Wednesday, November 04, 2009

Using fairy tales, make believe, and "a new Alternative Minimum Tax" to finance health care reform.

"I will not sign a plan that adds one dime to our deficits -- either now or in the future. Period" -- President Barack Obama

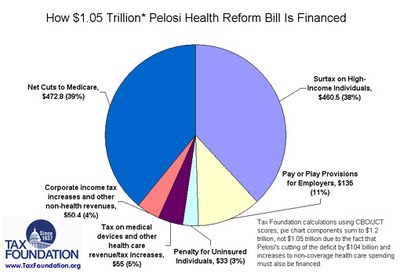

The chart below from the Tax Foundation shows how House Democrats say they will finance the "Pelosi Plan" health care reform proposal that they've just produced.

Note two items. The plan's cost is...

#1) 39% paid for by spending cuts in Medicare, to be named later. We all believe that, right?

#2) 38% paid for by a new 5.4% surtax on "high income individuals" -- those with income exceeding $500,000.

This surtax is a bit interesting. The amount of revenue it is projected to produce is based on the tax being not indexed for inflation, so as to grow every year by hitting ever more people at lower and lower real income levels -- from $30 billion in 2011 to $70 billion in 2019, up 133% in eight years, and ever-rising thereafter.

But as the Tax Policy Center points out, this creates "another Alternative Minimum Tax deal". Which is not good.

The AMT is one of the huge headaches in the tax system today. When created decades ago it affected only the very richest, disallowing many of their deductions, credits and other tax-saving "preferences", purportedly to be sure the richest didn't eliminate too much of their tax bills through "loopholes". But the income threshold for being subject to AMT has never been indexed for inflation, so it has hit more people at ever-lower real income levels every year.

Today the AMT threshold is well down into middle-class income territory -- threatening to strike millions of people. This, of course, has produced an outcry of: "The AMT was never meant to hit us!". And the politicians all agree -- no politician in either party wants to be responsible for dropping a costly, complicated new tax on millions of middle-class voters -- "yes, it is a mistake, and we'll fix it". Which they do every year or two, enacting a "patch" to the law that temporarily keeps the AMT from expanding.

But the claim that the AMT's non-inflation-indexed structure is "mistake" is belied by the fact that Congress has let it run on so for decades, never fixing it, causing one last-minute legislative mini-crisis after another. Fixing this "mistake" would be simple: repeal the tax, or formally inflation-index it, or declare that in the future it will apply as written, whatever. Yet Congress always declines.

Why does it so perpetuate such a mistake? Because the AMT as written increases officially projected budget revenue in future years, which makes it easier for Congress to enact new programs under its "paygo" procedures, reduces officially projected future deficits, makes Congress look more fiscally responsible ... and enables it to take credit for passing a "tax cut" every couple of years with the latest "patch".

In contrast, actually fixing the AMT by, say, inflation-indexing it at its current level would officially be scored as a huge tax cut. But Congress would get no credit from voters for passing that tax cut -- because taxpayers would see it as just keeping the AMT as it is, no tax cut at all.

The last thing Congress wants to do is pass a big tax cut and get no credit for it. That would leave the future budget projections much worse (and closer to reality) make Congress look bad (if no more so than it deserves) and make it harder to justify new spending increases/tax cuts. What would Congress gain from that?

So Congress continues the game of fixing the "mistake" in the AMT with temporary patch after patch, effectively just about inflation-indexing it. But is there really any mistake in the AMT at all?

Now, with the Pelosi Plan, we see Congress intentionally making the very same mistake in its plan to fund health care reform. The surtax will hit only a very small number of people in year one, but by not being inflation-indexed will hit more and more every year thereafter.

Before long, people at lower income levels being newly hit by it will say: "This tax was never meant to hit us". When enough do, Congress will step up to "fix the mistake" with a cap, patch, inflation-indexing, or whatever, and stop the growth of the tax -- just as with the AMT -- leaving health care even that much more underfunded.

Face it, if Congress had the nerve to drop the tax needed to pay for health care reform on lower-income persons, it would do it now -- and not defer dropping the tax on them until later out-of-sight years using this gimmick. But with the gimmick, Congress can score much higher "official" revenue projections long into the future, claim to have paid for health reform, and happily go on its spending way.

The Pelosi Plan is 39% paid for by "spending cuts to Medicare, to be named later", and 38% by "the AMT of health care reform" -- that's 77% between the two of them.

Perhaps looking back someday President Obama will say, as the lawyer he is, "I didn't sign a plan that added one dime to our deficits -- it added tens of trillions of them!"

The chart below from the Tax Foundation shows how House Democrats say they will finance the "Pelosi Plan" health care reform proposal that they've just produced.

Note two items. The plan's cost is...

#1) 39% paid for by spending cuts in Medicare, to be named later. We all believe that, right?

#2) 38% paid for by a new 5.4% surtax on "high income individuals" -- those with income exceeding $500,000.

This surtax is a bit interesting. The amount of revenue it is projected to produce is based on the tax being not indexed for inflation, so as to grow every year by hitting ever more people at lower and lower real income levels -- from $30 billion in 2011 to $70 billion in 2019, up 133% in eight years, and ever-rising thereafter.

But as the Tax Policy Center points out, this creates "another Alternative Minimum Tax deal". Which is not good.

The AMT is one of the huge headaches in the tax system today. When created decades ago it affected only the very richest, disallowing many of their deductions, credits and other tax-saving "preferences", purportedly to be sure the richest didn't eliminate too much of their tax bills through "loopholes". But the income threshold for being subject to AMT has never been indexed for inflation, so it has hit more people at ever-lower real income levels every year.

Today the AMT threshold is well down into middle-class income territory -- threatening to strike millions of people. This, of course, has produced an outcry of: "The AMT was never meant to hit us!". And the politicians all agree -- no politician in either party wants to be responsible for dropping a costly, complicated new tax on millions of middle-class voters -- "yes, it is a mistake, and we'll fix it". Which they do every year or two, enacting a "patch" to the law that temporarily keeps the AMT from expanding.

But the claim that the AMT's non-inflation-indexed structure is "mistake" is belied by the fact that Congress has let it run on so for decades, never fixing it, causing one last-minute legislative mini-crisis after another. Fixing this "mistake" would be simple: repeal the tax, or formally inflation-index it, or declare that in the future it will apply as written, whatever. Yet Congress always declines.

Why does it so perpetuate such a mistake? Because the AMT as written increases officially projected budget revenue in future years, which makes it easier for Congress to enact new programs under its "paygo" procedures, reduces officially projected future deficits, makes Congress look more fiscally responsible ... and enables it to take credit for passing a "tax cut" every couple of years with the latest "patch".

In contrast, actually fixing the AMT by, say, inflation-indexing it at its current level would officially be scored as a huge tax cut. But Congress would get no credit from voters for passing that tax cut -- because taxpayers would see it as just keeping the AMT as it is, no tax cut at all.

The last thing Congress wants to do is pass a big tax cut and get no credit for it. That would leave the future budget projections much worse (and closer to reality) make Congress look bad (if no more so than it deserves) and make it harder to justify new spending increases/tax cuts. What would Congress gain from that?

So Congress continues the game of fixing the "mistake" in the AMT with temporary patch after patch, effectively just about inflation-indexing it. But is there really any mistake in the AMT at all?

Now, with the Pelosi Plan, we see Congress intentionally making the very same mistake in its plan to fund health care reform. The surtax will hit only a very small number of people in year one, but by not being inflation-indexed will hit more and more every year thereafter.

Before long, people at lower income levels being newly hit by it will say: "This tax was never meant to hit us". When enough do, Congress will step up to "fix the mistake" with a cap, patch, inflation-indexing, or whatever, and stop the growth of the tax -- just as with the AMT -- leaving health care even that much more underfunded.

Face it, if Congress had the nerve to drop the tax needed to pay for health care reform on lower-income persons, it would do it now -- and not defer dropping the tax on them until later out-of-sight years using this gimmick. But with the gimmick, Congress can score much higher "official" revenue projections long into the future, claim to have paid for health reform, and happily go on its spending way.

The Pelosi Plan is 39% paid for by "spending cuts to Medicare, to be named later", and 38% by "the AMT of health care reform" -- that's 77% between the two of them.

Perhaps looking back someday President Obama will say, as the lawyer he is, "I didn't sign a plan that added one dime to our deficits -- it added tens of trillions of them!"