Thursday, April 30, 2009

The angst felt by Yankees fans who paid more than $2,500 per seat to go to the New Yankee Stadium and watch the team lose 22-4 was previously mentioned.

But, it turns out, there weren't so many of them

Inspired by the sight of hundreds of empty "premium" seats behind first and third bases during each and every game broadcast on their cable TV network, and on the sports highlight shows, the Yankees have decided to go "downmarket" and welcome the proletariate into the New Stadium.

The Yankees are cutting tickets priced at $2,500 per game to $1,250, and their $1,000 tickets to only $650, and their $750 tickets to only $550 each! [MLB fanhouse]

Honey, turn over the couch cushions, I'm collecting the money to take the kids to a game!

24 hours in the life.

Last Friday I picked up my eight-year old from school a bit early, as we were going on a trip.

Walking hand-in-in hand along 22nd Street we passed Salman Rushdie enjoying a a late lunch with a couple of women at a sidewalk cafe.

Walking hand-in-in hand along 22nd Street we passed Salman Rushdie enjoying a a late lunch with a couple of women at a sidewalk cafe. One thing about living in Manhattan is that you get to see various celebrities in their natural element all the time. How the natural element of a guy who looks like Rushdie is amid women like that .... but I digress. After passing within a couple feet of the man and moving on a couple paces, I quickly spun around towards him, threw my arms in the air, yelled out ...

... and boy, did he jump! Well, in my imagination. Tempted as I was, I didn't actually do it, because if it had resulted in having to spend time explaining my unfortunate sense of humor to someone in a uniform I might have missed my plane.

Visitors to NYC often ask, how long does it take to get out to the airport?  The answer for all three airports is about the same: 25 minutes if there is no traffic, but give yourself two hours in case there is. And Friday at 4pm, the beginning of rush hour ... it took three solid hours to get to the departure gate at Newark airport, a distance of 13 miles from my apartment's front door. Then the plane sat in traffic for 45 minutes working through the line to take off. So it took more time to travel those 13-and-a-tad miles from my home to the plane's takeoff point than it did to fly the 1,500 miles from there to Austin, Texas.

The answer for all three airports is about the same: 25 minutes if there is no traffic, but give yourself two hours in case there is. And Friday at 4pm, the beginning of rush hour ... it took three solid hours to get to the departure gate at Newark airport, a distance of 13 miles from my apartment's front door. Then the plane sat in traffic for 45 minutes working through the line to take off. So it took more time to travel those 13-and-a-tad miles from my home to the plane's takeoff point than it did to fly the 1,500 miles from there to Austin, Texas.

After taking off the fellow sitting next to me on the plane started reading a book, "Modern Quantum Field Theory". Geeze. I thought, oh, in high school I was good at math, I could be reading a book like that too if I hadn't gone the law school route. Then a little while later he started reading another book, "Innovation in Financial Regulation in Common Law Jurisdictions". That was the title, the text was in Mandarin. Geeze. Who's going to take over the world?

The Austin Airport Hilton is pretty nice, I can recommend it, although it is unusual as airport hotels go. It's the converted former headquarters of Bergstrom Air Force base, a cold war Strategic Air Command base that was home to nuke-carrying B-52s. (My wife wanted to stay there because her father worked in the building as an Air Force officer.) It's built in a circle (like a round Pentagon). "Why in a circle?", I asked the people there. "To make it more defensible against attack", I was told. OK, I can see that with a round building it's easier to shoot out the windows at attackers, like if there were still hostile Indians around. But who was going to launch a ground attack against an Air Force SAC base in Texas in the 1950s? Mexicans?

(My wife wanted to stay there because her father worked in the building as an Air Force officer.) It's built in a circle (like a round Pentagon). "Why in a circle?", I asked the people there. "To make it more defensible against attack", I was told. OK, I can see that with a round building it's easier to shoot out the windows at attackers, like if there were still hostile Indians around. But who was going to launch a ground attack against an Air Force SAC base in Texas in the 1950s? Mexicans?

Since the hotel is built like a giant doughnut, half the rooms have windows with an interior view over the central courtyard, which has a dome over it and is filled with a waterfall, indoor-outdoor cafes, and so on. All very nice indeed, except for the grackle flying around.

New York has pigeons, Texas has grackles.  If New York had grackles New Yorkers would carry guns like Texans do. They are black, ornery-looking things, and screech. When one landed a couple feet away from me and started eyeballing my breakfast buffet the restaurant manager explained, "When it gets hot they occasionally take the door to the hotel as a cave and fly in, and it's not so easy to get them out". But if you are a bird lover, that's no complaint.

If New York had grackles New Yorkers would carry guns like Texans do. They are black, ornery-looking things, and screech. When one landed a couple feet away from me and started eyeballing my breakfast buffet the restaurant manager explained, "When it gets hot they occasionally take the door to the hotel as a cave and fly in, and it's not so easy to get them out". But if you are a bird lover, that's no complaint.

After saying goodbye to the grackle I had to drive out into the Texas countryside amid the longhorns -- and Texas cattle actually do have long horns, you just don't see cows like that in New Jersey -- to meet some people at someplace on some back road. I asked, "How is a tourist from New York City in a rental car like me supposed to find this place?" They said, "Don't worry, well hang a balloon by the side of the road, so you can't miss it."

But they forgot to put the balloon out there. Still, I probably could have found the place with no trouble, because there was a jet fighter there, if only they had told me. The fighter had been helicoptered over from Bergstrom when the base closed, and dropped at the turnoff I was supposed to take. But it didn't occur to them to tell me that.

That's another difference between Texans and New Yorkers. If a visitor is going to have to find a local turnoff where a jet fighter is sitting on the corner, a New Yorker would probably say, "There's a jet fighter sitting there, you can't miss it." But to Texans weapons of all kinds seem to be, oh, indistinguishable. So they think about it a minute and say, "We'll hang a balloon there." On the fighter.

Well, I finally found the place and got there. And had a beer to celebrate the end of my troubles doing so. And then another. And that pretty much marked the end of that 24 hours.

Saturday, April 25, 2009

Only 53% of American adults believe capitalism is better than socialism...The young, still most influenced by their school years, are more sympathetic to socialism. The older, who've learned from experience, aren't. Showing there's truth in the old adage, "If at age 20 you aren't a socialist you have no heart, if at 40 you still are you have no head". Still it would be nice if our schools taught the young "lessons in applied socialism from the 20th Century", so they didn't have to figure it out for themselves the hard way.

Adults under 30 are essentially evenly divided: 37% prefer capitalism, 33% socialism, and 30% are undecided ... Adults over 40 strongly favor capitalism, and just 13% of those older Americans believe socialism is better...

There is a partisan gap as well. Republicans - by an 11-to-1 margin - favor capitalism. Democrats are much more closely divided: Just 39% say capitalism is better while 30% prefer socialism ... [Rasmussen]

And Democrats apparently are more resistant to learning from experience.

Friday, April 24, 2009

What happens when the efficiency of government meets the efficiency of academia?

Cost of the NSERC Science Grant Peer Review System Exceeds the Cost of Giving Every Qualified Researcher a Baseline Grant

... we show that the $40,000 (Canadian) cost of preparation for a grant application and rejection by peer review in 2007 exceeded that of giving every qualified investigator a direct baseline discovery grant of $30,000 (average grant)... [Informaworld]

What's driving the now ever-rising deficits that now are on course to bankrupt the US in 20 years or so? Lack of taxes? Nope. Here it is in pictures: Spending in the short run, and (ooh boy!) spending in the long run.

Remember way, way back, oh, nine months ago, when all the experts and media were predicting oil would be $150 if not $200 a barrel by ... oh ... today? Well, now they are getting back to predicting "cheap oil forever". (Why do I get the feeling that these predictions about forever into the future are always based on looking backwards about three months?)

The Constitution is a living document. In fact, parts of it sometimes seemingly spring right back from the dead.

Yup, not only is it in the Constitution it's right up front there in Article 1. The Founders had this on their minds. Not only that, there's a US Code Section specifically authorizing Obama to get cracking on it! Maybe this is a way some of the laid off captains of Wall Street can finance keeping their yachts. Instead of being financial privateers, become literal ones!...a growing number of national security experts are calling on Congress to consider using letters of marque and reprisal, a power written into the Constitution that allows the United States to hire private citizens to keep international waters safe.

Used heavily during the Revolution and the War of 1812, letters of marque serve as official warrants from the government, allowing privateers to seize or destroy enemies, their loot and their vessels in exchange for bounty money... [Politico]

Wednesday, April 22, 2009

Save the Earth. Grow the economy. Faster! Faster!

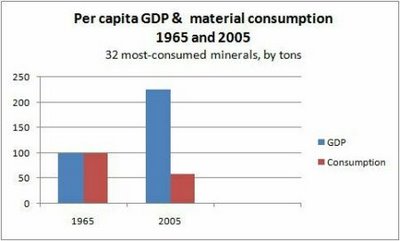

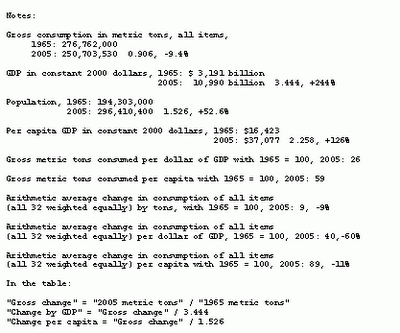

But don't you believe it. The facts and data below say something different. In fact, we are saving the Earth right now by becoming richer! This picture probably makes this fact clearer than any argument....

GDP per person 125% up! Consumption of the mineral wealth of the world 40% down! Remember this rule...

"The more advanced an economy grows, and the richer its population becomes, the less in physical resources it consumes."

Tell your environmentalist friends: to Save the Earth, grow its economies! Especially its most backward ones (but ours too). As fast as you can!

They may not get it right away. The idea that "the more advanced an economy grows the less it consumes" may seem counterintuitive at first ... but is easily explained -- and actually becomes self-evident to the point of being obvious after one ponders it a bit in light of the plain facts there in front of us all. (Sort of like the idea "the world is round" once was). But don't take my word for it, let's let the evidence speak for itself.

Fact: The amount of trash produced by the population of New York City peaked at over 2,000 pounds per person in the 1940s, and has since fallen to around 900 pounds -- yes, by more than 50%.

The idea that America's output of garbage rises ever skyward -- more trash, year by passing year -- has become one of the great unchallenged assumptions about how the world works ...Remember that the average real income in New York City tripled from the 1940s to today, as trash per capita declined by more than half -- so trash per dollar of income fell by more than 83%: more wealth, less waste.

Daniel C. Walsh an adjunct professor at the Earth Institute at Columbia University, believed it too, until he began poking through the musty records in the New York City Archives and stumbled on a long-unread paper trail that he said might be unique among big American cities: 100 years of painstakingly kept records about what New Yorkers threw away...

Pounds of trash per person peaked not in the prosperous 1990's, but in 1940...

The great trend of the 20th century, Dr. Walsh concluded, has been toward less garbage -- or at least lighter garbage -- because the economics demanded it and technology made it possible.

"There are very significant forces out there that are working to minimize the mass of the waste stream," he said. "The forces are strong and they're incredibly effective"...

... the most profound conclusion that emerged from the records, Dr. Walsh said, was not the historical nuggets, but the underlying engine that produced them. The big economic drivers of the 20th century ... all moved in one direction: toward less waste, not more...

"Everything relates to two principal factors -- one is reducing costs, making things lighter and easier to transport, and the other is making them more convenient to the consumer..." [NY Times]

But that's just New York City, something unique might have happened there, how about the nation as a whole?

Fact: In the entire US economy people have consumed less of the material world on an individual basis as they have gotten richer. This was a topic Alan Greenspan enjoyed talking about during his tenure as head of the Federal Reserve...

...the rate of increase of the gross domestic product in the United States, adjusted for price change -- our measure of gains in the real value of output -- has averaged around three percent per year.What he is talking about here is three things:

Only a small fraction of that represents growth in the tonnage of physical materials -- oil, coal, ores, wood, raw chemicals, for example. The remainder represents new insights into how to rearrange those physical materials to better serve human needs... The share of the nation's output that is conceptual appears to have accelerated... [FedRes]

1) An ever larger part of the economy is becoming "non-physical". Education, medicine, entertainment, electronic and film media, communications, finance, law and other non-manufacturing sectors of the economy, that comprise a steadily growing portion of GDP, consume very little in the way of the earth's natural resources -- so the common idea that a fast-growing economy must increase its consumption of natural resources at an equally fast rate is a very naive mistake.

2) Even in manufacturing, emphasis has shifted to the non-physical, conceptual part of products, reducing material consumption. In the early part of the 20th century the leading manufacturer was US Steel, which consumed vast amounts of iron ore, coal, and other material resources at a rapid rate. In the last part of the century the leading manufacturer was Intel, which spent billions of dollars figuring out how to arrange little bits of silicon (basically sand) in the most productive manner.

3) Even in the manufacturing of old fashioned products, the products are utilizing steadily less physical material. Cans were once made out of steel, then became tin cans made from real tin and opened with a heavy "church key" can opener, then became aluminum cans opened with a light can opener, then became pop-tops, and now have become light plastic, utilizing side products from the oil industry and containing no metal at all.

And that means that each individual's consumption of physical assets has declined over history as the economy has grown. The nation's population more than tripled over those hundred years, from 76 million to about 275 million, and GDP grew about 25-fold.The physical weight of our gross domestic product is evidently only modestly higher today than it was fifty or one hundred years ago.

By far the largest contributor to growth of our price adjusted GDP, or value added, has been ideas -- insights that leveraged physical reality. [FedRes]

So for the weight of the physical components of the economy to grow only "modestly" over that time period means consumption of physical goods must have fallen per individual and plunged per dollar of GDP.

Oh ... but Alan was just an old guy talking, is there any real hard data available today that shows this process of "dematerializing" the economy is really happening now, by the numbers? Indeed there is!

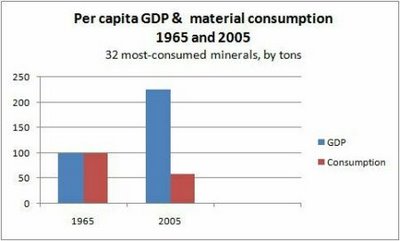

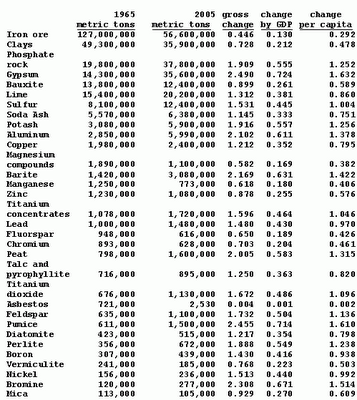

Facts: To put together the data reflected in the chart at the top of this post, I went to the Historical Statistics for Mineral and Material Commodities in the United States of the US Geological Survey, which presents comprehensive data on mineral consumption in the US.

Going through its listing from "abrasives" to "zirconium" I selected the 32 minerals with the highest levels of consumption in metric tons, all over 100,000 in 1965 (omitting a few like "crushed rock" and "salt" which even the most rabid of greens won't allege we are depleting), and then compared the amounts of them consumed in 1965 and 2005.

Now, during those 40 years the GDP of the US multiplied to 3.444 times its 1965 level, and the US population grew by 52.6%, so GDP per capita consequently grew by 126% to 2.26 times its 1965 level -- the average American grew that much richer.

The consumption levels of the 32 minerals most-consumed changed thusly:

[] Per dollar of GDP, all 32 of 32 declined in consumption. Total metric tons consumed of all the minerals combined fell by 9%. With GDP multiplying 3.44-fold at the same time, this means the per dollar of GDP consumption of these minerals fell by 74%, to only 26% of its previous level.

That total of course is the (very literally) "weighted average" of the decline for all the items. If instead we look at the arithmetic average amount by which all the 32 minerals fell in consumption (with each weighted equally in computing the average) we see that measure of the average fell by 60%.

[] Per capita, 19 of the 32 minerals fell in consumption, so less was consumed of most of the minerals per person in the US in 2005 than in 1965. Adding all 32 together, their per capita consumption fell by 41% -- even as per capita income more than doubled!

Taking the arithmetic average for the 32 minerals, with each weighted equally, gives a per capita average reduction of 11%.

[] In absolute terms, 11 of the 32 declined outright in consumption, and the total consumption of all 32 declined in absolute terms by 9%.

So less of them in total actually had to be dug out of the ground to satisfy US consumers in 2005 than 1965 -- even with GDP more than tripling and US population increasing more than 50%!

"The bottom line is the bottom line" as they say, and that's the bottom line.

But the clearest picture in my opinion is that of the per person change in income and consumption of these materials, so here that is again. Americans getting richer while consuming less of the material world...

Tell your friends! Tell the whole world to copy us! "Get rich! Save your physical resources! Grow as fast as you can!"

Underneath are the full data that went into this analysis.

BTW, I'm sure someone will ask, "what about oil?" I'm saving energy resources for another post (and oil generally isn't measured in metric tons). But for the record, oil products consumed rose from 4,202,039 thousand barrels in 1965 to 7,592,789 in 2005, an increase of 81% in absolute terms.

That's also a decrease of 47% per dollar of GDP ... a decrease of 20% per dollar of GDP per capita ... and an increase of 18% per capita.

Update: John Tierney in the NY Times has a story on energy consumption making a similar point, Use Energy, Get Rich and Save the Planet.

~~~

~~~

Sunday, April 19, 2009

Because we don't have it anymore.

Projected Social Security surpluses over the next decade have all but disappeared. Next year's operating surplus, previously estimated at $86 billion, is now $3 billion. Ten years of cumulative surpluses, once seen at about $703 billion, are now projected at $83 billion."The future is now", as the saying goes. Or a whole lot closer. More later.

In short, the long-predicted Social Security crisis is arriving sooner than expected... [USA Today editorial]

Take me out to the ball game...

.. Take me out with the crowd.

.. Take me out with the crowd.Buy me some peanuts and Cracker Jack...

What? They cost how much? Then just give me one hot dog. WHAT?

... I don't care if I never get back.

Let me root, root, root for the home team,

If they don't win it's a shame...

WHAT???

PAIN COMES AT HIGH PRICEAnd you saw history in the making! How does one put a price on that?

The Indians slaughtered the Yankees, 22-4, at Yankee Stadium before an angry crowd of 45,167 that chanted for outfielder Nick Swisher to pitch...

The Indians pasted the Yankees with a record-shattering, 14-run second inning -- the worst inning the storied organization ever has endured ... The 22 runs tied for the most allowed by the Yanks at home in their 107 major league seasons...

... SO, you plunked down $2,625 for a ticket to yesterday's game at the new Yankee Stadium and then watched the Indians put up 14 runs in the second inning, the worst inning in Yankees history.

Think of it this way. That's only $187.50 per run. A bargain.... [NY Post]

For the record, the four worst beatings the Yankees have taken in their storied 107 years have all been administered by the Cleveland Indians (22-0 in 2004, 22-4 yesterday, 19-1 in 2006, and 24-6 in 1928). What would you have given as the odds of that?

(Yes, I'm a Mets fan. It's a hard life, but we have our small pleasures.)

Saturday, April 18, 2009

This past week's April 15th, tax return filing day, was also "tea party day" on which scores of local protests against tax-and-spend government were held around the country.

Well, of course Paul Krugman couldn't resist taking a shot at them in his column -- but even by his standards this was a real name-calling fest (with precious little "analysis" of anything). He seemed at bit embarrassed about it himself ...

This is a column about Republicans — and I’m not sure I should even be writing it.Not that it stopped him...

Republicans have become embarrassing to watch. And it doesn’t feel right to make fun of crazy people.... the “tea parties” ... have been the subject of considerable mockery, and rightly so ... Crazy stuff — but nowhere near as crazy as the claims, during the last Democratic administration, that the Clintons were murderers ... what’s the implication of the fact that Republicans are refusing to grow up... ? [etc., etc.]... including his signature bogus personal slur.

Well, Krugman's always been a gratuitous name caller, since long before his NY Times days, (see The Fraga Incident, Brian Arthur, John Kenneth Galbraith, Stephen Jay Gould, "the Galbraith of his subject", and on and on). It's enough to make one wonder why someone who's been so greatly blessed by fate, in nearly every visible way, carries such a chip on his shoulder (something he seemed to wonder himself once in a WaPo profile).

But even so, this "tea party" column seemed a specially gratuitous exercise in venting, being so totally devoid as it was of any actual analysis of the tax issues involved in the tea party movement ... such as one might hope to receive from, you know, a Nobel economist.

Why was this little exercise so nasty and devoid of analysis too? I suspect it is because Krugman feels ... jealous of the tea party movement. And probably threatened by it as well. (We all know how jealously and insecurity often run together.)

That's because he knows that there is no chance on God's Green Earth that he will ever see grassroots demonstrations around the country supporting his favored policy -- big tax increases ...

Professor Paul Krugman, currently enjoying the status of being the Mick Jagger of political/economic punditry, currently in Bangkok ... starts talking to Asia Times Online about the US and the global economy.... [W]hat would he do to extricate the US from this mess? ... Tax increases: "We should be getting 28% of GDP in revenue. We are only collecting 17%." ...Wow. How much would taxes have to go up to collect "28% of GDP in revenue"? Well...

In 2007, the last year numbers weren't affected by the recession, all income taxes totaled 11.2% of GDP, and all federal revenue totaled 18.8%. So to collect an extra 9.2% of GDP in revenue would require...

[] An across-the-board increase of all income taxes (personal and corporate) by 82%; or

[] An across-the-board-increase of all federal revenue raisers (income, payroll, estate, gas and excise taxes, tariffs, admission fees to national parks, et. al.) by 49%; or

[] A new national source of revenue, such as maybe a national sales tax, to produce the revenue combined with hikes in current taxes.

That's how much! Does Krugman expect to ever see grassroots "tax hike parties" breaking out across the nation in favor of any of those options? But it's much worse than just that for him. He's got two more problems...

[] He is right that just to maintain the spending programs the politicians have already given us, which he fully supports unchanged as they are (Medicare, Social Security, etc.), is going to require truly massive tax increases in the fast approaching future (about 15 years) and then further tax hikes forever more. That's not counting his ambitions for national health care and all the rest.

And what message do you imagine he is receiving about the likely political future of these huge tax hikes from the "tea parties" around the nation protesting today's level of taxes? Ouch. But even more aggravatingly...

[] He can't tell the truth about what he believes, even in his own column. We deduce this from the fact that he hasn't in nine years. He will say we need a 49% revenue increase now, today, easily enough when traveling in Asia ... but not once in his own column here in the US.

The reason is pretty clear. Imagine him saying before last year's election, or before the coming 2010 election, "We Democrats should responsibly promise to raise all taxes by more than 50% right away to fund our existing social spending programs and national health care too..."

How many seconds would pass on the clock before Obama, Pelosi, Reid, and the rest of Democratic establishment would be protesting to the electorate: "No! No! No! That man does not speak for us!...", with the Mick Jagger of liberal economic punditry being exiled to lecture the audiences of The Nation and Mother Jones?

This is a guy who thinks of himself, and bills himself, as the great and brave teller of truth to power, and who apparently really believes it. But he can't speak the plain truth about the simple economics of this situation -- or of the "tea parties" -- because it would blow up his own party's side before the next election ... and him with it. For such a brave truth teller, that got to be aggravating.

And yet even moreso ... today Krugman's Democrats are in command of the entire government, the Presidency and Congress, the best political position he can ever hope to see -- but are they enacting anything like his tax increases? No! They are bailing out on tax increases and actually voting for more tax cuts!...

By a 51-48 vote, the Senate passed an amendment which would provide for an exemption level of $5 million [up from $3.5 million] and a top estate tax rate of 35 percent [down from 45%]. Responding quickly ... Senate Assistant Majority Leader Richard Durbin, D-Ill., offered an amendment to condition any additional reduction in the estate tax with equally large middle-income tax breaks. That amendment passed, 56 to 43.Such is the power of "tea party politics" on his own Democrats! How aggravating must that be for Krugman? Is any real tax increase at all coming from his Democrats? If not, then from whom? If nobody, then what of the fate of his big spending programs?

The Senate also dealt a blow to President Obama's plan to fund his planned healthcare reform by limiting deductibility of charitable contributions from high-income taxpayers by cutting the rate at which taxpayers earning more than $250,000 could claim deductions from 35 percent to 28 percent. By voice vote, the Senate adopted an amendment by Sen. Robert F. Bennett, R-Utah, that would bar such a change to the deduction....

At the first signs of congressional opposition, the administration caved on its $180 billion proposal to limit itemized deductions for upper-income taxpayers ... [Tax Analysts]

So these "tea parties" ... we can easily imagine that they are aggravating. And what happens when a snarky guy gets aggravated and can't vent by telling the truth of what he thinks ("we need a 50% tax increase on everyone")? Maybe he instead vents with just one long stream of insults.

"Oh, if only we could have grassroots demonstrations of people demanding tax increases!" A man can dream.

Thursday, April 16, 2009

Found at the intersection of sports and politics....

Abstract:From there they could go on to conclude that Washington's logrollers for some reason have never been "lubricated" by baseball.

We examine the correlation between federal government activity and the performance of the D.C. area's National Football League team, the Washington Redskins. We find a significantly positive, non-spurious, and robust correlation between the Redskins' winning percentage and the amount of federal government bureaucratic activity as measured by the number of pages in the Federal Register.

Because the Redskins' performance is prototypically exogenous, we give this surprising result a causal interpretation. Drawing upon public choice theory and behavioral economics, we provide a plausible explanation for the causal mechanism: bureaucrats must make "logrolling" deals in order to expand their regulatory power, and a winning football team acts as a commonly shared source of joyous optimism to lubricate such negotiations.

We do not find the same correlation when examining Congressional activity, which we attribute to legislator loyalty to their home state's team(s). [SSRN]

In fact, maybe they've always hated it, as evidenced by the historical record of miserable Washington DC teams, and the little ditty popular among baseball fans throughout the 20th Century...

"Washington DC: First in War, First in Peace, Last in the American League."

Wednesday, April 15, 2009

Well, unless you get an extension.

Here's some useful last-minute filing tips for your 2008 tax return, for all you last-minute filers out there (via the Onion).

The good news for this year, 2009, is that Tax Freedom Day -- the day upon which the average American has earned enough income to pay the year's taxes -- has already arrived, and a good two weeks earlier than last year: two days ago on April 13th.

In fact, this year's is the earliest Tax Freedom Day since 1967.

The bad news is that its early arrival is due to the fact that the recession has reduced taxpayers' income by so much, and the thus the amount of taxes owed on it.

The worse news is that Deficit Day -- the day until which the average American would have to work to make enough money to pay for his or her share of all government spending including the deficit -- this year falls on the latest date since World War II, May 29. [Calculations by the Tax Foundation.]

Pity the Swedish tax collectors.

Tax auditors can never rest...

Sweden's tax authorities are seeking the bare facts about webcam strippers' income, estimating that hundreds of Swedish women are dodging the law.

The search involves tax officials examining websites that feature Swedish strippers, in an effort to identify them and chase them for tax returns...

Project leader Dag Hardyson said 200 Swedish strippers had been investigated so far....

"They are young girls, we can see from the photos..." said Mr Hardyson, head of the tax authority's national project on internet trade...

Mr Hardyson told BBC News that the strippers could be liable to pay about half of their earnings in tax. Striptease via webcam is quite legal in Sweden, unlike prostitution, he added...Web search tools like spiders had failed to detect the Swedish strippers.

"When we investigated the sites manually it worked better," he added. [BBC]

Monday, April 13, 2009

Continuing observations of the character of the various peoples of our globe as revealed by their actions:

"A horse is a horse, of course, of course, and no one would give a fancy hairdo to a horse of course..." Except for Australians.

Photographs of horses sporting elaborate hair extensions are proving an unlikely internet sensation. "The idea for these images came from a discussion with a friend who said, 'Hey wouldn't it be fun to shoot horses with big hair?"," said Sydney-born Julian Wolkenstein, 36 ... He teamed up with hair-stylist Acacio da Silva to whip the horses into shape ... [Telegraph]

People Eating Tasty Animals.

Fishermen in the Philippines have accidentally caught and then eaten one of the rarest sharks in the world. The megamouth shark ... eaten by the fishermen was only the 41st ever spotted... A WWF representative said the shark was butchered and its meat sautéed in coconut milk as a local delicacy, against the conservation group’s advice... [ Daily Times ]

"Marriage is better than leprosy because it's easier to get rid of," said W.C. Fields, humor apparently not translatable into Russian...

A Russian man survived after downing three bottles of vodka and leaping from a fifth floor balcony -- twice ... Alexei Roskov says he jumped the second time because he couldn't take his wife's nagging about the first time... [Ananova]

After you put in the 14 cup holders, then what?

Dog-crazy Americans will soon be able to buy a pet-friendly car with a cushioned dog bed in the trunk, fitted with a built-in water bowl and fan and a ramp to help less agile dogs climb in...

Japanese car maker Honda Motor Co unveiled the pet friendly version of its Element utility vehicle at the New York Auto Show.

It features easy-wash seat covers, a fitted dog bed with restraints ... in the event of a crash, and a paw logo on the side.

Honda said the car would go on sale across the United States from the fall of this year ... Senior product planner James Jenkins said Americans spend $41 billion a year on their pets, a figure forecast to rise to $52 billion in two years, indicating a big market for the car. [Reuters]

New world record for rubbing hot chilli peppers into one's own eyes.

An Indian woman sets a new world record by rubbing twenty-four or the world's hottest chilli peppers into her eyes. TV celebrity chef Gordon Ramsay jumps up and down with excitement ... Video report.

Thursday, April 09, 2009

Wednesday, April 08, 2009

Regarding the Obama Administration's "cap and trade" carbon emission reduction proposal, Tom Friedman of the Times writes...

Advocates of cap-and-trade argue that it is preferable to a simple carbon tax because it fixes a national cap on carbon emissions and it “hides the ball” — it doesn’t use the word “tax” — even though it amounts to one...Deceit as a virtue! And Tom apparently agrees, as his only evident objection is, it isn't working:

opponents are not playing hide the ball anymore. In the past two weeks, you could hear a chorus of Republicans, coal-state Democrats, right-wing think tanks and enviro-skeptics all singing the same tune: “Cap-and-trade is a tax. Obama is going to raise your taxes ...Damn truth-tellers! Fighting the plan by calling it a tax merely because it is! How low can one sink in politics?

Since the opponents of cap-and-trade are going to pillory it as a tax anyway, why not go for the real thing — a simple, transparent, economy-wide carbon tax?Retreat to the classic Nixonian strategy: "Truth as a last resort". Well, Tom has a point, if deceit isn't working then what is there left to lose?

Reality is this: Efficient, well-designed carbon tax and cap-and-trade programs that reduce emissions to the same level will have the exact same effects as each other. The amount of revenue received by the government from carbon emitters through auctioning off emission permits that reduce emission levels to X will exactly match the revenue received from carbon emitters from imposing a tax on emissions that reduce them to the same level.

The reason for this should be easy enough to see. What reduces emissions from level X1 to level X is the increased cost of emitting that is dropped on emitters and collected by the government. In both cases the government imposes the same cost -- collecting the same amount of revenue from the same emitters to produce the same result -- the only difference being whether that revenue is called "auction fees" or "taxes" ... see much of a difference in that?

Well, there's no tax or economic difference in theory -- but there's a big institutional and political difference, in practice.

[] A carbon tax of a given amount per ton of carbon emitted is simple, clear and transparent. No big bureaucracy (that politicians can staff, influence and run in their own interest) is needed -- and a transparent tax makes it very difficult to hand out favors to political constituents. "Hey, how come they get a lower tax rate than we do?"

[] A carbon emission rights auction requires an entire auction "process". That means a bureaucracy to figure out how to do it the "right way", listening to lobbyists who represent various constituents who as a matter of "fairness" need the auction process adjusted for them to meet their unique circumstances, and so on.

And as a result of all the room for, and incentives driving, political intervention in the auction process, you can bet it won't be anywhere near as "efficient, well-designed" as a much simpler carbon tax, in actual practice.

OK, so which of the two options to reach the same objective do you think our rationally self-interested politicians will choose...

(1) A simple, transparent, efficient method that limits the politicians' ability to interfere in it; or

(2) A complex, opaque method that requires the politicians to manage it, thus making the politicians' "empathy" more valuable to constituent groups and their lobbyists, who become more highly motivated to, um, "earn" it ... regardless of how that degrades the efficiency of the program.

Why, they'd pick the option they have picked, #2, of course!

Because that's how they benefit their political careers the most. Which is good for them. Even though it means playing "hide the ball" with the fact that #2 really is just a much more complex and opaque version of #1, as Tom says.

Deceit as a virtue in politics.

Monday, April 06, 2009

Mankiw suggests the NCAA is evil, citing...

... college sports is big business, but very little of this flows to the student-athletes...While Robert Barro points to the NCAA's particulary perverse success at selling itself as the "good guy"...

At a time when most schools are tightening their belts with salary freezes, staff layoffs and the like, the University of Tennessee just announced it was going to start paying two assistant football coaches $650,000 or more each (the head coach makes $2 million).

Jim Calhoun, head coach of the University of Connecticut men's basketball team, recently made headlines when he launched into a tirade at a blogger who questioned his $1.6 million annual compensation. Those high salaries are financed from the talents of unpaid student-athletes. (Talk about income inequality.) So not only are the young being exploited, but the exploitation is being committed by their adult mentors...

"...more impressive is the NCAA's ability to maintain the moral high ground ... the athletic association has managed to convince most people that the evildoers are the schools that violate the rules by attempting to pay athletes, rather than the cartel enforcers who keep the student-athletes from getting paid..."... in naming the NCAA "The Best Little Monopoly in America".

My only disagreement with them is that they're too easy on it.

Sunday, April 05, 2009

I had an accident today. While turning through the pages of the Sunday NY Post looking for the gossip, the Parade supplement dropped out and fell open to her column, "Ask the Lady with the Guinness Book of World Records Hall of Fame Highest IQ!" The question for her there was...

"...But what about all the folks who buy a stock at its high of $100 and then watch it collapse to $1 per share? Where did that money go? "

Marilyn's answer:

Their money went into the hands of the sellers. But this real-money figure accounts for only a small proportion of the “lost” money.Huh? Can you follow that? I suppose her first sentence was literally correct, and she might have stopped there. But she went on, and the rest of her answer was a mix of incoherent and wrong. For instance...

When those folks bought the stock at $100, they artificially inflated the net worth of all the shareholders, including the people who bought the stock at $1, $5, and so on. That’s because brokerage statements indicate that everyone’s stock is worth the last share price multiplied by the number of shares they own.

This huge collective amount—derived from the misleading multiple—is the nonexistent money that people believe they have lost when a stock tanks.

But what if they had all sold the stock at its peak? Wouldn’t that make the money real? Nope. That was never possible. Only the early sellers get the peak price. When sellers start to outnumber buyers, the price drops. And with many would-be sellers, the stock plummets. Shareholders find themselves back at square one, asking the same question: “Where did all the money go?”

When sellers start to outnumber buyers, the price drops... is flat wrong. At any given market price the number of shares sold and bought exactly match ... obviously! And as to the numbers of sellers and buyers, who knows? On either side there could be one person dealing all the shares, or as many people as shares dealing one each, or anything in between.

Moreover, it makes little sense to talk about numbers of buyers and sellers, because at a high enough price everyone who owns a stock will try to sell it, while at a low enough price hordes of people will seek to buy it. So potential buyers and sellers both exist in the market in indefinitely large numbers at all times. What the market does is find the one price at the moment at which the number of shares sought to be sold and sought to be purchased are equal.

And her ...

But what if they had all sold the stock at its peak? Wouldn’t that make the money real? Nope.... muddles "value" with "money" to everybody's confusion. Nobody "makes money real" except the Federal Reserve using green ink and special paper.

So was that answer really worthy of a purported IQ of 228? Or does the economy operate so counter-intuitively that even geniuses don't understand the very basics unless they read a textbook about it?

My own proven middlin' IQ might have answered something like this, in the same number of column inches...

"To say somebody 'made money' in the stock market is a colloquialism. Nobody literally does that -- the Federal Reserve makes money with printing presses.

"When buying stock shares you swap money for them, when selling shares you swap them for money. There's no mystery about where the money goes -- back and forth between buyers and sellers, in unchanged amount.

"When stocks shares you own go up in price you may think, "I made money!", but actually you gained wealth through their increase in value. If your shares fall in price you may cry, "Where did my money go?" But you lost wealth, not money, as their value fell. Your money was gone before their value fell, as of the date you bought them. To see where it went look in your checkbook: to whom did you write that check?

"As the stock market rises and falls, no money is literally "made" or "lost" at all.

"The simple lesson is: don't take colloquialisms literally, you'll confuse yourself."

The next question for Marilyn was...

My neighbor claims that one cup of regular brewed coffee has more caffeine than one shot of espresso. Is he right?

Her answer....

Yes. At Starbucks, the world’s largest chain of coffee houses, one cup (8 oz.) of coffee has about 180 mg of caffeine. A shot (1 oz.) of espresso has about 75 mg....It takes an IQ of 228 to call Starbucks and ask: "Hey, which has the most caffeine...?" (Or tell your assistant to do it?)

Friday, April 03, 2009

The US government's budget deficit for 2008 was $454.8 billion as officially reported by the Treasury -- the number reported in the news that everyone writes editorials and op-eds about.

But wait ... the Treasury has also published another set of numbers on its web site, in its 2008 Financial Report of the United States Government, that give a very different figure for the increase in its net liabilities for 2008, albeit one that receives very little publicity: More than $3 trillion, with a "t".

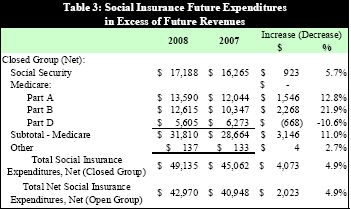

For starters, the one-year increased liability for Medicare and Social Security all by itself was $2.023 trillion (but not included in the official deficit number).

Then there is another $550 billion for pensions for federal employees and veterans, also not included in the official budget and deficit numbers...

In FY 2008, the Government’s budget deficit of $454.8 billion (budget basis reporting) was $554.3 billion less than its net operating cost (from the Financial Report) of just over $1 trillion ... almost the entire difference between the Government’s budget deficit and net operating costs in FY 2008 can be attributed to a $550 billion increase in net accrued but unpaid Federal employee and veteran benefits. This amount is not included in the Budget, but is recognized as a cost and liability in the financial statements... [FRotUSG]So already we're at...

Official deficit.......................... $455 b... a total of more than $3 trillion for the increase in the government's real liabilities during 2008 -- and that's not counting many more little odds 'n ends that won't be bothered with here.

Pension liability increase ............... $550 b

Medicare/SocSec liability increase ..... $2,023 b

Total .................................. $3,028 b

To put that $3 trillion in perspective....

[] All federal revenues of all kinds in 2008 totaled $2,524 billion. Thus, to cover the $3,000 billion liability run up by the government would have required a 120% increase in all kinds of federal revenue across-the-board -- income taxes (personal and corporate), employment taxes, gas tax, excise taxes, tariffs, admission fees to national parks, all of 'em -- to 2.2 times what they are today.

[] All income taxes, personal and business, total $1.5 trillion. So to cover the $3 trillion with income taxes would on its face require a tripling of income tax bracket rates -- to 30% for the working poor, and 105% as the top rate for businesses and individuals.

[] All federal expenditures in 2008 totaled $2,979 billion. So the government ran up a one-year liability increase in 2008 that was larger than the government itself!

[] The total U.S. national debt held by the public at the end of 2007 was $5.04 trillion. That was the balance of all US bonds sold to the public since George Washington was inaugurated ... for purposes such as fighting two World Wars, getting through a Great Depression, putting men on the moon, waging the Cold War and defeating Communism ... over a period of 219 years.

The one-year "off the books" liability increase for 2008 of $2.58 trillion was more than half of that -- for Social Security, Medicare and federal pensions alone.

HOW IT HAPPENS

How can two such hugely different numbers one year's debt increase -- one 6.6 times larger than the other -- be provided by the US Treasury for the same thing? The answer lies in accounting methods: the difference between cash and accrual accounting.

Cash accounting is what the government uses for its official budget and deficit calculations. It counts only cash income "in" and cash expenditures "out" during the year, and comes up with a net total.

Accrual accounting, in contrast, also counts legally incurred rights to receive future income, and obligations to make future expenditures, that accrue during the accounting period.

The federal government uses cash accounting when computing its official budget deficit number.

In the private sector, cash accounting is illegal for most businesses much larger than a newsstand, and accrual accounting is required instead. The reasons should be obvious, but a simple example can make them clear.

Say you are running a business and one of your expenses is an obligation to pay pensions and health benefits to your employees when they retire in the future. Possibly, if you are fiscally responsible and a hard bargainer, you even have your employees pay to you, now up-front, amounts to cover the cost of their retirement benefits later.

With accrual accounting you count in your income for the year all the net business income you earn, plus the contributions from employees you receive, and then subtract from that amount the increase in your future liabilities, discounted to present value. (So if your liability to retirees 20 years from now increases by $1 million, and the interest rate is 5%, you incur a $377,000 charge against your income today). That gives you a full picture of your finances, looking into the future. In contrast...

With cash accounting all you count is your net cash income today, including the contributions from your employees towards their future retirement costs -- and you ignore the cost of the future retiree benefits you are running up. So those employee contributions you collect are pure profit!

Hey, do yourself a favor! Give your employees much bigger future retirement benefits, in exchange for bigger contributions from them today. Your profit just went way up! Now point out how you increased the business's profits to its happy shareholders. Give yourself a big raise and cash bonus as a reward!

Of course, a generation later, when all those retirement benefits suddenly come due as a cash cost, the business may well turn out to be General Motors or Chrysler with its shareholders howling, "if we were so profitable, what the !@#$% happened?", all the way to bankruptcy court.

(But that won't be your problem, you'll be retired to your mansion on the Italian Riviera.)

Or the organization you were running could turn out to be the US federal government. In 2008 it ran a cash deficit on operations of $638 billion. But it also received $180 billion in cash contributions towards future Social Security benefits that it included in its income, which (combined with a few other small items) reduced its cash-basis deficit to only the official $455 billion -- ignoring the $2.58 trillion liability incurred during the year for future Social Security, Medicare, and federal employee retirement benefits.

General Motors, Chrysler and the UAW were penny ante operators compared to our politicians!

DEFICITS AND DEBT

Which brings us to another point, the size of the real national debt that the real federal deficit increases annually -- including not only the total of US bonds issued by the Treasury, but also the present value of legally promised future spending for items such as, yes, federal employee pensions, Social Security and Medicare benefits.

Those who take the official defict number of $455 billion for 2008 at face value are likely to do the same with the official national debt numbers for 2008 of $5.8 trillion for "debt held by the public", and $10.0 trillion including "intra-governmental debt holdings" such as bonds held in the Social Security trust fund and other such government accounts.

But the real total accrued national debt including the "implicit debt" of social insurance liabilities, federal pensions and other items, at present value as of the end of 2008 was more than $53 trillion...

THE FUTURE

... and, as we see above, this number is growing by more than $3 trillion annually! (Under President Obama's plans it is going to grow a lot faster than that ... but that will be for next year's post.)

When will the US federal government reach the sorry financial situation that General Motors and Chrysler are in today?

Well, let's pick the year 2030 -- only 21 years from now. The Congressional Budget Office projects that just to keep even with spending increases for Social Security and Medicare, all income taxes across-the-board (both personal and corporate) will have to increase by more than 50% by then.

Social Security, Medicare, and Medicaid expenditures are projected to grow from 44 percent of Government non-interest expenditures to 65 percent by 2030.These numbers show that only 20 years from now the US federal government will be most of the way to converting itself into "a pension and retiree health benefit plan with an army".

[FRotUSG]

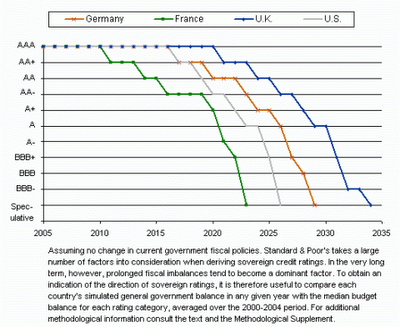

Except it may not be able to afford the army. The future credit rating of the US on the basis of current policy projected by Standard and Poor's:

"Junk" by 2027.

Well, at least the French go first.

It's National Clevage Day!

I wanted to remind everone of the fact while there's still time to celebrate!

PaaaarrtttY!!

"According to Samantha Paterson, the brand manager for Wonderbra, National Cleavage Day was started according to a design to solemnize women's independence and power in all facets of life..."Uhhhh ... maybe this goes into the "never mind" file.

[Wikipedia]