Monday, November 30, 2009

Now that he's running the entire economy, don't we all feel better?

Harvard ignored warnings about investments

Advisers told Summers, others not to put so much cash in market; losses hit $1.8b

It happened at least once a year, every year. In a roomful of a dozen Harvard University financial officials, Jack Meyer, the hugely successful head of Harvard’s endowment, and Lawrence Summers, then the school’s president, would face off in a heated debate. The topic: cash and how the university was managing - or mismanaging - its basic operating funds.

Meyer repeatedly warned Summers and other Harvard officials that the school was being too aggressive with billions of dollars in cash ... Meyer’s successor, Mohamed El-Erian, would later sound the same warnings to Summers, and to Harvard financial staff and board members...

But the warnings fell on deaf ears, under Summers’s regime and beyond. And when the market crashed in the fall of 2008, Harvard would pay dearly, as $1.8 billion in cash simply vanished. Indeed, it is still paying, in the form of tighter budgets, deferred expansion plans, and big interest payments on bonds issued to cover the losses...

Harvard ... would pay $500 million to get out of the interest-rate swaps Summers had entered into, which imploded when rates fell instead of rising...

Summers, now head of President Obama’s economic team, declined to be quoted on his handling of Harvard finances... [Boston.com]

They're calling it "the Second Louisiana Purchase".

On the eve of the showdown in the Senate over health-care reform, Democratic leaders still hadn’t secured the support of Sen. Mary Landrieu (D-La.), one of the 60 votes needed to keep the legislation alive.

The wavering lawmaker was offered a sweetener: at least $100 million in extra federal money for her home state.

And so it came to pass that Landrieu walked onto the Senate floor midafternoon Saturday to announce her aye vote — and to trumpet the financial “fix” she had arranged for Louisiana. “I am not going to be defensive,” she declared. “And it’s not a $100 million fix. It’s a $300 million fix.”... [WaPo]

And how does Congress write a law to pay a $300 million bribe, er "fix", at taxpayer expense, to purchase one vote for one party on a single issue? Here's how.

BTW, you'll remember I predicted this back when telling how "it's good to be have the power of the marginal vote".

Do you have a pet? Get a tax break and boost the economy too. Support the "HAPPY" Act!

Animal shelters across the country have reported a sharp surge in abandoned animals... Now, Rep. Thaddeus McCotter (R., Mich.) has introduced a bill that would use the federal tax code to help.OK, this sounds absurd. But really, it's not any more so than many of the other things we'd been doing lately. Have the government give $14 billion of cash to people just because they are over 65 years old (in lieu of a Social Security cost-of-living increase, when the cost of living has fallen) ... or have it give cash to people because they own pets. Not so different.The Humanity and Pets Partnered Through the Years (HAPPY) Act would allow pet owners to deduct the cost of food, veterinary care, and other pet-related expenses from their income taxes — up to $3500 per year. McCotter says the bill would provide tax relief for pet owners while at the same time strengthening "the human-animal bond."

Leo Grillo, an animal-rights activist, says a tax break for the 60% of Americans who own pets will help keep pets in the home, where they contribute to the emotional well-being of families. "If Americans are happy and emotionally stable, they are going to be more productive, and that helps the economy," he says... [Parade]

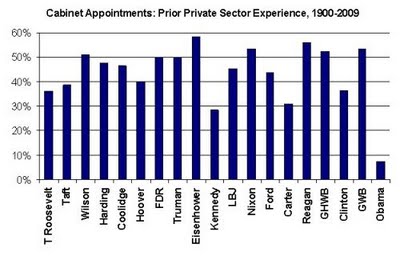

"Federal government to staff -- no private sector experience necessary."

Sunday, November 29, 2009

The Sunday sports section

~~

How to beat the spread on NFL football games, II. Again from Pro Football Reference.com:

... Now here's what you should be thinking: Chase picked four relatively arbitrary stats, combined them in a totally arbitrary way without explaining why, and then multiplied them by a number he picked from his you know what. How could these possibly be useful?...~~~

To see how my system did, however, you need to look at the most extreme games. In 462 games, my projected point spread differed from the actual point spread by 5.0 points or more. The team my system would say was underrated by the point spread covered in 297 of those games and failed to cover in 152 of them; thirteen games were a push. A 297-152-13 record translates to a .657 winning percentage against the spread...

Bump the requirement to 10.0 points differential or more, and the undervalued teams went 74-29-4, an incredible 0.710 winning percentage.

The bad tattoos of pro athletes. Really, with all the money these guys make they could afford better -- at least some proofreading...

...that's not as bad as the tattoo that Washington Wizards G/F DeShawn Stevenson added this past offseason -- a Pittsburgh Pirates "P" on his cheek. The only problem is, it's backward. Did you do it yourself in a mirror, DeShawn? Because it looks like a 9.(More)

"If you're standing [farther away] it looks like a P," Stevenson told The Washington Times, in what has to be a leader for Dumbest Quote of 2009...

~~

Forget the Belichick brouhaha everyone was mad about last week. The game ending/losing coaching Epic Fail of the year -- maybe any year -- was committed by Les Miles of LSU (with his $3.5 million "amateur sports" salary) last week, who clearly had no idea what the @#$%! he was doing as his team exercised mass confusion while time ran out rather than kick a short field goal to win.

Then he lied about it, telling the press after the game, "The one thing we couldn't do there is clock (spike) the ball. I have no idea who told the QB to clock the ball". This while video of the game clearly showed him jumping and waving and yelling at the QB "clock the ball!, clock the ball!" As the ESPN announcers said later, "Coach, you've got to know you're on camera". The story, and assorted videos.

~~

It had to be the biggest sports story of the year, and I missed it! I know it was the biggest story of the year because in the print edition of the New York Times sports section it was full-page width -- five columns wide -- and they don't even give that to any single story on the Super Bowl!

This vital reporting was about a dramatic, indeed traumatic event in women's college soccer...

ALBUQUERQUE — Nearly two weeks later, the University of New Mexico soccer player Elizabeth Lambert said she still could not fully explain what led her to yank an opponent from Brigham Young down by her ponytail...I missed this story because for some reason I don't read the sports section of the Times any more, and it wasn't noticeably reported by any other newspaper, television or radio show, or web site that I pay attention to.

I saw it only because there was a week-old copy of the Times my wife had left lying in the house, and I noticed the story while taking the paper to recycling.

I apologize for my ignorance and neglect.

Friday, November 27, 2009

Paul Krugman can’t stop debunking his former hysterical self.

Deficit hysteriaAlthough he gives it to us (again and again and again and again) in his ongoing campaign to fight hysterical fear of surging government deficits and the ever-growing national debt.

Urg. Big piece on the front page saying that, on the one hand, some people say that we’re going to have a debt crisis any day now, while on the other hand ... well, actually we never hear from the other side...

Ah ... but remember who was leading the flight into hysteria not so long ago, urging us all to be afraid, very afraid: his very self!

I'm terrified about what will happen to interest rates once financial markets wake up to the implications of skyrocketing budget deficits... we're looking at a fiscal crisis ... a looming threat to the federal government's solvency.Thus explaining why he paid good money to refinance from a variable-rate into a fixed-rate mortgage -- to save his home from the coming "banana republic" fiscal calamity!

That may sound alarmist: right now the deficit, while huge in absolute terms, is only 2 , make that 3, O.K., maybe 4 percent of G.D.P.

But that misses the point ... because of the future liabilities of Social Security and Medicare, the true budget picture is much worse than the conventional deficit numbers suggest.

... the conclusion is inescapable. Without the Bush tax cuts, it would have been difficult to cope with the fiscal implications of an aging population. With those tax cuts, the task is simply impossible. The accident, the fiscal train wreck, is already under way.

How will the train wreck play itself out? ... my prediction is that politicians will eventually be tempted to resolve the crisis the way irresponsible governments usually do: by printing money, both to pay current bills and to inflate away debt. And as that temptation becomes obvious, interest rates will soar.

... investors still can't believe that the leaders of the United States are acting like the rulers of a banana republic. But I've done the math, and reached my own conclusions -- and I've locked in my rate.

Yet today, with the the long-term budget situation much worse, he switches to bashing debt hysterics like his former self -- and supporting Obama's renewal of the bulk of the Bush tax cuts. Hey, interest rates aren't likely to increase soon; and in the longer run the debt held by the public won't be any larger in 2019 than it was in 1950 for Ozzie & Harriet, and things worked out fine for them. Oh, and European nations are carrying that much debt already without the roof falling in on them, so what’s to worry?

(More detail: Krugman versus Krugman.)

"But, Paul, because of the future liabilities of Social Security and Medicare, isn't the true budget picture much worse than these conventional deficit numbers suggest? Making it simply impossible to cope with the fiscal implications of the aging population?"

"What? What?"

Here all the Krugmanista apologists rush to interject, "Hey, before he was talking about the long-term budget mess (created by the Republicans) but today he is talking about short-term deficits desperately needed as a stimulus in the Great Recession."

Sorry, no dice.

Krugman the deficit hysteric wrote that he was "terrified" about "what will happen to interest rates once financial markets wake up to the implications of skyrocketing budget deficits".

Krugman the deficit Pollyanna trashed a Times story that wrote:

The United States government is financing its more than trillion-dollar-a-year borrowing with i.o.u.’s on terms that seem too good to be true. But that happy situation, aided by ultralow interest rates, may not last much longer ... interest rates are sure to climb back to normal [when] the emergency has passed...Both are talking about a future of normal times -- except for huge debt. Nobody doubts deficits can be financed today at low short-term cost. The issue is the long-term implications of debt fast growing from huge to huger, after the recession is over.

When Hysteric Krugman wrote that he was protecting his home from “the looming threat to the federal government's solvency” he was talking about the end years of his mortgage -- the 2020s.

When Pollyanna Krugman compares 2019 to 1950, and writes "I haven’t heard that anyone considered America a debt-crippled nation when JFK took office," he's comparing the 1950s to the 2020s. Same time!

Hysteric Krugman wrote about entitlements in the 2020s...

Without the Bush tax cuts, it would have been difficult to cope with the fiscal implications of an aging population. With those tax cuts, the task is simply impossible. The accident, the fiscal train wreck, is already under way.Pollyanna Krugman writes about these entitlements in the 2020s ... um, not a word, nor here, nope, nope, nope.

Great! It seems we’ve found the remedy for the Bush tax cuts making it "simply impossible ... to cope with the fiscal implications of an aging population": Renew the Bush tax cuts when they expire as the Obama-Democratic tax cuts, and forget that the implications of an aging population exist!

Pollyanna, short-term Krugman says to look at how all these other European nations can have more debt than the US without being hurt so far as they head towards their own retiree funding crises. OK, but we might also want to look at some of their projected future sovereign credit ratings.

As to the US, before the recession and the arrival of all this new debt, with 2007 as a base line, to keep up with the exploding entitlement spending costs Krugman now ignores, we were heading towards needing a 50% across-the-board income tax increase (or the equivalent) by 2030, to keep the US from taking its spot on that chart. Now it’s worse.

The bottom line here is: either Krugman made a bad mistake in refinancing his mortgage for fear that the "banana republic" politicians of the 2020s will turn to "printing money, both to pay current bills and to inflate away debt. And as that temptation becomes obvious, interest rates will soar", or he didn’t.

Hysteric Krugman wrote: "I've done the math, and reached my own conclusions": that banana republic fiscal calamity is coming before his mortgage runs out.

But now Pollyanna Krugman has re-done the math -- with trillions of additional debt added into the equation -- and claims it says the 2020s figure to be the happy days of the 1960s all over again.

That’s some special kind of math!

(It’s almost as if mathematical results depend on whether or not deficits are being directed by Democrats on spending Krugman that likes, such as creating an entire new major entitlement. Is that too cynical?)

But really, one can't do the same arithmetic for the same date and come up with two such radically different results.

At least one of those results has got to be a mistake (if not political propaganda).

Which do you think it is?

Thursday, November 26, 2009

For a highly happy Thanksgiving dinner...

Here's a recipe ...

Here's a recipe ..."... Holding the turkey upright, with the opening of the body cavity at the bottom, lower it onto the beer can so that the fits into the cavity..."...and videos illustrating cooking how tos. Note: You may need a larger than regular-sized beer can, like a 32-oz Fosters or Heineken mini-keg.

(Personally I find this a lot more appealing than deep-frying the dang thing.)

If on the other hand you are an urban type who's planning on having others cook for you, and you happen to be in New York City, you might consider dropping in at O'Casey's Tavern on East 41st Street...

A Tipsy Turkey DinnerTell them I sent you ... and tell me if it was worth it.

... "It's a turkey you can eat and drink at the same time, but you'll need a cab home," said pub owner Paul Hurley, who will serve up birds injected with 100-proof Georgi vodka. "There's an ounce of vodka in every bite."Hurley, the owner of O'Casey's, said his mother came up with the idea in Ireland 15 years ago.

Although the bird will have a strong vodka flavor, a lot of the alcohol content will evaporate in the oven, said chef Paul Loftus. So to ensure a strong kick, Loftus will add plenty of sauce -- and we do mean sauce -- to the cooked gravy, which he'll serve with a straw.

And in case this still isn't enough of a hit, each serving of bird will include a turkey-embedded reservoir with a fruit-flavored vodka shot and a straw, allowing diners to eat, drink and be merry -- all in a single bite.

[Sunday] marked the first step of the process, with Loftus injecting 8 ounces of the vodka into each of the 20-pound birds. He'll continue the process every six hours until Thursday, giving the turkey more than half a week to soak up a half-gallon of hooch.

Loftus is also using apple, lemon, peach, orange and cherry vodka for a fruity finale. And, of course, the chef recommends pairing the meal with vodka martinis.

The $29.95 meal includes a hefty serving of sauced turkey, sage and sausage stuffing, cranberry sauce, sweet potatoes and a cab to anywhere in Manhattan...

Those who want to eat at home but don't want to cook can pick up the whole cooked bird at the pub for $69. [NY Post]

NYC: The poor are better off hungry than eating trans fats.

Hungry, sure, but food is healthierThe poor on the city's food lines say to Billionaire Mayor Bloomberg, "Thank you for making our hunger so much more healthy."

When a small church comes to the Bowery Mission bearing fried chicken with trans fat, unwittingly breaking the law, they’re told "thank you." Then workers quietly chuck the food, mission director Tom Bastile said.

"It’s always hard for us to do," Basile said. "We know we have to do it."...

Lines at soup kitchens are up by 21 percent this year, according to a NYC Coalition Against Hunger report released yesterday.

The city’s law banishing trans fat took effect in July 2008 and touched everyone with Health Department food licenses — including emergency food providers... [Metro]

Wednesday, November 25, 2009

Battling headlines of the day

New York Times, November 17:

USA Today, November 17:Hunger in U.S. at a 14-Year High

(Print edition version: "49 Million Americans Report Lack of Food”)

Study Foresees an Increase in Obesity and Its Costs

the search for ways to slow the growth of health care spending ... may be overwhelmed by the surging prevalence of obesity ... if current trends continue 103 million American adults will be considered obese by 2018. That would be 43 percent of adults.

'Wake-up call': 1 in 6 went hungry in America in 2008America, land of miracles! Land of the increasingly starving increasingly obese!

Rising obesity will cost U.S. health care $344 billion a year

Or maybe it's just that two studies by different groups got released to the press by their

And the press fulfilled its role of credulously

Charles Lane of the WaPo squares the data circle.

Tuesday, November 24, 2009

The untold George Carlin....

~~~ quote ~~~Who says mere men of business do no good?

... In 1972 ... between [his wife] Brenda’s drinking, his pot use, and their mutual dependence on cocaine, the couple began a death spiral.

By 1974, both were suffering from hallucinations. Brenda would see groups of nonexistent people on their roof, and once tried to stab George with a sword because she didn’t know who he was.

On one Hawaiian vacation, the pair brandished knives at each other in front of their 10-year-old daughter Kelly. The sobbing young girl made them sign a contract swearing to shun pot and coke, which they signed but did not honor.

When they returned, the difference between the sun’s appearance in Hawaii and California convinced Carlin that it had exploded. He rushed his family out onto the lawn, screaming that the world would end in eight minutes, before reason finally prevailed.

The couple cleaned up soon after, but Carlin lost his comedic edge. His career tanked, and thanks to his years of drugged oblivion, he owed the IRS millions.

As his fortunes neared bottom, a man named Jerry Hamza became his manager, and developed a plan for Carlin to come back as someone with “a permanent place in comedy.”

Hamza’s plan succeeded wildly, and he would remain Carlin’s manager and best friend until Carlin’s death last June...

-- from a New York Post review of the Carlin memoir, "Last Words".

~~~

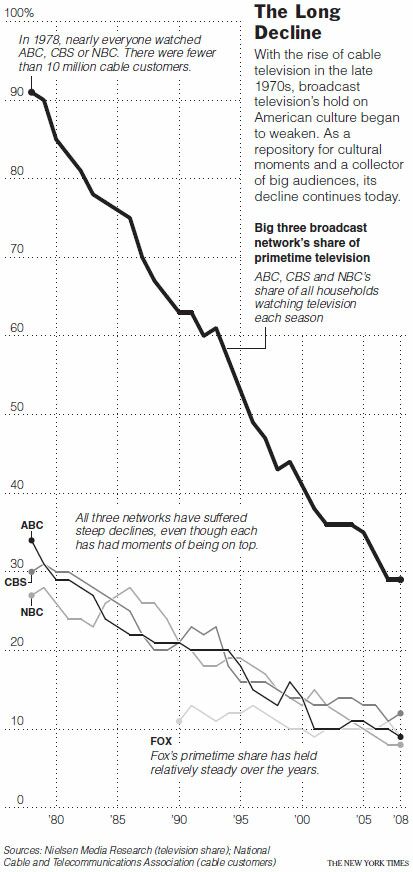

Broadcast television networks -- the long goodbye.

Oh, ain't it so.

... the cultural implications of the decline of broadcast television may be as profound as the business forces at play.

Broadcast television was “a place, an arena, where ideas were presented in a fashion in which people could become attached to or explore,” said Mr. Newcomb, the professor.

"Issues with civil rights and the women’s movement were embedded into entertainment programs and people would see them and either accept it or reject it," he said. "Today, you can watch TV and not have to be challenged."

~~

I well remember the days of my childhood when families all across America would sit together in front of the TV and form a common culture, together exploring all the dramatic social and political issues of the 1960s -- war, peace, civil rights, the sexual revolution, nuclear disarmament, rock music, the drug culture -- while watching America's #1 show, The Beverly Hillbillies. Followed by Green Acres.

Monday, November 23, 2009

From around the blogroll...

Now comes a national map of changes in home prices during the crisis, and a discussion of what made that handful of states special, at Econbrowser. (Note all the "white area".)

[] "African leaders advise Bono on reform of U2." William Easterly is back from Africa. Just read his whole blog, and keep reading it for what's happening among those with real economic problems.

[] Interesting musing on how IQ is valued in politics and out, at Falkenblog.

[] How helping the poor through means tested benefits traps the poor: They are punished for increasing their income by very high effective tax rates "that can reach or exceed 100 percent" as their benefits are reduced. Via Greg Mankiw

[] Marketing global warming [.pdf]...

"The language we use to describe the challenge of climate change is huge, hyperbolic and almost pornographic; the language of the solutions is often all about ‘small, cheap and easy’. We need to make solutions sound more heroic, use grander terms, and make the scale of the solution sound equal to the scale of the problem."via voluntaryXchange

[] "Farewell to the worst deal in history", as Time Warner prepares to spin off AOL (says the Telegraph). Ah, but it was the best deal in history if you were an owner of AOL, says Tim Worstall, as what was basically a grossly overvalued gaming/chat room service with a dubious business model acquired one of the great media businesses of the century.

If Steve Case had just declared victory and walked away to become a professor or buy a pro sports team or something -- instead of staying on in the top management of the combined

[] At Volokh, amid continuing discussion of the traditional use of the Socratic method in law school education...

The Really Traditional Socratic Method: You ask people hard questions. Then they kill you.

Sunday, November 22, 2009

Sunday Sports Section

The former home of the NFL Detroit Lions, built in 1975 at a cost of $55.7 million -- $224 million 2009 dollars -- has been auctioned off for $583,000. The sale includes 127 adjacent acres.

The Silverdome had also served as home to the Detroit Pistons, hosted Super Bowl XVI in 1982, and games of the 1994 World Cup.

The winning bidder was "an unnamed Canadian company that plans to bring a soccer league to the stadium. The company's name will be released when the sale is finalized."

With its 80,311 seats, the world's cheapest "personal seat licences" to the new soccer team's games would seem to cover the stadiums entire purchase price amply. (For $7.25 a seat, I might buy a couple from here in NYC in case I ever go out there to visit.)

[] When the lady of the house suggests you turn the game off before it upsets you, maybe you should listen for both your sakes. Via the Sports Economist...

... we find that upset losses by the home team (losses in games that the home team was predicted to win by more than 3 points) lead to an 8 percent increase in police reports of at-home male-on-female intimate partner violence.It was a great week to see growing divide between ye olde time traditional sports fans and the newly influential quantitatively analyzing sports geeks...

There is no corresponding effect on female-on-male violence. Consistent with the behavioral prediction that losses matter more than gains, upset victories by the home team have (at most) a small dampening effect on family violence. We also find that unexpected losses in highly salient or frustrating games have a 50% to 100% larger impact on rates of family violence...

-- Economists David Card and Gordon Dahl, NBER working paper.

~~

[] Tim Lincecum wins the Cy Young award for best pitcher in the National League. And he did it winning only 15 games, the fewest in baseball history (in a non-strike shortened season).

The traditionalists protest, "When did pitching victories become passe?" I had to listen to a ranting host on NYC's biggest sports radio station: "All my life judging pitchers by wins and losses and maybe Earned Run Average has been good enough for me. Why do I have to listen to all these other geek stats? They're made up by overaged kids who live in the basement and never had a date."

Yeah, like Theo Epstein.

The obvious problem with deciding who's the best pitcher by "wins" is that baseball is half offense and half defense, pitching is only part of defense, and starting-pitcher candidates for the Cy Young award throw on average about seven of the nine innings per game (78%).

Say (generously) that pitching is 90% of baseball defense, then a top starting pitcher is responsible for only about 35% of the "won - loss" outcome (50% x 90% x 78%) in the games he pitches. The other 65% that is "not him" can have a huge impact on his W-L record -- does he pitch for bad team playing a tough schedule? Or a good team with an easy schedule? Etc. All the new statistics measure much more tightly the performance of each pitcher himself.

The divide between the traditionalists and the stat heads was clear in the Cy Young voting. The most first place votes for the award went to Adam Wainwright, who led the league in wins with 19. He collected 12 of those, but only five seconds along with 15 thirds -- and became only the second player with the most first-place votes to not win the award. Lincecum received 11 first-place votes, 12 seconds and nine thirds.

The Baseball Writers Association of America, which delivers the Cy Young award, has two voters for it for each MLB city, but is increasingly designating voters at "stat" organizations such as Baseball Prospectus.

"Five years ago, Lincecum wouldn’t have stood a chance in the voting,” Dave Cameron wrote at fangraphs.com ... "He might not have even stood a chance a year ago. But there are clearly members of the Writers Association who are not clinging to the analysis that they grew up with." -- NY TimesWe're past the tipping point in baseball. As the Theo Epsteins take over the team front offices, expect the stat geeks to take over the award ceremonies and other recognitions of talent as well.

But as to fooball...

[] Belichick's "4th and 2" brouhaha -- and the ignorance of experts. The Lincecum dispute was as nothing compared to the explosion of arrogant ignorance among media commentators damning three-time Super Bowl winning coach Bill Belichick of the New England Patriots after he "went for it" on 4th and 2 from his own 28 yard line, with two minutes left in the game, while ahead 34-28, against the Peyton Manning directed Indianapolis Colts.

All of football tradition says, in this position, "punt and hope your defense holds the Colts out of the end zone" -- although in their previous possession Manning had taken the Colts 79 yard for a TD in 1 minute 45 seconds. As it happened, the Pats just missed making the first down, giving the Colts the ball, who took it and won.

But if the Pats had gained the two yards to get the first down, they could have run out the clock and put the game in their pocket. And in fact, trying that was the safest, "high percentage" play, as calculated out by Advanced NFL Stats:

A 4th and 2 conversion would be successful 60% of the time. Historically, in a situation with 2:00 left and needing a TD to either win or tie, teams get the TD 53% of the time from that field position. The total WP [expected winning percentage] for the 4th down conversion attempt would be:The other computers agree.

(0.60 * 1) + (0.40 * (1-0.53)) = 0.79 WP

A punt from the 28 typically nets 38 yards, starting the Colts at their own 34. Teams historically get the TD 30% of the time in that situation. So the punt gives the Pats about a 0.70 WP.

Statistically, the better decision would be to go for it, and by a good amount.

However, these numbers are baselines for the league as a whole. You'd have to expect the Colts had a better than a 30% chance of scoring from their 34, and an accordingly higher chance to score from the Pats' 28. But any adjustment in their likelihood of scoring from either field position increases the advantage of going for it.

You can play with the numbers any way you like, but it's pretty hard to come up with a realistic combination of numbers that make punting the better option.

But, oh boy, don't tell that to the commentator "experts". The New York Daily News made it a Page One cover story (in New York -- the Pats don't even play here)

Call it the gaffe heard 'round the world.Bill Simmons at ESPN.com had an extended tantrum...

Patriots coach Bill Belichick's brutal mistake Sunday night - going for it on fourth-and-2 from his own 28-yard line with a 6-point lead and 2:08 remaining - not only cost his team a win against Peyton Manning and the rival Colts, it also made him the whipping boy of Monday-morning quarterbacks everywhere.

"This was as bad as anything the Red Sox ever did," writes columnist Dan Shaughnessy in Monday's Boston Globe. "Had it been a playoff game, it would be right up there with Bucky Dent, Bill Buckner, Aaron Boone, and History Derailed in Glendale, Ariz."

Ouch.

"Bill Belichick, dummy," the Daily News' own football expert Hank Gola writes in his recap of the 35-34 Indianapolis victory, calling it "one of the most bizarre coaching decisions in the history of football."... "Is there an insanity defense for football coaches?" writes Ron Borges in the Boston Herald...

There was no angle other than "What the f--- was Belichick thinking?" None ... and this is coming from someone who watches 12 hours of football every Sunday dating back to elementary schoolWow, that's an impressive claim to authority, isn't it?

But probably most enjoyable was Peter King, who actually tried to play the numbers game but then forgot how to use arithmetic...

Let’s place the odds of Brady getting two yards at 60, 65 percent. The odds of Manning going 72 yards to score a touchdown in less than two minutes ... that’s maybe 35 percent.Then he forgets to calculate out his own numbers, which is just as well because with them (Brady having a 65% chance to get the two yards) punting can be the wrong decision only if the Colts' chance of scoring exceeded 100% when the Pats' fourth down attempt fails.

Which all in all leaves us with plenty of evidence that football fans are far, far behind baseball fans in learning to accept any kind of objective rational analysis of their game.

There's more here too. The first paper comprehensively demonstrating that punting is near always an error -- football teams should almost always "go for it" on 4th down to maximize their winning percentages, regardless of the situation -- was written by economist David Romer, to explore why football coaches do not do so.

The conclusion reached by Romer and many other observers is that it's because winning the game is only a coach's #2 priority. His #1 priority is keeping his job. And a coach who never punts when all the fans and media experts "know" he should risks being lynched by the ignorant mob. Ask Jim Zorn.

Belichick has the most rock-solid job security in the NFL today, so he can do the right thing and risk taking all the fire that may result. (Maybe that's part of why he wins more than any other coach.) But others...

There are larger lessons to be drawn from this -- I was going to point to how the very same media organizations report on politics, war & peace, taxes, deficits and health care reform -- and how our political leaders are every bit as concerned with job priority #1 as football coaches are ... but this has run very long, so that will be for another time. (And frankly, I don't like thinking about it.)

Saturday, November 21, 2009

Attorney General Holder flubs basic questions about terrorist trials.

We NYCers who experienced 9/11, and will have the fun of experiencing the civilian-court trial of Khalid Sheikh Mohammed and his 9/11 co-conspirators, pay attention to this sort of thing.

The AG's performance leaves even the cynical reporter from

The exchange started with Graham stumping Holder with a question one would have thought the attorney general would have been prepared for:Read the whole thing.

GRAHAM: Can you give me a case in United States history where a (sic) enemy combatant caught on a battlefield was tried in civilian court?

ATTY GEN. HOLDER: I don't know. I'd have to look at that. I think that, you know, the determination I've made --

SEN. GRAHAM: We're making history here, Mr. Attorney General. I'll answer it for you. The answer is no.

ATTY GEN. HOLDER: Well, I think --

[...]

SEN. GRAHAM: Well, let me ask you this. Okay, let me ask you this. Let's say we capture him tomorrow. When does custodial interrogation begin in his case?

If we captured bin Laden tomorrow, would he be entitled to Miranda warnings at the moment of capture?

ATTY GEN. HOLDER: Again I'm not -- that all depends. I mean, the notion that we --

SEN. GRAHAM: Well, it does not depend. If you're going to prosecute anybody in civilian court, our law is clear that the moment custodial interrogation occurs the defendant, the criminal defendant, is entitled to a lawyer and to be informed of their right to remain silent.

The big problem I have is that you're criminalizing the war, that if we caught bin Laden tomorrow, we'd have mixed theories and we couldn't turn him over -- to the CIA, the FBI or military intelligence -- for an interrogation on the battlefield, because now we're saying that he is subject to criminal court in the United States. And you're confusing the people fighting this war.

What would you tell the military commander who captured him? Would you tell him, "You must read him his rights and give him a lawyer"? And if you didn't tell him that, would you jeopardize the prosecution in a federal court?

ATTY GEN. HOLDER: We have captured thousands of people on the battlefield, only a few of which have actually been given their Miranda warnings.

[Well, it's good to know a few have!]

With regard to bin Laden and the desire or the need for statements from him, the case against him at this point is so overwhelming that we do not need to --

SEN. GRAHAM: Mr. Attorney General, my only point -- the only point I'm making, that if we're going to use federal court as a disposition for terrorists, you take everything that comes with being in federal court. And what comes with being in federal court is that the rules in this country, unlike military law -- you can have military operations, you can interrogate somebody for military intelligence purposes, and the law-enforcement rights do not attach.

But under domestic criminal law, the moment the person is in the hands of the United States government, they're entitled to be told they have a right to a lawyer and can remain silent. And if we go down that road, we're going to make this country less safe. That is my problem with what you have done.

[...] I think you've made a fundamental mistake here. You have taken a wartime model that will allow us flexibility when it comes to intelligence gathering, and you have compromised this country's ability to deal with people who are at war with us, by interjecting into this system the possibility that they may be given the same constitutional rights as any American citizen.

ATTY GEN. HOLDER: [...] The conviction of Osama bin Laden, were he to come into our custody, would not depend on any custodial statements that he would make. The case against him, both for those cases that have already been indicted --- the case that we could make against him for the -- his involvement in the 9/11 case --

SEN. GRAHAM: Right --

ATTY GEN. HOLDER: -- would not be dependent on Miranda warnings --

SEN. GRAHAM: Mr. Attorney --

ATTY GEN. HOLDER: -- would not be dependent on custodial interrogations. And so I think in some ways you've thrown up something that is -- with all due respect, I think is a red herring.

[...]

SEN. GRAHAM: With all due respect, every military lawyer that I've talked to is deeply concerned about the fact that, if we go down this road, we're criminalizing the war and we're putting our intelligence-gathering at risk. And I will have some statements from them to back up what I'm saying.

SEN. LEAHY: Senator Graham, I --

SEN. GRAHAM: My time is up.

Friday, November 20, 2009

Are you smart enough to work for Google?

Now that I know the answers to these questions, maybe the next time I'm in there I'll go upstairs and drop off an application.

Thursday, November 19, 2009

Hennesssey on Krugman on California, and the long-term fiscal strategy of the left.

With the the future of America at stake, Paul Krugman gives his take on California -- and we get a take on Krugman's take from Keith Hennessey...

Krugman telegraphs the Left’s long-term fiscal strategy when he writes about California Republicans.California was tied for second-highest per capita tax collections in the nation in 2007, according to the Tax Foundation...For what we may be seeing is America starting to be Californiafied. … And if Tea Party Republicans do win big next year, what has already happened in California could happen at the national level.

In California, the G.O.P. has essentially shrunk down to a rump party with no interest in actually governing — but that rump remains big enough to prevent anyone else from dealing with the state’s fiscal crisis.

If this happens to America as a whole, as it all too easily could, the country could become effectively ungovernable in the midst of an ongoing economic disaster.

The [telegraphed] strategy is simple:

* Increase government spending, especially through rapidly growing entitlements. At the state level it’s Medicaid.

* Wait.

* While you’re waiting, define deficits as the problem, rather than spending.

* Try to label as radical and extreme those who argue for slowing spending growth and preventing tax increases. The goal is to discredit these solutions as legitimate.

* Once deficits get large enough, shrug and say we have no choice but to raise taxes.

* This is especially true for entitlement programs directed toward the elderly, who have less ability to adjust to changed government promises.

* Argue we must protect low and middle-income from higher taxes, so upper-income taxpayers must bear the entire burden increase.

* Raise taxes on upper-income taxpayers.

* Rinse and repeat.

This is a simplified version of an Engorge the Beast strategy, which is almost the converse of the Starve the Beast strategy...

When Dr. Krugman writes "no interest in actually governing ... prevent anyone else from dealing with the state’s fiscal crisis," he means "no interest in raising taxes ... prevent anyone else from raising taxes"...

Both parties have their paranoid nutcases and bigots. Dr. Krugman tries to use a few signs [at tea parties] to discredit a reasonable position on fiscal policy. I would dismiss this as amateurish if the Times didn’t give him such a big megaphone.

California and the Federal government have another quite reasonable option available. Cut spending. Indeed, just slowing unsustainable spending growth would be a great start...Our long-term deficit problem is a spending problem...

~~

1. New York 8.8%

2. California 7.9%

2. New Jersey 7.9%

2. Hawaii 7.9%

5. Maryland 7.6%

~

US Average 6.7%

... so it doesn't seem that California's problem really is being starved of taxes by Republicans.

Indeed, there are other more complete and nuanced explanations of California problems, for instance in Who Killed California? and The City Journal's look at The Big-Spending, High-Taxing, Lousy-Services Paradigm.

As to Krugman, we might recall once again that a little while back he told the Asia Times that the US has the finances of "a banana republic" and...

"We should be getting 28% of GDP in revenue. We are only collecting 17%."... that increase to 28% being equivalent of about a 90% increase in all income tax revenue (both personal and corporate). And that was before national health care and all the recent rest.

Strangely, Krugman has never had the nerve to mention this to his American audience through his New York Times column (in spite of how he presents himself as the brave speaker of hard truths).

Perhaps, as brave about speaking truth as he is, he feels it would be tactically disadvantageous as a matter of politics to openly admit that his side's political agenda would require a 90% increase in income taxes (or the equivalent) to start with, today -- if implemented responsibly.

Wednesday, November 18, 2009

Stimulus "job saving" success of the day...

California State University officials reported late last week that they saved more jobs with stimulus money than the number of jobs saved in Texas –- and in 44 other states.There's something special about California Universities.

In a required state report to the federal government, the university system said the $268.5 million it received in stimulus funding through October allowed it to retain 26,156 employees. That total represents more than half of CSU's statewide work force.

However, university officials confirmed Thursday that half their workers were not going to be laid off without the stimulus dollars.

"This is not really a real number of people," CSU spokeswoman Clara Potes-Fellow said. "It's like a budget number..."

Runner-up job creation performance...

"A $1,000 grant to purchase a single lawn mower was credited with saving 50 jobs."... from a survey of jobs saved/created reports nationwide by the Washington Examiner.

Tuesday, November 17, 2009

Noted...

The New York Times tells us:

G.M. said Monday that while it was still losing money [a mere $1.2 billion in the third quarter -- an amount not mentioned until the story's 11th graf] it had stabilized enough that it could take an important symbolic step and begin returning some of the $50 billion that the federal government provided to help give it a second chance.Of course, what else could the administration say? But what does a bankrupt business that's still losing billions after being bailed out with taxpayers' money use to pay back a debt? Mickey Kaus expands:

The Obama administration said it was “encouraged” by G.M.’s initial performance since emerging from bankruptcy in July...

When GM says 'Here's your money back,' they really mean it!

GM "says it will begin to pay back U.S. loans." But of course it's paying back that debt to taxpayers with money from ... taxpayers. Even the new, nicer Truth About Cars isn't falling for it. GM got $50 billion from the government, after all, mainly for a 60% share in the company. It's planning to pay back $1.2 billion in December -- basically a PR attempt, TTAC speculates, to erase its negative consumer image as a bailout baby. The only hope for the taxpayers actually being repaid for their entire $50B investment is an IPO...

P.S.: Also, these financial results are not GAAP-ready. "North American Operations are still bleeding cash. And, as Henderson has admitted, the fourth quarter results for 2009 are only going to bring worse news."...

Stiglitz versus Stiglitz. Watching Nobelists argue versus themselves is always fun. But Stiglitz has a special knack for savagely criticizing the positions he'd taken with his former associates while apparently forgetting that the were positions he'd taken with his former associates -- earning from his former associates special letters of appreciation, such as ... and.

From David Warsh, interesting backstory on international advisers "doing well by doing good" while helping develop foreign economies ... sometimes doing very well indeed.

Obama was against using legal compulsion to force people to buy health insurance before he was for it.

Monday, November 16, 2009

Seen around and about...

History Matters: If you paid a $4 poll tax in 1910, your great-grandchild gets a polio vaccine todayMosquitoes caused the poll tax in 1910.

[] Monkey economics. Topics: Rewards to education and "

[] Betting on the health plan at Intrade: "A federal government run health insurance plan to be approved before midnight ET 31 Dec 2009" -- now down to 5%, at this writing. (More precisely: "You can buy this at 6.4 ... sell at 4.5").

[] Ramirez cartoon.

[] What is US citizenship worth? To most, apparently less than $675.

Currently, citizenship application and processing fees in the US are $675 per person ... [and] were increased by 69% in July 2007.Clearly demonstrating: (1) The value of citizenship is less than $675 to the 50 percent who stopped applying for it; and (2) The governmental bureaucratic attitude of "if it doesn't work do more of it, especially if it costs people money".

The number of US citizenship applications from legal residents dropped by 50 percent in the two years after the price increase. As a result, the Federal agency handling citizenship applications still runs a budget deficit, suggesting to some bureaucrats that the price needs to be raised again.

[] "Congress Approves $500 Billion For Monument To Human Folly" . It seems as reasonable as any other part of the spending stimulus -- in fact, particularly appropriate.

Sunday, November 15, 2009

Sunday Sports Section

To check whether this converts into something visible in results against the spread, the good people at Pro Football Reference.com ran the "results against the spread" numbers for visiting teams to recently constructed football stadiums.

Visiting teams on their first visit went: won 169, loss 205, push 10 = 0.453.

"That 0.453 'against the spread' winning percentage in games for road teams in their first visit is statistically significant (p=0.03) compared to the expected .500 record"

That's not a huge edge against the spread, but it's something and it looks to be real -- and how often do you have a real something against the spread? It's logical (though untested) that the same effect may exist in other sports.

In subsequent visits, the effect against the spread basically disappeared.

[] Billy Beane really did change the way baseball values talent, says research cited by JC Bradbury.

[] Baseball's Gold Glove awards command all the respect of "the teen choice awards" observes Dave Cameron, after the Seattle Mariners' center fielder, Franklin "Death to Flying Things" Gutierrez, failed to receive one this week. Cameron points to how little thought goes into selecting the winners. The WSJ's Daily Fix Blog surveys the outrage among those who do think about it, and who empirically rate fielding ability, over the Gutierrez slight and others...

when the Gold Glove awards were announced earlier this week, Gutierrez was snubbed, as were the other top five fielders from 2007-2009, except Ryan Zimmerman.Meanwhile, Derek Jeter of the Yankees won his fourth Gold Glove in spite of being maybe as good as the fifth best fielding shortstop in the American League, because, well, he is Derek Jeter of the Yankees.

[]

[] The Big Theme in the econo-sports blogs on the blogroll this week is warning against being seduced by the siren song of "big future economic benefits" into making taxpayer investments in new sports stadiums and big sporting events.

* Chicago likely won by losing its bid to host the 2016 Olympics, says Skip Sauer at the Sports Economist, citing reports that the 2000, 2004 and 2008 Olympic Games all hurt the tourism industry of the host country on net.

* The near bankrupt great state of California may only put itself deeper in the hole with the new pro football stadium that governor Schwarzenegger just got approved by the state legislature for teamless Los Angeles. Dave Berri (normally of the Wages of Wins) writes in the Huffington Post's new sports section to warn Californians, "If You Build It, Nothing Really Comes"

* The sobering warning example of how the business-end of the Kelo v City of New London Supreme Court case has turned out is put before us by Brad Humphreys, also at the Sports Economist. This was the controversial case where the Court upheld the power of local government to seize private property, including and private homes, to further commercial development.

The case emerged from the desire of New London, CT, to tear down an existing residential neighborhood in order to create a mixed use commercial/residential "urban village" anchored by Pfizer, a big pharma corporation. Last week, Pfizer announced that it was leaving New London. What is the legacy of the Kelo takings?

"Pfizer said it would pull 1,400 jobs out of New London within two years...

"It would leave behind the city’s biggest office complex and an adjacent swath of barren land that was cleared of dozens of homes to make room for a hotel, stores and condominiums that were never built...."

The important lesson here is that it is relatively easy to make seemingly credible claims about future economic benefits from an urban "revitalization" project ... But realizing those benefits is a much more difficult accomplishment, even if the planners mean well. The final outcome in New London should serve as a warning to those who swallow claims of future economic benefits hook, line and sinker.

Saturday, November 14, 2009

Anti-Krugman shot of the day.

It’s always impressive to see one person excel in two widely disparate activities: a first-rate mathematician who’s also a world class mountaineer, or a titan of industry who conducts symphony orchestras on the side.Paul really knows how to inspire people!

But sometimes I think Paul Krugman is out to top them all, by excelling in two activities that are not just disparate but diametrically opposed: economics (for which he was awarded a well-deserved Nobel Prize) and obliviousness to the lessons of economics (for which he’s been awarded a column at the New York Times).

It’s a dazzling performance. Time after time, Krugman leaves me wide-eyed with wonder at how much economics he has to forget to write those columns. But today’s, on why America should consider European-style employment protection, is his masterpiece. It opens thus ... [more]

And I have to admit, when I see him writing...

we could have policies that support private-sector employment. Such policies could range from labor rules that discourage firing... Mein Gott in Himmel! Sacre Bleu! I feel a bit inspired myself.

What's the first thing employers do when governments impose rules making it harder to fire workers?

Answer: They slash hiring, for fear of becoming stuck with low-quality workers (or workers who decide to take advantage of the new rules to slack off), hiring instead only those they can be absolutely most sure of. A good 25 years of unemployment in France averaging 10%, a level seen in the US only once every 27 years or so in a "great recession", shows that plainly enough.

In this column Krugman praises German employment policy for keeping unemployment down. Did he praise it during the previous 12 years when German unemployment averaged 8.8% (higher than seen in the US since the 1982 recession) versus the US's 5.0% ... did he praise how in 2005 it kept German unemployment down to only 10.6% (higher than in the US today) while the US level was 5.1%?

Just wonderin'.

The evil that poets do -- or, how economics became "dismal".

Quoting from William Easterly's excellent Aidwatchers blog, guest blogger Adam Martin...

~~~

... contemptible economists -– apologists for markets, purveyors of selfishness -– were the public defenders of racial equality (along with the “Exeter Hall” evangelical Christians).

Then who were the bad guys? The poets: Thomas Carlyle, John Ruskin, and everyone’s favorite literary critic of capitalism, Charles Dickens.

It was Carlyle who christened economics [social science] as the "dismal science", in contrast with the “gay science” of poetry. The context is shocking:

Truly, my philanthropic friends, Exeter Hall philanthropy is wonderful; and the social science — not a "gay science", but a rueful –- which finds the secret of this universe in "supply and demand", and reduces the duty of human governors to that of letting men alone, is also wonderful.Carlyle is arguing here for the reintroduction of slavery in the West Indian colonies.

Not a "gay science", I should say, like some we have heard of; no, a dreary, desolate and, indeed, quite abject and distressing one; what we might call, by way of eminence, the dismal science.

These two, Exeter Hall philanthropy and the Dismal Science, led by any sacred cause of black emancipation, or the like, to fall in love and make a wedding of it —- will give birth to progenies and prodigies: dark extensive moon-calves, unnameable abortions, wide-coiled monstrosities, such as the world has not seen hitherto!...

John Stuart Mill responded, in line with classical economists’ assumption of a deep human homogeneity. Differences between societies are the result of the incentives individuals face, meaning that history and institutions are the root cause of different levels of development.

By contrast, the Romantic poets argued that inherent differences between individuals justified hierarchical relationships -– for the good of the lesser races, of course.

They longed for bygone feudalism when better men cared for their inferiors, while the economists argued that equals should come together in mutually beneficial market exchange...

Economists played this part again in the debate over Irish home rule, arguing that Ireland’s economic backwardness was due to bad institutional arrangements, themselves the result of centuries of British invasions...

In both these cases, economists’ underlying egalitarianism clashed with paternalism of an ugly sort. The “dismal” label should be worn as a badge of honor...

~~~

Friday, November 13, 2009

Is it a good idea to slash executive pay when you take over a business?

Let's agree that at least in the case where the government effectively becomes the controlling shareholder of a business, such as AIG or Citibank, it has the right to set whatever pay levels and practices it wants for top executives.Pay czar backtracks

The pay czar job may be getting to Kenneth Feinberg.

The government's special master for executive compensation said yesterday that he is "very concerned" that plans to rein in Wall Street bonuses may, in fact, be backfiring.

Companies including American International Group and Citigroup, which are under government control, have complained that pay restrictions will cause them to lose talented bankers and dealmakers to rivals.

"I'm very cognizant of the concerns expressed by these companies," said Feinberg at an event hosted by Bloomberg LLC. "The law makes it clear that the determinations I render are designed, first and foremost, to make sure those companies thrive and that the taxpayers get their money back."

The issue of pay restrictions has been a hotly debated topic in Washington and on Wall Street ... those hot-button issues were on display as AIG's CEO Robert Benmosche butted heads with the government over pay caps for his top 100 earners ... reports indicated that he had threatened to resign over the matter... [NY Post]

(Let's also agree that as a matter of politics, after the financial bailouts the Obama administration had to engage in some visible "beating up" of the financial firms' top people, to appease its left-side political base and the populists.)

The question is: should you slash pay across-the-board?

One might ponder several issues (the effect on contract rights and such), but let's stick to the most simple of questions: Is it good business?

The answer is: No!

How often have you heard of, say, Warren Buffett doing such a thing after buying a business? Never.

The reason is clear. After taking over a business, you want to have the best people you can get running it for you, to make money for you.

That means you may well fire a lot of the existing management when you take over (especially if the business was failing, which was what enabled you to take it over) and replace them with a management team of your own choosing. There's no problem with that.

But as to the executives you keep -- because they know the business and are the best ones you can get to do the job -- slashing their pay is suicidal.

What's going to happen? Salaries are set in a competitive marketplace. If you unilaterally reduce your executives' salaries to below the market level, they are going to leave en masse for other jobs (such as with your competitors). Certainly your best executives are going to leave, and you will be left with only your worst.

The problem is much like the well-known one faced by businesses that need to lay off rank-and-file personnel, but which wish to protect morale in the work force by offering "voluntary buyouts" instead of imposing forced layoffs.

Who takes the buyouts? Obviously, the best employees who can pocket the money and step into another good job right away, keeping the buyout money as a profit. Who declines them? The worst employees who fear they cannot get other jobs. So the work force that remains after the round of buyouts is degraded.

Slashing the pay of top executives across-the-board is similar but worse. The best executives leave ... the worst executives who remain have their morale devastated with their slashed paychecks, making their performance even worse yet ... and these are the business's most important managers, the people most critical to the future profitability or failure of the business.

Slashing executive pay across-the-board is nothing but self-destructive populist politics, Chavez management.

"Pay Czar" Feinberg seems to have had a first encounter with reality on this issue. To the extent you are a taxpayer and thus an owner of AIG, Citibank and the rest, hope the lesson sinks in and sticks.

Thursday, November 12, 2009

Notes on the day...

This is the same Sptizer who as governor of New York initiated the events of the notorious Troopergate scandal, in which state troopers spied on political opponents ... as attorney general even more notoriously habitually personally threatened and bullied those he investigated -- in cases that later collapsed one after another ... and who was first elected to public office as state attorney general while repeatedly lying about and hiding the fact that he was illegally funding his campaign with his father's money.

And, oh yes, as attorney general and governor he did use the services of illegal prostitution rings that he was supposed to be prosecuting. His "madame" who arranged those services has written to the director of the Harvard Center for Ethics, Professor Lawrence Lessig, noting the irony.

Professor Lessig responded to his critics. "We don't have a moral test for listening to people's perspectives". [NYP]

Similarly, the Harvard Center for Morality applies no ethical test to its invited speakers' perspectives.

~~

Gallup: Generic Republicans pull ahead of generic Democrats

Republicans Edge Ahead of Democrats in 2010 VotePutting more fun into that final vote on health care!

Registered voters prefer Republicans for the House, 48% to 44%

Republicans have moved ahead of Democrats by 48% to 44% among registered voters in the latest update on Gallup's generic congressional ballot for the 2010 House elections, after trailing by six points in July and two points last month.

... independents are helping the Republicans' cause. In the latest poll, independent registered voters favor the Republican candidate by 52% to 30%.

Over the course of the year, independents' preference for the Republican candidate in their districts has grown, from a 1-point advantage in July to the current 22-point gap...

~~

Another reason why we really don't want a World Government

Transit workers are taking their gripes all the way to the U.N.As if the TWU needs more influence among our local politicians as it constantly re-sets the bar for standards of efficiency and public service.

[New York City's] Transport Workers Union Local 100 flew all the way to Switzerland to file a challenge to the Taylor Law, the state rule barring transit strikes. The union is gunning for the International Labor Organization — the world’s top dog for workplace legal questions — to recommend overturning the law.

In the 17-page complaint filed Wednesday, the union states that the law enacted in 1967 is a “severe violation” of international labor standards. The Taylor Law also posses heavy fines and jail time for transit unions that strike.

The U.N. group is likely to side with the union, as it has in other cases involving collective bargaining, said Lance Compa, an international labor law expert at Cornell University. "I think it’s a very solid complaint,” Compa said.

The organization takes at least a year to make its decisions, and while they are not legally binding, but they can influence decisions by local lawmakers... [AM NY]

If being so tough on the TWU is "a 'severe violation' of international labor standards" ... it kind of makes you wonder, doesn't it?

At last, celebrity-designed clothing I can endorse.

Wednesday, November 11, 2009

Color Photographs of World War I

The Great War is a remote black-and-white war to us, basically. But rare color photographs present the humanity of it.

Gallery of French photos ... A YouTube slide show ... More pictures, both color and not (including this color slideshow, click on the first picture).

Tuesday, November 10, 2009

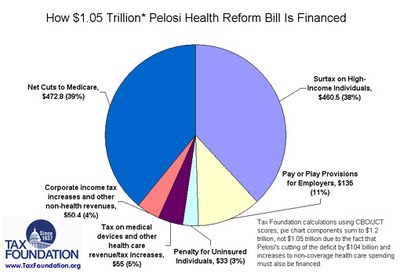

The odds of health care reform passing Congress this year

"A federal government run health insurance plan (a public option) to be approved before midnight ET 31 Dec 2009"

The money wagerers seem not overly impressed by Saturday evening's House vote. Was that "victory" for Speaker Pelosi a sign of strength or weakness?

Pelosi has a 60% majority in the House ... House rules give her the power to rule pretty much with an iron hand ... she needed 218 votes, and got all of 219 Democrats (plus one Republican) while losing 39 from her own side.

Now it is very likely that the vote really wasn't exactly that close, that once she had her 218 votes she gave permission to some Democrats to vote against the bill, as political "cover" going into the next election.

But being that the Democrats surely would have liked to pass this bill with a big majority, why would she give permission to enough members to vote against it to make the final tally so close?

Well, because now a clear majority of the public polls as being being against the health care plan: 44% in favor versus 52% against at this writing (the graph below is a "live" one that changes with updates) with the trend line rising "against"...

And among the critical "independents" -- who control the political life and death of Democrats in swing jurisdictions that were held by a Republican majority not so very long ago -- opposition to health reform has risen by 15 percentage points to an outright majority of 53%.

The Democrats just saw their team lose big in swing state Virginia and the normally totally Democratic state of New Jersey. Senators now are openly talking about taking the legislative process over into 2010, which has an election in it. The Senate is going to have great fun passing this bill -- and if it does, it and the House will have more fun reconciling what clearly will be two very different bills into one as they keep more than one eye on the polls and approaching 2010 vote.

Keith Hennessey, former Director of the U.S. National Economic Council, calculates the odds on various possible outcomes and legislative strategies going forward from here.

UPDATE: Those poll numbers will determine all, says Mickey Kaus, who believes the supposed "problem issues" for the health care plan -- the public option, who pays how much in taxes, abortion, who gets what subsidies -- aren't real problems at all.

If the Democrats think they will win in 2010 by passing a health care bill, there is no problem issue that they can't compromise, defer, or otherwise fudge to get a bill voted through.

But if enough Democrats start thinking they will lose their seats due a bill, you can look for them to start taking "principled stands" on these issues that are "too important to compromise" -- to scuttle any bill presented to them, while remaining able to say that of course they were for health care reform all along.

So watch those poll numbers.

Monday, November 09, 2009

Economics textbooks having trouble predicting the present.

Beware what you read in textbooks." the Soviet economy is proof that, contrary to what many skeptics had earlier believed, a socialist command economy can function and even thrive"

-- Paul Samuelson's textbook on economics, probably the most influential ever, 13th Edition, 1989, the year the Soviet eastern block collapsed.

Hat tip: Luskin

The Berlin Wall fell 20 years ago today.

I remember the fall of The Wall well. I had friends living in East Berlin when it happened -- they thought it would never happen (nobody believed it would so soon). Earlier I'd had my own personal close encounter with a Soviet military invasion and occupation force. But enough of that -- you know about Communism, I hope. There's no need to repeat the contents of the Black Book of Communism, as long as they are remembered.Berliners to mark demise of Wall

World leaders are due to join thousands of people to mark 20 years since the Berlin Wall's fall, an event that paved the way for the end of the Cold War. The main celebrations in the city will be at the Brandenburg Gate ...

Giant dominoes will be toppled to show how Communist governments in Eastern Europe fell one after another in 1989... [BBC]

It's also worth remembering -- as a warning, when looking to our own future -- the amount of support the builders of The Wall received from many on the western side of it.

In 1982, the leftist intellectual journal Semiotext(e) published the German Issue, more than 300 pages dedicated to the then-split nation. Now, on the 20th anniversary of the fall of the Berlin Wall, the journal is reissuing it ...Too bad they didn't realize it before then -- perhaps from the number of people being shot trying to flee the East, and the very need for a Wall to keep them in.

It is fascinating not just for its content -- it includes pieces by Michel Foucault, Martin Heidegger, Heiner Müller, Cristo, Jean Baudrillard and William Burroughs -- but also for its nature as an artifact. It is suffused with the leftist idea of political revolution, envisioning a Marxist/socialist idyll over exploitative capitalism...

Even as contributors wrote about the troubling issues of surveillance and control, there is a sense that a communist state was to be desired...

The underlying assumptions are exposed in the conversation between [editor] Lotringer and [film maker] Schlöndorff, which took place in June this year.

"The German Left in general," Schlöndorff says, "always suspected that what was on the other side of the wall, in East Germany or in all the socialist countries for that matter, was not really socialism.... 'If you are not happy here, why don't you go to the other side?' the conservative and bourgeois press kept asking them. And I must say, in retrospect, that it was a very valid argument.... But the Left would not accept the argument. There was a complete blindness, especially in West Berlin, on the true nature of the system in the East."

After the wall fell, Schlöndorff went to East Germany to lead UFA, a once-famous film studio that had languished for decades. "I came to realize that this socialism that we had dreamt of not only had destroyed the economy, the habitat and the environment -- it had really destroyed the people; it had broken their back ..." [L.A. Times]

Intellectuals will believe, truly believe, any idea that builds up their intellectual self-esteem -- a fact as true today as then.

I might mention, as an aisde, that right now here in Manhattan, New York City, there is a KGB Bar that is a favorite of the literary and intellectual set. Curiously, there is no Gestapo Bar, for some reason.

Today the Berlin Wall is replaced by the U2 Wall, pertty much in the same location...

Organisers of a free concert by the rock band U2 to mark the 20th anniversary of the fall of the Berlin Wall have triggered an outcry after they erected a 12ft barrier to keep out anyone without a ticket.But at least this one comes with music, and will be torn down after only a day.

The irony of the erection of a "wall" covered in white plastic sheeting almost identical to the colour of the wall that divided the German capital for almost 30 years was lost on no one... [Telegraph]

Sunday, November 08, 2009

The Sunday Sports Section

[] "Clutch play" takes another hit. Among NFL field goal kickers it is undetectable.

[] Would Bill Belichick trade Tom Brady? If the price was right, apparently.

[] Is Derek Anderson the worst NFL starting QB ever? Maybe not, but PFR.com explores the question. (A commenter notes: "If every pass a quarterback attempts falls to the ground incomplete his QB rating is 39.6. Derek Anderson's quarterback rating is 36.2.")

[] When you die, do you want your ashes spread around your favorite sports team's home field? It's popular around the world...

In Argentina, the tradition of scattering ashes on the wildly popular Boca Juniors soccer team's pitch each time a goal was scored got so out of hand that the club opened a cemetery in 2007 expressly for fans, in part out of concern for the health of the playing surface.In America, NASCAR leads the way...

A soccer club in Hamburg followed suit in 2008, overrun with scattering requests....

at NASCAR's Bristol (Tenn.) Motor Speedway, Wayne Estes has adopted the informal role of "scattering counselor," gently proposing trackside locations with more permanence than the start-finish line family members invariably request ... "If this place means that much to somebody, it's the least we can do," says Estes, vice president of events at the fan-friendly track ...Some fans of other sports just can't wait!...

44-year-old Christopher Noteboom, during a 2005 Philadelphia Eagles-Green Bay Packers game ... threw caution (and a bit of his mother, a lifelong Eagles fan) to the wind and charged toward midfield, kneeled at the 30-yard line, let spill the contents of his plastic bag and blurted out, "This is for you, Mom!"... [WaPo, h/t: The Sports Economist]

Baseball fans can now buy "officially licensed by Major League Baseball" urns and caskets, with their favorite team logo.

Baseball fans can now buy "officially licensed by Major League Baseball" urns and caskets, with their favorite team logo."Each urn sits atop a 'home plate' base outlined in black. Each also features a baseball display dome at the top in which a favorite collectible baseball can be displayed. (Please note: the urn comes with a baseball, which the purchaser or family can replace with a special ball from their own collection.)"

So the only issue now is where to place them. There's money in it for the league ... the rest will come. Right now Babe Ruth and Lou Gehrig have memorials in Yankee Stadium's "memorial park". Live long enough and pay enough, and someday you may have one right next to them.

Saturday, November 07, 2009

Another Krugman versus Krugman

In 1998 he wrote a notable paper arguing that monetary policy would work in spite of 0% short-term interest rates (a "liquidity trap"), and criticizing Japan's wasteful government-spending "stimulus" that greatly increased its national debt...

Japan has already engaged in extensive public works spending in an unsuccessful attempt to stimulate its economy. Much of this spending has been notoriously unproductive: bridges more or less to nowhere, airports few people use, etc....But today, regarding the US recession, Krugman has morphed into the champion of all things "spending stimulus", and into a critic of monetary policy claiming it is ineffective due to extremely low interest rates (a "liquidity trap").

However, considering his prior analysis regarding Japan, his criticism is in very carefully couched terms -- some might even say intentionally misleadingly so.

One who does say so is economist Scott Sumner, who recalls the charges recently hurled by Krugman at economist Steve "SuperFreakonomics" Levitt and his co-author Stephen Dubner over their alleged heresy regarding global warming, and concludes: pot, kettle, black -- only a lot more so. Sumner writes [emphasis in original]...

... let’s review Krugman’s criticism of Levitt and Dubner’s chapter on global warming. Recall that their chapter opened with a charming and entirely accurate anecdote about how “some” scientists had predicted global cooling in the 1970s. But then Levitt and Dubner went on to emphasize that the current science on global warming was quite solid, and therefore we needed to consider some pretty extreme policy options for dealing with this very serious problem.Read Sumner's entire post. Others in the conversation: The Economist, and David Beckworth, who started it all.

Krugman argued that their opening 1 1/2 pages of this 45 page chapter were misleading, leaving the clear impression that the current consensus for global warming was suspect.

I don’t see how anyone reading the entire chapter could conclude that, but let’s say Krugman was right. Even Levitt and Dubner’s worst enemies would have to concede that they also presented lots of evidence in favor of the global warming hypothesis.

Now let’s compare that to Krugman’s post. He makes the very misleading statement that his 1998 paper shows monetary policy doesn’t work in a liquidity trap, when the paper actually ends up arguing that monetary stimulus is one of the most promising policy options for Japan.

And then he hides the relevant policy option in a parenthesis. That is far more misleading than anything Levitt and Dubner were accused of doing....

Even worse, Krugman did this when discussing one of the most important issues facing the world today. The unemployment rate hit 10.2% today....

Here’s how Krugman scolded L&D:That’s how I feel about Krugman. He creates the impression that monetary stimulus can’t work, even though his own scientific writings suggest otherwise.Levitt now says that the chapter wasn’t meant to lend credibility to global warming denial — but when you open your chapter by giving major play to the false claim that scientists used to predict global cooling, you have in effect taken the denier side...

And that’s not acceptable. This is a serious issue. We’re not talking about the ethics of sumo wrestling here; we’re talking, quite possibly, about the fate of civilization. It’s not a place to play snarky, contrarian games.

And a recession causing tens of millions of workers around the world to become unemployed, perhaps for many years, is also a very serious issue.

Changing one's mind on the way down before one hits.

Man survives leap off GW BridgeSwitching at the last moment from a cannonball or bellyflop to a knife position that will slice into the water doesn't work if you went off the Empire State Building.

A former Naval Academy water-polo star amazingly survived a suicide leap of 212 feet off the George Washington Bridge into the 55-degree waters of the Hudson yesterday -- then swam to New Jersey after suddenly finding that he still had the will to live.

Adrian Rawn, 28, took the plunge without so much as a pause after abruptly stopping his car on the span's lower level at about 11:30 a.m., sources said.

He was pulled from the freezing water by Fort Lee church deacon Gi Yeon Rheem, who had been walking along the base of the Palisades when she spotted someone clutching a rock about a quarter-mile to the north, sources said.

"He started shivering," Rheem, 63, told The Post, adding that the impact had torn off Rawn's pants and shredded his underwear.

"He got up and walked into the sunshine," she said.

"I gave him my scarf, and he said, 'Thank you.'"... [NY Post]

Always preserve your options ... you never know.

Friday, November 06, 2009

Yankees tickertape parade day -- two cheers for the Yankees!

Yankees fans should be every bit as proud of their team winning it all as fans of any team that outspent its playoff opponents on player payroll by an average of $104 million, 121% (outspending the Phillies by $88 million, 78%; Angels by $87 million 77%; and Twins by $136 million, 209%) can be.

Do I sound a bit spoilsport-ish? Not at all. It's just that all Yankees fans are front runners.

There's nothing "front runner" about us life-long Mets fans! As the Mets this year burned through baseball's second biggest payroll to lose 92 games, lifer Mets fans who stayed true to their team through yet another long, long season once again demonstrated to the sports world the true spirit of

Star Yankees Fan of the Series: The award goes to one Douglas Clark, age 50, who after being arrested for trying to sell counterfeit tickets to game two tried to bribe his way out the charges by offering police tickets to game six. [NYP]

Thursday, November 05, 2009

How jobs "created and saved" by the stimulus get counted.