Wednesday, June 03, 2009

Obama says cap-and-trade plan "doesn't work" except as "the largest corporate welfare program ever".

Or: "Cap and trade" becomes "Pork out and squeal."

The "cap and trade" plan to reduce atmospheric carbon emissions by industry, to fend off global warming, is intended to work through a permit system that enables permit holders to emit given amounts of CO2, but limit the total amount emitted.

Firms are to be able to trade permits in a market, so that the businesses that most need permits can buy them, while those able to most efficiently reduce their emissions can profit from doing so (by selling permits) giving them an incentive to do so. The whole process can be much more economically efficient than governmental rationing of the right to emit. In theory.

But the first critical question is: how are permits to be distributed?

The starting-point idea behind the whole concept of "cap and trade" is that permits will be auctioned off by the government. Then an efficient market in them is created right away, as the firms that need them most bid the most for them, they are distributed efficiently through the bidding process, and market prices are quickly established.

Well, considering that idea for a moment, you may think that the money to be received by the government from the auction actually is a tax -- and you'd be right!

Of course, it is a tax. How do you reduce the production of something? By increasing the cost of production. The amount that businesses must pay to the government through the auction process for permission to emit CO2 into the atmosphere is a tax on such emissions that increases the cost of emitting, and so reduces their amount.

Will that tax be passed on by businesses to consumers? Of course it will, to the extent that businesses can pass it on. That's what will reduce "consumer demand" for CO2 emissions. If you want to reduce CO2 to fight global warming, this is a good thing.

Even if you are a "small government" type who doesn't want to see the government collect more tax revenue, this can still be a good thing -- because the government can remit the tax collected back to taxpayers by reducing other taxes, such as income taxes, payroll taxes, whatever ... and this "Pigouvian tax" on emissions is less distorting to the economy than the other taxes it would replace as explained in in Greg Mankiw's Pigou Club Manifesto. So the net tax collected could be zero -- with the tax system's distortion of the economy actually reduced in the process.

At worst (if more realistically) this "auction tax" would reduce the need to increase other taxes in our era of ever-rising deficits (a need that will soon arrive big time) and this Pigovian tax would be much less harmful to the economy than other kinds of tax hikes, such as big increases in the income tax, or a new national sales tax.

But now you may think, well, if this whole cap-and-trade business boils down to really being a tax on CO2 emissions, wouldn't it be a whole lot simpler just to tax CO2 emissions themselves, directly, to achieve the same thing?

The answer to which is "yes" -- you'd be right again! As Professor Mankiw says: "a cap-and-trade system is equivalent to a tax on carbon emissions" -- that is, when it is done right, it is.

But what if it is done wrong? What if, for instance, politics intervenes so the emission permits aren't auctioned off, but instead are handed out by politicians for free to their friends, campaign contributors, and the constituents they want to win over before the next election -- distributed in accord not with economic efficiency but political influence?

Then the whole system starts going wrong. The permit system that reduces CO2 emissions still increases cost to consumers -- but instead of the "tax" that consumers pay through higher prices going to the government, it goes to ... the producers of CO2 emissions!

Let President Obama himself tell you himself (while speaking to the Business Roundtable, this past March 12):

Politics has intervened! Looking at the cap-and-trade bill that the Democrats are passing through Congress at this moment, we see only 15% of emission permits will be auctioned -- with the other 85% to be handed out by political fiat: 2% to oil refiners, 5% to free-standing coal plants, 9% to regulated natural-gas distributors, and so on ... here's the list (so far) [.pdf] .

And President Obama hailed passage of this bill through committee as "a historic leap"!

That's a historic leap towards a plan model that less than three months ago, he himself said "doesn't work", and which his budget director said would be "the largest corporate welfare program that has ever been enacted in the history of the United States."

That's some special kind of leap into history being made there!

The pigs are lining up to feed at the political trough -- at the expense of both consumers and taxpayers.

The pigs are lining up to feed at the political trough -- at the expense of both consumers and taxpayers.

As Professor Mankiw puts it in his "The Fundamental Theorem of Carbon Taxation":

As a postscript, Paul Krugman, for the last eight years the foremost scourge of dirty deals between Washington politicians and big business, seems now to becoming much more tolerant about such things...

Also, this is one case where Krugman doesn't object to sticking it to the poor and middle class to make the rich richer.

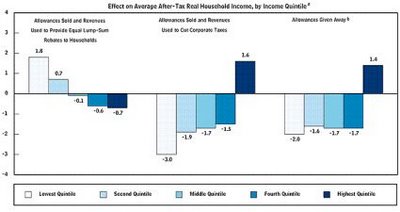

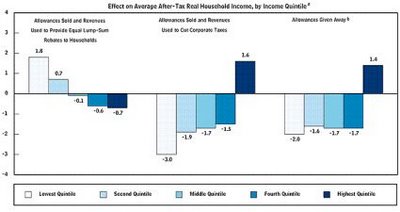

CBO [.pdf], Figure 1

Or: "Cap and trade" becomes "Pork out and squeal."

The "cap and trade" plan to reduce atmospheric carbon emissions by industry, to fend off global warming, is intended to work through a permit system that enables permit holders to emit given amounts of CO2, but limit the total amount emitted.

Firms are to be able to trade permits in a market, so that the businesses that most need permits can buy them, while those able to most efficiently reduce their emissions can profit from doing so (by selling permits) giving them an incentive to do so. The whole process can be much more economically efficient than governmental rationing of the right to emit. In theory.

But the first critical question is: how are permits to be distributed?

The starting-point idea behind the whole concept of "cap and trade" is that permits will be auctioned off by the government. Then an efficient market in them is created right away, as the firms that need them most bid the most for them, they are distributed efficiently through the bidding process, and market prices are quickly established.

Well, considering that idea for a moment, you may think that the money to be received by the government from the auction actually is a tax -- and you'd be right!

Of course, it is a tax. How do you reduce the production of something? By increasing the cost of production. The amount that businesses must pay to the government through the auction process for permission to emit CO2 into the atmosphere is a tax on such emissions that increases the cost of emitting, and so reduces their amount.

Will that tax be passed on by businesses to consumers? Of course it will, to the extent that businesses can pass it on. That's what will reduce "consumer demand" for CO2 emissions. If you want to reduce CO2 to fight global warming, this is a good thing.

Even if you are a "small government" type who doesn't want to see the government collect more tax revenue, this can still be a good thing -- because the government can remit the tax collected back to taxpayers by reducing other taxes, such as income taxes, payroll taxes, whatever ... and this "Pigouvian tax" on emissions is less distorting to the economy than the other taxes it would replace as explained in in Greg Mankiw's Pigou Club Manifesto. So the net tax collected could be zero -- with the tax system's distortion of the economy actually reduced in the process.

At worst (if more realistically) this "auction tax" would reduce the need to increase other taxes in our era of ever-rising deficits (a need that will soon arrive big time) and this Pigovian tax would be much less harmful to the economy than other kinds of tax hikes, such as big increases in the income tax, or a new national sales tax.

But now you may think, well, if this whole cap-and-trade business boils down to really being a tax on CO2 emissions, wouldn't it be a whole lot simpler just to tax CO2 emissions themselves, directly, to achieve the same thing?

The answer to which is "yes" -- you'd be right again! As Professor Mankiw says: "a cap-and-trade system is equivalent to a tax on carbon emissions" -- that is, when it is done right, it is.

But what if it is done wrong? What if, for instance, politics intervenes so the emission permits aren't auctioned off, but instead are handed out by politicians for free to their friends, campaign contributors, and the constituents they want to win over before the next election -- distributed in accord not with economic efficiency but political influence?

Then the whole system starts going wrong. The permit system that reduces CO2 emissions still increases cost to consumers -- but instead of the "tax" that consumers pay through higher prices going to the government, it goes to ... the producers of CO2 emissions!

Let President Obama himself tell you himself (while speaking to the Business Roundtable, this past March 12):

Now, the experience of a cap and trade system thus far is that if youíre giving away carbon permits for free, then basically youíre not really pricing the thing and it doesnít work -- or people can game the system in so many ways that itís not creating the incentive structures that weíre looking for.Obama's budget director, Peter Orszag, until recently the head of the Congressional Budget Office, explains what "gaming the system" means...

"If you didn't auction the permit, it would represent the largest corporate welfare program that has ever been enacted in the history of the United States.Last year, a report [.pdf] by Orszag's CBO provided more detail...

"In particular, all of the evidence suggests that what would occur is the corporate profits would increase by approximately the value of the permit.

"So that -- whatever that is, $600 billion, $800 billion, whatever the value is, would go in a sense almost directly into corporate profits rather than being available to fund energy efficiency investments and to provide a cushion or some compensation to American households.

"That is why the president, I think, has made absolutely the right choice in saying that the permit should be auctioned"

"[G]iving away allowances could yield windfall profits for the producers that received them by effectively transferring income from consumers to firms' owners and shareholders...."So we can be thankful that, as Orszag said, the president has made "absolutely the right choice in saying that the permit should be auctioned" .... except wait! ... hello??

"If all of the allowances were distributed for free to producers in the oil, natural gas, and coal sectors, stock values would double for oil and gas producers, and increase more than sevenfold for coal producers, compared with projected values in the absence of a cap"...

Politics has intervened! Looking at the cap-and-trade bill that the Democrats are passing through Congress at this moment, we see only 15% of emission permits will be auctioned -- with the other 85% to be handed out by political fiat: 2% to oil refiners, 5% to free-standing coal plants, 9% to regulated natural-gas distributors, and so on ... here's the list (so far) [.pdf] .

And President Obama hailed passage of this bill through committee as "a historic leap"!

That's a historic leap towards a plan model that less than three months ago, he himself said "doesn't work", and which his budget director said would be "the largest corporate welfare program that has ever been enacted in the history of the United States."

That's some special kind of leap into history being made there!

The pigs are lining up to feed at the political trough -- at the expense of both consumers and taxpayers.

The pigs are lining up to feed at the political trough -- at the expense of both consumers and taxpayers.As Professor Mankiw puts it in his "The Fundamental Theorem of Carbon Taxation":

Cap and trade = Carbon tax + Corporate welfare.And we now are on course to soon see corporate welfare on a scale as we have never seen it before. (Although GM, Chrysler, AIG, all those banks, et. al., were an impessive enough start ... weren't the champions of corporate welfare supposed to be Republicans? We have a new one!)

As a postscript, Paul Krugman, for the last eight years the foremost scourge of dirty deals between Washington politicians and big business, seems now to becoming much more tolerant about such things...

... handing out emission permits does, in effect, transfer wealth from taxpayers to industry. So if you had your heart set on a clean program, without major political payoffs, Waxman-Markey is a disappointment ... but itís action we can take now.... as what is there to object to about creating "the largest corporate welfare program that has ever been enacted in the history of the United States", when it's tied to a bill that your team wants to get passed? It's such a petty complaint!

Also, this is one case where Krugman doesn't object to sticking it to the poor and middle class to make the rich richer.

CBO [.pdf], Figure 1