Sunday, May 17, 2009

OK, it's not like this has never happened before, but here's another entertaining example of local politics in action.

New York City's Metropolitan Transit Authority, best known for running the subways but which also runs the local buses and commuter trains, is staggeringly broke. (Largely from consuming away, rather than saving, a huge subsidy it received from city property taxes during the real estate boom, which subsidy now has effectively disappeared.) So it needs a whole lot of new revenue.

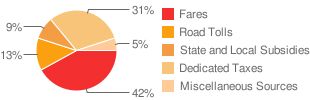

A fare increase large enough to cover the financing gap (one of about 35%), that would drop more of the cost of transit service on those who most benefit from it (its users!) was a non-starter. "Fare politics" has been infamous in New York City for over 100 years (often called "the third rail" of city politics). The MTA's finances are famously opaque, but the MTA says fares cover only 42% of operating cost. The rest comes from tolls imposed on drivers and various government subsidies.

Moreover a big fare increase would risk focusing riders' anger on the fundamental causes of the problem, the MTA's epic mismanagement and (not unrelated) bloated, above-market paid work force that is politically protected (by political patronage at the top, municipal unions the rest of the way through). The MTA is a quasi-independent agency, so no politician has the power to discipline it -- they have to simply pony up when it asks for "more, more". But I digress into causation....

The solution that the politicians dithered and delayed and stalled until the last minute before finally hitting upon consists mainly to two new taxes:

(1) A new payroll tax on all employees in New York City and surrounding counties, who presumably benefit from the MTA's operations. (Employees of public school districts are the only workers exempt from this tax, in case one wonders who has influence in state politics.)

(2) A 50-cent charge added to each taxi fare in the city and surrounding counties, to be collected by the state tax authority. This makes sense, say the politicians: Taxis compete with subways and buses ... we want people to take public transport ... this prevents public transport from being disadvantaged to taxis as a result of the modest, less-than-inflation-matching fare increase of 10% that's part of the deal. (The current $2 fare was adopted in 2003. An inflation-matching hike would be 16%.)

Well, a tax that makes sense in theory is well and good ... but a tax must be collectible too. The payroll tax is no problem, all employees already pay payroll tax, so this is just added on to it. But the new "taxi trip tax" is something of an issue!

Taxi drivers don't pay any current business tax to the state tax authorities, so there is no existing mechanism to pay/collect this tax -- taxi drivers just tally their net income at year end and report it to the IRS and state tax collector by April 15th, as everyone else does. Taxi companies tend to be small, one-person or few-person businesses (at least outside of Manhattan) that may come and go, so there is no easy way to monitor them. Taxi driving is a cash business -- like pizzerias and bars and laundromats and hot dog stands -- and cash businesses tend to greatly under-report their income (by about 40% says the IRS ) because they know there is no cost effective way for the tax collector to verify their income and enforce the tax due on it.

So how are the politicians going to save the subways by collecting their new "taxi trip tax"?

[] By spending years and many millions of dollars to develop a new computerized system, staffed with an attendant bureaucracy, that will download the number of trips each taxi takes directly off its meter -- to tally up 50-cent charges?

[] By mailing out new tax-reporting forms and telling taxi drivers: "Now you count up all your trips and self-assess this tax honestly, you hear? Remember, we have high-paid auditors and they're good at their jobs -- and we'll be taking them off audits of banks and corporations and millionaires, to audit a fair sampling of all of you and your 50-cent charges!"

Mayor Bloomberg opines...

The [Legislature] is collecting 50 cents a ride from the taxis. I don't know how you're going to do that because you're going to depend on these people to pay. That's not likely ... They could charge $1 every time you take a shower. Who knows?" [NY Post]

It's an issue. But it's par for the course in a world of politics where, as Bastiat put it, everybody tries to live at everybody else's expense, and feels entitled to do so.

When living (or riding the transit system) at somebody else's expense, you don't particularly care how much money the other people pay or how efficiently it is spent -- as Milton Friedman memorably explained (on video) -- as long as you get what you want. The result is epic mismanagement and organizational bloat ... and a continuing need to drop the ever-rising cost that follows on ever more "other people".

So now workers in Dutchess County, 80 miles north of New York City, are impressed into paying a payroll tax to subsidize the New York City subway system ... and the tax net newly snares taxi owners aross the entire metropolitan area ... while the riders of the subway system themselves emerge from the "crisis" paying a fare that doesn't even keep up with inflation.

And to think ... one hundred years ago the subways were built ahead of schedule and under budget, and their trains ran clean and on time between chandeliered stations designed and decorated by the likes of Stanford White, as one of the urban marvels of the world. While being run by private-sector operators who charged riders a 5-cent fare -- $1.25 inflation-adjusted to our money -- that paid for everything, including financing the entire system's construction, and the operators' profit too.

Ah ... those were the days.