve of labor unions

Gallup finds organized labor taking a significant image hit in the past year ... fewer than half of Americans -- 48%, an all-time low -- approve of labor unions ....

... Gallup records significant increases in ... sentiment that unions have a negative effect on companies where workers are organized ...

There has been an even larger jump in the percentage saying labor unions mostly hurt the U.S. economy, from 36% in 2006 to 51% today. This is the first time since the question was established in 1997 that more Americans have said unions hurt rather than help the economy.

...does this mean Americans would like unions' reach to be expanded or cut back? The answer in this year's survey ...: 42% say they want unions to have less influence in the United States, compared with 25% favoring more influence.

Could it be that the public noticed that while there are 14 auto manufacturers building cars in the US, it was only the three organized by the United Auto Workers union that hit the rocks, with two of three sinking beneath the waves?

Or that General Motors got re-floated with $70 billion of taxpayers' money to keep the UAW's biggest

Or maybe it's how the public school teachers' unions never reform and the situations they create -- so that even liberals as far left as the Village Voice now say it is time to "roll" them?

Who knows?

Saturday, September 05, 2009

Satan's own state: Florida

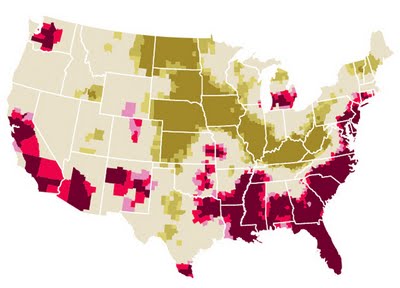

The Seven Deadly Sins are more concentrated in it than in any other place in America. No doubt it's all the old people getting their last licks in. Look at it ... dangling there.

The Seven Deadly Sins are more concentrated in it than in any other place in America. No doubt it's all the old people getting their last licks in. Look at it ... dangling there.After it, Arizona (more last licks), California's Sodom and Gomorra cities of Los Angeles and San Francisco, Washington DC, New Jersey, and of course Delaware, all reasonable enough. Louisiana, Missouri, the southeast states ... you can see for yourself.

National maps sin by sin.

I never once ever thought of moving to Florida upon retiring, but now I'm considering it.

Thursday, September 03, 2009

The real reason why health care costs keep going up.

The main factor is that the long-term income elasticity of the demand for health care is 1.6 -- for every 1 percent increase in a family's income, the family wants to increase its expenditures on health care by 1.6 percent. This is not a new trend... [ht: Arnold Kling]What he's saying is that health care is a "superior good". This is a good that people want to spend a larger percentage of their income on, as their income rises.

The logic works like this: The value provided by most consumer expenditures is subject to diminishing returns -- additional amounts spent produce less and less "reward", value to the consumer.

For instance, the first car you buy may be vital to your earning an income if you need it for work, so you will pay good money for a good-and-reliable one. Your family's second car is a convenience, so you'd pay less for it. The third car is just so the teenagers won't drive one of the two good ones -- you get 'em a clunker ... there isn't going to be any fifth car on your bill, if the kids all want their own they can get jobs and buy them themselves.

(Or: The first calories you consume are essential to keep you alive. But those last calories you just consumed only put you that much closer to diabetes, heart attack and not being able to lift yourself out of your chair -- they had negative value and you'd have done better without them.)

A superior good is one that produces closer to constant rather than diminishing returns -- so as expenditures on "diminishing return goods" produce less benefit for you, you shift your additional expenditures to the superior good.

Spending that extends your life in good health always produces a valuable benefit for you, so you shift steadily more of your income to it as you finally buy all the cars you can drive, flat-screen TVs you can watch, and food you can choke down.

It follows that since consumers' incomes generally rise with overall economic growth as the years pass, total spending on health care rises faster than income -- because that's what people want.

Professor Mankiw has expanded on this and quoted detailed analysis concluding:

...based on the quantitative analysis of our model, the optimal health share of spending seems likely to exceed 30 percent by the middle of the century.This is not just in the US, it is universal in all developed economies.

As noted here before, the average rate of "excessive growth" in health care costs (the amount by which they grow faster than GDP) since 1990 in 23 OECD countries has been 1.62%, almost exactly the same as the US rate of 1.66%, according to Andrew Biggs. He found the US's "excess growth" rate to rank ninth of the 23 -- lower than in nations famous for the national health care systems such as France and Britain.

The implications are that ...

(1.) The steadily rising cost of health care -- the increasing portion of national income it consumes -- that is seen everywhere is in fact natural and good, beneficial, and what people want.*

(2.) Any political attempt to stop this natural and beneficial process is only going to get people angry, and be doomed to fail.

(3.) The higher level of health care costs seen in the US compared to other nations is not due to their cost rising faster in the US -- their growth rate is not higher here -- but due to higher "base level costs". In particular, salaries throughout the US health care sector are far higher than in other countries like France, Canada, and the U.K. (Mankiw on this.)

But the implication of this is that if the goal is really to get US health care costs closer to the level seen in those other countries, the method is going to require taking on a wide range of powerful health industry groups extending from the American Medical Association to the United Healthcare Workers Union to slash the real incomes of their members over time -- which seems politically problematical at best, and is something nobody in all the health care reform debate has had the nerve to even mention yet.

This is not to say that there aren't a whole lot of major inefficiencies in the US health system to fix to obtain "one off" cost savings -- I could give a list, and maybe I will, but that will be for another post. However, "one off" savings, as valuable as they may be, don't "bend the cost curve".

The bottom line here is: You can pretty much dismiss the mantra that was coming from the left for a while there, "Health Reform is Budget Reform". There's no credible health care reform proposal in sight to "bend the cost curve down" -- and to the extent that health care is a "superior good", you shouldn't want there to be.

If you want legislated health care reform, want it for other reasons.

---

* This, of course, does not mean that everyone's effort to have everyone else pay for it, so they can escape their own costs, is good and beneficial, "natural" though it may be. Quite the contrary. But that's another story.

Wednesday, September 02, 2009

Charlie Rangel, Congressman of many primary residences.

And also a four-bedroom house in Washington, D.C., that he reported as his primary residence to claim D.C.'s "homestead" property tax deduction.

And also a four-bedroom house in Washington, D.C., that he reported as his primary residence to claim D.C.'s "homestead" property tax deduction.Reports have it that he has taxpayers lease him a nice car too.

Charlie is pictured at the right taking a nap at his Caribbean villa. He never claimed that as a primary residence, but he did fail to report $75,000 of rental income from it on his tax returns, after buying it with a 0% interest loan obtained from a well-known New York City union lawyer and political power broker.

The news today was that, as chairman of the House Ways and Means Committee, Charlie is filling the Democrats' "health care reform" law with new provisions for a big crackdown on tax cheats, to raise more revenue for it.

Everybody hates tax cheats. Go get 'em, Charlie!

Google rules!

~~~

Or perhaps it's time to short Google and take a look at Bing.